Gop Tax Bill Criticism

The passage of the Tax Cuts and Jobs Act, often referred to as the GOP Tax Bill, in 2017 marked a significant overhaul of the US tax system. While touted as a boost to economic growth and job creation, the legislation has sparked intense debate and criticism from various quarters. In this article, we delve into the key aspects of the GOP Tax Bill and explore the reasons behind the widespread criticism it has received.

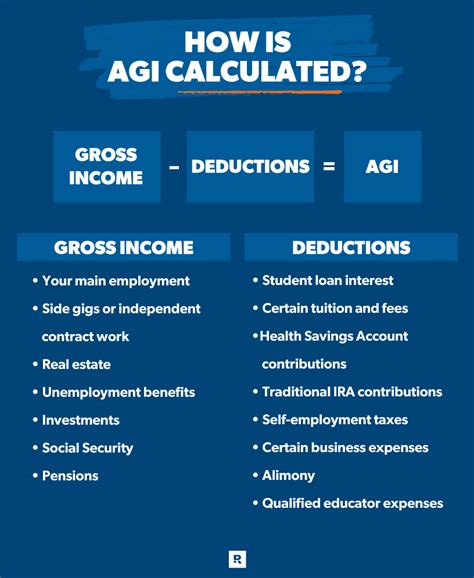

Understanding the GOP Tax Bill

The GOP Tax Bill was a flagship legislative achievement of the Republican Party during the Trump administration. It aimed to simplify the tax code, reduce tax burdens on individuals and businesses, and encourage investment and economic growth. The bill made substantial changes to tax rates, deductions, and credits, with the most notable changes including:

- Individual Tax Rates: The bill introduced new tax brackets and reduced rates for most income levels. For instance, the top marginal tax rate was lowered from 39.6% to 37%, and the lowest bracket's rate was reduced from 10% to 12%.

- Corporate Tax Rate: Perhaps the most controversial change, the bill slashed the corporate tax rate from 35% to 21%, a move proponents argued would boost business investment and job creation.

- Deduction Changes: The legislation made significant alterations to itemized deductions, including limiting the state and local tax deduction (SALT) to $10,000, which disproportionately affected high-tax states like California and New York.

- Pass-Through Entities: The bill introduced a new deduction for pass-through entities, such as sole proprietorships and partnerships, allowing them to deduct up to 20% of their business income.

- Repeal of Individual Mandate: The bill also repealed the Affordable Care Act's individual mandate, which required most Americans to have health insurance or face a tax penalty.

Criticisms and Concerns

The GOP Tax Bill faced criticism from a wide range of stakeholders, including economists, policy analysts, and advocacy groups. Here are some of the key concerns that have fueled the opposition to this legislation:

Lack of Long-Term Sustainability

Critics argue that the tax cuts, particularly for corporations and high-income earners, were not sustainable in the long run. The Congressional Budget Office (CBO) estimated that the bill would add $1.9 trillion to the national debt over ten years. This increase in debt could lead to higher interest rates, reduced government spending on vital services, and potential economic instability.

