How Do Tax Write Offs Work

Tax write-offs, also known as tax deductions, are a crucial aspect of financial planning and can significantly impact an individual's or a business's tax liability. Understanding how tax write-offs work is essential for maximizing potential savings and ensuring compliance with tax regulations. In this comprehensive guide, we will delve into the world of tax write-offs, exploring their definitions, types, and the process of claiming them effectively. By the end of this article, you will have a clear understanding of how to navigate the complex landscape of tax deductions and optimize your financial strategy.

Unraveling the Concept of Tax Write-Offs

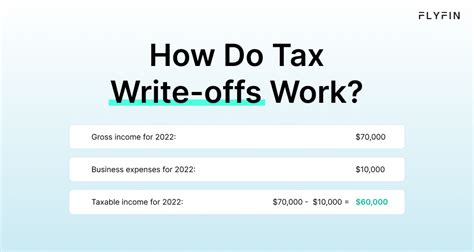

At its core, a tax write-off represents an expense or reduction that can be subtracted from an individual’s or business’s taxable income, thereby lowering the overall tax burden. These write-offs are recognized and permitted by tax authorities, such as the Internal Revenue Service (IRS) in the United States, as a means to encourage specific behaviors or compensate for certain expenditures.

Tax write-offs serve as a strategic tool to reduce the amount of income subject to taxation, resulting in potential savings or a reduced tax liability. They are an integral part of the tax system, offering incentives and benefits to taxpayers who meet specific criteria or incur eligible expenses.

Types of Tax Write-Offs

Tax write-offs come in various forms, each catering to different aspects of an individual’s or business’s financial situation. Understanding the different types of write-offs is crucial for identifying those that may be applicable to your circumstances.

Personal Tax Write-Offs

Personal tax write-offs are deductions that individuals can claim on their tax returns. These deductions are designed to account for expenses incurred throughout the year that directly impact an individual’s financial well-being. Here are some common personal tax write-offs:

- Standard Deduction: A predetermined amount that reduces taxable income, available to all taxpayers, allowing them to subtract a fixed sum from their gross income.

- Itemized Deductions: These are specific expenses that can be claimed individually, such as medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain investment costs. Itemizing allows taxpayers to choose the deductions that best fit their financial situation.

- Education Expenses: Qualifying education expenses, including tuition, fees, and books, can be deducted or claimed through tax credits, reducing the tax burden for those investing in their education.

- Healthcare Costs: Unreimbursed medical expenses that exceed a certain threshold of adjusted gross income can be deducted, providing relief for individuals with significant healthcare expenditures.

- Retirement Contributions: Contributions to retirement accounts, such as IRAs or 401(k)s, can be tax-deductible, encouraging individuals to save for their future.

Business Tax Write-Offs

Businesses have a unique set of tax write-offs that cater to their operational needs and expenses. These deductions are designed to offset the costs of running a business and can vary depending on the industry and business structure.

- Operating Expenses: Everyday business expenses, including rent, utilities, supplies, and advertising costs, can be fully deducted if they are considered ordinary and necessary for the business's operations.

- Business Assets: The cost of assets, such as equipment, vehicles, and furniture, can be deducted over time through depreciation, allowing businesses to recover the cost gradually.

- Travel and Entertainment: Expenses incurred during business travel, including meals, lodging, and transportation, may be deductible if they meet certain criteria and are directly related to business activities.

- Employee Benefits: Contributions to employee health insurance plans, retirement plans, and certain employee incentives can be tax-deductible, providing an incentive for businesses to offer comprehensive benefits.

- Start-up Costs: New businesses can deduct a portion of their start-up costs, such as research and development expenses, to offset the initial investments required to launch a venture.

Claiming Tax Write-Offs: A Step-by-Step Guide

Claiming tax write-offs requires careful documentation and adherence to tax regulations. Here is a step-by-step guide to help you navigate the process effectively:

- Understand Eligibility: Begin by researching and understanding the specific criteria for each tax write-off you intend to claim. Ensure that you meet the requirements and can provide the necessary documentation.

- Gather Supporting Documents: Collect all relevant receipts, invoices, bank statements, and other records that substantiate your expenses. Proper documentation is essential for accurate reporting and potential audits.

