Michigan Tax Rate

Michigan's tax landscape is a complex interplay of various taxes, rates, and exemptions that shape the financial obligations of its residents and businesses. Understanding these tax structures is crucial for individuals and enterprises operating within the state. This comprehensive guide aims to delve into the intricacies of Michigan's tax system, offering an in-depth analysis of its tax rates, applicable taxes, and their implications.

Understanding Michigan’s Tax Structure

Michigan’s tax framework encompasses a range of taxes, each serving a specific purpose and contributing to the state’s revenue generation. Here’s an overview of the key taxes and their roles:

Income Tax

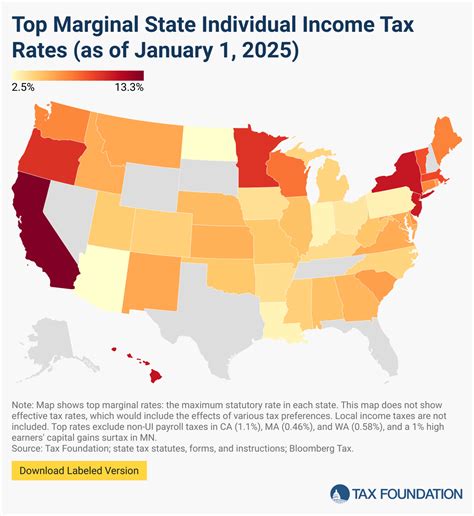

Michigan imposes an individual income tax on residents and nonresidents earning income within the state. The tax rate varies depending on income brackets, with a flat rate of 4.25% applied to taxable income. This income tax is a significant source of revenue for the state, funding essential services and infrastructure development.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $39,200 | 4.25% |

| $39,201 - $98,000 | 4.25% |

| $98,001 and above | 4.25% |

It's important to note that Michigan offers tax credits and deductions, such as the Homestead Property Tax Credit, which can reduce the tax burden for eligible individuals.

Sales and Use Tax

The 6% sales and use tax is a crucial component of Michigan’s tax revenue. Applicable to the retail sale, lease, or rental of tangible personal property, this tax is collected by retailers and remitted to the state. The sales tax rate may vary by jurisdiction, with some cities and counties imposing additional local taxes.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Sales Tax | Varies by jurisdiction |

Certain items, such as food, prescription drugs, and some medical devices, are exempt from sales tax, providing relief to consumers and promoting accessibility.

Property Tax

Property taxes in Michigan are primarily assessed and collected by local governments, with the revenue used to fund local services and infrastructure. The tax rate varies depending on the location and the type of property, such as residential, commercial, or industrial.

| Property Type | Average Effective Tax Rate |

|---|---|

| Residential | 1.55% |

| Commercial | 2.34% |

| Industrial | 2.52% |

Michigan offers various property tax exemptions and credits, such as the Principal Residence Exemption, which provides a tax relief benefit for homeowners who occupy their property as their primary residence.

Other Taxes

In addition to the aforementioned taxes, Michigan levies other taxes, including:

- Intangibles Tax: A tax on the transfer of intangible property, such as stocks, bonds, and mutual funds.

- Use Tax: Applicable to purchases made outside Michigan but used or stored within the state, ensuring equitable taxation.

- Excise Taxes: Taxes on specific goods and services, such as tobacco, alcohol, and fuel.

- Inheritance Tax: A tax on the transfer of property upon death, with rates varying based on the relationship to the deceased.

Tax Incentives and Credits

Michigan recognizes the importance of incentivizing economic growth and supporting businesses. To this end, the state offers a range of tax incentives and credits designed to attract investments and promote business expansion.

Business Tax Incentives

Michigan’s Michigan Business Development Program provides tax credits to businesses that create or retain jobs and invest in infrastructure. The credits are available for eligible expenses, such as employee training, facility upgrades, and equipment purchases.

Additionally, the Michigan Main Street Revitalization Program offers tax credits to businesses that invest in the rehabilitation of historic buildings in designated downtown areas. This program aims to revitalize urban centers and encourage sustainable development.

