Car Winning Tax Calculator

Welcome to the ultimate guide on understanding and navigating the often-confusing world of car winning taxes. Whether you've recently won a car in a competition or are simply curious about the tax implications of such a prize, this article will provide you with the knowledge and tools to make informed decisions.

The Exciting Moment: Winning a Car

Imagine the thrill of winning a brand new car—a dream come true for many. But as exciting as it is, this victory comes with some financial considerations, specifically the taxes associated with your newfound prize. Understanding these taxes is crucial to ensure you’re prepared and can fully enjoy your win.

Understanding the Car Winning Tax

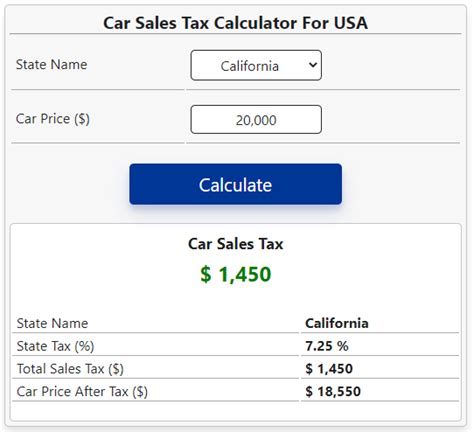

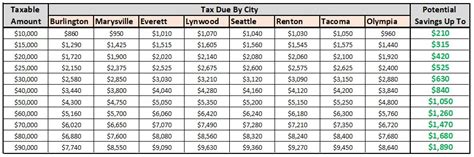

The tax implications of winning a car can vary depending on your location and the value of the prize. In this section, we’ll delve into the specifics of these taxes, helping you navigate the complexities and ensure you’re compliant with the law.

Tax Treatment by Country

Let’s explore how different countries approach the taxation of car winnings:

- United States: In the US, winning a car is considered ordinary income and is subject to federal and state income taxes. The value of the car is added to your taxable income for the year, and you’ll need to report it on your tax return.

- United Kingdom: The UK treats car winnings differently, exempting them from income tax. However, you may still need to pay a Gift Tax if the car is valued over a certain threshold and gifted to someone else.

- Canada: Canadian tax laws view car winnings as income, which means they are taxable. The amount of tax you pay depends on your province and the value of the car.

- Australia: Australia has a unique approach, where car winnings are generally not taxable if won in a competition. However, if the car is used for business purposes, it may be subject to tax.

- European Union: EU countries have varying tax regulations, but generally, car winnings are considered income and are taxable. The specific tax rate and requirements can differ from country to country.

It's important to note that these are general guidelines, and the specific tax implications can vary based on individual circumstances and local laws. Consulting a tax professional or researching the regulations in your specific jurisdiction is highly recommended.

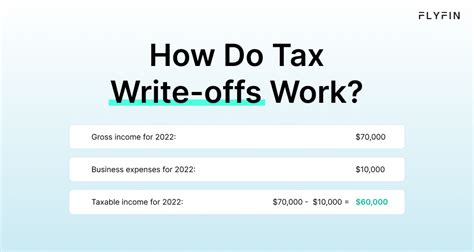

Calculating Your Tax Liability

The process of calculating the tax on your car winnings can be complex, as it involves understanding the tax brackets, applicable rates, and potential deductions. Here’s a simplified breakdown:

| Country | Tax Rate | Thresholds | Deductions |

|---|---|---|---|

| United States | Varies by state and federal tax brackets | Income thresholds for each tax bracket | Standard deductions or itemized deductions |

| United Kingdom | N/A (exempt from income tax) | Gift Tax threshold for car value | N/A |

| Canada | Varies by province and federal tax rates | Income thresholds for each tax bracket | Basic personal amount and other deductions |

| Australia | 0% (generally not taxable) | N/A | N/A |

| European Union | Varies by country and tax brackets | Income thresholds for each tax bracket | Standard deductions or personal allowances |

Remember, these are just general guidelines, and your specific tax liability will depend on your individual circumstances. It's always best to consult a tax advisor or use reputable tax calculation tools to ensure accuracy.

