Ny Tax Calculator

The New York State Department of Taxation and Finance offers a range of tools and resources to assist individuals and businesses in calculating and understanding their tax obligations. One such tool is the NY Tax Calculator, which provides a convenient and user-friendly way to estimate tax liabilities and make informed decisions. In this comprehensive guide, we will delve into the intricacies of the NY Tax Calculator, exploring its features, functionality, and how it can benefit taxpayers in the Empire State.

Understanding the NY Tax Calculator

The NY Tax Calculator is an online platform designed to simplify the process of calculating various taxes applicable in New York. It serves as a valuable resource for taxpayers, tax professionals, and businesses, offering a quick and accurate estimation of tax liabilities. This calculator covers a wide range of tax types, ensuring that users can address their specific tax needs efficiently.

The calculator's interface is intuitive and user-friendly, making it accessible to individuals with varying levels of tax expertise. Users can navigate through different tax categories, input relevant information, and receive instant calculations, providing a seamless experience. The tool's accuracy is backed by the expertise of the Department of Taxation and Finance, ensuring that taxpayers can rely on the results for their financial planning.

Key Features and Benefits

- Personal Income Tax Calculation: The NY Tax Calculator allows individuals to estimate their personal income tax liability based on their filing status, income, deductions, and credits. This feature is particularly useful for residents of New York State who want to understand their tax obligations before filing their returns.

- Business Tax Calculations: Businesses operating in New York can utilize the calculator to determine their tax liabilities for various business-related taxes, including sales and use tax, corporate income tax, and franchise tax. This helps businesses plan their financial strategies and ensure compliance with state tax regulations.

- Real-Time Calculations: One of the standout features of the NY Tax Calculator is its real-time calculation capability. Users can input their tax data, and the calculator instantly provides an estimate, saving time and effort compared to traditional manual calculations.

- Customizable Tax Forms: The calculator offers a wide range of tax forms tailored to different tax scenarios. Whether it’s calculating sales tax on a specific transaction or determining payroll tax for employees, the NY Tax Calculator provides the necessary forms and guidance to ensure accuracy.

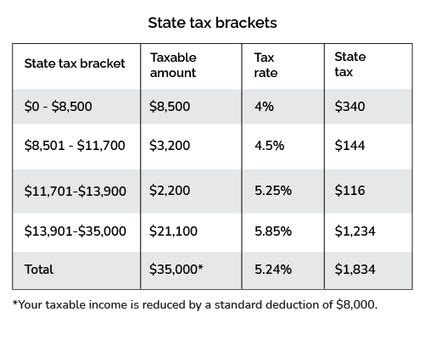

- Tax Rate Information: Tax rates can vary based on location and specific circumstances. The NY Tax Calculator provides up-to-date tax rate information, ensuring that users have access to the latest data for accurate calculations. This is especially beneficial for businesses with multiple locations or individuals with complex tax situations.

How to Use the NY Tax Calculator

Utilizing the NY Tax Calculator is straightforward and user-friendly. Here’s a step-by-step guide to help you navigate the platform:

- Access the Calculator: Visit the official website of the New York State Department of Taxation and Finance and locate the NY Tax Calculator link. Alternatively, you can directly search for "NY Tax Calculator" on a web browser, which will direct you to the calculator's homepage.

- Select Your Tax Type: The calculator's homepage presents a range of tax categories. Choose the tax type relevant to your needs, such as Personal Income Tax, Sales and Use Tax, or Corporate Tax. Each category has a dedicated section with specific forms and instructions.

- Input Tax Information: Once you've selected your tax category, you'll be prompted to input the necessary details. This may include personal information, income details, tax deductions, or business-related data, depending on the tax type you've chosen.

- Review and Calculate: After entering the required information, carefully review the details to ensure accuracy. Once satisfied, click on the "Calculate" button to generate an instant estimate of your tax liability. The calculator will display the results, including the estimated tax amount and any applicable credits or deductions.

- Save and Print: The NY Tax Calculator allows users to save their calculations for future reference. You can also print the results, which can be helpful for record-keeping or when seeking professional tax advice.

