Wv Tax Refund Status

Welcome to the comprehensive guide on tracking your West Virginia tax refund status. In this article, we will explore the various methods and steps you can take to stay informed about the progress of your tax refund. Whether you're eager to receive your refund or simply want to ensure the process is on track, we've got you covered with valuable insights and expert advice.

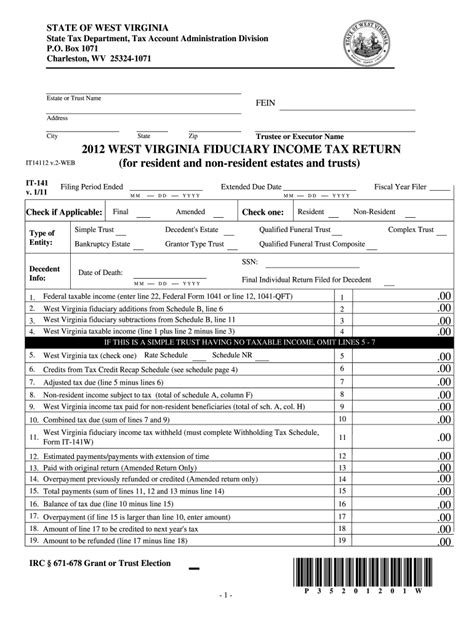

Understanding the West Virginia Tax Refund Process

The West Virginia State Tax Department handles tax refund processing for residents and businesses. It's essential to understand the timeline and factors that can impact the speed of your refund. On average, it takes approximately 4-6 weeks for the state to process individual income tax returns and issue refunds. However, there are several variables that can influence this timeline.

One crucial factor is the method of filing. If you choose to file your taxes electronically, it generally speeds up the process compared to traditional paper filing. Additionally, the accuracy and completeness of your tax return play a significant role. Errors or missing information can lead to delays, so it's crucial to double-check your tax forms before submission.

When to Expect Your Refund

The West Virginia Tax Department aims to process refunds within a reasonable timeframe. However, the exact timing can vary based on several factors, including the volume of tax returns received and the complexity of your individual tax situation. To estimate when you might receive your refund, consider the following:

- Filing Date: Generally, the earlier you file, the sooner you can expect your refund. The tax season commences on January 23rd, and returns are processed on a first-come, first-served basis.

- Processing Time: As mentioned, the standard processing time is around 4-6 weeks. However, it's worth noting that refunds for complex returns or those with additional forms might take longer.

- Payment Method: If you opt for direct deposit, your refund will typically arrive faster than if you choose a paper check. Direct deposit refunds are usually received within 2-3 weeks, while paper checks may take up to 6 weeks.

To ensure a smooth refund process, it's advisable to file your taxes accurately and completely. Take the time to review your tax forms and gather all necessary documentation before submission. This proactive approach can help prevent errors and potential delays.

Tracking Your WV Tax Refund Status

Now, let's delve into the various methods you can utilize to track the status of your West Virginia tax refund. These options provide transparency and peace of mind, allowing you to stay informed throughout the refund process.

Online Refund Tracker

The West Virginia State Tax Department offers an online refund tracker as a convenient way to monitor the progress of your refund. This user-friendly tool is accessible through the official state website. To utilize the refund tracker, you'll need the following information:

- Social Security Number (SSN): Your SSN serves as a unique identifier for your tax return.

- Refund Amount: This is the exact amount of your expected refund. It's essential to provide the correct amount to ensure an accurate status update.

- Date of Birth: Your date of birth is another key identifier used for security purposes.

Once you have this information ready, follow these steps to access the online refund tracker:

- Visit the West Virginia Tax Department's website and navigate to the "Refund Status" section.

- Enter your SSN, refund amount, and date of birth into the designated fields.

- Click on the "Check Refund Status" button to retrieve the current status of your refund.

- The tracker will display one of the following messages:

- Refund Sent: Your refund has been processed and sent. It's important to note that this status does not guarantee the receipt of your refund. Allow for the standard processing time for your chosen payment method.

