Commission Tax Rate

The concept of commission tax rate is an essential aspect of the business world, particularly for professionals operating within the sales and commerce sectors. It plays a crucial role in determining the earnings and financial obligations of individuals working on a commission basis. Understanding the nuances of commission tax rates is not only vital for tax compliance but also for effective financial planning and strategic decision-making.

In this comprehensive guide, we will delve into the intricacies of commission tax rates, exploring their definitions, variations, and implications. By the end of this article, you will have a thorough understanding of commission tax rates and their impact on various professions, equipped with the knowledge to navigate this aspect of your financial journey.

Understanding Commission Tax Rates

At its core, a commission tax rate refers to the percentage of commission earnings that an individual is required to pay in taxes. It is a critical component of the overall tax liability for those who earn a significant portion of their income through commissions, bonuses, or similar performance-based compensation.

Commission-based income is distinct from traditional salaries or wages, as it is often more variable and dependent on individual performance. As a result, the tax treatment of commission income can be more complex, requiring a nuanced understanding of applicable tax laws and regulations.

The Impact of Commission Tax Rates

The commission tax rate can have a significant impact on an individual’s net income. A higher tax rate can reduce the overall earnings from commissions, while a lower rate can provide a financial incentive for high-performing individuals. It is, therefore, a critical consideration for professionals in sales, real estate, insurance, and other commission-based industries.

Moreover, the commission tax rate can influence an individual's tax planning strategies. Understanding the applicable tax rates can help professionals make informed decisions about when and how to claim commissions, optimize deductions, and structure their financial affairs to minimize tax liabilities.

Variations in Commission Tax Rates

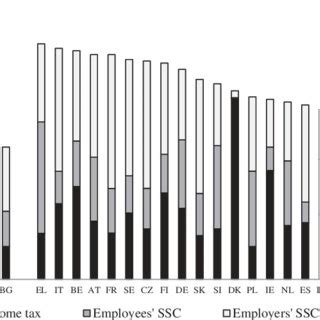

The commission tax rate can vary significantly depending on a multitude of factors, including the individual’s country of residence, the nature of the commission income, and the specific tax laws and regulations in that jurisdiction.

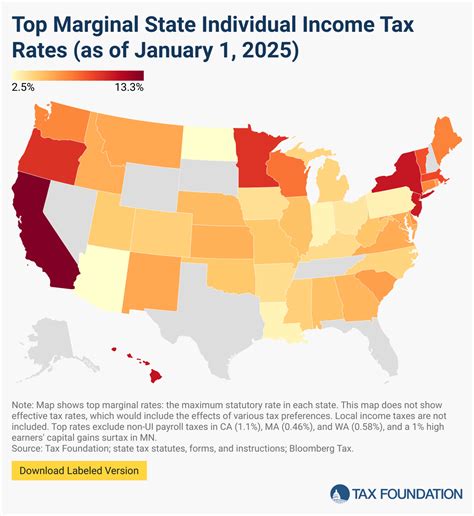

Country-Specific Commission Tax Rates

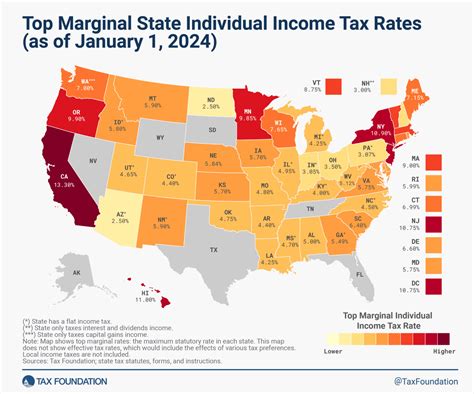

Different countries have distinct tax systems and regulations, which can result in varying commission tax rates. For instance, the United States has a progressive tax system, where the tax rate increases as income rises. In contrast, some countries have a flat tax rate, applying the same percentage to all income levels.

Additionally, some countries may have specific tax regulations for commission income, such as the United Kingdom, which offers a special tax allowance for certain types of commission earnings.

Industry and Sector Variations

The commission tax rate can also vary based on the industry and sector in which the individual operates. For example, the tax treatment of commissions in the real estate industry may differ from that of the insurance sector or sales and marketing professions.

Understanding these variations is crucial for professionals to ensure they are compliant with the relevant tax laws and regulations in their industry and jurisdiction.