Individual Tax Credits

Individuals can benefit from various tax credits, including the Michigan Homestead Property Tax Credit, which provides a credit for homeowners based on their income and property taxes paid. This credit aims to alleviate the tax burden on homeowners, especially those with lower incomes.

The Michigan Education Tax Credit offers a tax credit for eligible expenses related to higher education, encouraging individuals to pursue further education and supporting the state's commitment to lifelong learning.

Tax Compliance and Reporting

Navigating Michigan’s tax landscape requires a thorough understanding of tax compliance and reporting obligations. Here’s an overview of key considerations:

Registration and Licensing

Businesses operating in Michigan must obtain the necessary licenses and registrations. This includes registering with the Michigan Department of Licensing and Regulatory Affairs (LARA) and obtaining applicable permits and licenses based on the nature of the business.

Tax Filing and Payment

Taxpayers in Michigan have access to online filing and payment options through the Michigan Department of Treasury website. The department provides resources and guidance to ensure accurate and timely tax filing.

Tax Returns and Due Dates

Income tax returns for individuals and businesses are due on April 15th each year. Sales and use tax returns are due on the 20th of the month following the reporting period. Property taxes are typically due in summer and winter, with specific dates varying by jurisdiction.

Tax Implications and Planning

Understanding the tax implications of various financial decisions is crucial for effective tax planning. Michigan’s tax landscape offers opportunities for individuals and businesses to optimize their tax obligations and maximize their financial well-being.

Income Tax Strategies

Individuals can explore strategies such as maximizing tax deductions and credits, such as the Michigan Homestead Property Tax Credit and the Michigan Education Tax Credit. Businesses can benefit from tax incentives, such as the Michigan Business Development Program, to reduce their tax liability and promote growth.

Sales and Use Tax Optimization

Businesses can optimize their sales and use tax obligations by ensuring accurate tax collection and remittance. Understanding the nuances of tax-exempt items and applicable local sales tax rates can help businesses avoid overpayment and ensure compliance.

Property Tax Planning

Homeowners can benefit from exploring property tax exemptions and credits, such as the Principal Residence Exemption and the Homestead Property Tax Credit. Understanding the assessment process and staying informed about local tax rates can aid in effective property tax planning.

Future Implications and Developments

Michigan’s tax landscape is subject to ongoing changes and developments, driven by economic shifts, legislative actions, and societal needs. Here’s a glimpse into potential future implications and trends:

Economic Impact

As Michigan’s economy continues to evolve, the state’s tax revenue and tax policies will play a pivotal role in shaping its economic trajectory. The balance between revenue generation and tax relief will be a critical consideration, impacting the state’s ability to fund essential services and infrastructure projects.

Legislative Changes

Legislative actions, such as tax reforms and policy revisions, can significantly impact Michigan’s tax landscape. Proposed changes to tax rates, exemptions, and incentives can influence the financial obligations of residents and businesses, shaping their tax planning strategies.

Social and Environmental Considerations

Michigan’s tax policies are increasingly influenced by social and environmental considerations. The state’s commitment to sustainability and social equity may drive the implementation of taxes and incentives aimed at promoting eco-friendly practices and supporting vulnerable communities.

What is the average property tax rate in Michigan?

+

The average effective property tax rate in Michigan varies depending on the type of property. Residential properties have an average rate of 1.55%, commercial properties at 2.34%, and industrial properties at 2.52%.

Are there any tax incentives for businesses in Michigan?

+

Yes, Michigan offers various tax incentives for businesses, such as the Michigan Business Development Program, which provides tax credits for job creation and investment.

What is the sales tax rate in Michigan?

+

The state sales tax rate in Michigan is 6%, but local jurisdictions may impose additional taxes, resulting in a higher combined rate.

Are there any tax exemptions for homeowners in Michigan?

+

Yes, Michigan offers tax exemptions and credits for homeowners, such as the Principal Residence Exemption and the Homestead Property Tax Credit.

How often do property taxes change in Michigan?

+

Property taxes in Michigan are typically assessed and changed annually, with the assessment process varying by jurisdiction.