Riverside Sales Tax: Navigating Rates and Revenue Insights

In the intricate landscape of local taxation, Riverside County stands as a compelling case study. Its sales tax policies exemplify how regional economic activities, demographic shifts, and legislative decisions intertwine to craft a dynamic fiscal environment. For practitioners, policymakers, and economic analysts alike, comprehending the nuanced mechanisms behind Riverside sales tax rates and revenue generation is indispensable. This guide offers a comprehensive, structured review—drawing from the latest data, legal frameworks, and strategic considerations—to serve as an authoritative resource for navigating Riverside’s sales tax terrain effectively.

Understanding Riverside Sales Tax: Foundations and Frameworks

The sales tax system in Riverside County is governed by a combination of state law, county ordinances, and municipal regulations. Its architecture is designed to optimize revenue capture while accommodating regional economic diversity. As of 2023, Riverside’s base sales tax rate stands at 7.75%, but with local surcharges and special district taxes, the total rate can reach upwards of 8.75% in certain jurisdictions.

Its primary components include the statewide California sales tax, local district taxes funding transportation, public safety, and community development projects, alongside optional voter-approved measures that further modulate the overall rate. The evolution of these rates over the past decade underscores a pattern of incremental increases aligned with infrastructural investments and fiscal requirements.

From a legal perspective, Riverside County’s sales tax framework aligns with California Department of Tax and Fee Administration (CDTFA) guidelines, yet municipalities possess discretion to impose or adjust their own local taxes within statutory limits. This decentralization facilitates tailored fiscal strategies but demands precise compliance management and ongoing monitoring of legislative changes.

Components Influencing Riverside Sales Tax Rates

Statewide and Local Legislation

California’s Proposition 30 and subsequent measures have historically impacted sales tax rates statewide. Riverside, like other counties, maintains the authority to implement additional local taxes through voter approval, often to fund specific regional projects. These include special district taxes dedicated to transportation or flood control, which can add 0.25% to 2% to the base rate.

District and Special Purpose Taxes

Riverside’s adjacent transportation districts, for instance, levy additional taxes targeted specifically at transit infrastructure expansion, road repairs, and environmental sustainability initiatives. These add layers of complexity, as businesses must accrue multiple, sometimes overlapping, tax components depending on their location and commerce activities.

| Relevant Category | Substantive Data |

|---|---|

| Base Statewide Sales Tax | 7.25% (California statewide rate as of 2023) |

| County and Local Additions | Variable; averaging around 0.25% to 1.50%, depending on jurisdiction |

| Special District Taxes | Up to 1.00%, often targeting infrastructure investments |

