Maryland Taxes Refund

Maryland, known for its vibrant communities and diverse landscapes, offers a unique tax landscape that impacts residents and businesses alike. Understanding the intricacies of Maryland's tax system, especially when it comes to refunds, is crucial for individuals and businesses navigating their financial obligations within the state.

Unraveling Maryland’s Tax Landscape

Maryland’s tax system is characterized by a range of taxes, including income tax, sales tax, property tax, and various other fees and levies. The state’s tax policies are designed to support public services, infrastructure, and social programs, making the understanding and effective management of taxes essential for all taxpayers.

The income tax structure in Maryland is progressive, meaning higher earners pay a larger proportion of their income in tax. This system aims to ensure fairness and contribute to the state's revenue. Sales tax, on the other hand, is a flat rate applied to most goods and services, providing a steady source of income for the state.

The Importance of Tax Refunds

Tax refunds are a crucial aspect of Maryland’s tax system, offering financial relief to taxpayers who have overpaid their taxes throughout the year. These refunds can be substantial, providing individuals and businesses with an opportunity to reclaim excess tax payments and improve their financial health.

For many Maryland residents, tax refunds are a significant financial boost, often used to pay off debts, save for the future, or invest in personal or business ventures. Businesses, too, benefit from refunds, as they can help improve cash flow and support growth initiatives.

Understanding the process of claiming and receiving tax refunds in Maryland is therefore essential. It empowers taxpayers to ensure they receive the refunds they are entitled to, and helps them plan their finances more effectively.

The Process of Claiming a Maryland Tax Refund

The journey to claiming a tax refund in Maryland begins with understanding the state’s tax laws and regulations. Maryland’s tax system is complex, and staying informed about the latest changes and requirements is crucial for a smooth refund process.

Step 1: Prepare Your Tax Documents

The first step in claiming a Maryland tax refund is to gather and organize all relevant tax documents. This includes W-2 forms, 1099 forms, receipts for deductible expenses, and any other documentation supporting your income, deductions, and credits.

For businesses, this step is particularly crucial. It involves gathering financial records, invoices, and any other evidence of expenses or income that can be used to maximize deductions and minimize taxable income.

Step 2: File Your Tax Return

Once your tax documents are in order, it’s time to file your tax return. Maryland offers both electronic and paper filing options. Electronic filing is generally faster and more efficient, often resulting in quicker refund processing.

When filing, it's essential to double-check all the information for accuracy. Mistakes on your tax return can lead to delays in processing or even additional tax liabilities.

Step 3: Calculate Your Refund

After filing your tax return, the next step is to calculate your refund. This involves a careful review of your tax forms and the application of any eligible deductions, credits, and exemptions. Maryland’s tax forms guide you through this process, ensuring you claim all the refunds you’re entitled to.

For those less familiar with tax calculations, there are online tools and software available to assist with this step. These resources can simplify the process and reduce the risk of errors.

Step 4: Claim Your Refund

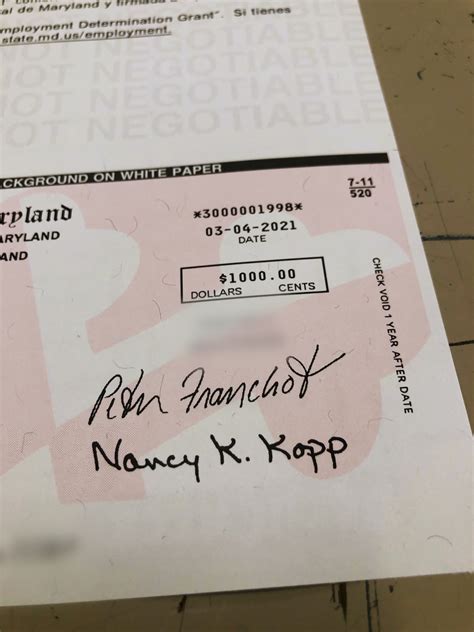

Once you’ve calculated your refund, it’s time to claim it. Maryland offers several refund claiming options, including direct deposit, check, and even the option to apply your refund to the following year’s taxes.

Direct deposit is often the fastest and most convenient method, as it eliminates the wait time for a physical check. However, other methods may be more suitable for certain taxpayers, depending on their preferences and financial situation.

Maximizing Your Maryland Tax Refund

While the process of claiming a tax refund is relatively straightforward, there are strategies that can help maximize the amount of your refund.

Take Advantage of Deductions and Credits

Maryland offers a range of deductions and credits that can reduce your taxable income and increase your refund. These include deductions for medical expenses, charitable donations, and certain business-related expenses. Credits, such as the Child and Dependent Care Credit and the Earned Income Tax Credit, can also boost your refund.

Understanding which deductions and credits you're eligible for and maximizing their use can significantly increase your refund.

File Electronically and Claim Early

Filing your tax return electronically and claiming your refund early can often lead to faster processing and receipt of your refund. Electronic filing reduces the risk of errors and allows for quicker verification of your return.

Additionally, claiming your refund early in the tax season can ensure a swifter refund, as processing times may increase as the tax season progresses.

