Where Do I Get Tax Forms

Tax forms are essential documents that individuals and businesses use to report their income, expenses, and other financial information to tax authorities. These forms are crucial for determining tax liabilities and ensuring compliance with tax laws. In this comprehensive guide, we will explore the various sources from which you can obtain tax forms, ensuring you have the necessary tools to fulfill your tax obligations accurately and on time.

Understanding Tax Forms and Their Significance

Tax forms serve as the primary medium through which taxpayers communicate their financial data to government tax agencies. These forms are designed to collect specific information relevant to the tax system, enabling tax authorities to assess the tax liabilities of individuals and businesses. The accuracy and completeness of the information provided on tax forms are crucial for maintaining tax compliance and avoiding potential penalties.

For individuals, tax forms are used to report income from various sources, including wages, investments, business activities, and more. These forms also allow taxpayers to claim deductions, credits, and exemptions that can reduce their overall tax burden. On the other hand, businesses utilize tax forms to report their profits, losses, and other financial details, ensuring they meet their tax obligations accurately.

Online Sources for Tax Forms

In the digital age, one of the most convenient ways to obtain tax forms is through online sources. Tax authorities in many countries have embraced technology and made tax forms readily available on their official websites. These websites often provide a dedicated section or portal specifically designed for taxpayers to access and download the necessary forms.

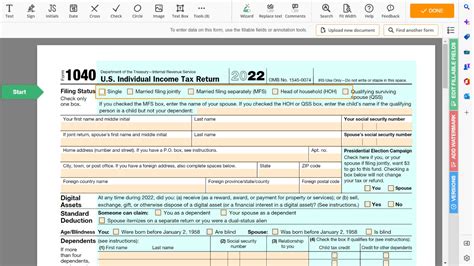

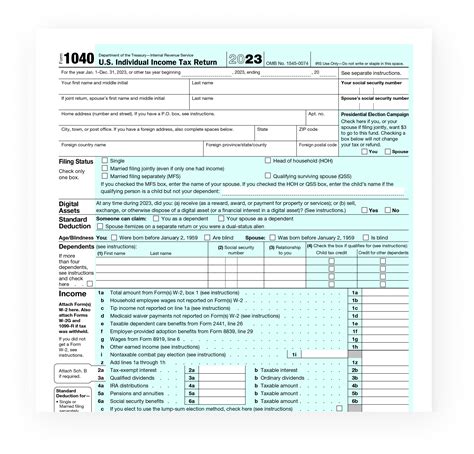

For instance, in the United States, the Internal Revenue Service (IRS) maintains a comprehensive website (https://www.irs.gov) where taxpayers can find a wide range of tax forms and publications. The IRS website offers a user-friendly interface, allowing visitors to search for specific forms by name, number, or keyword. Additionally, the website provides detailed instructions and guides to help taxpayers understand the forms and complete them accurately.

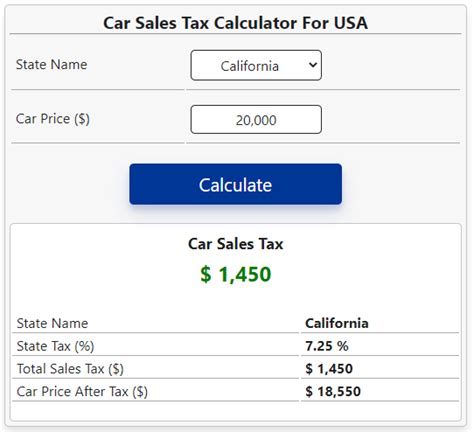

Similarly, tax authorities in other countries, such as the Canada Revenue Agency (CRA) and Her Majesty's Revenue and Customs (HMRC) in the United Kingdom, also have official websites where taxpayers can access tax forms and related information. These websites often provide interactive tools and calculators to assist taxpayers in estimating their tax liabilities and choosing the right forms.

When accessing tax forms online, it is crucial to ensure that you are on the official website of the relevant tax authority. This helps prevent falling victim to fraudulent websites that may attempt to mimic official tax portals. Look for secure connections (indicated by "https" in the website address) and verify the authenticity of the website by checking for official logos and contact information.

Tax Form Libraries and Download Centers

Many tax authorities maintain dedicated libraries or download centers on their websites, offering a centralized location for taxpayers to access various tax forms and publications. These libraries are typically organized by tax year, form category, or purpose, making it easier for taxpayers to find the specific forms they need.

For example, the IRS provides a Forms & Pubs section on its website, where taxpayers can browse through different categories of forms, such as Individual Income Tax, Business & Self-Employed, and Tax Professionals. Each category contains a comprehensive list of forms, with descriptions and download links. The IRS also offers a search function within the library, allowing taxpayers to quickly locate specific forms by name or form number.

Tax form libraries often provide additional resources, such as instructions, frequently asked questions (FAQs), and helpful guides. These resources can assist taxpayers in understanding the purpose of each form, the required information, and the proper way to complete and file the forms.

