Wake County Taxes

Welcome to a comprehensive guide on Wake County Taxes, a topic that is essential for understanding the financial landscape and obligations of residents and businesses in this vibrant North Carolina county. As one of the fastest-growing counties in the state, Wake County's tax structure plays a crucial role in its economic growth and development. This article aims to provide an in-depth analysis, offering valuable insights and practical information for anyone seeking to navigate the world of Wake County Taxes effectively.

Understanding the Basics of Wake County Taxes

Wake County, with its diverse economy and thriving communities, operates a tax system that supports its rapid growth and development. The tax structure is designed to fund essential services, infrastructure projects, and initiatives that enhance the quality of life for its residents. This section provides an overview of the fundamental aspects of Wake County’s tax system.

Property Taxes: The Foundation of County Revenue

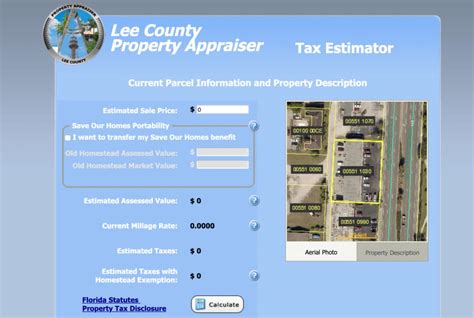

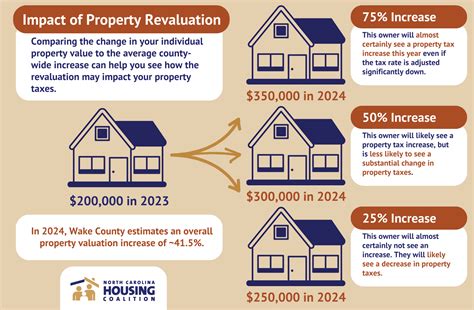

Property taxes are the primary source of revenue for Wake County. These taxes are assessed on both real estate and personal property owned within the county. The property tax rate is determined annually by the Wake County Board of Commissioners and is applied uniformly across the county.

The county’s property tax system is designed to be fair and equitable. Assessments are based on the property’s value, taking into account factors such as location, size, and improvements. Property owners are responsible for paying taxes on their assessed value, with the rate being a percentage of this value. The tax rate is typically expressed as a millage rate, which represents the amount of tax owed per 1,000 of assessed value.</p> <p>For instance, if a homeowner's property is assessed at 200,000 and the millage rate is 0.80%, the annual property tax owed would be $1,600. This calculation ensures that property owners contribute fairly to the county’s revenue based on the value of their assets.

| Property Type | Assessment Ratio | Tax Rate (Millage) |

|---|---|---|

| Residential | 80% | 0.80% |

| Commercial | 85% | 0.90% |

| Agricultural | 80% | 0.75% |

The table above provides a simplified example of how property tax rates can vary based on the type of property. However, it's important to note that these rates are subject to change annually and may differ based on specific circumstances and tax districts within Wake County.

Tax Relief Programs: Supporting Wake County Residents

Wake County recognizes the importance of supporting its residents, especially those who may face financial challenges. As such, the county offers various tax relief programs to ease the burden of property taxes for eligible individuals and families.

One notable program is the Property Tax Deferral for Elderly and Disabled, which allows qualifying residents aged 65 or older or those with disabilities to defer a portion of their property taxes. This program provides much-needed financial relief, allowing seniors and disabled individuals to retain more of their income for essential needs.

Additionally, the Homestead Exclusion program provides a property tax exemption for a portion of the home’s value, benefiting homeowners by reducing their tax liability. This program aims to encourage homeownership and stabilize the housing market within the county.

Other relief programs include the Property Tax Relief for Low-Income Homeowners and the Farmland Preservation Program, which offers tax incentives for preserving agricultural land. These initiatives demonstrate Wake County’s commitment to supporting its residents and fostering a strong, resilient community.

The Process of Tax Assessment and Payment

Understanding the process of tax assessment and payment is vital for property owners in Wake County. This section provides a step-by-step guide to help residents navigate the tax system effectively.

Annual Tax Assessment Cycle

The tax assessment process in Wake County follows a defined cycle, ensuring fairness and accuracy in the valuation of properties.

- Property Valuation: The Wake County Tax Assessor’s Office conducts an annual valuation of all properties within the county. This process involves assessing the property’s value based on various factors, including market trends, location, and improvements.

- Notice of Valuation: Property owners receive a Notice of Valuation, which details the assessed value of their property. This notice serves as an opportunity for property owners to review the assessment and ensure its accuracy.

- Appeal Process: If a property owner disagrees with the assessed value, they have the right to appeal. The appeal process allows for a formal review of the assessment, ensuring that property values are fair and accurate.

- Final Assessment: After the appeal process, the Tax Assessor’s Office finalizes the assessed value, taking into account any adjustments made during the appeal. This final assessment forms the basis for property tax calculations.

Tax Payment Options and Deadlines

Once the assessed value is finalized, property owners are responsible for paying their property taxes. Wake County offers various payment options to accommodate different preferences and needs.

- Online Payment: Property owners can conveniently pay their taxes online through the Wake County Tax Office’s website. This option provides a secure and efficient way to make payments, offering real-time confirmation and the ability to track payment status.

- Mail-in Payment: For those who prefer traditional methods, tax payments can be mailed to the Wake County Tax Office. It’s important to include the proper remittance form and ensure timely postage to avoid late fees.

- In-Person Payment: Property owners can visit the Wake County Tax Office to make payments in person. This option allows for immediate confirmation and the ability to address any questions or concerns directly with tax office staff.

