Property Tax Maryland

Property taxes in Maryland are an essential component of the state's revenue stream, impacting not only homeowners but also businesses and commercial entities. The Maryland Department of Assessments and Taxation (MDOT) is responsible for assessing and collecting these taxes, which are then distributed to various local governments and agencies. This process is critical for funding essential services and infrastructure development across the state.

Understanding Property Tax in Maryland

Property tax in Maryland is an ad valorem tax, which means it is based on the assessed value of a property. This value is determined by the MDOT, which assesses properties on a regular basis, typically every three years. The assessed value takes into account factors such as the property’s location, size, improvements, and overall market conditions.

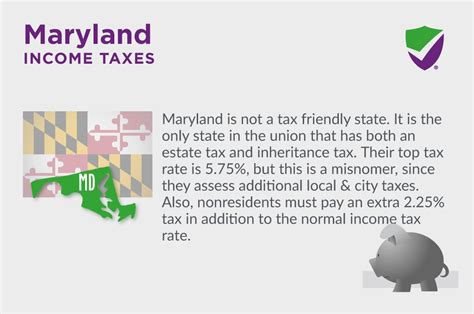

The property tax rate in Maryland varies depending on the jurisdiction. Each county and Baltimore City has its own tax rate, which is applied to the assessed value of the property. These rates are set by local governments and can change annually. For instance, in 2022, Baltimore County's tax rate was $1.107 per $100 of assessed value, while Howard County's rate was $0.978 per $100.

The tax base in Maryland is extensive, encompassing residential, commercial, and agricultural properties. Residential properties, which include single-family homes, condominiums, and cooperatives, make up the majority of the tax base. Commercial properties, such as offices, retail spaces, and industrial buildings, also contribute significantly to the tax revenue. Agricultural properties, including farmland and timberland, are assessed at use value, which is often lower than the market value, to support the state's agricultural industry.

Assessment Process and Appeals

The MDOT follows a systematic process to assess properties. This involves physical inspections, market analysis, and the application of valuation models. Property owners are notified of their assessments and have the right to appeal if they believe the assessed value is inaccurate or unfair. The appeal process typically involves a review by the local assessment office and, if necessary, a hearing before the Maryland Tax Court.

Appealing a property tax assessment requires a well-prepared case. Property owners may need to provide evidence such as recent sales of similar properties, expert appraisals, or documentation of any errors in the assessment. The success of an appeal often depends on the strength of this evidence and the property owner's ability to demonstrate that the assessed value is significantly higher than the property's actual market value.

Impact on Homeowners

For homeowners in Maryland, property taxes are a significant financial obligation. The amount of tax owed can vary greatly, depending on the property’s value and the local tax rate. To illustrate, a homeowner in Montgomery County with a property valued at 500,000 would pay approximately 7,000 in property taxes annually based on the county’s 2022 tax rate of 1.398 per 100 of assessed value.

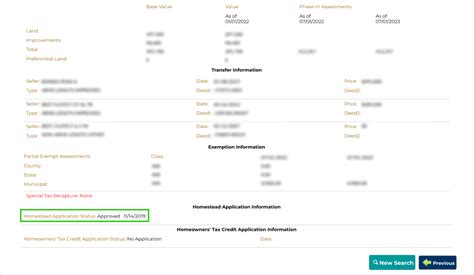

To ease the burden on homeowners, Maryland offers several tax relief programs. These include the Homestead Tax Credit, which provides a credit of up to $2,500 for eligible homeowners, and the Property Tax Credit Program, which offers credits to homeowners based on income and property value. Additionally, the state provides tax breaks for senior citizens, disabled veterans, and those with low incomes.

Property Taxes and the Business Community

Businesses in Maryland also face property tax obligations. Commercial property taxes can be substantial, impacting a company’s financial health and decision-making. For example, a large warehouse with an assessed value of 10 million in Baltimore City would face an annual tax bill of approximately 600,000 based on the city’s 2022 tax rate of 0.0603 per 100 of assessed value.

To attract and retain businesses, Maryland offers various tax incentives. These include tax credits for businesses that create jobs, invest in research and development, or locate in targeted areas. The state also provides tax breaks for certain industries, such as manufacturing and biotechnology, to encourage economic growth and job creation.

Property Tax and Local Government Funding

Property taxes are a primary source of revenue for local governments in Maryland. These funds are crucial for maintaining public services such as schools, police and fire departments, road maintenance, and other infrastructure projects. The distribution of property tax revenue is governed by state laws, with a portion going directly to the local jurisdiction and the remainder being distributed to various state and local agencies.

The reliance on property taxes for local government funding has led to a focus on tax efficiency and equity. Local governments strive to set tax rates that provide adequate revenue without overburdening taxpayers. They also work to ensure that the assessment process is fair and accurate, which can involve regular reviews and adjustments to tax rates and assessment methodologies.

Future Outlook and Potential Reforms

The property tax system in Maryland is constantly evolving to meet the changing needs of the state. As the state’s population grows and property values fluctuate, the tax system must adapt to ensure fairness and adequacy. This may involve periodic reviews of assessment methodologies, tax rates, and the distribution of tax revenue.

There are ongoing discussions and proposals for property tax reform in Maryland. Some of these reforms aim to simplify the tax system, making it more transparent and understandable for taxpayers. Others focus on ensuring that the tax burden is distributed fairly across different types of properties and income levels. Additionally, there are proposals to increase the frequency of property reassessments to better reflect changing market values.

One potential reform is the implementation of a circuit breaker program, which would limit the amount of property tax increase a homeowner can face in a given year, protecting them from rapid increases in their tax bill. Another proposal is to adjust the assessment methodology for agricultural properties to better reflect their market value, while still providing support for the agricultural industry.

| County | 2022 Tax Rate ($ per $100) |

|---|---|

| Anne Arundel | 1.152 |

| Baltimore County | 1.107 |

| Baltimore City | 0.603 |

| Carroll | 0.957 |

| Cecil | 1.032 |

| Frederick | 1.017 |

| Harford | 1.037 |

| Howard | 0.978 |

| Montgomery | 1.398 |

| Prince George's | 1.129 |

| St. Mary's | 0.997 |

| Washington | 1.070 |

How often are properties assessed in Maryland?

+Properties are typically assessed every three years by the Maryland Department of Assessments and Taxation. However, there may be exceptions for new construction or significant improvements to a property, which may trigger an earlier assessment.

What happens if I disagree with my property assessment?

+You have the right to appeal your assessment. The process involves submitting an appeal to your local assessment office, providing evidence to support your case, and potentially attending a hearing before the Maryland Tax Court.

Are there any tax relief programs for homeowners in Maryland?

+Yes, Maryland offers several tax relief programs, including the Homestead Tax Credit, Property Tax Credit Program, and specific credits for senior citizens, disabled veterans, and low-income homeowners. These programs aim to ease the tax burden on eligible homeowners.

How do property taxes impact businesses in Maryland?

+Businesses face significant property tax obligations, which can affect their financial health and operations. To attract and retain businesses, Maryland offers various tax incentives, including tax credits for job creation, research and development, and investment in targeted areas.

What is the role of property taxes in funding local governments in Maryland?

+Property taxes are a primary source of revenue for local governments, supporting essential services and infrastructure. The distribution of property tax revenue is governed by state laws, with funds going to local jurisdictions and various state and local agencies.