Sales Tax Rate For Seattle Wa

Welcome to our comprehensive guide on the Sales Tax Rate for Seattle, Washington, where we delve into the intricacies of this vital tax component for businesses and consumers alike. Understanding sales tax is crucial for compliance and financial planning, especially in a bustling city like Seattle, known for its vibrant economy and diverse business landscape.

Seattle, nestled in the picturesque Pacific Northwest, boasts a thriving commercial scene, from tech giants to small local enterprises. The city's sales tax structure plays a pivotal role in funding essential public services and infrastructure while also impacting the city's economic growth and consumer behavior. This article aims to provide an in-depth analysis of Seattle's sales tax rate, offering a comprehensive understanding of its implications and the latest regulations.

Understanding Seattle’s Sales Tax Structure

The sales tax in Seattle is a complex interplay of state, county, and city taxes, each contributing to the overall rate. This layered structure is designed to allocate tax revenues to various levels of government, ensuring efficient funding for a range of public services and initiatives.

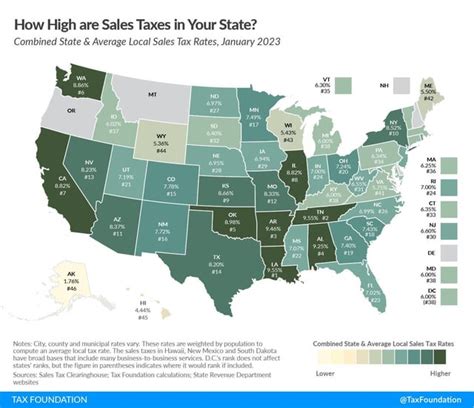

At the core of this structure is the state sales tax rate, which serves as the foundation for all sales tax calculations in Washington. Currently set at 6.5%, this rate is applied uniformly across the state, forming the baseline for local tax additions.

In addition to the state tax, Seattle imposes its own city sales tax, which is levied on top of the state rate. This city-specific tax is crucial for funding local projects and initiatives, such as transportation improvements and community development. As of the latest data, the Seattle city sales tax rate stands at 1.75%, bringing the total sales tax rate for Seattle to 8.25% when combined with the state rate.

Furthermore, Seattle is located within King County, which also applies its own sales and use tax to most transactions. The county tax rate for Seattle currently stands at 0.5%, adding another layer to the city's sales tax structure.

To provide a visual representation of this structure, here's a breakdown of the sales tax rates applicable in Seattle:

| Taxing Jurisdiction | Sales Tax Rate |

|---|---|

| State of Washington | 6.5% |

| City of Seattle | 1.75% |

| King County | 0.5% |

| Total Sales Tax Rate for Seattle | 8.75% |

It's important to note that this breakdown may not include all applicable taxes, such as special district taxes, which can vary based on the specific location within Seattle. Always consult the latest official sources for the most accurate and up-to-date information.

Sales Tax Exemptions and Special Considerations

While the sales tax rate in Seattle is relatively straightforward, there are certain transactions and items that are exempt from sales tax or subject to special rates. Understanding these exemptions is crucial for businesses and consumers to navigate the tax landscape effectively.

Exempt Items

In Washington state, certain goods and services are exempt from sales tax. These exemptions are designed to alleviate the tax burden on essential items or promote specific economic sectors. Some common examples of exempt items in Seattle include:

- Groceries: Food items for home consumption, including non-prepared foods, are generally exempt from sales tax.

- Prescription Medications: Pharmaceuticals dispensed by licensed pharmacies are exempt from sales tax.

- Clothing and Shoes: Most clothing and footwear items are exempt from sales tax, regardless of price.

- Manufacturing Machinery: Sales or leases of machinery and equipment used directly in manufacturing are exempt from state sales tax.

Special Tax Rates

In addition to exemptions, Seattle and Washington state offer special tax rates for certain items or transactions. These rates are designed to encourage specific economic activities or provide relief to certain industries.

