Hamilton County Taxes

Welcome to this comprehensive guide on Hamilton County taxes, a topic of great interest and importance to residents and businesses within this vibrant community. Hamilton County, nestled in the heart of Ohio, boasts a rich history, a thriving economy, and a unique tax landscape that shapes the financial well-being of its residents. As an expert in tax affairs, I aim to unravel the intricacies of Hamilton County's tax system, providing you with a deep understanding of its structure, rates, and implications.

Understanding Hamilton County’s Tax Structure

The tax landscape of Hamilton County is multifaceted, encompassing a range of taxes that contribute to the county’s revenue and the provision of essential services. At the heart of this system lies the property tax, a fundamental source of funding for local governments across the United States. In Hamilton County, property taxes play a pivotal role, with the rates varying across different municipalities and special districts.

Property taxes in Hamilton County are levied on both real estate and personal property. The county's tax assessor's office is responsible for evaluating property values, a crucial step in determining the tax liability of property owners. These assessments are conducted periodically, ensuring that the tax burden is distributed fairly among residents and businesses.

Real Estate Taxes: A Pillar of Hamilton County’s Revenue

Real estate taxes form a significant portion of Hamilton County’s tax revenue. These taxes are imposed on the value of land and buildings, with the rates differing based on the location and usage of the property. For instance, residential properties may be subject to different tax rates compared to commercial or industrial properties.

The tax rate structure in Hamilton County is complex, incorporating a combination of countywide tax rates and municipal tax rates. The countywide rate applies uniformly across the county, while municipal rates are set by individual cities, villages, and townships. This dual rate system allows for a degree of local control over tax policy while maintaining a cohesive countywide tax framework.

| Taxing Authority | Tax Rate (per $100 of Assessed Value) |

|---|---|

| Hamilton County | 2.10 |

| Cincinnati | 2.15 |

| Blue Ash | 1.70 |

| Montgomery | 1.95 |

Personal Property Taxes: A Lesser-Known Component

While real estate taxes take center stage, Hamilton County also imposes taxes on personal property, including vehicles, boats, and business equipment. These taxes are typically based on the value of the property and are assessed annually. Personal property taxes contribute to the overall tax revenue of the county, although they often garner less attention than real estate taxes.

The tax rates for personal property can vary based on the type of property and its intended use. For instance, vehicles used for business purposes may be subject to different tax rates compared to personal vehicles. The county's tax assessor's office plays a crucial role in evaluating the value of personal property and ensuring compliance with tax regulations.

The Impact of Hamilton County Taxes

The tax system in Hamilton County has far-reaching implications for its residents and businesses. For homeowners, property taxes are a significant financial consideration, impacting their monthly budgets and overall financial planning. The tax rates, combined with the assessed value of their properties, determine the tax liability, which can vary significantly from one neighborhood to another.

Businesses operating in Hamilton County also face unique tax challenges. The county's tax structure, particularly the varying municipal tax rates, can influence business decisions, such as choosing a location or expanding operations. Understanding the tax landscape is crucial for businesses to optimize their financial strategies and ensure compliance with local tax regulations.

Tax Incentives and Economic Development

Hamilton County, like many other jurisdictions, recognizes the importance of attracting and retaining businesses. To this end, the county offers a range of tax incentives and programs aimed at fostering economic development. These incentives can take various forms, including tax abatements, tax credits, and enterprise zones, each designed to encourage investment and job creation.

Tax abatements, for instance, involve a reduction or elimination of property taxes for a defined period, often in exchange for a commitment to invest in the community. This strategy has been employed to encourage the redevelopment of underutilized properties, such as converting old industrial sites into vibrant mixed-use developments.

Tax credits, on the other hand, provide a direct reduction in the tax liability of businesses that meet certain criteria. These criteria can be based on factors such as job creation, investment in research and development, or environmental sustainability initiatives. By offering tax credits, Hamilton County aims to encourage businesses to pursue activities that benefit the community and drive economic growth.

Taxes and Public Services

The revenue generated through Hamilton County’s tax system is a vital source of funding for public services and infrastructure. From schools and public safety to road maintenance and social services, the taxes collected are invested back into the community to enhance the quality of life for residents.

For instance, a portion of the property taxes collected goes towards funding local schools, ensuring that students have access to quality education. Additionally, tax revenue supports the maintenance and improvement of public parks, libraries, and other recreational facilities, fostering a sense of community and providing opportunities for residents to engage in healthy activities.

Navigating the Tax Landscape: Expert Insights

As an expert in Hamilton County’s tax affairs, I offer the following insights to help residents and businesses navigate the complex tax landscape:

- Stay Informed: Keep abreast of tax rate changes and assess your tax liability annually. The tax landscape can evolve rapidly, and staying informed is crucial for accurate financial planning.

- Utilize Tax Incentives: Businesses should explore the various tax incentives offered by Hamilton County. These incentives can significantly reduce tax burdens and encourage growth, making them a valuable tool for strategic financial management.

- Seek Professional Advice: The tax system can be intricate, especially for businesses with complex operations. Engaging the services of a tax professional can ensure compliance, optimize tax strategies, and provide peace of mind.

- Understand Assessment Process: For property owners, understanding how their property is assessed is essential. This knowledge can help identify potential discrepancies and ensure fair taxation.

Conclusion

Hamilton County’s tax system is a dynamic and integral part of the community’s financial ecosystem. From property taxes to personal property taxes and tax incentives, each component plays a unique role in shaping the county’s economic landscape. By understanding these elements and their implications, residents and businesses can make informed decisions, ensuring a prosperous and sustainable future for Hamilton County.

What are the tax rates for Hamilton County residents in 2023?

+The tax rates for Hamilton County residents in 2023 are as follows: Hamilton County - 2.10 per $100 of assessed value, Cincinnati - 2.15, Blue Ash - 1.70, and Montgomery - 1.95. These rates may vary annually and are subject to change based on budgetary needs.

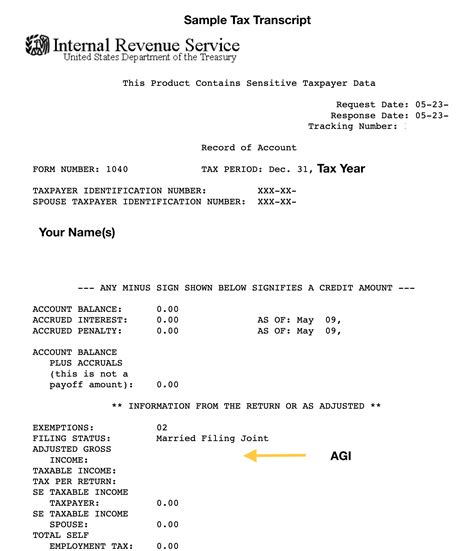

How are property values assessed in Hamilton County?

+Property values in Hamilton County are assessed by the county’s tax assessor’s office. The assessment process involves evaluating the fair market value of properties, considering factors such as location, size, and recent sales data. Assessments are conducted periodically to ensure accurate tax liability.

Are there any tax incentives available for businesses in Hamilton County?

+Yes, Hamilton County offers a range of tax incentives to attract and retain businesses. These incentives include tax abatements, tax credits, and enterprise zones. Businesses can benefit from these incentives by exploring opportunities for growth and investment in the community.