Can You File Taxes Without Working

Filing taxes is an annual ritual for many individuals, but the question arises: is it necessary to have employment or income to file taxes? In this comprehensive guide, we will delve into the world of tax obligations, exploring the scenarios where you might find yourself navigating the tax system without a traditional job. From understanding the nuances of different income sources to exploring tax credits and deductions, we will provide an expert analysis to help you approach your tax filing with confidence.

Understanding Tax Obligations Without Employment

While employment is a common source of income, there are various situations where individuals may not have a traditional job yet still have tax obligations. Here are some scenarios to consider:

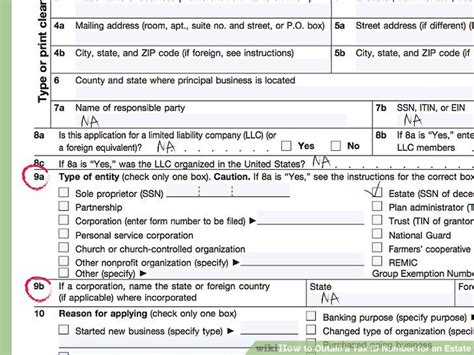

Self-Employment and Freelancing

Even without a standard employment contract, individuals who engage in self-employment or freelancing activities may still be subject to tax obligations. If you provide services or sell goods as an independent contractor, you are considered self-employed and responsible for reporting your income and paying taxes accordingly. This includes professionals like consultants, freelancers, and gig workers.

Investment Income

Investment activities can generate income that is subject to taxation. If you have investments in stocks, bonds, mutual funds, or other financial instruments, you may receive dividends, interest, or capital gains. These income sources are taxable and must be reported on your tax return.

Rental Property Ownership

If you own rental properties, whether residential or commercial, the rental income you receive is considered taxable. Even if you do not have a full-time job, managing rental properties can be a source of income and a potential tax liability.

Unemployment Benefits

In certain situations, individuals may receive unemployment benefits while between jobs. These benefits are considered taxable income and must be reported on your tax return. It is essential to understand the tax implications of unemployment benefits to ensure accurate reporting.

Pensions and Annuities

Retirement income, such as pensions or annuities, is another source of taxable income. If you receive regular payments from a pension plan or an annuity contract, these payments are generally subject to taxation.

Navigating the Tax System: Tips and Considerations

When filing taxes without traditional employment, it is crucial to understand the specific tax obligations associated with your income sources. Here are some tips and considerations to keep in mind:

Determine Your Taxable Income

Start by calculating your total taxable income from all sources. This includes income from self-employment, investments, rental properties, and any other sources. Be sure to understand the tax rates and brackets applicable to your income level.

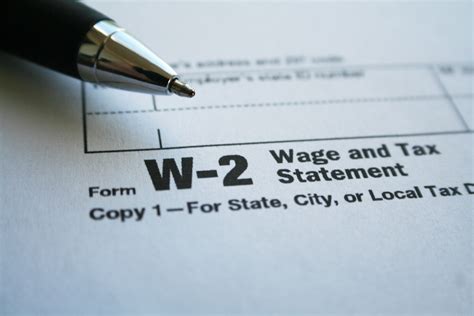

Report Income Accurately

Ensure that you accurately report all income on your tax return. This includes income from self-employment, which may require additional forms and schedules. Failure to report income accurately can lead to penalties and legal consequences.

Understand Tax Credits and Deductions

Explore the various tax credits and deductions available to you. These can help reduce your taxable income and potentially increase your refund. Examples include the Earned Income Tax Credit (EITC), Child Tax Credit, and deductions for medical expenses or educational costs.

Stay Informed About Tax Laws

Tax laws and regulations can change frequently. Stay informed about any updates or changes that may impact your tax obligations. This includes understanding the tax treatment of different income sources and any relevant tax incentives or programs.

Seek Professional Advice

If you have complex tax situations or are unsure about your obligations, consider seeking professional advice from a tax accountant or financial advisor. They can provide personalized guidance and ensure that you comply with tax laws while maximizing your potential tax benefits.

Maximizing Tax Benefits and Credits

Filing taxes without employment does not mean missing out on potential tax benefits. Here are some strategies to maximize your tax advantages:

Take Advantage of Tax Credits

Explore the various tax credits available to you, such as the Child Tax Credit, American Opportunity Tax Credit, or the Saver’s Credit. These credits can provide significant savings on your tax liability, especially if you have dependent children or are saving for retirement.

Claim Deductions Strategically

Identify and claim deductions that apply to your situation. This can include deductions for medical expenses, charitable contributions, or certain business expenses if you are self-employed. Strategically claiming deductions can reduce your taxable income and potentially lower your tax burden.

Utilize Retirement Savings Accounts

If you are not employed, consider contributing to retirement savings accounts such as Individual Retirement Accounts (IRAs) or employer-sponsored plans like 401(k)s. These accounts offer tax advantages, allowing you to reduce your taxable income and potentially receive tax deductions or credits.

Explore Tax-Efficient Investment Strategies

If you have investment income, consider implementing tax-efficient investment strategies. This may involve optimizing your portfolio to minimize capital gains taxes or utilizing tax-advantaged investment vehicles like tax-free municipal bonds or Roth IRAs.

Future Implications and Planning

Filing taxes without employment can impact your future financial planning and tax obligations. Here are some considerations for the long term:

Establish a Financial Plan

Develop a comprehensive financial plan that takes into account your current income sources and future goals. This plan should consider your tax obligations and strategies to optimize your financial situation.

Consider Future Employment

If you are currently between jobs or have plans to return to the workforce, understand the tax implications of future employment. Be prepared to navigate the transition from self-employment or other income sources to traditional employment, ensuring accurate tax reporting and compliance.

Stay Updated on Tax Changes

Keep yourself informed about any changes in tax laws and regulations that may impact your situation. This includes understanding new tax credits, deductions, or incentives that could benefit you in the future.

Explore Tax-Efficient Strategies

Continuously explore tax-efficient strategies to optimize your financial position. This may involve seeking advice from tax professionals, staying updated on tax planning techniques, and making informed decisions about your investments and financial activities.

| Income Source | Tax Considerations |

|---|---|

| Self-Employment | Report income accurately, understand tax obligations, and explore tax credits for self-employed individuals. |

| Investment Income | Consider tax-efficient investment strategies, understand capital gains taxes, and explore tax-advantaged accounts. |

| Rental Property Income | Report rental income, understand tax deductions for property expenses, and explore tax incentives for real estate investments. |

| Unemployment Benefits | Understand the tax treatment of unemployment benefits and report them accurately on your tax return. |

| Pensions and Annuities | Know the tax implications of retirement income and explore tax-efficient withdrawal strategies. |

What are the tax obligations for self-employed individuals without a traditional job?

+Self-employed individuals are responsible for reporting their income and paying self-employment taxes. This includes filing tax returns, paying estimated taxes throughout the year, and understanding tax deductions and credits specific to self-employment.

Are unemployment benefits taxable?

+Yes, unemployment benefits are generally taxable income and must be reported on your tax return. It is important to understand the tax implications and ensure accurate reporting.

How can I maximize tax benefits without employment?

+Explore tax credits like the Earned Income Tax Credit or Child Tax Credit, claim deductions for eligible expenses, and consider contributing to tax-advantaged retirement accounts to maximize your tax benefits.