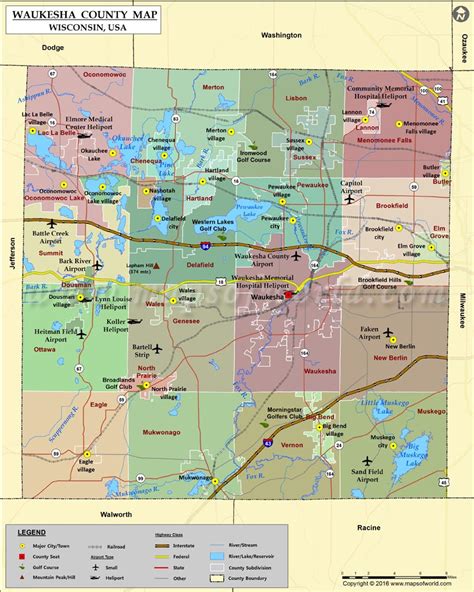

Waukesha County Tax

Welcome to an in-depth exploration of Waukesha County taxes. In this comprehensive guide, we will delve into the intricacies of the tax system in Waukesha County, Wisconsin, offering a detailed analysis for residents and property owners. From understanding the tax structure to navigating the assessment process and exploring tax relief options, we aim to provide valuable insights to help you manage your tax obligations effectively.

Understanding Waukesha County’s Tax Structure

The tax system in Waukesha County operates under a unique structure that combines state and local tax policies. Here’s a breakdown of the key components:

Property Taxes

Property taxes are a significant source of revenue for Waukesha County and play a crucial role in funding various services and infrastructure projects. These taxes are levied on both real estate and personal property within the county.

- Real Estate Taxes: These taxes are based on the assessed value of your property, including land and buildings. The assessment process, conducted by the Waukesha County Assessor’s Office, ensures that properties are valued fairly and consistently.

- Personal Property Taxes: Businesses and individuals owning personal property, such as vehicles, boats, and certain business assets, are subject to personal property taxes. The rates and regulations for these taxes vary depending on the specific type of property.

Sales and Use Taxes

Sales and use taxes contribute to the county’s revenue and are applicable to various transactions. Understanding these taxes is essential for both consumers and businesses operating in Waukesha County.

- Sales Tax: When making purchases within Waukesha County, a sales tax is applied to the total amount. The current sales tax rate is comprised of a state tax rate and a local tax rate, which are combined to determine the total tax liability.

- Use Tax: Use tax is similar to sales tax but is applied to goods and services purchased outside Waukesha County but used or consumed within the county. This ensures that all transactions are taxed fairly, regardless of where the purchase was made.

Income Taxes

Waukesha County residents are also subject to income taxes, which are levied at both the state and local levels. The income tax structure is designed to support essential county services and initiatives.

- State Income Tax: Wisconsin’s income tax system follows a progressive structure, with tax rates varying based on income brackets. The state tax department provides guidelines and resources to help residents calculate their tax liability accurately.

- Local Income Tax: In addition to state income tax, Waukesha County imposes a local income tax. This tax is typically a flat rate applied to taxable income, providing an additional source of revenue for the county.

The Assessment Process: A Step-by-Step Guide

The property assessment process is a critical component of Waukesha County’s tax system. It ensures that property values are determined accurately, allowing for fair taxation. Here’s an overview of the assessment process:

Property Appraisal

The Waukesha County Assessor’s Office is responsible for appraising all properties within the county. This process involves evaluating the market value of your property based on various factors, including:

- Recent sales of comparable properties in the area

- Replacement cost of the structure

- Income potential for income-producing properties

- Physical condition and age of the property

Assessment Notice

Once the appraisal process is complete, the Assessor’s Office will issue an assessment notice to the property owner. This notice provides detailed information about the assessed value of the property and the corresponding tax liability.

Review and Appeal

Property owners have the right to review the assessment and appeal if they believe the assessed value is inaccurate. The appeal process involves:

- Submitting a formal request for review to the Assessor’s Office within a specified timeframe.

- Providing evidence and documentation to support your claim, such as recent property sales data or professional appraisals.

- Attending a hearing or meeting with the Board of Assessment Review to present your case.

- Receiving a decision from the board, which may result in a change to your property’s assessed value.

Exploring Tax Relief Options in Waukesha County

Waukesha County recognizes the importance of providing tax relief to eligible residents and property owners. Several programs and initiatives are in place to ease the tax burden, especially for those facing financial hardships or unique circumstances.