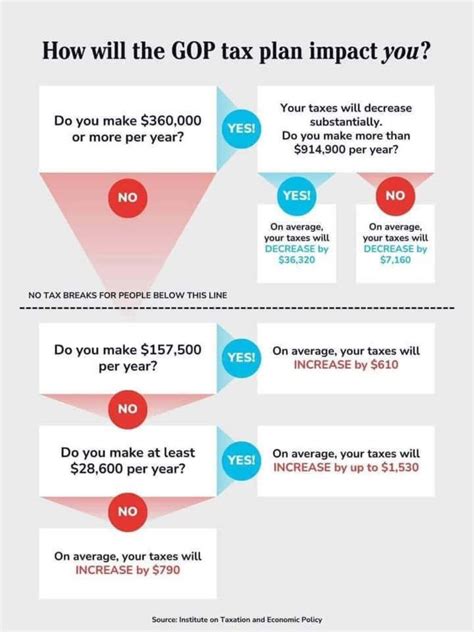

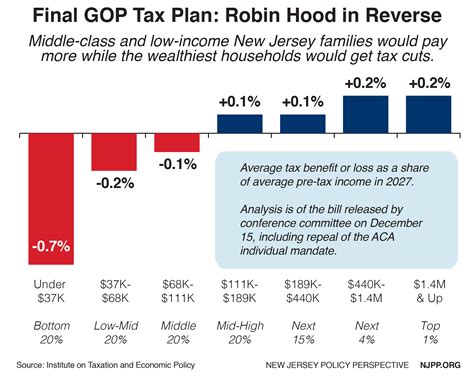

Benefits to the Wealthy

A major point of contention was the disproportionate benefits the bill provided to high-income earners and corporations. While the bill reduced tax rates across the board, the largest percentage reductions went to the highest income brackets. For instance, individuals earning over $500,000 saw their tax rates drop from 39.6% to 37%, a reduction of nearly 6%.

Furthermore, the pass-through entity deduction, which primarily benefits small businesses, has been criticized for also benefiting wealthy individuals who can structure their income through these entities to receive the deduction. This has been seen as a loophole that allows the wealthy to further reduce their tax liability.

Impact on State and Local Governments

The limitation of the state and local tax (SALT) deduction to $10,000 has been a significant concern for high-tax states. States like New York, California, and New Jersey, which have higher income and property taxes, saw a reduction in the federal tax benefits their residents could claim. This, in turn, has led to reduced revenue for these states, impacting their ability to fund vital services like education and infrastructure.

Reduced Healthcare Coverage

The repeal of the Affordable Care Act’s individual mandate was another controversial aspect of the bill. Critics argue that this repeal will lead to an increase in uninsured individuals, as the mandate was a key component in encouraging younger, healthier individuals to purchase health insurance, thereby spreading the risk and keeping premiums down for everyone.

Economic Growth and Job Creation

One of the central promises of the bill was to boost economic growth and create jobs. However, critics argue that the evidence for this is mixed. While there was a temporary boost in economic growth immediately after the bill’s passage, this growth has since slowed. Furthermore, the job creation benefits have been less clear, with some studies showing minimal impact on job growth.

Complexity and Administrative Burdens

Despite the goal of simplifying the tax code, critics argue that the bill introduced new complexities and administrative burdens. The pass-through entity deduction, for instance, requires businesses to calculate their qualified business income and track it separately from other income, adding to the compliance costs and complexity for small businesses.

| Metric | Impact |

|---|---|

| Corporate Tax Rate Reduction | Expected to boost business investment and job creation |

| Individual Tax Rate Changes | Reduced tax burden for most income levels, but benefits skewed towards high-income earners |

| Deduction Limitations | Limited state and local tax deductions for high-tax states, impacting state revenue |

| Pass-Through Entity Deduction | Benefits small businesses but also creates loophole for wealthy individuals |

The Future of Tax Policy

The debate surrounding the GOP Tax Bill has had a significant impact on the political landscape and public perception of tax policy. As the legislation approaches its fifth year in effect, its long-term impacts are becoming clearer. While some aspects of the bill, such as the corporate tax rate reduction, appear to have provided a boost to business investment, the overall effectiveness and sustainability of the bill are still being debated.

As we move forward, policymakers will need to carefully consider the lessons learned from the GOP Tax Bill. The challenge will be to balance the need for tax reform and economic growth with the goal of maintaining fiscal responsibility and addressing the concerns of all segments of society. This includes ensuring that tax policies promote fairness, simplicity, and long-term sustainability.

What were the main objectives of the GOP Tax Bill?

+The main objectives were to simplify the tax code, reduce tax burdens on individuals and businesses, and encourage investment and economic growth.

How did the bill impact corporate tax rates?

+The corporate tax rate was slashed from 35% to 21%, a significant reduction aimed at boosting business investment.

Did the bill benefit high-income earners more than lower-income individuals?

+Yes, the bill reduced tax rates across the board, but the largest percentage reductions went to the highest income brackets, disproportionately benefiting high-income earners.

What was the impact of limiting the SALT deduction on state and local governments?

+Limiting the SALT deduction reduced revenue for high-tax states, impacting their ability to fund vital services like education and infrastructure.

Did the bill achieve its goal of boosting economic growth and job creation?

+While there was a temporary boost in economic growth, the long-term impact on job creation is less clear, and the bill’s overall effectiveness is still being debated.