Multnomah Property Tax

Welcome to an in-depth exploration of the Multnomah Property Tax, a crucial aspect of the local economy and an important consideration for homeowners and businesses in the region. This article aims to provide a comprehensive understanding of the Multnomah Property Tax, its impact, and its role in the community. With a focus on Multnomah County, Oregon, we delve into the intricacies of this tax system, its history, and its current implications.

Understanding the Multnomah Property Tax

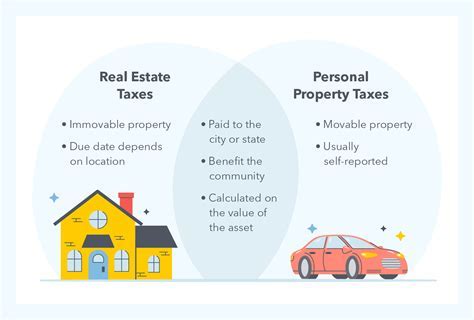

The Multnomah Property Tax is a locally administered tax system that generates revenue for various public services and infrastructure projects within Multnomah County. It is a vital source of funding for essential services such as education, public safety, healthcare, and transportation, among others. The tax is levied on real estate properties, including residential homes, commercial buildings, and land.

The history of the Multnomah Property Tax dates back to the early 20th century when the county first established a system to fund its operations. Over the years, the tax structure has evolved to meet the changing needs of the community and to adapt to economic fluctuations. Today, it stands as a cornerstone of the county's financial framework, providing stability and support for the local government's initiatives.

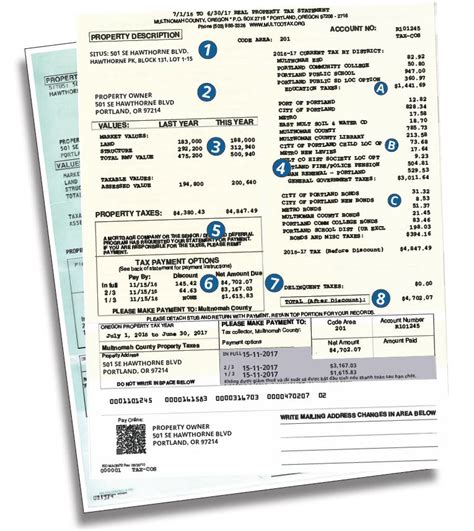

One of the key aspects of the Multnomah Property Tax is its assessment process. The county employs a team of assessors who are responsible for determining the fair market value of each property within the county. This valuation process takes into account various factors such as location, size, improvements, and recent sales data. The assessed value then forms the basis for calculating the property tax liability.

Tax Rate and Calculation

The Multnomah Property Tax is calculated based on a specific tax rate, which is determined annually by the county’s Board of Commissioners. This rate is expressed in terms of dollars per thousand dollars of assessed value. For instance, if the tax rate is set at 10 per thousand, a property with an assessed value of 250,000 would incur a property tax of $2,500.

The tax rate is subject to change each year, reflecting the county's budgetary needs and the overall economic climate. The Board of Commissioners carefully considers various factors, including the cost of providing public services, inflation rates, and the county's financial health, before setting the new tax rate.

