Cincinnati Income Tax

The Cincinnati Income Tax is a vital component of the city's financial landscape, playing a significant role in shaping the economic environment and contributing to the development and prosperity of the city. Understanding the intricacies of this tax is essential for residents, businesses, and investors alike. In this comprehensive guide, we delve into the specifics of the Cincinnati Income Tax, exploring its history, structure, implications, and future prospects.

History and Origins

The roots of the Cincinnati Income Tax can be traced back to the mid-20th century, when the city faced financial challenges and sought innovative ways to bolster its revenue streams. In 1969, the Cincinnati City Council approved Ordinance 279-1969, establishing a municipal income tax system. This ordinance aimed to provide a stable and reliable source of income for the city, ensuring the continuation of essential services and infrastructure development.

The implementation of the income tax marked a significant shift in Cincinnati's financial strategy, moving away from reliance on property taxes and other traditional revenue streams. This move was influenced by the need for a more equitable and sustainable funding model, recognizing the diverse economic activities within the city.

Tax Structure and Rates

The Cincinnati Income Tax operates on a progressive structure, with rates varying based on the type of income and the taxpayer’s residency status. The tax applies to both individuals and businesses, with specific provisions for each category.

Resident Individuals

Cincinnati residents are subject to a local income tax on their total earnings, including wages, salaries, commissions, and bonuses. The tax rate for residents is currently set at 2.1%, which is applied to the entire taxable income. However, it’s important to note that this rate is subject to change based on city ordinances and budgetary requirements.

For example, let's consider a resident earning an annual income of $60,000. The income tax liability for this individual would be calculated as follows:

| Income | Tax Rate | Tax Amount |

|---|---|---|

| $60,000 | 2.1% | $1,260 |

This calculation demonstrates the direct impact of the income tax on an individual's earnings, with a clear and transparent formula for determining tax liability.

Non-Resident Individuals

Individuals who work within Cincinnati but reside outside the city limits are considered non-residents for income tax purposes. These individuals are subject to a 1.8% tax rate on their earnings from Cincinnati sources. This distinction ensures that non-residents contribute to the city’s finances based on their economic activities within the city.

For instance, a non-resident earning $45,000 annually from Cincinnati-based employment would have an income tax liability of $810 for the year.

Businesses and Corporations

Cincinnati’s income tax also applies to businesses and corporations operating within the city limits. The tax rate for businesses is 2.1%, similar to resident individuals. However, businesses have additional considerations and obligations when it comes to tax reporting and payment.

Businesses are required to withhold income tax from their employees' paychecks and remit these funds to the city. They must also file quarterly tax returns and ensure compliance with all applicable regulations. The income tax revenue generated by businesses contributes significantly to the city's overall financial health.

Tax Benefits and Incentives

To encourage economic growth and attract investments, Cincinnati offers a range of tax benefits and incentives to both individuals and businesses. These incentives are designed to stimulate job creation, support entrepreneurship, and promote sustainable development.

Tax Credits for Individuals

Cincinnati residents who meet certain criteria may be eligible for tax credits, which can reduce their income tax liability. These credits are typically based on factors such as income level, family size, and participation in specific community programs.

For instance, the Earned Income Tax Credit (EITC) provides a refundable tax credit to low- and moderate-income workers, helping them keep a larger portion of their earnings. This credit aims to support working families and promote financial stability.

Business Tax Incentives

Cincinnati actively promotes business growth and investment through a variety of tax incentives. These incentives can take the form of tax abatements, tax credits, or special assessment districts, all aimed at reducing the tax burden for businesses that meet specific criteria.

One notable incentive is the Cincinnati Enterprise Zone Program, which offers tax abatements to businesses that invest in designated areas of the city. This program encourages redevelopment, job creation, and the retention of businesses in targeted neighborhoods.

Impact on the Local Economy

The Cincinnati Income Tax has had a profound impact on the city’s economic landscape, influencing investment patterns, business operations, and the overall fiscal health of the municipality.

Revenue Generation

The income tax is a significant source of revenue for Cincinnati, accounting for a substantial portion of the city’s annual budget. In 2022, the income tax generated over $200 million in revenue, which was allocated towards various city services, infrastructure projects, and debt repayment.

This revenue stream allows the city to maintain a stable financial position, fund essential services like police and fire departments, and invest in critical infrastructure upgrades. The income tax revenue also supports community development initiatives, ensuring a high quality of life for residents.

Business Operations and Investment

For businesses, the Cincinnati Income Tax is a key consideration in their operational strategies and investment decisions. The tax rate and incentives influence business location choices, expansion plans, and overall financial planning.

Companies that choose to establish or expand their operations in Cincinnati benefit from the city's supportive business environment and tax incentives. These incentives can offset the tax burden, making Cincinnati an attractive destination for businesses seeking to optimize their financial performance.

Community Development and Equity

The income tax plays a crucial role in promoting community development and addressing economic disparities. A portion of the tax revenue is directed towards initiatives that support low-income residents, provide job training programs, and invest in underserved neighborhoods.