- Organize Your Deductions: Categorize your deductions into personal and business expenses, ensuring that you separate them clearly. This organization will streamline the process and make it easier to reference specific deductions when needed.

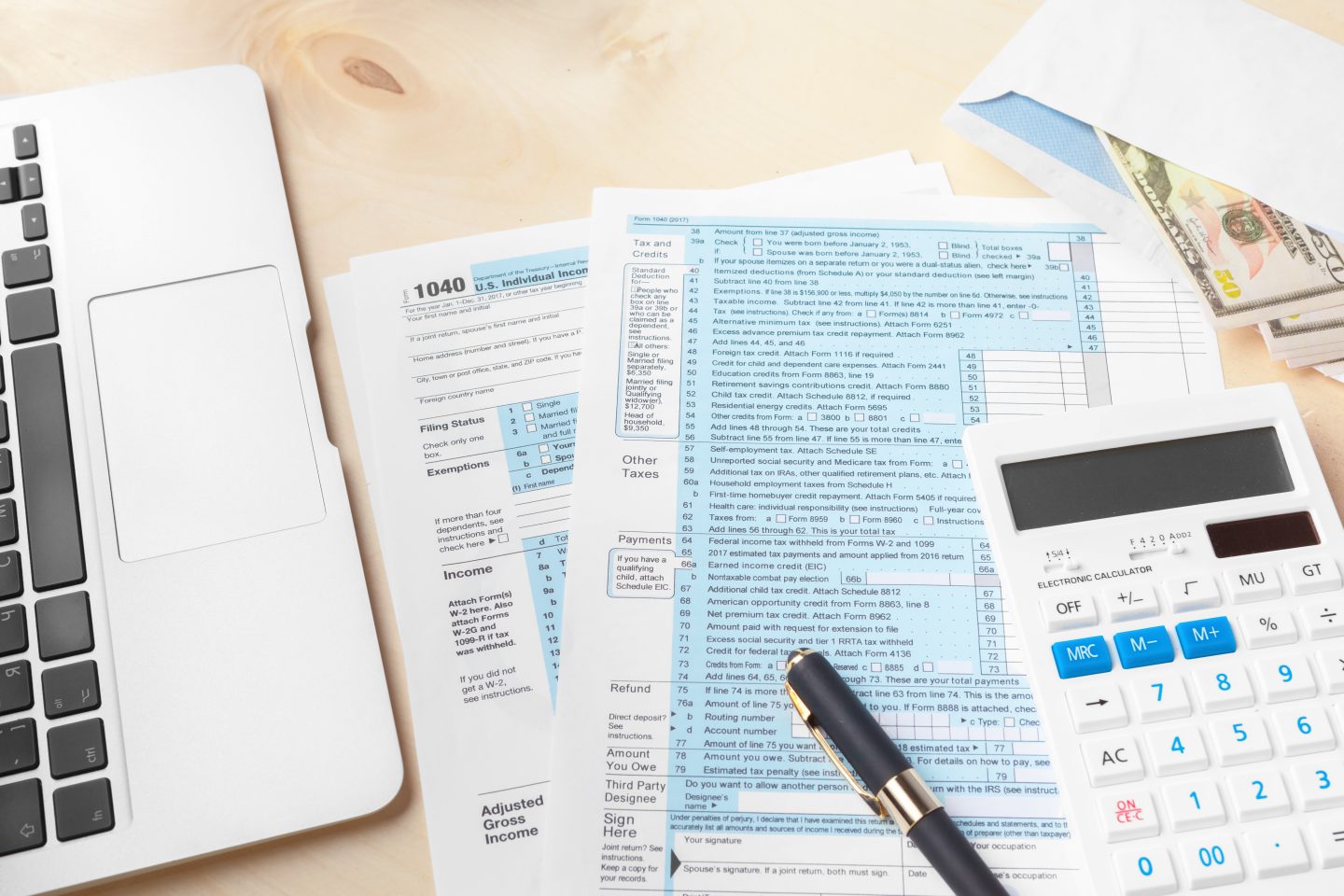

- Complete Tax Forms: Use the appropriate tax forms, such as IRS Form 1040 for individuals or the relevant business tax forms, to report your income and claim your deductions. Follow the instructions carefully and ensure accuracy.