Online Tax Software and Filing Platforms

In recent years, the use of online tax software and filing platforms has gained popularity as a convenient and efficient way to prepare and file tax returns. These platforms often include built-in tax form libraries, providing taxpayers with easy access to the necessary forms while they work on their tax returns.

Online tax software typically offers a step-by-step process, guiding taxpayers through the completion of their tax forms. The software automatically selects the relevant forms based on the taxpayer's responses to questions about their income, deductions, and tax situation. This simplifies the process and reduces the likelihood of errors.

Popular online tax software providers, such as TurboTax, H&R Block, and TaxAct, maintain comprehensive form libraries that are regularly updated to reflect the latest tax laws and regulations. These platforms often offer additional features, such as real-time tax calculations, error-checking tools, and the ability to e-file tax returns directly from the software.

Physical Locations for Tax Forms

While online sources are convenient, some taxpayers may prefer obtaining tax forms from physical locations. Here are a few places where you can acquire tax forms in person:

Tax Authority Offices

The offices of tax authorities, such as the IRS, CRA, or HMRC, are often equipped with information centers or help desks where taxpayers can access tax forms and receive assistance. These offices typically have a dedicated area where taxpayers can browse through physical copies of various tax forms and publications.

Tax authority offices provide an opportunity for taxpayers to seek guidance and clarification directly from tax professionals. Tax experts can assist with form selection, explain complex tax concepts, and address any concerns or queries taxpayers may have. This face-to-face interaction can be especially beneficial for individuals who prefer a more personalized approach to tax matters.

Post Offices and Government Buildings

In some countries, post offices or government buildings may also have tax forms available for pickup. These locations often serve as distribution centers for official government documents, including tax forms. However, it is essential to verify the availability of tax forms at these locations before making a visit.

Post offices and government buildings may provide tax forms as a public service, ensuring that taxpayers have access to the necessary documents. In some cases, these locations may have a limited supply of forms, so it is advisable to check their availability beforehand to avoid any inconvenience.

Public Libraries and Community Centers

Public libraries and community centers can be valuable resources for obtaining tax forms, especially in areas where access to technology may be limited. These institutions often maintain a collection of tax-related resources, including physical copies of tax forms and publications.

Public libraries and community centers may also offer additional support services, such as tax assistance programs or volunteer tax preparation services. These programs are typically organized by local organizations or tax professionals who volunteer their time to help individuals and families with their tax-related needs.

Tax Professionals and Accounting Firms

Engaging the services of tax professionals or accounting firms can provide taxpayers with access to a wealth of tax knowledge and expertise. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), often maintain a comprehensive library of tax forms and resources to assist their clients.

Tax professionals can guide taxpayers through the selection and completion of the appropriate tax forms, ensuring accuracy and compliance with tax laws. They are well-versed in the latest tax regulations and can provide valuable insights and strategies to optimize tax obligations. Additionally, tax professionals can represent taxpayers before tax authorities, should any issues or disputes arise.

Benefits of Working with Tax Professionals

Working with tax professionals offers several advantages, including:

- Expertise: Tax professionals have extensive knowledge of tax laws and regulations, ensuring accurate and compliant tax form completion.

- Personalized Service: They can provide tailored advice and strategies based on individual tax situations, maximizing tax benefits.

- Error Prevention: Tax professionals help minimize errors and reduce the risk of audits by ensuring the forms are completed correctly.

- Time Savings: Engaging a tax professional can save taxpayers valuable time, as they handle the complex task of tax form preparation.

- Peace of Mind: Tax professionals offer reassurance and support, alleviating the stress and confusion often associated with tax obligations.

Form-Specific Resources and Publications

In addition to the general tax forms, tax authorities often publish specific resources and guides related to particular tax topics or scenarios. These publications can provide valuable insights and instructions for completing complex tax forms or addressing unique tax situations.

Publications and Guides

Tax authorities release various publications and guides to assist taxpayers in understanding specific tax concepts and completing specialized tax forms. These resources often cover topics such as business taxes, estate and gift taxes, retirement plans, and international tax matters.

For instance, the IRS publishes a series of publications, including the Tax Guide for Small Business, which provides a comprehensive overview of tax obligations for small business owners. Similarly, the CRA offers guides like Business and Professional Income, specifically tailored to the needs of self-employed individuals and businesses.

These publications often include step-by-step instructions, examples, and practical tips to help taxpayers navigate complex tax scenarios. They can be invaluable resources for individuals and businesses seeking to ensure compliance and maximize tax benefits.

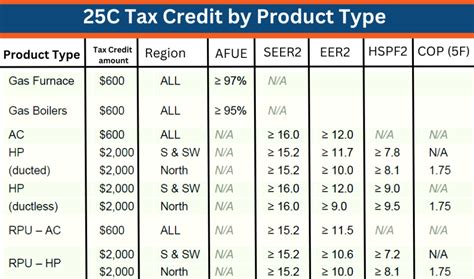

Specialized Tax Forms and Instructions

Certain tax situations may require the use of specialized tax forms, which are designed to address unique circumstances or specific tax obligations. These forms often come with detailed instructions to guide taxpayers through the completion process.