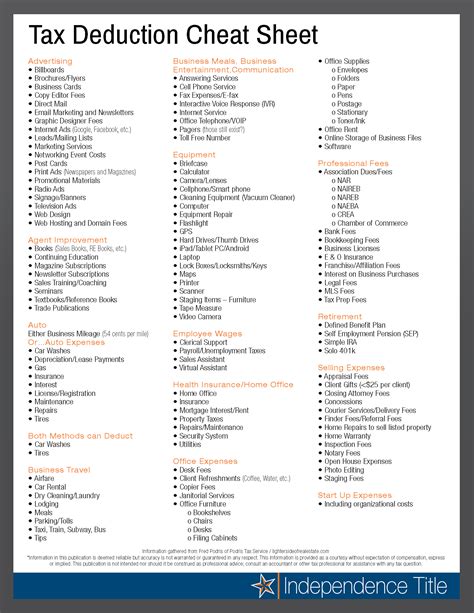

Strategies to Minimize Your Tax Burden

While you can’t avoid taxes entirely when winning a car, there are strategies you can employ to minimize your tax burden. Here are some expert tips to consider:

Donating the Car

If you’re not planning to keep the car, consider donating it to a charitable organization. This can provide you with a tax deduction, offsetting some of the tax liability from your car winnings. However, ensure you follow the proper procedures and keep records of the donation for tax purposes.

Trading the Car

Another strategy is to trade the car for something of value, such as another vehicle or even a non-cash prize. This can help reduce the taxable value of your winnings. However, be cautious and ensure the trade is fair and accurately reflects the value of the car.

Using the Car for Business

If you’re self-employed or have a business, you may be able to use the car for business purposes. This can provide tax benefits, as you can claim expenses related to the car, such as fuel, maintenance, and insurance. However, ensure you keep detailed records and consult a tax professional to ensure compliance.

Selling the Car

If you decide to sell the car, the proceeds can be considered a capital gain or a business income, depending on your circumstances. Selling the car can provide you with some liquidity, but it’s important to understand the tax implications and potential deductions you may be eligible for.

Future Implications and Long-Term Planning

Winning a car can have long-term financial implications, especially when it comes to taxes. Here are some key considerations for the future:

Future Tax Returns

Ensure you accurately report your car winnings on your tax return for the year you won the prize. This will impact your tax liability and may affect your tax brackets in future years.

Capital Gains Tax

If you decide to sell the car in the future, you may be subject to Capital Gains Tax on the difference between the selling price and the car’s original value. Understanding this tax and planning accordingly can help minimize your tax burden.

Insurance and Registration

Remember that owning a car comes with ongoing costs, including insurance and registration fees. These expenses can add up, so it’s important to budget accordingly and consider the long-term financial commitment of car ownership.

How do I determine the value of my car winnings for tax purposes?

+The value of your car winnings can be determined by referencing the retail price of the car or using a valuation tool. It's important to be accurate, as this value will impact your tax liability.

Are there any exceptions to the tax rules for car winnings?

+Yes, some countries have specific exemptions or reduced tax rates for certain types of car winnings, such as charitable donations or prizes from certain organizations. Researching these exemptions can help minimize your tax burden.

What happens if I don't report my car winnings on my tax return?

+Failing to report your car winnings can result in penalties and interest charges. It's important to accurately report your winnings to avoid legal consequences and ensure compliance with tax laws.

Can I claim any deductions for my car winnings?

+Deductions can vary based on your circumstances and the country's tax laws. Common deductions include donation values, trade-in values, and business-related expenses. Consult a tax professional to explore your options.

Winning a car is an exciting experience, and understanding the tax implications is crucial to making the most of your prize. By staying informed and seeking professional advice, you can navigate the tax landscape with confidence and enjoy your car winnings to the fullest.