| Tax Rate History | Rate ($/thousand) |

|---|---|

| 2022 | $12.50 |

| 2021 | $11.80 |

| 2020 | $11.20 |

Distribution of Property Tax Revenue

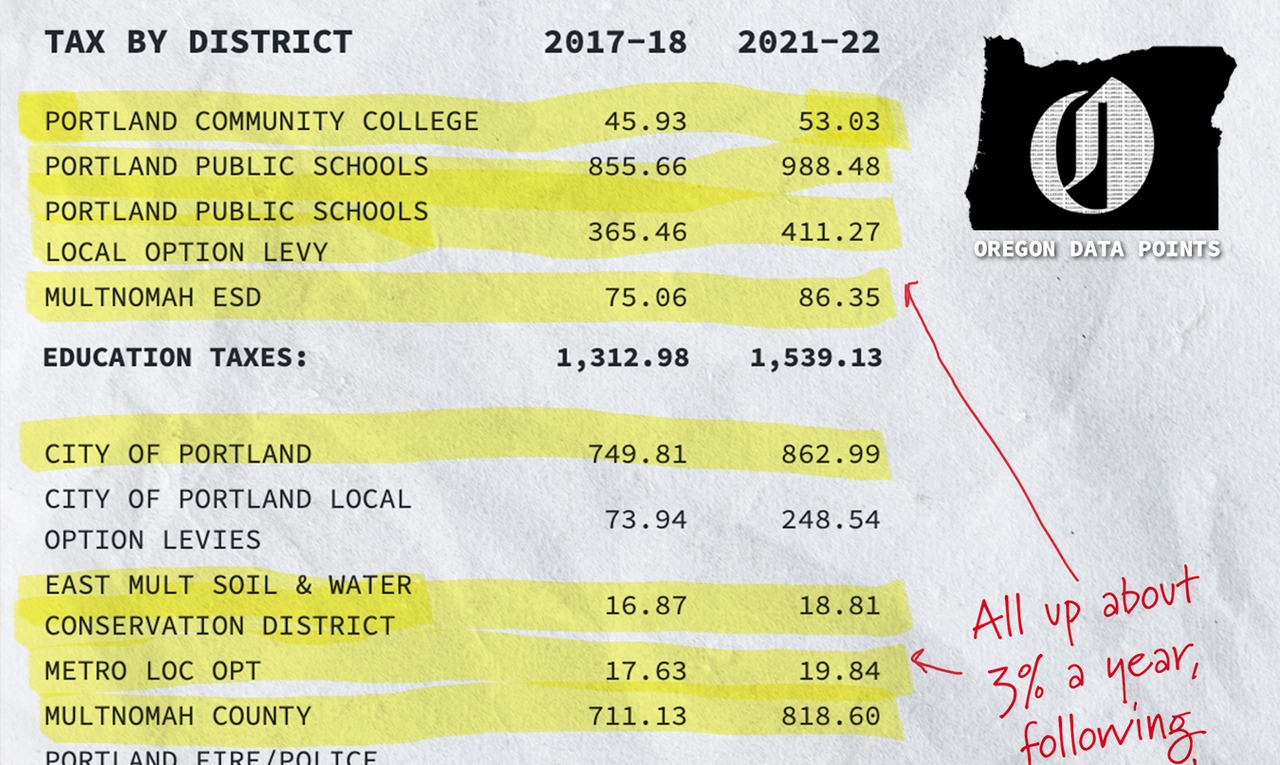

The revenue generated from the Multnomah Property Tax is distributed among various government entities and public services. A significant portion of the tax revenue goes towards funding the county’s schools, ensuring the education system remains robust and accessible to all residents. Other allocations include public safety departments, such as the police and fire services, as well as healthcare facilities and social services.

The county's transportation infrastructure also benefits from property tax revenue, with funds allocated for road maintenance, public transit improvements, and bicycle and pedestrian pathways. Furthermore, a portion of the tax revenue is dedicated to environmental initiatives, supporting sustainable practices and conservation efforts within the county.

Impact on the Community

The Multnomah Property Tax has a profound impact on the community it serves. Firstly, it ensures the provision of essential public services, maintaining the overall quality of life for residents. Well-funded schools, efficient public safety measures, and accessible healthcare are all made possible through the revenue generated by this tax.

Additionally, the tax plays a crucial role in economic development. By investing in infrastructure and public services, the county creates an attractive environment for businesses, fostering job growth and economic stability. The tax revenue also supports community development projects, such as affordable housing initiatives and urban revitalization efforts, further enhancing the community's overall well-being.

Residential and Commercial Perspectives

For homeowners, the Multnomah Property Tax represents a financial obligation, but it also carries significant benefits. Well-funded schools and public services enhance property values and create a desirable living environment. Moreover, the tax system offers various exemptions and deductions, making it more manageable for homeowners to contribute to the community’s growth.

From a commercial perspective, the tax is an investment in the local business environment. Well-maintained infrastructure, efficient public services, and a skilled workforce, all supported by property tax revenue, contribute to a thriving business climate. The tax system's flexibility, with its exemptions and incentives, encourages businesses to establish and expand within the county, fostering economic growth and job creation.

Challenges and Future Outlook

While the Multnomah Property Tax is a vital component of the county’s financial framework, it is not without its challenges. One of the primary concerns is the potential for tax increases, which can burden homeowners and businesses alike. The county must carefully balance its budgetary needs with the community’s financial capacity to ensure the tax remains sustainable and equitable.

Furthermore, the assessment process, while generally fair and accurate, may encounter challenges in rapidly changing real estate markets. Accurately valuing properties in dynamic markets can be complex, and the county's assessment team must stay abreast of market trends to ensure fair assessments for all taxpayers.

Potential Reforms and Innovations

Looking ahead, there are opportunities for the Multnomah Property Tax system to adapt and innovate. One potential reform is the exploration of land value taxation, which focuses on the value of the land itself rather than improvements made to it. This approach could encourage more efficient land use and promote sustainable development.

Additionally, the county could consider implementing a property tax relief program for low-income homeowners, providing targeted assistance to those who may struggle with rising property values and associated tax liabilities. Such initiatives would ensure that the tax system remains equitable and supportive of the community's most vulnerable residents.

Conclusion

In conclusion, the Multnomah Property Tax is a critical component of the county’s financial infrastructure, supporting essential public services and driving economic development. Its impact on the community is profound, shaping the quality of life and business environment within Multnomah County. As the county navigates economic challenges and strives for sustainable growth, the Multnomah Property Tax will continue to play a pivotal role in shaping the future of the region.

How is the Multnomah Property Tax assessed?

+The Multnomah Property Tax is assessed based on the fair market value of a property, determined by the county’s assessors. This value is then used to calculate the tax liability using the current tax rate.

Are there any exemptions or deductions available for property owners?

+Yes, the county offers various exemptions and deductions, such as the homeowner’s exemption and senior citizen assessments. These reduce the taxable value of a property, providing relief to eligible taxpayers.

How is the tax rate determined each year?

+The tax rate is set by the Board of Commissioners, considering the county’s budgetary needs, inflation rates, and economic factors. It is expressed in dollars per thousand dollars of assessed value.