Calculating Commission Tax

Calculating the commission tax liability involves several steps and considerations. Here’s a simplified breakdown of the process:

Step 1: Determine the Commission Income

The first step is to identify the total commission income earned during the tax year. This includes all commissions, bonuses, and performance-based payments received from various sources.

Step 2: Understand Applicable Tax Rates

Research and understand the tax rates applicable to your commission income. This may involve consulting tax guides, speaking with tax professionals, or referring to official tax publications.

Step 3: Calculate Tax Liability

Using the applicable tax rates and your commission income, calculate the tax liability. This can be a complex process, especially for high-income earners or those with multiple sources of commission income. Consider seeking professional tax advice for an accurate calculation.

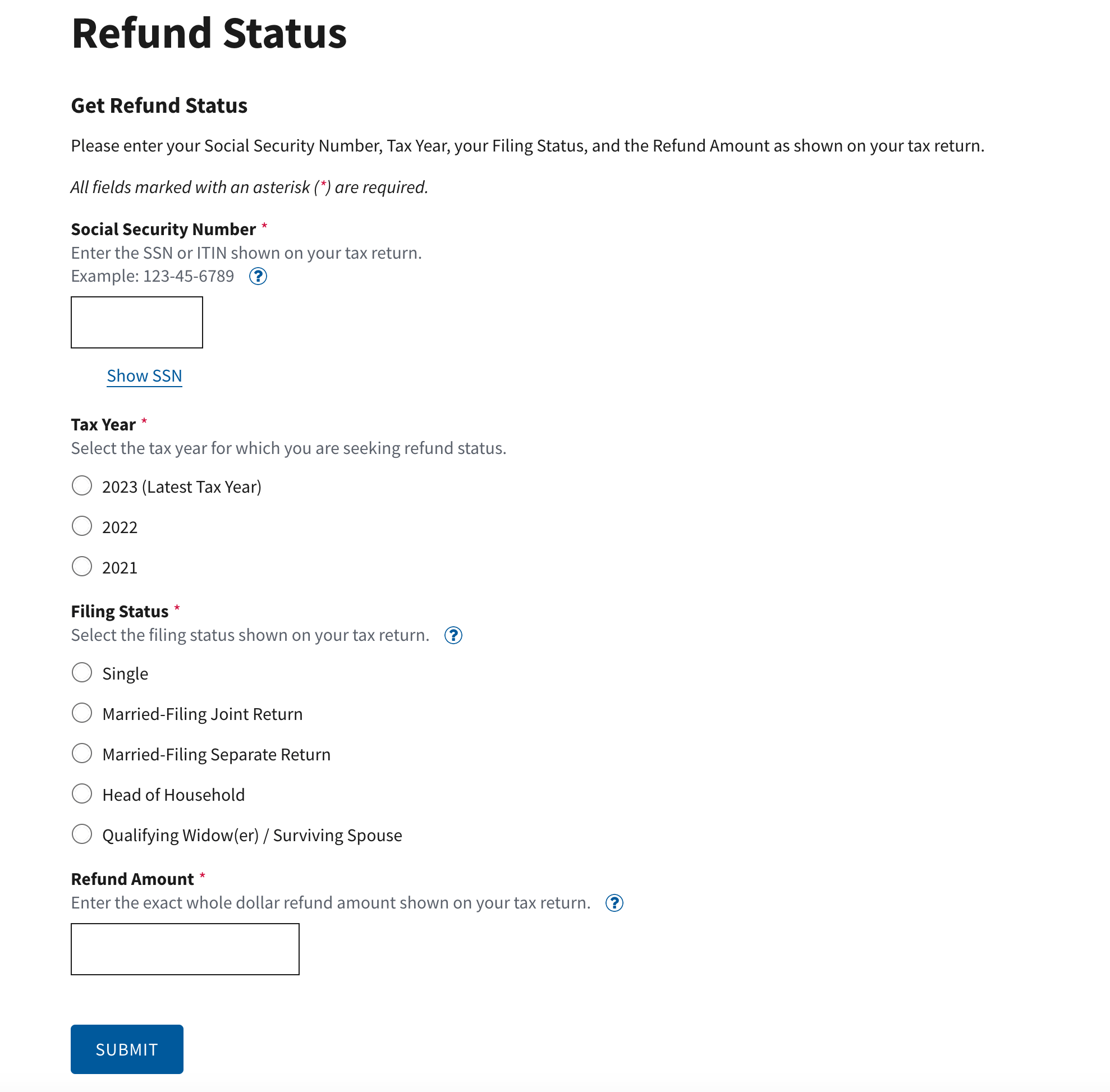

Step 4: Pay Tax Obligations

Once you have determined your tax liability, ensure you meet your tax obligations by paying the required amount to the relevant tax authorities. This may involve making estimated tax payments throughout the year or settling the full amount during the tax filing season.

