Guilford County Tax Bill Search

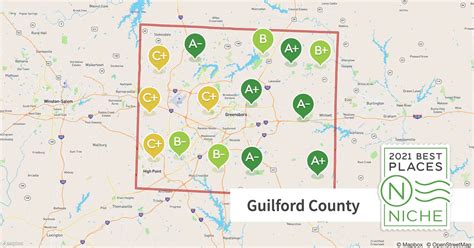

Welcome to the ultimate guide on navigating the Guilford County Tax Bill Search, an essential resource for property owners and investors in the vibrant community of Guilford County, North Carolina. In this comprehensive article, we'll delve into the ins and outs of this platform, providing you with all the information you need to efficiently manage your property taxes and understand the process behind them.

Exploring the Guilford County Tax Bill Search: A Comprehensive Guide

Guilford County, known for its thriving economy, diverse communities, and rich cultural heritage, offers a robust online platform to assist residents and businesses with their tax-related inquiries. The Guilford County Tax Bill Search serves as a user-friendly gateway to access a wealth of information about property taxes, ensuring transparency and convenience for all taxpayers.

This guide aims to provide an in-depth exploration of the features and functionalities of the Guilford County Tax Bill Search, empowering you to make informed decisions about your property tax obligations. Whether you're a homeowner, a real estate investor, or a business owner, understanding the intricacies of property taxes is crucial for effective financial planning and compliance.

Understanding Property Taxes in Guilford County

Before we dive into the specifics of the tax bill search, let's establish a foundational understanding of property taxes in Guilford County. Property taxes are a vital source of revenue for local governments, including counties like Guilford, and are used to fund essential services such as public education, infrastructure development, and public safety initiatives.

In Guilford County, property taxes are levied based on the assessed value of real estate properties, including residential homes, commercial buildings, and vacant land. The tax rate is determined annually by the county commissioners, taking into consideration the budgetary needs of the county and its various departments.

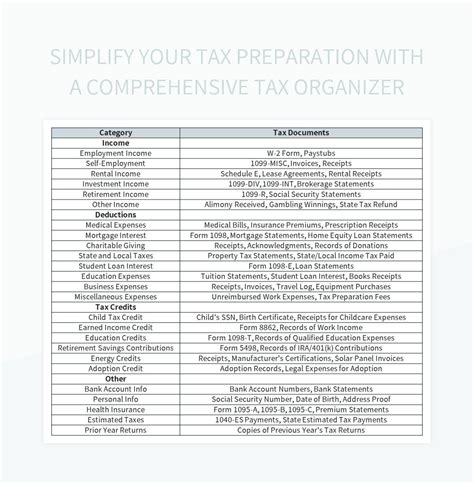

| Property Tax Facts | Details |

|---|---|

| Tax Rate Structure | Guilford County utilizes a uniform tax rate for all property types, ensuring fairness and simplicity in tax assessments. |

| Assessment Process | Property assessments are conducted periodically to determine the current market value of properties, which forms the basis for tax calculations. |

| Tax Bill Generation | Tax bills are typically issued annually, detailing the assessed value, tax rate, and the amount due for the upcoming tax year. |

| Payment Options | Guilford County offers various payment methods, including online payments, in-person payments at designated locations, and mail-in payments. |

Understanding these fundamental aspects of property taxes in Guilford County sets the stage for our exploration of the Guilford County Tax Bill Search, a valuable tool for staying informed and up-to-date with your tax obligations.

The Benefits of Utilizing the Tax Bill Search Platform

The Guilford County Tax Bill Search platform offers a multitude of benefits to taxpayers, making the management of property taxes more efficient and transparent. Here's a glimpse into some of the key advantages:

- Convenience and Accessibility: The online platform allows taxpayers to access their tax information anytime, from anywhere, eliminating the need for physical visits to government offices.

- Real-Time Data: Taxpayers can view up-to-date tax assessments, bills, and payment histories, ensuring they have the most current information at their fingertips.