Homestead Credit

The Homestead Credit program offers a tax credit to eligible homeowners or renters based on their income and property taxes paid. This credit can significantly reduce the tax liability for qualifying individuals, making it an essential relief option.

| Eligibility Criteria | Maximum Credit Amount |

|---|---|

| Homeowners: Income below 50,000</td> <td>2,250 | |

| Renters: Income below 20,000</td> <td>750 |

Senior Citizen Tax Relief

Waukesha County provides tax relief specifically for senior citizens. Eligible individuals can apply for a reduction in their property taxes based on their age, income, and property value. This program aims to support seniors in maintaining their homes and managing their financial obligations.

Veteran’s Tax Relief

Veterans and their surviving spouses may be eligible for tax relief through the Veteran’s Exemption program. This exemption reduces the assessed value of the property, resulting in lower property taxes. To qualify, veterans must meet specific service requirements and reside in Waukesha County.

Other Tax Relief Programs

Waukesha County offers additional tax relief programs, such as the Forest Land Exemption for landowners who maintain forest land and the Open Space Exemption for properties dedicated to conservation or recreational purposes. These programs encourage sustainable land use and provide tax benefits to participating landowners.

Tax Payment Options and Deadlines

Understanding the tax payment process and deadlines is crucial to avoid penalties and ensure timely payment. Here’s an overview of the payment options and important dates:

Payment Methods

- Online Payment: Waukesha County provides an online payment portal where taxpayers can make secure payments using their credit or debit cards. This method is convenient and accessible.

- Mail-in Payment: Taxpayers can also remit their tax payments via mail. The Treasurer’s Office provides instructions and addresses for mailing payments.

- In-Person Payment: For those who prefer a personal approach, the Treasurer’s Office accepts walk-in payments during regular business hours.

Payment Deadlines

Tax payments in Waukesha County are due in two installments. The first installment is typically due in January, while the second installment is due in July. Failure to pay by the deadline may result in late fees and penalties.

Navigating Tax Challenges: Resources and Support

Taxation can be complex, and Waukesha County recognizes the need for taxpayer support and education. Several resources and initiatives are available to assist residents and property owners in navigating the tax system effectively.

Taxpayer Assistance Programs

The Waukesha County Treasurer’s Office offers taxpayer assistance programs to provide guidance and support. These programs include:

- Taxpayer education workshops: Informative sessions covering various tax-related topics, helping residents understand their rights and obligations.

- Individual counseling: One-on-one sessions with tax professionals to address specific tax concerns and provide personalized advice.

- Online resources: The county’s website offers a wealth of information, including tax forms, payment instructions, and frequently asked questions.

Community Partnerships

Waukesha County collaborates with community organizations and non-profits to provide additional support to taxpayers. These partnerships offer:

- Free tax preparation assistance for low-income individuals and families.

- Financial literacy programs to educate residents on budgeting, saving, and managing tax obligations.

- Outreach initiatives to ensure that all residents, regardless of their background, have access to tax-related information and support.

Future Implications and Ongoing Initiatives

Waukesha County’s tax system is subject to ongoing review and improvement. The county is committed to maintaining a fair and efficient tax structure that supports its residents and businesses while funding essential services and infrastructure.

Tax Reform Initiatives

Recent tax reform initiatives in Waukesha County have focused on simplifying the tax code, enhancing transparency, and ensuring that tax policies remain equitable for all taxpayers. These reforms aim to reduce complexity and make the tax system more accessible.

Community Engagement

Waukesha County actively engages with its residents and stakeholders to gather feedback and address concerns. Town hall meetings, public hearings, and online surveys provide opportunities for taxpayers to voice their opinions and influence tax policies.

Economic Development and Tax Incentives

The county recognizes the importance of economic development and has implemented tax incentives to attract businesses and stimulate growth. These incentives can take the form of tax credits, abatements, or reduced tax rates for qualifying businesses, encouraging investment and job creation.

How often are property assessments conducted in Waukesha County?

+Property assessments in Waukesha County are typically conducted every two years. However, the Assessor’s Office may conduct reassessments if there are significant changes to a property, such as renovations or additions.

Are there any tax exemptions for new homeowners in Waukesha County?

+Yes, Waukesha County offers a First-Time Homebuyer Credit to encourage homeownership. This credit provides a reduction in property taxes for eligible first-time homebuyers, making it an attractive incentive for those entering the housing market.

How can I stay informed about tax changes and updates in Waukesha County?

+Waukesha County provides a dedicated Tax Updates section on its official website. This section includes news, announcements, and important information regarding tax changes, deadlines, and new initiatives. It’s a valuable resource for staying informed.