Kansas State Tax Refund Status

Navigating the world of state tax refunds can be a complex process, especially when it involves understanding the specific policies and procedures of individual states. This comprehensive guide aims to shed light on the Kansas state tax refund status, providing an in-depth analysis of the process, timelines, and factors influencing refund issuance. By delving into the intricacies of the Kansas tax system, we hope to offer a valuable resource for taxpayers seeking clarity and insight into their refund journey.

Understanding the Kansas Tax Refund Process

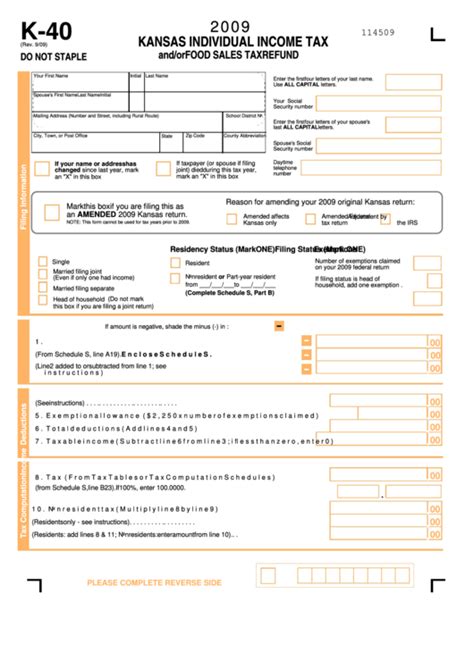

The Kansas Department of Revenue (KDOR) oversees the state’s tax refund process, which is designed to ensure that taxpayers receive their refunds promptly and accurately. The process begins with the submission of a Kansas Individual Income Tax Return, typically due by April 15th of each year. This form, often referred to as Form 1040, is the primary document through which individuals report their income, deductions, and credits to the state.

Once the tax return is submitted, the KDOR reviews the information provided to verify its accuracy and calculate the taxpayer's liability or refund amount. This process involves a meticulous review of the taxpayer's income sources, deductions claimed, and any applicable credits. The department utilizes sophisticated software and procedures to ensure that each return is processed efficiently and in accordance with state tax laws.

Key Steps in the Refund Process

The Kansas tax refund process can be broken down into several key steps, each of which plays a crucial role in determining the outcome and timing of the refund:

- Filing the Tax Return: Taxpayers must ensure that their returns are complete and accurate, including all relevant forms and schedules. The KDOR provides comprehensive guidelines and resources to assist taxpayers in preparing their returns, reducing the likelihood of errors.

- Processing and Verification: Upon receipt, the KDOR assigns a unique identifier to each return and initiates the processing phase. This step involves a thorough review of the return’s data, including income verification, deduction verification, and credit eligibility checks.

- Calculation and Payment: Once the verification process is complete, the KDOR calculates the taxpayer’s liability or refund amount. If a refund is due, the department issues a refund check or, for those who opt for direct deposit, transfers the funds electronically to the taxpayer’s designated account.

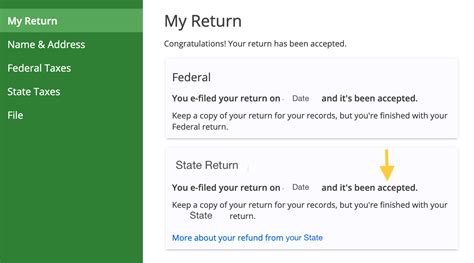

- Tracking and Communication: The KDOR provides various methods for taxpayers to track the status of their refund. This includes online tools, phone support, and even text message updates, ensuring that taxpayers can stay informed throughout the process.

By following these steps, the KDOR aims to deliver efficient and transparent tax refund services to Kansas taxpayers. The department's commitment to accuracy and timeliness ensures that taxpayers receive their refunds promptly, contributing to the overall satisfaction and financial well-being of Kansans.

Factors Influencing Refund Timelines

While the Kansas tax refund process is designed to be efficient, several factors can influence the timeline for receiving a refund. Understanding these factors can help taxpayers manage their expectations and plan their finances accordingly.

Return Complexity

The complexity of a taxpayer’s return can significantly impact the processing time. Returns that involve multiple income sources, extensive deductions, or complex tax situations may require additional review and analysis. This can result in longer processing times, as the KDOR takes the necessary steps to ensure accurate calculations and compliance with tax laws.

For instance, taxpayers with self-employment income, rental property income, or substantial investment gains may face more intricate return processing. The KDOR's commitment to thoroughness in these cases ensures that all applicable tax rules are adhered to, but it may extend the time required for refund issuance.

Error Resolution

Errors on tax returns can delay the refund process significantly. Even minor mistakes, such as incorrect Social Security numbers or miscalculations, can trigger additional scrutiny and delay refund issuance. The KDOR employs robust error detection systems to identify and rectify such issues, ensuring the integrity of the tax system.

When errors are detected, the KDOR may send a notice to the taxpayer, requesting additional information or clarifying details. Responding promptly to such notices is crucial to avoid further delays in the refund process. Taxpayers should carefully review their returns and provide accurate information to expedite the resolution process.

Peak Processing Periods

The timing of tax return filing can also affect refund timelines. During the peak filing season, which typically spans from late January to mid-April, the KDOR experiences a surge in return submissions. This increased workload can lead to longer processing times as the department manages the influx of returns.