Keep Detailed Records

Maintaining detailed records of your income, expenses, and tax-related documents is crucial for maximizing your refund. These records not only help with the initial calculation of your refund but can also provide evidence in case of an audit or if you need to amend your return.

Organizing your records digitally or in a secure physical location can make the process of filing and claiming your refund smoother and less stressful.

Common Issues and Challenges with Maryland Tax Refunds

While the process of claiming a Maryland tax refund is generally straightforward, there are some common issues and challenges that taxpayers may encounter.

Audit and Review Processes

Maryland’s tax authorities may select certain returns for audit or review. This is a standard process to ensure the accuracy and integrity of the tax system. If your return is selected for audit, it’s important to respond promptly and provide any requested documentation.

Being prepared for an audit, understanding the process, and seeking professional assistance if needed can help navigate this situation smoothly.

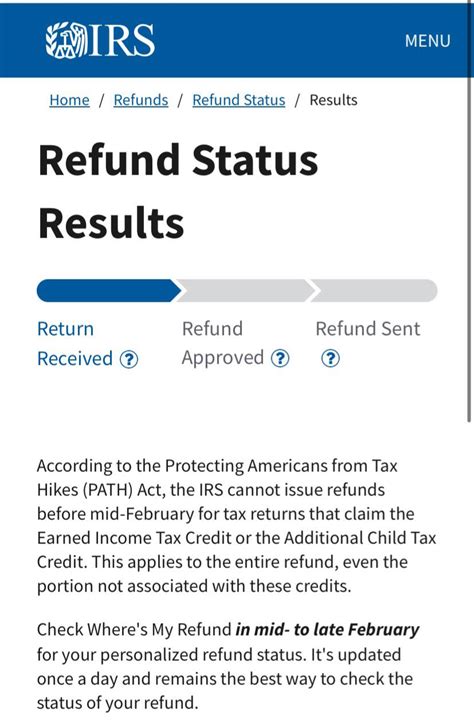

Delays in Refund Processing

While most refunds are processed within a reasonable timeframe, there can be delays due to various factors. These may include errors on the tax return, missing information, or high volumes during peak tax season.

If your refund is delayed, it's important to track its status using the tools provided by the Maryland tax authorities. In some cases, contacting the tax office directly may be necessary to resolve the issue.

Changes in Tax Laws and Regulations

Maryland’s tax laws and regulations are subject to change, which can impact the refund process. Staying informed about these changes is crucial to ensure compliance and maximize your refund.

Tax professionals and resources provided by the Maryland tax authorities can help keep you updated on any changes and their implications for your tax situation.

The Future of Maryland Tax Refunds

As technology advances and tax systems evolve, the process of claiming tax refunds in Maryland is likely to become more efficient and taxpayer-friendly.

Enhanced Digital Services

Maryland is continuously improving its digital services, making it easier for taxpayers to file their returns and claim refunds online. These improvements include enhanced security measures, user-friendly interfaces, and more comprehensive online resources.

As more taxpayers opt for digital filing and refund claiming, the process is expected to become faster and more streamlined.

Simplified Tax Laws and Regulations

Efforts to simplify Maryland’s tax laws and regulations are ongoing. These initiatives aim to make the tax system more understandable and accessible for taxpayers, reducing the complexity of the refund claiming process.

Simplification of tax laws can also lead to a more efficient tax system, benefiting both taxpayers and the state's revenue collection process.

Increased Focus on Taxpayer Education

Maryland recognizes the importance of taxpayer education in ensuring compliance and maximizing refunds. As such, the state is investing in resources and initiatives to educate taxpayers about their rights and responsibilities, as well as the refund claiming process.

By empowering taxpayers with knowledge, Maryland aims to reduce errors and delays in the refund process, creating a more efficient and taxpayer-centric system.

| Tax Type | Rate |

|---|---|

| Income Tax | Progressive, ranging from 2% to 5.75% |

| Sales Tax | 6% |

| Property Tax | Varies by county |

How long does it take to receive a Maryland tax refund?

+

The processing time for a Maryland tax refund can vary depending on several factors, including the method of filing and the time of year. Generally, refunds are issued within 45 days from the date of filing. However, during peak tax season, processing times may be longer.

What if I haven’t received my Maryland tax refund within the expected timeframe?

+

If you haven’t received your refund within the expected timeframe, it’s recommended to check the status of your refund using the tools provided by the Maryland tax authorities. If the status indicates a delay, you can contact the tax office for further assistance.

Can I track the status of my Maryland tax refund online?

+

Yes, Maryland provides online tools to track the status of your tax refund. You can access these tools through the official website of the Maryland Comptroller of Maryland. By entering your filing information, you can view the current status of your refund.

Are there any penalties for filing a Maryland tax return late?

+

Yes, Maryland imposes penalties for late filing of tax returns. The penalty is typically a percentage of the unpaid tax, and it may also include interest on the outstanding amount. It’s important to file your tax return on time to avoid these penalties.

Can I use my Maryland tax refund to pay off other debts or bills?

+

Yes, you have the flexibility to use your Maryland tax refund as you see fit. Many taxpayers use their refunds to pay off debts, save for emergencies, or invest in personal or business ventures. The refund can be a significant financial boost and can be used to improve your overall financial situation.