What Is Sdi Tax

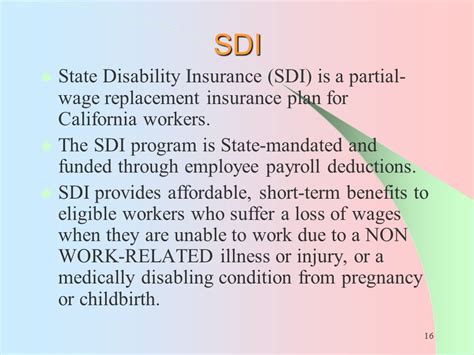

The State Disability Insurance (SDI) tax is a vital component of California's social safety net, providing financial support to eligible individuals who are unable to work due to non-work-related disabilities. This comprehensive insurance program ensures that residents of the Golden State have access to a reliable income source during times of temporary disability, promoting economic stability and well-being. With its unique features and benefits, the SDI tax plays a crucial role in California's employment landscape, offering protection and support to its workforce.

Understanding the SDI Tax Structure

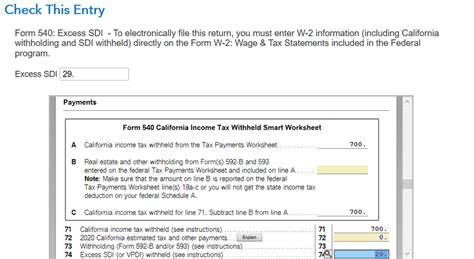

The SDI tax is a payroll tax, similar to its federal counterpart, Social Security. It is mandatory for most California employers, who must withhold a percentage of their employees’ wages to fund the program. The tax rate is adjusted annually, with the latest rate for 2024 being 1.1% of the employee’s wages, up to a maximum taxable wage of $149,300.

| Year | Tax Rate | Maximum Taxable Wage |

|---|---|---|

| 2024 | 1.1% | $149,300 |

| 2023 | 1.0% | $146,200 |

| 2022 | 0.9% | $143,700 |

Employees contribute to the SDI fund through payroll deductions, ensuring they are eligible for disability benefits should they ever need them. The tax is calculated based on the employee's gross wages, with the maximum taxable amount acting as a cap on the total SDI contribution.

How SDI Benefits Work

SDI benefits are designed to provide a partial replacement of wages for individuals who are unable to work due to non-work-related illnesses or injuries. To qualify, individuals must have earned sufficient wages in the base period, which is generally the first four of the last five completed calendar quarters before the disability starts. They must also meet certain disability criteria and provide medical certification of their condition.

Eligible individuals can receive up to 55% of their average weekly wages, with a maximum weekly benefit amount of $1,493 for the 2024 benefit year. The exact benefit amount depends on the individual's earnings and is subject to a minimum weekly benefit amount of $50.

| Year | Maximum Weekly Benefit | Minimum Weekly Benefit |

|---|---|---|

| 2024 | $1,493 | $50 |

| 2023 | $1,437 | $50 |

| 2022 | $1,395 | $50 |

SDI benefits are typically paid for a maximum of 52 weeks within a benefit year, which is a period of 12 consecutive months. However, individuals with certain severe disabilities may qualify for extended benefits of up to 104 weeks.

SDI Tax and Employers

Employers play a crucial role in the SDI program, as they are responsible for withholding and remitting the SDI tax from employee wages. Additionally, they must provide employees with information about their SDI benefits and how to apply for them. This includes supplying the necessary forms and instructions, as well as keeping accurate records of employee earnings and SDI contributions.

It's important for employers to understand their responsibilities under the SDI program to ensure compliance with state regulations. Failure to withhold and remit SDI taxes can result in penalties and interest, as well as potential audits and legal repercussions.

Employer Responsibilities and Challenges

One of the primary challenges for employers is ensuring accurate SDI tax withholding and reporting. This involves keeping up-to-date with the latest tax rates and maximum taxable wages, as well as accurately calculating and withholding the tax from employee wages. Mistakes in this area can lead to over- or under-withholding, which can impact both the employer and employee.

Employers must also stay informed about eligibility criteria and benefit amounts to properly advise their employees. This includes understanding the disability criteria, the base period for benefit calculations, and the process for applying for SDI benefits.

Another challenge is managing the administrative burden of the SDI program. This involves maintaining accurate records, providing necessary forms and information to employees, and staying compliant with state regulations. For larger employers, this can be a significant task, often requiring dedicated resources and systems.

SDI Tax and Employees

For employees, the SDI tax provides a vital safety net during times of disability. By contributing to the SDI fund through payroll deductions, employees ensure they have access to disability benefits should they ever need them. This can provide significant peace of mind and financial security during difficult times.

Understanding Employee Benefits and Rights

Employees should be aware of their rights and the benefits they are entitled to under the SDI program. This includes understanding the eligibility criteria, the process for applying for benefits, and the potential benefit amounts they can receive.

Employees should also be aware of their responsibilities, such as providing medical certification of their disability and keeping their employer informed about their disability status. Additionally, they should understand the importance of accurate earnings reporting, as this directly impacts their benefit calculations.

For employees with disabilities, the SDI program can provide much-needed financial support, allowing them to focus on their recovery without the added stress of financial strain. It's essential for employees to understand their rights and benefits under the program to ensure they receive the support they are entitled to.

Future Implications and Potential Changes

The SDI program is subject to ongoing review and potential changes to ensure its sustainability and effectiveness. This includes regular adjustments to tax rates and maximum taxable wages, as well as potential modifications to benefit amounts and eligibility criteria.

One area of focus is expanding access to SDI benefits for certain populations, such as low-income workers and those with part-time or gig economy jobs. Efforts are being made to ensure that these individuals, who may not have traditional full-time employment, are still eligible for disability benefits when needed.

Another area of potential change is the extension of benefits for individuals with certain disabilities. Currently, only those with the most severe disabilities are eligible for extended benefits of up to 104 weeks. However, there is a growing recognition of the need to support individuals with long-term disabilities, which may lead to an expansion of this benefit.

Additionally, there is a push to improve the application and claims process for SDI benefits. This includes streamlining the process, increasing accessibility, and providing more support and guidance to applicants. The goal is to ensure that eligible individuals can easily navigate the system and receive the benefits they are entitled to without unnecessary barriers.

What is the purpose of the SDI tax?

+The SDI tax is a payroll tax that funds California’s State Disability Insurance program. It provides financial support to eligible individuals who are unable to work due to non-work-related disabilities, offering a partial replacement of wages during their disability period.

How much is the SDI tax rate for 2024?

+The SDI tax rate for 2024 is 1.1% of an employee’s wages, up to a maximum taxable wage of 149,300.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What is the maximum weekly benefit for SDI in 2024?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The maximum weekly benefit for SDI in 2024 is 1,493.

Who is eligible for SDI benefits?

+To be eligible for SDI benefits, individuals must have earned sufficient wages in the base period (generally the first four of the last five completed calendar quarters before the disability starts), meet certain disability criteria, and provide medical certification of their condition.

What are the responsibilities of employers under the SDI program?

+Employers are responsible for withholding and remitting the SDI tax from employee wages, providing employees with information about their SDI benefits and how to apply, and maintaining accurate records of employee earnings and SDI contributions.