To mitigate delays during peak periods, the KDOR encourages taxpayers to file their returns as early as possible. By submitting returns early, taxpayers can reduce their wait time for refunds and avoid the potential bottlenecks that can occur later in the filing season.

Tracking and Communicating Refund Status

The KDOR recognizes the importance of providing taxpayers with timely and accurate information about their refund status. To this end, the department offers several tools and resources to help taxpayers track their refunds and stay informed throughout the process.

Online Refund Status Checkers

The KDOR’s website features an online tool specifically designed to allow taxpayers to check the status of their refunds. This tool, known as the Where’s My Refund feature, provides real-time updates on the progress of a taxpayer’s refund. By entering their Social Security number, filing status, and refund amount, taxpayers can quickly access information about their refund status.

The Where's My Refund tool offers a convenient and efficient way for taxpayers to stay informed, reducing the need for frequent calls or visits to the KDOR's offices. This self-service option aligns with the department's commitment to providing accessible and user-friendly services to Kansans.

Phone Support and Text Updates

For taxpayers who prefer personal assistance, the KDOR offers phone support through its dedicated tax refund hotline. Trained representatives are available to provide detailed information about refund status, processing times, and any issues that may be delaying the refund.

Additionally, the KDOR offers a text message update service, allowing taxpayers to receive real-time notifications about their refund status. By signing up for this service, taxpayers can receive updates directly to their mobile devices, ensuring they are always informed about the progress of their refund.

These communication channels demonstrate the KDOR's commitment to ensuring that taxpayers have access to the information they need to make informed decisions about their finances. By providing multiple avenues for refund status updates, the department enhances transparency and builds trust with Kansan taxpayers.

Future Outlook and Continuous Improvement

The Kansas Department of Revenue is committed to continuously improving its tax refund services to better serve Kansan taxpayers. As technology advances and taxpayer needs evolve, the department remains dedicated to implementing innovative solutions that enhance the refund process.

Digital Transformation

The KDOR is actively exploring digital transformation initiatives to streamline the tax refund process and enhance the taxpayer experience. This includes the development of new online platforms and mobile applications that will provide taxpayers with even more convenient and efficient ways to manage their tax obligations and track their refunds.

By embracing digital technologies, the department aims to reduce processing times, minimize errors, and provide taxpayers with real-time information. These initiatives align with the KDOR's vision of creating a modern, efficient, and taxpayer-centric tax administration system.

Taxpayer Education and Outreach

In addition to technological advancements, the KDOR recognizes the importance of taxpayer education and outreach. The department is dedicated to providing resources and guidance to help taxpayers understand their rights and responsibilities under Kansas tax laws.

Through its website and various communication channels, the KDOR offers comprehensive tax guides, tutorials, and FAQs. These resources aim to empower taxpayers with the knowledge they need to prepare accurate tax returns, understand the refund process, and navigate any complexities that may arise.

By investing in taxpayer education, the KDOR aims to reduce errors and misunderstandings, ultimately leading to a more efficient and satisfactory tax refund experience for Kansans.

Collaboration and Partnership

The KDOR actively collaborates with other state agencies, local governments, and community organizations to enhance its tax refund services. By partnering with these entities, the department can leverage their expertise and resources to improve taxpayer support and outreach efforts.

For instance, the KDOR works closely with local tax preparers and accountants to ensure they have the latest information and resources to assist their clients effectively. This collaboration benefits taxpayers by ensuring that they receive accurate and up-to-date guidance from trusted professionals.

Additionally, the KDOR engages with community organizations to provide tax assistance to underserved populations, ensuring that all Kansans have access to the support they need to navigate the tax system successfully.

| Metric | Value |

|---|---|

| Average Processing Time for Refunds | 21-28 days |

| Peak Processing Period | Late January to mid-April |

| Online Refund Status Tool | Where's My Refund |

How can I check the status of my Kansas state tax refund online?

+You can check the status of your Kansas state tax refund online by visiting the Where’s My Refund page on the KDOR website. You’ll need to provide your Social Security number, filing status, and the exact refund amount shown on your return.

What should I do if my refund status shows an error or delay?

+If your refund status shows an error or delay, it’s important to review your tax return for any inaccuracies or missing information. The KDOR may send a notice requesting additional information. Respond promptly to any such notices to expedite the refund process. If you have further questions, you can contact the KDOR’s refund hotline for assistance.

How can I receive text updates about my refund status?

+To receive text updates about your refund status, you can sign up for the KDOR’s text message service. Visit the Where’s My Refund page and follow the instructions to register your mobile number. You’ll receive real-time notifications about your refund status directly to your phone.

What if I have not received my refund after several weeks?

+If you have not received your refund after several weeks, it’s recommended to check the status of your refund using the online tool or by calling the KDOR’s refund hotline. If your refund status shows that it has been processed, but you still haven’t received the refund, you can contact the KDOR to report the issue and request assistance.

Can I call the KDOR to inquire about my refund status?

+Yes, you can call the KDOR’s refund hotline to inquire about your refund status. The hotline number is typically listed on the department’s website. Trained representatives are available to provide you with detailed information about your refund and assist you with any issues or concerns.