By targeting resources towards community development, Cincinnati aims to create a more equitable and inclusive city. This approach not only improves the overall well-being of residents but also fosters a sense of social cohesion and shared prosperity.

Future Outlook and Considerations

As Cincinnati continues to evolve and adapt to changing economic conditions, the income tax will remain a critical component of the city’s financial strategy. However, there are several key considerations and potential developments that may shape the future of this tax system.

Economic Growth and Expansion

Cincinnati’s economic growth and expansion will directly impact the income tax revenue. As the city attracts new businesses and experiences population growth, the tax base will expand, leading to increased revenue generation. This growth will enable the city to invest further in infrastructure, services, and community initiatives.

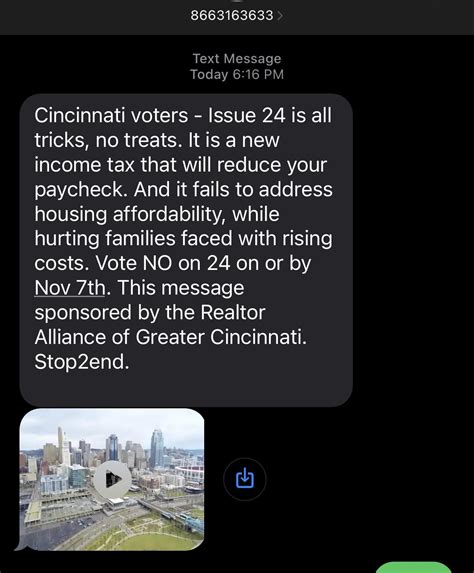

Tax Reform and Equitable Taxation

Discussions surrounding tax reform and equitable taxation are ongoing in Cincinnati. There is a growing recognition of the need to ensure that the tax system remains fair and progressive, considering the diverse economic circumstances of residents and businesses.

Potential reforms may include adjustments to tax rates, revisions to tax credits and incentives, or the introduction of new tax categories to better align with the evolving economic landscape. These reforms aim to maintain a balanced and sustainable tax system that supports the city's long-term financial health.

Community Engagement and Feedback

Community engagement and feedback play a vital role in shaping the future of the Cincinnati Income Tax. The city actively seeks input from residents, businesses, and community organizations to understand their perspectives and ensure that tax policies are responsive to their needs.

Through public hearings, surveys, and community forums, Cincinnati aims to create a transparent and inclusive process for tax-related decisions. This engagement fosters a sense of ownership and involvement among residents, strengthening the city's commitment to equitable and responsible taxation.

Digital Transformation and Tax Compliance

The digital transformation of tax systems is a global trend, and Cincinnati is no exception. The city is exploring ways to enhance tax compliance and efficiency through digital solutions. This includes the development of online platforms for tax filing, payment, and information sharing, making the process more accessible and convenient for taxpayers.

Digital transformation also presents opportunities for improved data analysis and tax policy evaluation. By leveraging technology, Cincinnati can optimize its tax system, identify areas for improvement, and ensure that tax policies remain effective and responsive to changing circumstances.

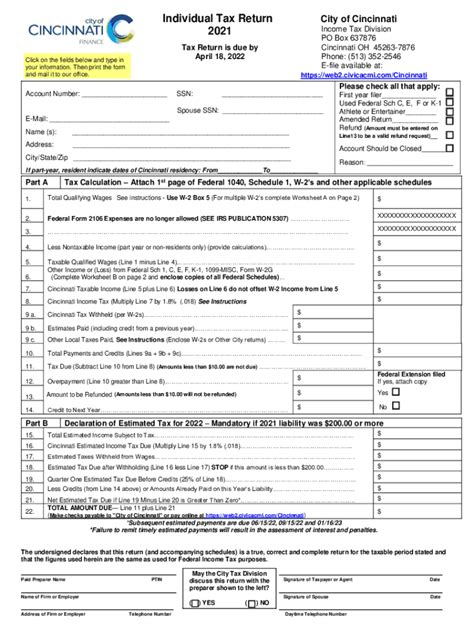

How often do residents need to file income tax returns in Cincinnati?

+Residents are required to file income tax returns annually, typically by April 15th. However, the due date may vary based on the year and specific circumstances.

Are there any income thresholds for tax liability in Cincinnati?

+Yes, there are income thresholds below which individuals are not required to pay income tax. These thresholds vary based on filing status and are subject to annual adjustments.

Can businesses pass the income tax burden onto their customers?

+No, businesses cannot directly pass the income tax burden onto their customers. The tax is considered a cost of doing business, and businesses must account for it in their financial planning.

How does Cincinnati compare to other cities in terms of income tax rates?

+Cincinnati’s income tax rates are generally competitive compared to other major cities in the region. However, it’s important to note that tax structures and rates can vary significantly across different municipalities.

Are there any plans to simplify the tax filing process for residents and businesses?

+The city is continuously working to improve the tax filing process and make it more user-friendly. Digital platforms and streamlined procedures are being developed to enhance accessibility and efficiency.