- Review and Verify: Before submitting your tax return, review all the information for accuracy and completeness. Double-check calculations and ensure that you have not missed any applicable deductions.

- File Your Return: Submit your tax return by the deadline, either electronically or by mail. Remember to keep a copy of your return and supporting documents for your records.

Tips for Maximizing Tax Write-Offs

Maximizing tax write-offs requires a proactive approach and a thorough understanding of your financial situation. Consider the following tips to make the most of your deductions:

- Keep Detailed Records: Maintain an organized system for tracking and documenting your expenses throughout the year. This will make it easier to claim deductions accurately and support your claims during audits.

- Explore All Eligible Deductions: Research and consult with tax professionals to identify all possible deductions applicable to your circumstances. There may be deductions that you are unaware of, and exploring these options can lead to significant savings.

- Consider Business Structure: For businesses, choosing the right legal structure can impact the availability and extent of tax write-offs. Consult with legal and tax experts to determine the most advantageous structure for your specific business.

- Plan Ahead: Tax planning is a year-round process. Stay informed about tax law changes and plan your financial strategies accordingly. By anticipating potential deductions and expenses, you can optimize your tax position.

The Impact of Tax Write-Offs on Financial Planning

Tax write-offs play a pivotal role in financial planning, offering taxpayers an opportunity to optimize their tax liability and allocate resources more efficiently. By strategically claiming eligible deductions, individuals and businesses can reduce their tax burden, freeing up funds for other financial goals.

For individuals, tax write-offs can significantly impact their disposable income, allowing for increased savings or investments. Businesses, on the other hand, can use tax write-offs to enhance their profitability and reinvest in their operations. The ability to deduct expenses encourages financial discipline and strategic decision-making, ensuring that taxpayers make the most of their financial resources.

Conclusion: Navigating the Tax Landscape

Tax write-offs are a powerful tool in the hands of savvy taxpayers, offering a legal and strategic way to reduce tax liability. By understanding the different types of deductions, adhering to proper documentation, and staying informed about tax regulations, individuals and businesses can navigate the complex tax landscape with confidence.

Maximizing tax write-offs requires a proactive and informed approach, but the potential savings and financial benefits make it a worthwhile endeavor. As you embark on your tax planning journey, remember that knowledge and strategic financial management are key to unlocking the full potential of tax write-offs.

Can I claim personal expenses as tax write-offs?

+While personal expenses generally cannot be claimed as tax write-offs, certain specific categories, such as medical expenses and education costs, may qualify under certain conditions. It’s important to consult tax guidelines and professionals to understand the eligibility criteria for personal expense deductions.

Are there any limits to the amount of tax write-offs I can claim?

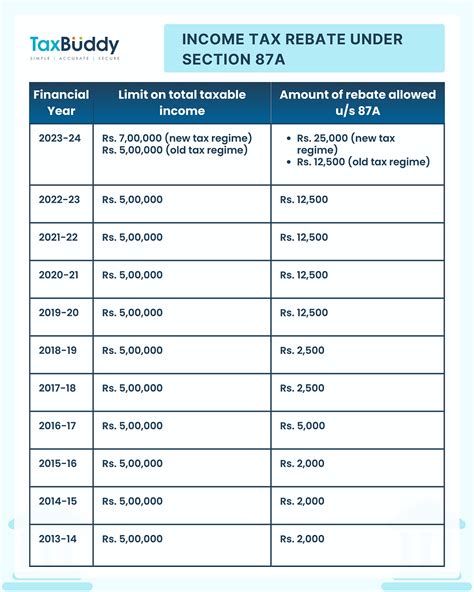

+Yes, there are often limits and thresholds associated with tax write-offs. For example, the standard deduction has a predetermined amount, and itemized deductions may be subject to phase-outs or limitations based on income levels. It’s crucial to understand these limits to maximize your deductions within the allowed parameters.

How can I stay updated on tax law changes that impact tax write-offs?

+Staying informed about tax law changes is essential for effective tax planning. Follow reputable tax news sources, subscribe to tax-related newsletters, and consult with tax professionals who can provide insights into recent developments. Being proactive in understanding tax law changes will ensure you can adapt your strategies accordingly.