States With The Lowest Taxes

Taxes are a significant factor that influences various aspects of our lives, from our personal finances to the overall economic landscape of a region. Understanding the tax structures and rates across different states can provide valuable insights, especially for individuals and businesses considering relocation or investment opportunities. In this comprehensive guide, we delve into the states with the lowest taxes, exploring the tax climate, incentives, and potential benefits they offer.

Exploring the States with Minimal Tax Burdens

When it comes to taxes, certain states in the United States have gained recognition for their favorable tax environments. These states have implemented strategies to attract residents, businesses, and investors by reducing the overall tax burden. Let’s uncover the states that stand out for their low tax rates and the implications this has on their economic growth.

Wyoming: A Tax Haven for Individuals and Businesses

Wyoming boasts one of the most tax-friendly environments in the country. Known for its breathtaking landscapes and vibrant outdoor culture, Wyoming also offers a competitive tax structure that appeals to a wide range of taxpayers.

One of the standout features of Wyoming’s tax system is the absence of personal income tax. This means that residents do not pay state income tax on their earnings, providing a significant advantage compared to many other states. Additionally, Wyoming has a low sales tax rate of 4%, which further reduces the tax burden on consumers.

For businesses, Wyoming offers an attractive corporate income tax rate of 2.5%, one of the lowest in the nation. This low rate, combined with the state’s lack of personal property taxes on business equipment, creates an ideal environment for companies to thrive and expand. Wyoming’s tax climate encourages business growth and investment, making it an appealing destination for entrepreneurs and established enterprises alike.

| Tax Category | Wyoming’s Tax Rate |

|---|---|

| Personal Income Tax | 0% |

| Sales Tax | 4% |

| Corporate Income Tax | 2.5% |

Alaska: A Unique Tax Climate with No Sales Tax

Alaska is renowned for its majestic wilderness and abundant natural resources, but it also boasts a unique tax structure that sets it apart from most states. One of the most notable aspects of Alaska’s tax system is the absence of a statewide sales tax.

Alaska’s decision to forego a sales tax has significant implications for its residents and businesses. While some local governments may impose sales taxes, the overall impact is much lower compared to states with state-level sales taxes. This lack of a sales tax burden makes Alaska an attractive destination for consumers seeking to minimize their tax expenses.

In terms of income taxes, Alaska operates under a progressive tax system, meaning that higher earners pay a higher tax rate. However, the top marginal tax rate is still relatively low at 9.4%, making it one of the lowest in the country. This progressive structure ensures that the tax burden is distributed fairly across different income levels.

| Tax Category | Alaska’s Tax Rate |

|---|---|

| Statewide Sales Tax | 0% |

| Top Marginal Income Tax Rate | 9.4% |

Florida: Sun, Fun, and Low Taxes

Florida, often associated with sunny beaches and a vibrant lifestyle, also offers a compelling tax environment. One of the key attractions of Florida’s tax system is the absence of a state income tax on personal income.

By eliminating state income tax, Florida provides its residents with a significant financial advantage. This means that individuals can keep more of their earnings, leading to higher disposable income and improved economic well-being. Additionally, Florida’s low sales tax rate of 6% further reduces the tax burden on consumers.

For businesses, Florida’s tax climate is equally appealing. The state offers a low corporate income tax rate of 5.5%, creating an environment conducive to business growth and investment. Florida’s tax structure, combined with its thriving tourism industry and diverse economy, makes it a top choice for entrepreneurs and businesses seeking to minimize their tax obligations.

| Tax Category | Florida’s Tax Rate |

|---|---|

| Personal Income Tax | 0% |

| Sales Tax | 6% |

| Corporate Income Tax | 5.5% |

Texas: A Balanced Approach to Low Taxes

Texas, known for its diverse economy and vibrant culture, takes a balanced approach to taxes. While it may not have the absolute lowest tax rates, Texas offers a competitive tax environment that appeals to a wide range of taxpayers.

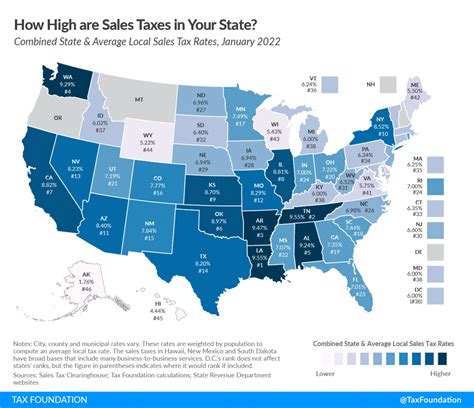

One of the key advantages of Texas’ tax system is the absence of a state income tax on personal income. This means that Texans do not pay state income tax, allowing them to keep more of their earnings. Additionally, Texas has a low sales tax rate of 6.25%, which is below the national average.

For businesses, Texas provides a low corporate income tax rate of 4.5%, making it an attractive destination for companies looking to minimize their tax obligations. Texas also offers a range of tax incentives and exemptions for specific industries, further enhancing its appeal to businesses.

| Tax Category | Texas’ Tax Rate |

|---|---|

| Personal Income Tax | 0% |

| Sales Tax | 6.25% |

| Corporate Income Tax | 4.5% |

Nevada: A Tax-Friendly Environment for Entrepreneurs

Nevada is renowned for its vibrant entertainment industry and bustling tourism sector, but it also boasts a tax system that favors entrepreneurs and businesses. One of the key advantages of Nevada’s tax structure is the absence of a state income tax on personal income.

By eliminating state income tax, Nevada provides a significant financial incentive for individuals to reside and work in the state. This absence of income tax allows residents to keep more of their earnings, leading to higher disposable income and improved financial well-being. Additionally, Nevada has a low sales tax rate of 6.85%, which is relatively competitive compared to other states.