- Refund In Process: Your refund is currently being processed. Check back periodically for an updated status.

- Return Not Processed: Your tax return has not yet been processed. This could be due to various reasons, such as missing information or errors. Contact the tax department for further assistance.

The online refund tracker is a valuable resource, providing real-time updates on the progress of your refund. However, it's worth noting that the status updates may not always be immediate. In some cases, there might be a slight delay between the actual processing and the update appearing on the tracker.

Telephone Inquiries

If you prefer a more direct approach, you can reach out to the West Virginia Tax Department via telephone to inquire about your refund status. The department has dedicated customer service representatives who are available to assist you.

To contact the tax department, you can call the following number:

| West Virginia Tax Department | 1-800-982-8267 |

|---|

When contacting the department, be prepared with the following information to expedite the process:

- Your Full Name: Provide your legal name as it appears on your tax return.

- Social Security Number (SSN): Your SSN is a crucial identifier for your tax return.

- Tax Year: Specify the tax year for which you are inquiring about the refund.

- Refund Amount: Have the exact amount of your expected refund ready.

The customer service representatives will verify your information and provide you with the current status of your refund. They can also assist you with any additional questions or concerns you may have regarding your tax return.

Mail Correspondence

For those who prefer traditional methods, the West Virginia Tax Department also accepts refund status inquiries via mail. While this option may take longer than online or telephone inquiries, it can still be a viable choice for some individuals.

To request a refund status update through mail, follow these steps:

- Download and print the Refund Inquiry Form from the official state website.

- Fill out the form with your personal details, including your full name, SSN, tax year, and refund amount.

- Mail the completed form to the following address:

- West Virginia State Tax Department

- P.O. Box 429

- Charleston, WV 25322

Please allow sufficient time for the department to process your request and respond to your inquiry. The processing time for mail correspondence may vary, so it's advisable to be patient and allow for additional days compared to online or telephone inquiries.

Common Reasons for Refund Delays

While the West Virginia Tax Department strives to process refunds efficiently, there are certain factors that can lead to delays. Understanding these common reasons can help you navigate the refund process more effectively.

Error or Incomplete Information

One of the primary causes of refund delays is errors or incomplete information on your tax return. The tax department must carefully review and correct any inaccuracies before processing your refund. Common errors include:

- Incorrect SSN or other personal information.

- Missing or incorrect tax forms.

- Miscalculations in tax liabilities or credits.

- Discrepancies between reported income and other sources.

To avoid delays, it's crucial to review your tax return thoroughly before submission. Double-check all personal information, ensure all necessary forms are included, and verify the accuracy of your calculations. If you have any doubts or concerns, consider seeking professional assistance from a tax preparer or accountant.

Identity Verification

In an effort to combat tax fraud and protect taxpayers, the West Virginia Tax Department may implement additional security measures, such as identity verification. If your tax return triggers any red flags or requires further verification, the department might request additional documentation or information from you.

Identity verification processes can include:

- Reviewing your tax return for suspicious activities or discrepancies.

- Sending a letter requesting specific documents to verify your identity.

- Conducting a thorough investigation if there are indications of potential fraud.

While these measures are in place to protect your interests, they can potentially lead to delays in processing your refund. It's important to respond promptly to any requests for additional information and provide the necessary documentation to expedite the verification process.

What to Do If Your Refund Is Delayed

In the event that your West Virginia tax refund is delayed beyond the expected timeframe, it's essential to take proactive steps to resolve the situation. Here are some recommended actions you can take:

Contact the Tax Department

If you've checked the online refund tracker or contacted the tax department and your refund status indicates a delay, it's advisable to reach out to the department directly. Their customer service representatives can provide further insights into the cause of the delay and offer guidance on the next steps.

When contacting the department, be prepared with the following information:

- Your full name and SSN.

- The tax year for which you are inquiring.

- The expected refund amount.

- Any relevant details or documentation related to your tax return.