| Maximum Possible Rate | Up to 8.75% in some high-activity zones |

Revenue Insights and Fiscal Impacts of Riverside Sales Tax

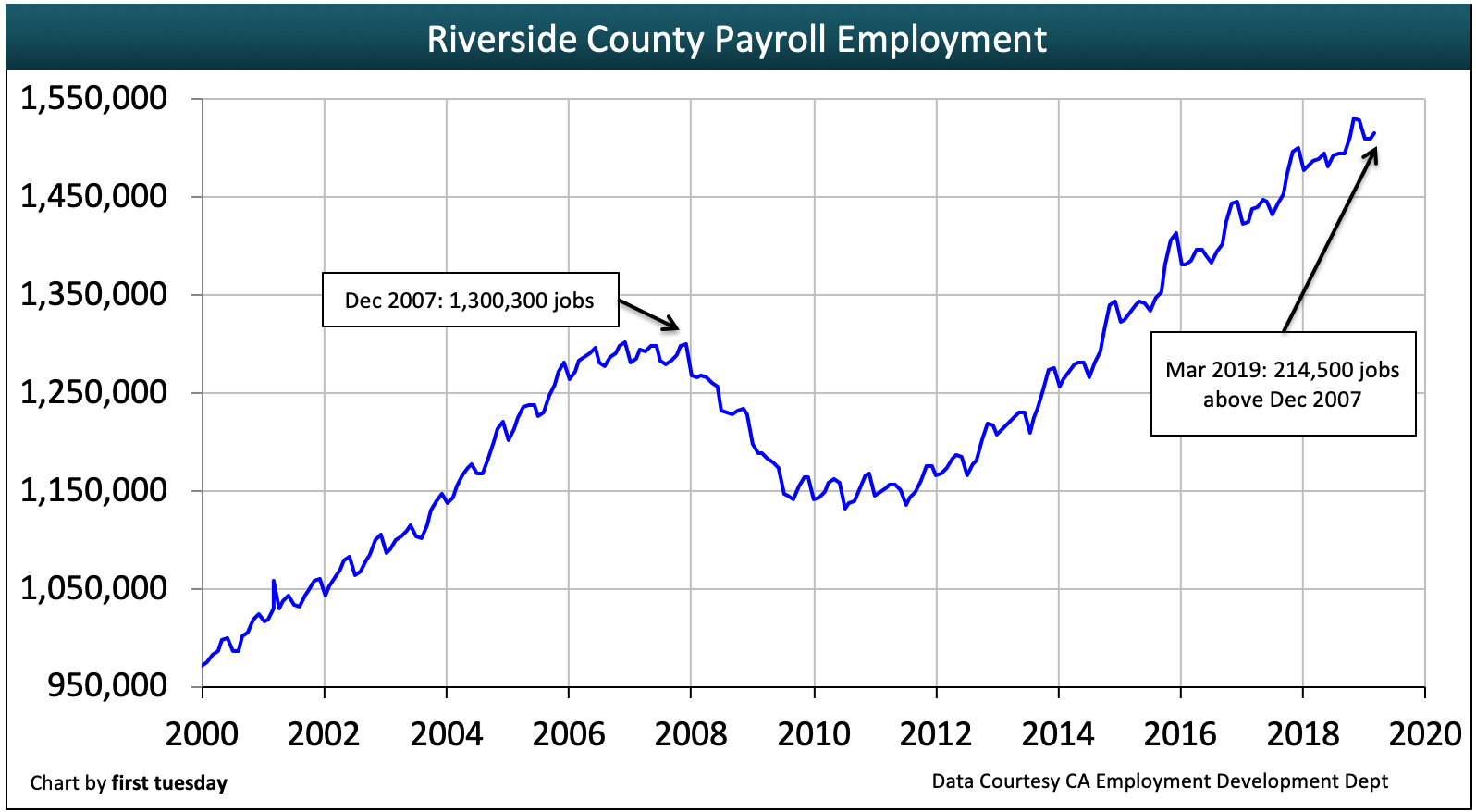

Deciphering how Riverside’s sales tax revenues are generated and allocated provides critical insight into regional economic health and fiscal resilience. In fiscal year 2022–2023, Riverside County reported gross sales tax revenues exceeding 2.3 billion, reflecting robust consumer activity and strategic tax rate application.</p> <p>The distribution model allocates revenues to various sectors: approximately 55% supports transportation infrastructure, 20% funds public safety initiatives, while the remaining 25% bolster community development and environmental programs. Maintaining this equilibrium requires predictive analytics, careful fiscal planning, and adaptive policy measures responsive to market fluctuations.</p> <h3>Revenue Trends and Economic Correlations</h3> <p>Historical data reveal that Riverside’s sales tax revenue correlates strongly with regional economic indicators, including retail sales volume, employment rates, and demographic shifts. A 10% increase in retail activity typically results in a proportional 7% rise in sales tax income, after accounting for inflation and rate adjustments. Moreover, the COVID-19 pandemic temporarily depressed revenues in 2020 but experienced a swift rebound as consumer spending recovered strongly in subsequent years.</p> <table> <tr><th>Key Metric</th><th>Value/Trend</th></tr> <tr><td>Annual Sales Tax Revenue (2022–2023)</td><td>2.36 billion Growth Rate (Year-over-Year)5.2% Major Revenue SourceRetail sales and hospitality sector Impact of Economic BoomsRevenues escalate by approximately 6–8% during regional economic expansions

Navigating Compliance and Maximizing Revenue Collection

For businesses and fiscal agents operating within Riverside, meticulous compliance with sales tax regulations is paramount. This includes accurate calculation, timely filing, and comprehensive record-keeping. The CDTFA provides detailed guidelines on nexus determination, taxability of goods/services, and exemption procedures, which must be carefully integrated into business operations.

Compliance Best Practices

- Maintain detailed transaction logs segregated by jurisdiction and tax rate applicability.

- Regularly update point-of-sale systems to reflect current rates and rules.

- Train personnel on exemptions, resales, and documentation requirements.

- Leverage electronic filing platforms for efficiency and accuracy.

Particularly in Riverside, where multiple overlapping tax districts exist, misclassification or miscollection can lead to audit penalties and revenue shortfalls. Engaging with professional tax advisors or leveraging automated compliance software often mitigates these risks effectively.

Revenue Optimization Strategies

Tax planning within Riverside can harness legal structuring, such as strategic location choices, to benefit from lower tax jurisdictions where permissible. Additionally, understanding seasonal cycles and consumer behaviors informs targeted marketing and sales strategies, thus boosting overall taxable transactions.

Key Points

- Comprehending layered rates is vital for accurate pricing and compliance.

- Analyzing historical trends supports predictive revenue modeling and fiscal planning.

- Adhering to regulations minimizes legal risks and penalties.

- Leveraging strategic location and timing can enhance revenue capture.

- Investing in automation streamlines compliance and reporting processes.

Future Outlook: Trends and Policy Directions for Riverside Sales Tax

Forecasting Riverside’s sales tax landscape indicates continued growth driven by regional development, infrastructure investments, and evolving consumer patterns. Upcoming policy debates are likely to focus on adjusting rates for inflation, expanding exemptions, and enhancing collection technology. The integration of digital transaction monitoring, real-time reporting, and machine learning analytics stands to revolutionize the efficiency and transparency of sales tax administration.

Moreover, regional collaborations with neighboring counties and statewide initiatives aimed at economic resilience and sustainability will shape future revenue strategies. Practitioners should monitor legislative developments, demographic shifts, and technological innovations to stay ahead of the curve.

How often do Riverside sales tax rates change?

+Riverside sales tax rates are subject to periodic adjustments based on legislation, voter-approved measures, and regional development needs. Typically, rate changes are enacted through specific ballot measures or administrative updates, with most adjustments occurring every 2–4 years following public approval or statutory review.

What are the primary challenges in managing Riverside sales tax revenue?

+Key challenges include navigating overlapping jurisdictional rates, ensuring compliance across diverse local regulations, adapting to legislative changes, and implementing advanced tracking systems to prevent fraud and misreporting. Consistent stakeholder engagement and technological upgrades are necessary to mitigate these issues effectively.

How can businesses optimize their sales tax obligations in Riverside?

+Businesses can optimize their sales tax obligations by conducting detailed nexus analyses, leveraging exemption certificates where applicable, utilizing automated compliance tools, and strategically selecting locations with favorable rates. Staying informed about rate changes and participating in local policy discussions also positions businesses to adapt swiftly.

What technological trends are shaping the future of Riverside sales tax collection?

+Emerging trends include real-time transaction monitoring, AI-driven analytics for predictive revenue estimation, digital payment integrations, and blockchain-based systems for transparent auditing. These advancements aim to enhance accuracy, reduce fraud, and streamline reporting processes for both authorities and taxpayers.