Maximizing Your Commission Income

While understanding and complying with commission tax rates is crucial, it’s also essential to explore strategies to maximize your commission income and overall financial wellbeing.

Tax-Efficient Strategies

Consider implementing tax-efficient strategies to minimize the impact of commission tax rates on your earnings. This may include utilizing tax deductions, exploring tax-advantaged savings plans, or taking advantage of any tax incentives or credits available in your jurisdiction.

Income Diversification

Diversifying your income sources can be a powerful strategy to mitigate the impact of commission tax rates. By earning income through multiple streams, you can potentially reduce your overall tax liability and increase your financial stability.

Professional Development

Investing in your professional development can lead to higher commissions and better tax outcomes. By enhancing your skills, expanding your network, and staying updated with industry trends, you can increase your earning potential and potentially negotiate more favorable commission structures.

Commission Tax Rates: A Global Perspective

Commission tax rates vary significantly across the globe, reflecting the diverse tax systems and regulations in different countries. Here’s a glimpse at some global variations:

| Country | Commission Tax Rate |

|---|---|

| United States | Progressive tax system with rates ranging from 10% to 37% for individual income tax |

| United Kingdom | Basic rate of 20% for income between £12,571 and £50,270, higher rate of 40% for income above £50,271 |

| Australia | Progressive tax rates ranging from 0% to 45% for individual income tax |

| Canada | Progressive tax system with federal rates ranging from 15% to 33% and provincial rates varying by province |

| Germany | Progressive tax rates with a basic tax-free allowance and rates up to 45% |

The Future of Commission Tax Rates

As tax laws and regulations are subject to change, it’s crucial to stay informed about any potential modifications to commission tax rates. Tax reforms and policy changes can significantly impact the financial planning and tax strategies of commission-based professionals.

For instance, some countries may introduce new tax incentives or deductions for certain industries or income brackets. Others may adjust tax rates to align with economic policies or changing social needs. Staying aware of these developments can help professionals adapt their financial strategies accordingly.

Emerging Trends in Commission Taxation

The taxation of commission income is an evolving area, influenced by various factors such as technological advancements, changing economic landscapes, and global tax reforms.

One emerging trend is the increasing focus on digital transactions and the tax implications of online sales and commissions. As more businesses shift to digital platforms, tax authorities are adapting their regulations to address these new income streams effectively.

Additionally, there is a growing emphasis on international tax cooperation, with countries collaborating to prevent tax evasion and ensure fair tax contributions. This can impact the tax treatment of commissions earned across borders, potentially affecting the financial strategies of globally mobile professionals.

Conclusion

Understanding commission tax rates is a critical aspect of financial management for professionals in commission-based industries. By comprehending the variations, implications, and strategies associated with commission tax, individuals can make informed decisions about their financial planning and tax obligations.

Staying updated with tax laws, regulations, and emerging trends is essential to ensure compliance and optimize financial outcomes. Whether through tax-efficient strategies, income diversification, or professional development, there are numerous ways to navigate the complexities of commission tax rates and achieve financial success.

How often should I review my commission tax rate and strategies?

+It is recommended to review your commission tax rate and strategies annually, or whenever there are significant changes in your income, tax laws, or personal circumstances. Regular reviews ensure that you are up-to-date with any relevant tax reforms and can adjust your financial planning accordingly.

Are there any tax-saving strategies specific to commission income?

+Yes, there are several tax-saving strategies that can be beneficial for commission-based income. These may include utilizing tax-advantaged savings plans, maximizing deductions for business expenses, and exploring tax incentives or credits specific to your industry or jurisdiction. Consulting a tax professional can provide tailored advice based on your unique circumstances.

What happens if I underestimate my commission tax liability?

+Underestimating your commission tax liability can result in penalties and interest charges from tax authorities. It is crucial to accurately estimate and pay your tax obligations to avoid these financial consequences. Consider seeking professional tax advice to ensure you are meeting your tax obligations correctly.

How can I stay informed about changes in commission tax rates and regulations?

+Staying informed about changes in commission tax rates and regulations is vital for effective financial planning. Follow reputable tax news sources, subscribe to tax-related newsletters, and consult tax professionals or industry associations for updates. Additionally, official tax websites and publications can provide the latest information on tax laws and regulations.