Pre Tax Vs Roth

The decision between a pre-tax and a Roth contribution is a crucial one when it comes to retirement planning. Both options offer unique advantages and considerations, and understanding the differences is essential for maximizing your retirement savings. This comprehensive guide will delve into the nuances of pre-tax and Roth contributions, helping you make an informed choice tailored to your financial goals and circumstances.

Understanding Pre-Tax Contributions

Pre-tax, or traditional, contributions to retirement accounts like 401(k)s or IRAs allow you to contribute funds before taxes are deducted. This means that the money you contribute reduces your taxable income for the year, providing an immediate tax benefit. The funds grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw the money during retirement.

Advantages of Pre-Tax Contributions

- Tax-deductible contributions: By contributing pre-tax, you lower your taxable income, which can result in significant tax savings, especially if you’re in a higher tax bracket.

- Tax-deferred growth: Your contributions and earnings grow without being subject to annual taxes, allowing for compounded growth over time.

- Suitable for high-income earners: Pre-tax contributions can be particularly beneficial for individuals in higher tax brackets, as they offer immediate tax relief.

Considerations for Pre-Tax

- Taxes at withdrawal: When you withdraw funds during retirement, you’ll pay income taxes on both the contributions and earnings.

- Potential tax bracket changes: If your tax bracket is lower during retirement, you may end up paying more taxes than expected.

- Limited contribution flexibility: Pre-tax contributions often have annual contribution limits, which may restrict your savings potential.

Exploring Roth Contributions

Roth contributions, on the other hand, are made with after-tax dollars, meaning you pay taxes on the income before contributing to your retirement account. While there’s no immediate tax benefit, the growth on these contributions is tax-free, and you won’t pay any taxes on withdrawals during retirement.

Advantages of Roth Contributions

- Tax-free withdrawals: One of the biggest advantages is the ability to withdraw your contributions and earnings tax-free during retirement.

- Potential for tax-free growth: Since you’ve already paid taxes on the contributions, all future growth is tax-free, offering significant long-term benefits.

- Suitable for young investors: Roth accounts are ideal for younger individuals as they provide tax-free growth over a longer period.

Considerations for Roth

- No immediate tax benefit: Unlike pre-tax contributions, Roth contributions don’t provide an immediate tax deduction.

- Income limits: There are income restrictions for contributing to Roth IRAs, which may limit your options if you’re a high-income earner.

- Limited withdrawal flexibility: While withdrawals of contributions are tax-free, early withdrawals of earnings may incur penalties and taxes.

Comparative Analysis

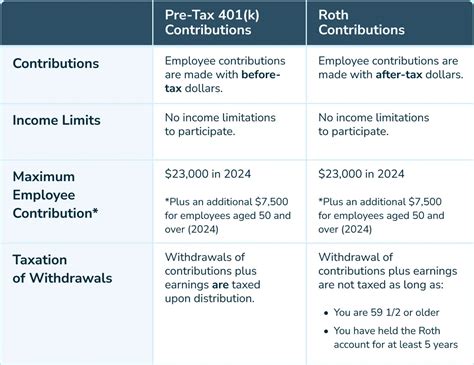

The choice between pre-tax and Roth contributions depends on various factors, including your current tax bracket, expected retirement income, and your investment timeline. Here’s a breakdown of how they compare:

| Category | Pre-Tax | Roth |

|---|---|---|

| Tax Treatment | Tax-deductible contributions, tax-deferred growth | After-tax contributions, tax-free growth and withdrawals |

| Immediate Tax Benefit | Yes | No |

| Taxes on Withdrawals | Taxed on contributions and earnings | Tax-free on contributions and earnings |

| Contribution Limits | Subject to annual limits | Income restrictions apply |

| Suitable for | High-income earners, those in higher tax brackets | Young investors, those in lower tax brackets |

Choosing the Right Option

The decision between pre-tax and Roth contributions is highly individualized. Here are some tips to guide your choice:

- If you’re in a high tax bracket and expect your income to decrease during retirement, pre-tax contributions might be more advantageous.

- For younger investors or those in lower tax brackets, Roth contributions offer the potential for substantial tax-free growth.

- Consider a mix of both options to balance immediate tax benefits with long-term tax-free growth.

Performance and Real-World Examples

Let’s look at some real-world scenarios to illustrate the potential benefits of each option. Imagine two individuals, Alex and Sarah, with different financial situations.

Alex’s Pre-Tax Journey

Alex, a high-income earner in their 40s, opts for pre-tax contributions. With an annual income of 200,000, Alex contributes 20,000 to their 401(k) each year. Over 20 years, this reduces their taxable income by 400,000, resulting in substantial tax savings. During retirement, when their income drops to 80,000, they’ll pay taxes on their withdrawals at a lower rate.

Sarah’s Roth Advantage

Sarah, a young professional in her 20s, earns 50,000 annually and chooses to contribute to a Roth IRA. By investing 6,000 annually, she takes advantage of tax-free growth. Over 40 years, this strategy could result in significant tax-free earnings, especially if her income increases over time.

Expert Insights

Future Implications

The decision you make today regarding pre-tax or Roth contributions can have a significant impact on your retirement income. With tax laws subject to change, it’s essential to stay informed and adapt your strategy as needed. Regularly reviewing and adjusting your retirement plan can ensure you’re on track to meet your financial goals.

Can I contribute to both pre-tax and Roth accounts simultaneously?

+Yes, many retirement plans allow for a combination of pre-tax and Roth contributions. This provides flexibility and the potential to optimize your tax strategy.

What happens if I change my mind about my contribution type?

+Converting between pre-tax and Roth accounts is possible, but it may have tax implications. Consult a financial advisor for guidance on the best approach.

Are there any age restrictions for contributing to Roth accounts?

+While there are no age restrictions per se, Roth IRA contributions are subject to income limits. However, there’s no age limit for Roth 401(k) contributions.