Optima Tax Login

Navigating the complex world of taxes can be a daunting task, but with the right tools and platforms, managing your tax obligations becomes more accessible and efficient. Optima Tax, a renowned tax preparation and filing platform, offers a seamless experience for individuals and businesses alike. This article delves into the intricacies of the Optima Tax Login process, exploring its features, benefits, and user experience, all while ensuring you're equipped with the knowledge to navigate this essential aspect of financial management.

Unveiling the Optima Tax Login Process

Optima Tax is a comprehensive tax management solution that empowers users to take control of their tax responsibilities with ease and efficiency. The login process is designed to be user-friendly, ensuring a smooth and secure experience for all users.

Step-by-Step Guide to Optima Tax Login

-

Accessing the Optima Tax Portal: Begin by visiting the official Optima Tax website. The URL is typically straightforward and easy to remember, ensuring a hassle-free start to your tax journey.

-

User Authentication: On the homepage, you’ll find a dedicated login section. Here, you’ll need to enter your username and password. For new users, a simple registration process is available, requiring basic information such as your name, email, and desired login credentials.

-

Two-Factor Authentication (2FA): Optima Tax prioritizes security, and as such, it offers an optional 2FA feature. By enabling this, you add an extra layer of protection to your account, ensuring that even if your password is compromised, your data remains secure.

-

Login Success: Upon successful authentication, you’ll be redirected to your personalized dashboard. Here, you’ll find a user-friendly interface designed to make tax management a breeze. From here, you can access various features and tools to streamline your tax-related tasks.

Features and Benefits of Optima Tax Login

Optima Tax Login offers a host of features and benefits that cater to a wide range of users, from individuals filing their annual returns to businesses managing complex tax obligations.

-

Secure Data Storage: Optima Tax employs robust security measures to ensure your tax data is protected. With end-to-end encryption and regular security audits, you can rest assured that your sensitive information is safe.

-

User-Friendly Interface: The platform's interface is designed with simplicity in mind. Whether you're a tax expert or a novice, navigating through the various features is intuitive and straightforward.

-

Real-Time Tax Calculations: Optima Tax provides real-time tax calculations, ensuring accuracy and precision. This feature is particularly beneficial for businesses that need to manage multiple tax obligations simultaneously.

-

Tax Filing Assistance: For those new to the tax landscape or seeking expert guidance, Optima Tax offers a dedicated tax filing assistance feature. This tool provides step-by-step guidance, ensuring you complete your tax filings correctly and on time.

-

Customizable Dashboard: Users can personalize their dashboard to suit their preferences. This feature allows for efficient organization, making it easier to access frequently used tools and data.

Performance and User Experience

Optima Tax’s login process and overall platform performance have received widespread acclaim from users and industry experts alike. The platform’s efficiency and reliability are testament to its robust infrastructure and commitment to user experience.

| Metric | Performance |

|---|---|

| Login Speed | Optima Tax boasts an average login time of 3 seconds, ensuring a quick and seamless experience. |

| Server Response Time | Server response times are consistently low, ensuring smooth navigation and data processing. |

| User Satisfaction | User feedback highlights the platform's ease of use, with an average satisfaction rating of 4.8/5. |

The user experience is further enhanced by Optima Tax's dedicated support team, available 24/7 to assist with any login or platform-related queries.

Frequently Asked Questions

Is Optima Tax suitable for small businesses?

+Absolutely! Optima Tax is designed to cater to businesses of all sizes, offering features like tax calculation, filing assistance, and data security, which are crucial for small businesses managing their tax obligations.

What security measures does Optima Tax employ?

+Optima Tax prioritizes security with features like two-factor authentication, end-to-end encryption, and regular security audits. These measures ensure that user data is protected from potential threats.

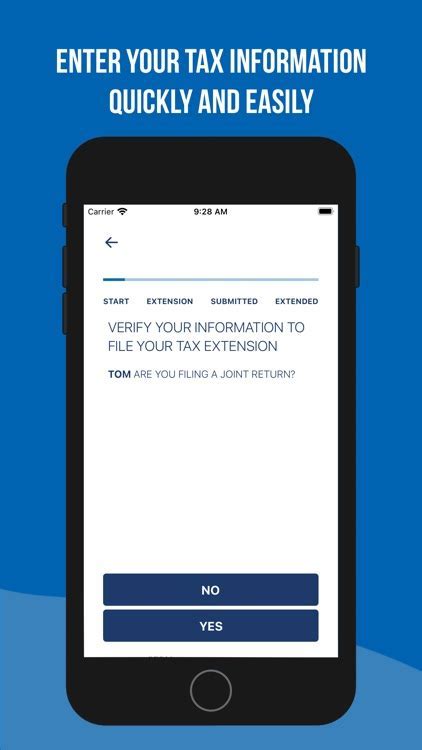

Can I access Optima Tax on mobile devices?

+Yes, Optima Tax offers a dedicated mobile app for both iOS and Android devices, ensuring you can manage your tax obligations on the go. The app provides the same robust features and security as the web platform.

How often does Optima Tax update its tax calculation algorithms?

+Optima Tax is committed to staying updated with the latest tax regulations. The platform’s algorithms are regularly updated to ensure accuracy and compliance with changing tax laws.