Wake County sets specific deadlines for tax payments to ensure a timely and efficient revenue collection process. Late payments are subject to penalties and interest, which can accumulate over time. It’s crucial for property owners to stay informed about these deadlines to avoid unnecessary financial burdens.

The Impact of Wake County Taxes on Economic Development

Wake County’s tax structure plays a pivotal role in its economic growth and development. The county’s tax policies and initiatives have a direct impact on businesses, investors, and the overall economic landscape.

Attracting Businesses and Investors

Wake County’s tax policies are designed to create a business-friendly environment, attracting new businesses and investors to the area. The county offers a competitive tax structure, with rates that are often lower than surrounding areas, making it an attractive destination for companies looking to expand or relocate.

Additionally, the county provides tax incentives for businesses that create jobs and contribute to the local economy. These incentives, such as tax credits and abatements, encourage businesses to invest in Wake County, leading to increased employment opportunities and economic growth.

For example, the Wake County Job Creation Tax Credit program offers tax credits to businesses that create a specified number of new jobs within the county. This initiative not only attracts businesses but also fosters a positive business environment, promoting innovation and economic prosperity.

Infrastructure Development and Public Services

The revenue generated from Wake County taxes is a vital source of funding for essential infrastructure projects and public services. These funds are invested in areas such as transportation, education, public safety, and healthcare, ensuring that the county’s residents have access to high-quality services and facilities.

For instance, property tax revenue is used to maintain and improve the county’s road network, making it safer and more efficient for commuters and businesses. This investment in infrastructure not only enhances the quality of life for residents but also attracts businesses by providing a well-connected and accessible community.

Furthermore, tax revenue supports the county’s public school system, ensuring that students have access to quality education. This investment in education is crucial for the future success of the county’s residents and the overall economic prosperity of the region.

Future Outlook and Tax Initiatives

As Wake County continues to grow and evolve, its tax structure and initiatives will play a critical role in shaping its future. This section explores the potential future directions and considerations for Wake County’s tax landscape.

Sustainable Tax Strategies

With the county’s rapid growth, sustainable tax strategies are becoming increasingly important. Wake County is exploring ways to ensure that its tax structure remains fair, efficient, and capable of supporting long-term economic development.

One key consideration is the implementation of green tax initiatives. These initiatives aim to encourage environmentally friendly practices and reduce the county’s carbon footprint. By offering tax incentives for renewable energy projects and sustainable business practices, Wake County can position itself as a leader in sustainable development.

Additionally, the county is evaluating ways to promote economic equity and social justice through its tax policies. This includes exploring progressive tax structures that take into account the ability to pay, ensuring that the tax burden is distributed fairly across different income levels.

Community Engagement and Transparency

Wake County recognizes the importance of community engagement and transparency in its tax policies. The county aims to foster a collaborative environment, involving residents and businesses in the decision-making process.

This includes hosting public forums and workshops to gather input on tax initiatives and provide opportunities for community members to voice their concerns and suggestions. By involving the community, Wake County can ensure that its tax policies reflect the needs and values of its residents.

Furthermore, the county is committed to providing transparent and accessible information about its tax structure. This includes publishing detailed reports on tax revenue, expenditures, and the impact of tax initiatives on the community. By being open and transparent, Wake County builds trust and ensures that its tax policies are well-understood and supported by the public.

Conclusion

Wake County’s tax system is a vital component of its economic ecosystem, supporting the county’s growth, development, and the well-being of its residents. From property taxes to tax relief programs and initiatives, the county’s tax policies are designed to create a thriving and equitable community.

As Wake County continues to evolve, its tax structure will play a crucial role in shaping its future. By embracing sustainable practices, fostering community engagement, and maintaining transparency, Wake County can ensure that its tax system remains fair, efficient, and capable of meeting the needs of its diverse population.

For residents and businesses alike, understanding Wake County’s tax landscape is essential for making informed decisions and contributing to the county’s continued success. This comprehensive guide aims to provide valuable insights and practical information, empowering individuals and organizations to navigate the world of Wake County Taxes with confidence and ease.

What is the current property tax rate in Wake County?

+

The property tax rate in Wake County is set annually by the Board of Commissioners. As of the most recent assessment, the rate is 0.80% for residential properties, 0.90% for commercial properties, and 0.75% for agricultural properties. These rates are subject to change and may vary based on specific circumstances and tax districts within the county.

How can I appeal my property tax assessment in Wake County?

+

If you believe your property tax assessment is inaccurate, you have the right to appeal. The appeal process involves submitting a formal request to the Wake County Tax Assessor’s Office, typically within a specified timeframe. The office will review your case and may require additional documentation to support your claim. It’s important to carefully follow the appeal process guidelines to ensure a successful outcome.

Are there any tax incentives or relief programs for businesses in Wake County?

+

Yes, Wake County offers various tax incentives and relief programs to attract and support businesses. These include tax credits for job creation, abatements for capital investments, and incentives for sustainable practices. The county aims to create a business-friendly environment, fostering economic growth and development. It’s recommended to consult with the Wake County Economic Development Office or a tax professional to explore the full range of available incentives.

How does Wake County allocate its tax revenue?

+

Wake County’s tax revenue is allocated to support various public services and infrastructure projects. A significant portion is dedicated to education, ensuring high-quality schools for the county’s students. Additionally, funds are allocated for public safety, healthcare, and transportation infrastructure. The county’s budget provides detailed information on how tax revenue is distributed, ensuring transparency and accountability.

Can I pay my Wake County taxes online?

+

Yes, Wake County offers convenient online payment options for property taxes. You can make payments through the Wake County Tax Office’s website, which provides a secure platform for transactions. Online payments offer real-time confirmation and the ability to track payment status, making it a preferred method for many taxpayers. However, other payment options, such as mail-in or in-person payments, are also available to accommodate different preferences.