Real-World Examples and Case Studies

To illustrate the practicality of the NY Tax Calculator, let’s explore a few real-world scenarios:

Scenario 1: Personal Income Tax Estimation

John, a resident of New York City, wants to estimate his personal income tax liability for the current tax year. He accesses the NY Tax Calculator and selects the “Personal Income Tax” category. He inputs his filing status, total income, deductions, and any applicable credits. The calculator instantly provides John with an estimate of his tax liability, helping him budget accordingly and plan for any potential tax payments.

Scenario 2: Sales Tax Calculation for Businesses

Imagine a small business owner, Sarah, who operates a retail store in Albany, NY. She needs to calculate the sales tax on a recent transaction. Using the NY Tax Calculator, Sarah selects the “Sales and Use Tax” category. She inputs the transaction details, including the sale amount and the applicable tax rate. The calculator provides an accurate sales tax calculation, ensuring Sarah’s compliance with state tax regulations and helping her maintain accurate financial records.

| Transaction Amount | Sales Tax Rate | Estimated Sales Tax |

|---|---|---|

| $500 | 8% | $40 |

Scenario 3: Corporate Income Tax for Large Enterprises

A multinational corporation with operations in New York State utilizes the NY Tax Calculator to estimate its corporate income tax liability. The calculator’s comprehensive forms and instructions guide the finance team through the process, ensuring accurate calculations. By inputting financial data and applicable deductions, the corporation can make informed decisions regarding tax planning and strategy.

Future Developments and Enhancements

The NY Tax Calculator is a dynamic tool that continuously evolves to meet the changing needs of taxpayers and businesses. Here are some potential future developments and enhancements to look forward to:

- Mobile App Integration: The development of a mobile application for the NY Tax Calculator would provide users with convenient access to tax calculation services on the go. This would enhance usability and reach a wider audience, especially those who prefer mobile devices for financial tasks.

- Advanced Tax Planning Tools: Expanding the calculator's capabilities to include advanced tax planning features could benefit businesses and individuals with complex tax situations. These tools might include tax optimization strategies, scenario analysis, and tax projection models, empowering users to make more informed financial decisions.

- Real-Time Tax Rate Updates: Ensuring that the NY Tax Calculator provides real-time updates on tax rates and regulations is crucial for maintaining its accuracy and relevance. Regular updates would keep users informed about any changes in tax laws, helping them stay compliant and make timely adjustments to their tax strategies.

- Integration with Accounting Software: Integrating the NY Tax Calculator with popular accounting software platforms would streamline the tax calculation process for businesses. This integration would allow seamless data transfer, reducing manual input and potential errors, and enhancing overall efficiency in financial management.

Conclusion

The NY Tax Calculator stands as a valuable resource for taxpayers and businesses in New York State, offering a convenient and accurate way to estimate tax liabilities. With its user-friendly interface, real-time calculations, and comprehensive coverage of various tax types, the calculator empowers individuals and businesses to take control of their tax obligations. As the tool continues to evolve, it will undoubtedly play a pivotal role in simplifying the tax landscape for residents and businesses across the Empire State.

Can I trust the results provided by the NY Tax Calculator?

+Absolutely! The NY Tax Calculator is developed and maintained by the New York State Department of Taxation and Finance, ensuring the accuracy and reliability of the results. However, it’s important to note that the calculator provides estimates, and official tax calculations may vary based on specific circumstances and additional factors. It’s always recommended to consult with a tax professional for precise tax liability assessments.

Is the NY Tax Calculator suitable for both individuals and businesses?

+Yes, the NY Tax Calculator caters to a wide range of users, including individuals, sole proprietors, and businesses of all sizes. The calculator offers tailored forms and instructions for different tax scenarios, ensuring that both personal and business tax obligations can be addressed efficiently.

Can I save my calculations for future reference?

+Certainly! The NY Tax Calculator provides an option to save your calculations, allowing you to revisit and review your tax estimates at any time. This feature is particularly useful for record-keeping and planning purposes, ensuring that you have access to your tax calculations when needed.

Are there any additional fees for using the NY Tax Calculator?

+No, the NY Tax Calculator is a free online tool provided by the Department of Taxation and Finance. There are no hidden fees or charges associated with its use. The calculator is designed to assist taxpayers and businesses in estimating their tax liabilities without any financial obligations.