The tax department's representatives will assist you in resolving the delay and provide an updated timeline for the processing of your refund.

Check for Missing Information

Sometimes, a refund delay can be attributed to missing or incomplete information on your tax return. Review your tax forms carefully to ensure that all required fields are filled out accurately and completely. Double-check for any missing signatures or additional forms that might be necessary.

If you identify any missing information, promptly submit the required documentation to the West Virginia Tax Department. This will help expedite the processing of your refund and prevent further delays.

Verify Your Mailing Address

Another potential reason for a delayed refund is an outdated or incorrect mailing address. The tax department relies on the address provided on your tax return to send your refund. If you've recently moved or anticipate a change of address, it's crucial to update your information with the department.

To verify or update your mailing address, you can:

- Log in to your online tax account (if applicable) and update your profile.

- Contact the tax department via telephone or mail to provide your new address.

- Include your updated address when submitting your tax return.

By ensuring that your mailing address is accurate, you can avoid potential delays caused by returned or undeliverable refunds.

Future Implications and Tips

As we conclude this comprehensive guide, let's explore some future implications and valuable tips to enhance your tax refund experience in West Virginia.

Future Enhancements

The West Virginia Tax Department is dedicated to improving its services and enhancing the tax refund process for residents. Here are some potential future enhancements you can expect:

- Enhanced Online Services: The department is working towards expanding its online platform to offer more comprehensive services. This may include additional features for tracking refunds, viewing tax history, and accessing tax forms and instructions.

- Improved Communication: Efforts are being made to enhance communication channels with taxpayers. This could involve implementing a more robust customer service system, including live chat support and expanded hours for telephone inquiries.

- Electronic Filing Incentives: To encourage taxpayers to file electronically, the department may introduce incentives such as faster processing times or exclusive online features for e-filers.

Tips for a Smooth Refund Process

To ensure a seamless and timely tax refund process, consider implementing these tips:

- File Early: Take advantage of the tax season opening by filing your taxes as early as possible. This reduces the risk of errors and allows the tax department to process your return promptly.

- Accurate Information: Double-check your tax forms for accuracy and completeness. Ensure all personal information, tax liabilities, and credits are correctly reported.

- Direct Deposit: Opt for direct deposit as your refund payment method. It's faster and more secure than receiving a paper check.

- Monitor Your Status: Utilize the online refund tracker regularly to stay informed about the progress of your refund. This proactive approach can help you identify and resolve any potential issues promptly.

By staying informed and proactive, you can navigate the West Virginia tax refund process with ease and receive your refund efficiently.

Frequently Asked Questions

How can I check the status of my WV tax refund if I don’t have access to the internet?

+

If you don’t have internet access, you can contact the West Virginia Tax Department via telephone or mail. Provide your personal details, including your full name, SSN, tax year, and refund amount, and a representative will assist you with your refund status inquiry.

What should I do if the online refund tracker shows “Return Not Processed” for an extended period?

+

If the online tracker consistently displays “Return Not Processed,” it’s advisable to contact the tax department directly. They can investigate the reason for the delay and provide further guidance. It’s important to be patient and allow sufficient time for the department to review your return.

Can I track my refund status if I filed a joint tax return with my spouse?

+

Yes, you can track the status of a joint tax return. When using the online refund tracker, enter the primary taxpayer’s information, which is typically the individual whose name appears first on the tax return. This will provide the status of the joint refund.

How often should I check the online refund tracker for updates?

+

While there is no specific frequency recommended, it’s a good practice to check the online tracker periodically, especially if you’ve filed your taxes early in the tax season. Regular checks allow you to stay informed and address any potential issues promptly. However, avoid excessive checking, as it may not provide real-time updates.

What if I don’t receive my refund within the expected timeframe, even after contacting the tax department?

+

If you’ve followed the recommended steps and your refund is still delayed, it’s advisable to escalate the issue. You can contact the West Virginia Tax Department’s office of the Taxpayer Advocate. They specialize in resolving complex tax issues and can provide further assistance.