- Transparency: The platform provides a clear breakdown of tax calculations, including assessed values, tax rates, and any applicable exemptions or discounts, fostering trust and understanding among taxpayers.

- Efficient Payment Options: With online payment facilities, taxpayers can make secure payments quickly, saving time and effort compared to traditional payment methods.

- Customizable Alerts: Users can set up notifications and alerts for important tax-related events, such as bill due dates or changes in tax assessments, ensuring they stay on top of their obligations.

By leveraging the benefits of the Guilford County Tax Bill Search, taxpayers can streamline their tax management processes, reducing administrative burdens and potential penalties associated with late payments or non-compliance.

Navigating the Guilford County Tax Bill Search Platform

Now, let's take a step-by-step journey through the Guilford County Tax Bill Search platform, exploring its features and functionalities in detail. This will ensure you have a seamless experience when utilizing the platform to manage your property taxes.

Step 1: Accessing the Platform

The first step is to access the Guilford County Tax Bill Search platform via the official Guilford County website. The platform is designed with user-friendliness in mind, ensuring a smooth and intuitive experience for all users, regardless of their technical expertise.

Step 2: Search by Property Address

Once you've accessed the platform, you'll be greeted with a user-friendly interface. The primary search function allows you to input your property address to retrieve the corresponding tax information. This search feature is a powerful tool, providing quick access to the tax details of any property within Guilford County.

Step 3: View Tax Assessment Details

After entering your property address, the platform will display a comprehensive overview of your tax assessment. This includes the assessed value of your property, the tax rate applicable to your area, and the resulting tax amount due for the current tax year. The platform provides a clear breakdown of these figures, ensuring transparency and clarity.

Step 4: Explore Payment Options

Guilford County offers a range of payment options to accommodate the diverse needs of its taxpayers. The Guilford County Tax Bill Search platform provides detailed information on these payment methods, including online payment portals, in-person payment locations, and mail-in payment instructions. Users can choose the method that best suits their preferences and circumstances.

Step 5: Review Payment History

To maintain transparency and accountability, the platform allows users to review their payment history. This feature provides a detailed record of all tax payments made, including the date, amount, and method of payment. This information is invaluable for taxpayers who wish to track their payment records and ensure compliance with their tax obligations.

Step 6: Set Up Alerts and Notifications

One of the standout features of the Guilford County Tax Bill Search platform is the ability to set up customizable alerts and notifications. Taxpayers can receive reminders for important tax-related events, such as bill due dates, assessment changes, or upcoming payment deadlines. These alerts ensure that taxpayers stay informed and proactive in managing their property taxes.

Advanced Features and Functionality

Beyond the core functionalities, the Guilford County Tax Bill Search platform offers advanced features that cater to the diverse needs of its users. These features enhance the user experience and provide additional tools for effective tax management.

Comparative Tax Analysis

For property owners and investors, understanding how their tax obligations compare to those of similar properties can be invaluable. The platform offers a comparative tax analysis feature, allowing users to compare their tax assessments with those of neighboring properties or properties with similar characteristics. This feature provides insights into the fairness and consistency of tax assessments, ensuring that taxpayers are not disadvantaged.

Historical Tax Data

The Guilford County Tax Bill Search platform maintains an extensive database of historical tax data. Users can access past tax assessments, bills, and payment records, providing valuable insights into the evolution of their property's tax obligations over time. This historical data is particularly useful for long-term property owners and investors who wish to analyze trends and make informed decisions.

Tax Exemptions and Discounts

Guilford County offers various tax exemptions and discounts to eligible taxpayers, such as senior citizen discounts, military exemptions, and homestead exemptions. The platform provides a dedicated section where users can explore these exemptions, understand the eligibility criteria, and apply for them if applicable. This feature ensures that taxpayers are aware of the benefits they may be entitled to and can take advantage of them.