For instance, the state of Washington offers a reduced sales tax rate of 4.5% for manufacturing businesses selling their products directly to customers. This rate is applied to the portion of the sale attributed to the manufacturing business, effectively reducing the overall tax burden for these enterprises.

Another notable special rate is the B&O tax rate for certain service businesses, which can be as low as 0.471% for certain service activities. The Business & Occupations (B&O) tax is a gross receipts tax levied on the privilege of doing business in Washington, and this reduced rate can provide significant savings for qualifying service businesses.

Use Tax Considerations

In Seattle, the use tax is an important component of the sales tax structure. Use tax is applied to purchases made outside of Seattle but used within the city limits, ensuring that all taxable transactions are subject to the appropriate tax rate. This includes online purchases, out-of-state purchases, and other transactions where sales tax may not have been collected at the point of sale.

Businesses operating in Seattle must be aware of their use tax obligations and ensure compliance with the applicable rates. For consumers, understanding the use tax is crucial when making purchases remotely to avoid unexpected tax liabilities.

Sales Tax Registration and Compliance

For businesses operating in Seattle, understanding and complying with sales tax regulations is essential. This involves registering with the appropriate tax authorities, collecting and remitting sales tax accurately, and maintaining proper records.

Registration Process

To collect and remit sales tax in Seattle, businesses must register with the Washington State Department of Revenue. The registration process involves completing the appropriate forms, providing business details, and obtaining a unique sales tax permit number. This permit number must be displayed on all sales tax documents and records.

Businesses should also register with the Seattle Office of Finance to obtain a city business license and comply with local tax regulations. This process typically involves submitting additional business information and paying applicable fees.

Sales Tax Collection and Remittance

Once registered, businesses are responsible for collecting sales tax from customers at the point of sale. This involves calculating the applicable tax rate, adding it to the transaction total, and clearly displaying the tax amount to the customer.

Businesses must then remit the collected sales tax to the appropriate tax authorities on a regular basis. The frequency of remittance depends on the business's sales volume and tax liability. Most businesses are required to remit sales tax monthly, quarterly, or annually, depending on their tax obligations.

It's crucial for businesses to maintain accurate records of sales tax transactions, including sales receipts, invoices, and payment records. These records must be retained for a specified period to ensure compliance with tax regulations and facilitate audits, if necessary.

Sales Tax for E-commerce Businesses

With the rise of e-commerce, understanding sales tax for online businesses is crucial. E-commerce businesses operating in Seattle must comply with the same sales tax regulations as brick-and-mortar stores, including registering with tax authorities, collecting sales tax, and remitting it on a regular basis.

Nexus and Sales Tax Obligations

Nexus refers to the connection or presence a business has in a particular state or jurisdiction, which triggers sales tax obligations. For e-commerce businesses, nexus can be established through various factors, including physical presence (such as a warehouse or office), economic presence (such as a significant volume of sales), or certain types of remote activities.

If an e-commerce business has nexus in Seattle, it must collect and remit sales tax on all taxable transactions with customers in the city. This includes online sales, drop-shipping transactions, and any other taxable sales made within Seattle's jurisdiction.

Sales Tax Software and Automation

Managing sales tax obligations for e-commerce businesses can be complex, especially with the varying tax rates and regulations across different jurisdictions. To streamline this process, many businesses utilize sales tax automation software.

These software solutions automate sales tax calculations based on the customer's location, ensuring accurate tax rates are applied to each transaction. They also facilitate sales tax collection at checkout, integrate with e-commerce platforms, and provide tools for sales tax filing and remittance.

By leveraging sales tax automation software, e-commerce businesses can simplify their tax compliance processes, reduce the risk of errors, and focus on their core operations.

Future Implications and Tax Reform

The sales tax landscape in Seattle and Washington state is subject to ongoing changes and reforms. While the current sales tax rate and structure provide a stable foundation for tax collection, there are ongoing discussions and initiatives aimed at reforming the tax system to address emerging economic challenges and promote fairness.