For businesses, Nevada offers a low corporate income tax rate of 1.5%, one of the lowest in the nation. This low tax rate, combined with the state’s lack of franchise taxes, creates an ideal environment for companies to establish and expand their operations. Nevada’s tax-friendly climate, coupled with its thriving tourism industry, makes it an attractive destination for entrepreneurs and businesses seeking to minimize their tax obligations.

| Tax Category | Nevada’s Tax Rate |

|---|---|

| Personal Income Tax | 0% |

| Sales Tax | 6.85% |

| Corporate Income Tax | 1.5% |

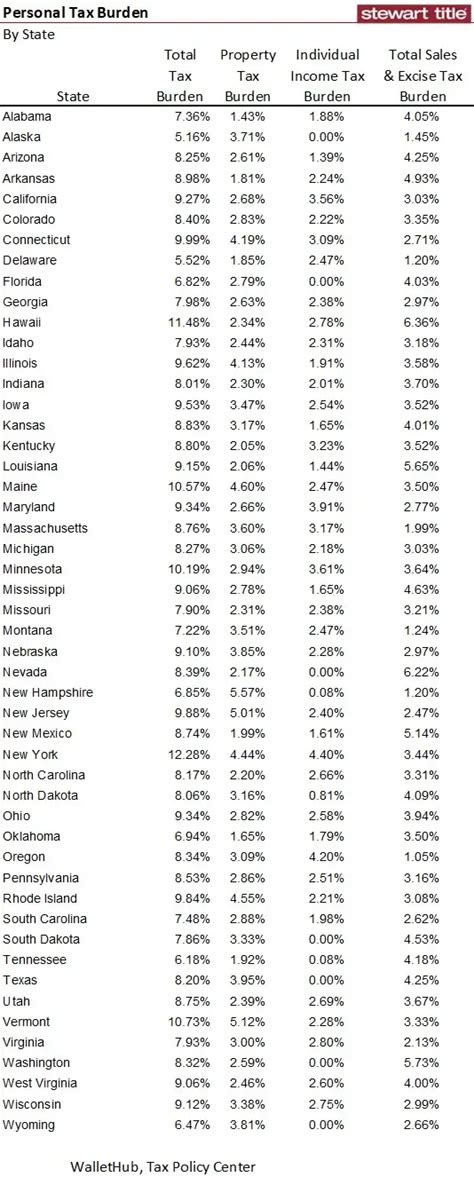

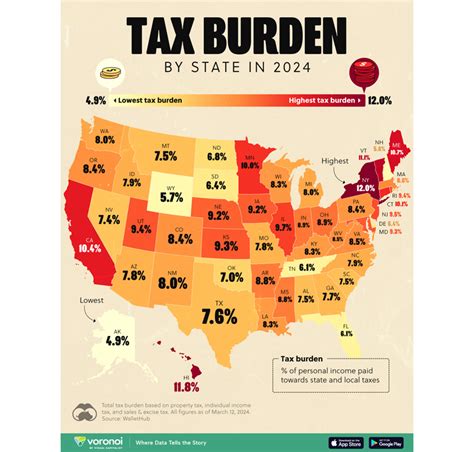

The Impact of Low Taxes: Economic Growth and Opportunities

The states with the lowest taxes have recognized the economic benefits that come with a favorable tax climate. By reducing the tax burden on residents and businesses, these states create an environment that fosters economic growth, attracts investment, and promotes entrepreneurship.

Low taxes can lead to increased disposable income for individuals, allowing them to save, invest, or spend more, thereby stimulating the local economy. For businesses, lower taxes mean more funds available for expansion, innovation, and job creation. This, in turn, contributes to a thriving business ecosystem and attracts talent and investment from across the country.

Furthermore, states with low taxes often offer a range of tax incentives and exemptions to specific industries, further encouraging economic diversification and job growth. These incentives can include tax breaks for research and development, manufacturing, or renewable energy initiatives, creating a competitive advantage for businesses operating in these sectors.

Conclusion: Navigating the Low-Tax States

In conclusion, the states with the lowest taxes offer a unique opportunity for individuals and businesses seeking to minimize their tax obligations. From the tax-free environment of Wyoming to the absence of sales tax in Alaska, these states provide a range of tax advantages that can significantly impact personal finances and business growth.

By understanding the tax structures and incentives offered by these states, individuals and businesses can make informed decisions about their financial future. Whether it’s choosing a state for retirement, establishing a new business, or relocating an existing enterprise, the low-tax states present a compelling case for consideration.

As the economic landscape continues to evolve, the states with the lowest taxes will likely remain attractive destinations, offering a competitive edge and a high quality of life. It is essential for taxpayers to stay informed about the latest tax policies and incentives to make the most of these tax-friendly environments.

Are there any other states with low taxes that were not mentioned in this article?

+Yes, there are several other states with competitive tax environments. For example, South Dakota, Washington, and Tennessee are known for their low tax rates and attractive tax structures. It’s worth exploring these states further to understand their specific tax advantages.

What are the potential drawbacks of living in a state with low taxes?

+While low taxes offer significant advantages, there may be trade-offs. Some states with low taxes may have less funding for public services, infrastructure, or social programs. Additionally, certain states may have higher property taxes or other fees to compensate for the lack of income or sales tax. It’s important to consider these factors when evaluating the overall cost of living.

How do low taxes impact the overall economy of a state?

+Low taxes can have a positive impact on a state’s economy by attracting businesses and individuals, leading to increased economic activity and job growth. However, the impact may vary depending on the specific tax structure and the state’s overall economic landscape. It’s essential to analyze the tax system as part of a broader economic strategy.