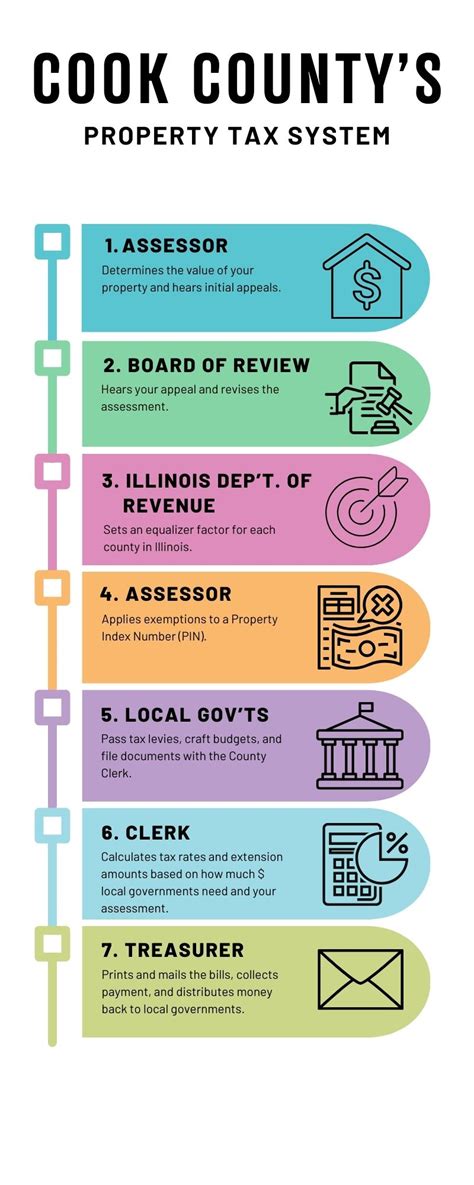

Online Tax Appeals Process

In the event that a taxpayer disagrees with their property assessment, the Guilford County Tax Bill Search platform simplifies the tax appeals process. Users can initiate an online appeal, providing a convenient and efficient alternative to traditional paper-based appeals. The platform guides users through the appeals process, ensuring a streamlined and transparent experience.

Conclusion: Embracing the Future of Property Tax Management

The Guilford County Tax Bill Search platform represents a significant step forward in the management of property taxes, offering a user-centric and technologically advanced solution. By embracing this platform, taxpayers in Guilford County can enjoy the benefits of convenience, transparency, and efficiency in their tax obligations.

As we conclude this comprehensive guide, we encourage you to explore the Guilford County Tax Bill Search platform and discover the wealth of information and tools it offers. By staying informed and proactive, taxpayers can ensure compliance, optimize their tax strategies, and contribute to the vibrant community of Guilford County.

FAQ

How often are tax assessments conducted in Guilford County?

+Tax assessments in Guilford County are typically conducted on a biennial basis, with the aim of ensuring that property values remain current and accurate.

Can I dispute my property assessment if I believe it is inaccurate?

+Absolutely! Guilford County provides a formal appeals process for taxpayers who wish to challenge their property assessments. The Guilford County Tax Bill Search platform offers guidance on initiating an appeal, ensuring a transparent and efficient process.

Are there any tax exemptions or discounts available for seniors in Guilford County?

+Yes, Guilford County offers a senior citizen tax exemption for eligible individuals aged 65 and above. The exemption provides a reduction in the taxable value of their property, resulting in lower tax obligations. The Guilford County Tax Bill Search platform provides detailed information on eligibility criteria and the application process.

What payment methods are accepted for property tax payments in Guilford County?

+Guilford County offers a variety of payment methods to accommodate different preferences. These include online payments through secure payment portals, in-person payments at designated locations, and mail-in payments. The Guilford County Tax Bill Search platform provides comprehensive instructions and guidelines for each payment method.

Can I view my tax bill online if I’ve lost or misplaced my paper copy?

+Absolutely! The Guilford County Tax Bill Search platform allows users to retrieve their tax bills online by simply entering their property address. This feature ensures that taxpayers can access their tax information anytime, even if they’ve misplaced their paper copy.