For example, the IRS Form 1040-NR (U.S. Nonresident Alien Income Tax Return) is used by nonresident aliens to report their U.S. source income and determine their tax liabilities. The instructions for this form provide a comprehensive explanation of the filing requirements, including the necessary supporting documents and calculations.

Tax authorities typically make these specialized forms and instructions available through their official websites or publication libraries. It is crucial to carefully review the instructions provided with these forms to ensure accurate and complete reporting.

Electronic Filing and Online Tax Services

In recent years, electronic filing (e-filing) has become an increasingly popular and efficient method for submitting tax returns. E-filing allows taxpayers to transmit their tax forms and related data directly to tax authorities through secure online platforms.

Tax authorities often encourage e-filing as it offers several benefits, including faster processing times, reduced errors, and the ability to track the status of tax returns online. E-filing also eliminates the need for physical tax forms, as the information is transmitted electronically.

To facilitate e-filing, tax authorities provide secure online portals or partner with third-party tax software providers. These platforms often guide taxpayers through the e-filing process, ensuring that all necessary forms and data are included. Some online tax services even offer pre-populated forms based on the taxpayer's previous filings, further simplifying the process.

E-filing is not only convenient but also environmentally friendly, as it reduces the reliance on paper forms and physical storage of tax documents.

Online Tax Preparation Services

Online tax preparation services have gained traction as an alternative to traditional tax preparation methods. These services typically provide step-by-step guidance and tools to help taxpayers complete their tax forms accurately and efficiently.

Online tax preparation services often utilize intuitive interfaces and question-and-answer formats to gather the necessary information. Based on the taxpayer's responses, the service automatically selects the appropriate forms and calculates the tax liability. Some services even offer real-time support or live assistance from tax professionals.

These services are designed to be user-friendly and accessible, catering to individuals who prefer a do-it-yourself approach to tax preparation. However, it is important to choose reputable and trusted online tax preparation services to ensure the security and accuracy of sensitive financial information.

Staying Informed and Up-to-Date

Tax laws and regulations can change frequently, making it essential for taxpayers to stay informed about any updates or modifications that may impact their tax obligations. Here are some tips to ensure you remain up-to-date with the latest tax form requirements:

- Official Websites: Regularly visit the official websites of tax authorities to check for any announcements or updates regarding tax forms and publications.

- Email Notifications: Subscribe to email newsletters or alerts provided by tax authorities to receive timely notifications about changes or new releases.

- Tax Software Updates: If you use tax software, ensure that you install any updates or patches provided by the software developer to access the latest tax forms and features.

- Tax News and Blogs: Follow reputable tax news sources and blogs to stay informed about tax-related developments and changes.

- Professional Guidance: Consult with tax professionals or accounting firms who can provide expert advice and keep you apprised of any relevant tax updates.

Conclusion

Obtaining tax forms is a crucial step in fulfilling your tax obligations accurately and on time. With the advancements in technology and the availability of online resources, accessing tax forms has become more convenient than ever before. Whether you prefer online sources, physical locations, or the expertise of tax professionals, there are numerous options to choose from.

By understanding the various sources for tax forms and staying informed about tax updates, you can ensure a smooth and compliant tax filing process. Remember to verify the authenticity of online sources, seek assistance when needed, and leverage the resources provided by tax authorities to maximize your tax benefits and minimize potential errors.

How can I find tax forms for a specific tax year?

+Tax authorities typically organize their online form libraries by tax year. Visit the official website of the relevant tax authority and navigate to their forms section. Look for a filter or search option that allows you to specify the tax year for which you need forms. Alternatively, you can check the website’s navigation or search for the specific tax year’s page.

Are tax forms available in multiple languages?

+Tax authorities often provide tax forms in multiple languages to accommodate diverse populations. When accessing tax forms online, look for a language selection option or a dedicated section for multilingual forms. Physical locations, such as tax authority offices or community centers, may also have tax forms available in different languages.

Can I access tax forms through mobile apps?

+Yes, many tax authorities and online tax service providers offer mobile apps that provide access to tax forms and related resources. These apps often have user-friendly interfaces, allowing taxpayers to download and view forms, receive notifications, and even complete certain tax-related tasks on their mobile devices.

How do I know which tax forms I need to complete?

+The specific tax forms you need to complete depend on your tax situation, income sources, and deductions. Tax authorities often provide tools or questionnaires to help taxpayers determine the appropriate forms. Additionally, tax professionals or online tax preparation services can guide you in selecting the right forms based on your circumstances.

Can I save or print tax forms from online sources?

+Yes, most online sources for tax forms allow you to save or print the forms directly from their websites. Look for download options or print icons on the form pages. Some websites may also provide the option to fill out the forms online and then download or print a completed copy.