Potential Tax Reforms

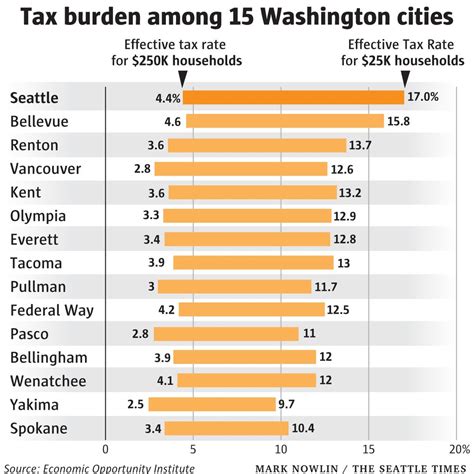

One of the key considerations in tax reform discussions is the impact of sales tax on different sectors and income levels. Critics argue that the current sales tax structure disproportionately affects lower-income individuals and certain industries, such as retail, which rely heavily on consumer spending.

Proposed reforms often focus on shifting the tax burden towards other sources, such as income tax or corporate tax, to achieve a more progressive and equitable tax system. These reforms aim to reduce the reliance on sales tax as a primary revenue source and alleviate the tax burden on certain sectors and individuals.

Emerging Technologies and Tax Collection

The rapid advancement of technology, particularly in e-commerce and remote transactions, presents both challenges and opportunities for tax collection. As more transactions move online, tax authorities face the task of ensuring compliance and capturing the appropriate tax revenues.

To address these challenges, tax authorities are exploring innovative solutions, such as blockchain technology and smart contracts, to enhance tax collection processes and improve compliance. These technologies can automate tax calculations, facilitate real-time tax reporting, and reduce the administrative burden on both taxpayers and tax authorities.

Regional Tax Initiatives

In the Pacific Northwest region, there are ongoing discussions and initiatives aimed at regional tax cooperation and harmonization. These efforts seek to streamline tax regulations and rates across different jurisdictions, making it easier for businesses to comply with tax obligations and reducing the administrative burden.

For instance, the Pacific Northwest Economic Region (PNWER) is exploring ways to facilitate cross-border trade and investment by harmonizing tax policies and procedures. This regional cooperation aims to create a more seamless business environment, promote economic growth, and attract investment across the region.

Conclusion: Navigating Seattle’s Sales Tax Landscape

Understanding and navigating Seattle’s sales tax structure is a crucial aspect of doing business in the city. With a layered tax system and various exemptions and special rates, businesses and consumers must stay informed to ensure compliance and optimize their tax strategies.

By staying up-to-date with the latest sales tax regulations, leveraging technology for tax compliance, and exploring emerging tax reform initiatives, businesses can effectively manage their tax obligations and contribute to the vibrant economy of Seattle.

As Seattle continues to thrive as a hub of innovation and commerce, its sales tax landscape will remain a dynamic and evolving aspect of its economic framework. By staying informed and adapting to changes, businesses can thrive in this bustling city while contributing to its prosperity and public services.

What is the sales tax rate for online purchases in Seattle?

+Online purchases made within Seattle are subject to the same sales tax rate as in-store purchases, which is currently 8.75%. This rate includes the state, city, and county sales tax.

Are there any sales tax holidays in Washington state?

+Yes, Washington state occasionally holds sales tax holidays, typically for back-to-school shopping or certain retail events. These holidays provide a temporary waiver of sales tax on specific items, offering savings for consumers. Check the Washington State Department of Revenue website for the latest information on sales tax holidays.

How often do sales tax rates change in Seattle?

+Sales tax rates in Seattle can change based on legislative decisions and policy changes. While the rates may remain stable for extended periods, it’s important to stay informed about any proposed or enacted changes. Businesses and consumers should regularly check official sources for updates on sales tax rates and regulations.

Are there any sales tax incentives for specific industries in Seattle?

+Yes, Seattle and Washington state offer various tax incentives and programs to support specific industries and promote economic development. These incentives can include reduced sales tax rates, tax credits, or exemptions for qualifying businesses. Check with the Washington State Department of Commerce and the Seattle Office of Economic Development for more information on available incentives.