Mobile County Property Tax

Mobile County, located in the heart of Alabama, is known for its vibrant communities, diverse landscapes, and rich history. One aspect that often captures the attention of both residents and investors is the Mobile County property tax system. This article aims to provide an in-depth analysis of the Mobile County property tax, exploring its rates, assessment process, and potential implications for property owners. By understanding the intricacies of this system, we can make informed decisions regarding property ownership and investments in this dynamic county.

Unraveling the Mobile County Property Tax: A Comprehensive Guide

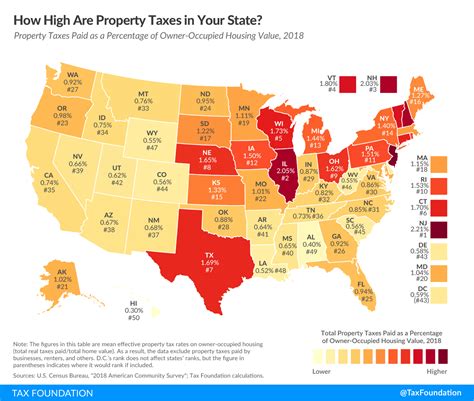

The property tax system in Mobile County, like many other counties across the United States, serves as a primary source of revenue for local government operations and essential services. It plays a crucial role in funding public schools, maintaining infrastructure, and supporting various community initiatives. Understanding how property taxes are assessed and calculated is essential for property owners to budget effectively and plan their financial strategies accordingly.

Mobile County's property tax structure is designed to ensure fairness and transparency. The process begins with the assessment of property values, which forms the basis for calculating the tax liability. The county's tax assessor's office is responsible for determining the fair market value of each property within its jurisdiction. This assessment takes into account various factors, including the property's location, size, improvements, and recent sales data of similar properties in the area.

Property Tax Rates in Mobile County

The property tax rate in Mobile County is expressed as millage rates, where one mill represents $1 of tax for every $1,000 of assessed property value. These millage rates are set annually by the Mobile County Commission and other local taxing authorities, including school districts and municipalities. The rate can vary depending on the specific location of the property within the county, as different taxing jurisdictions may have distinct millage rates.

For instance, let's consider a residential property located in the city of Mobile with an assessed value of $200,000. If the combined millage rate for this property is 35 mills, the property tax liability would be calculated as follows:

| Assessed Value | $200,000 |

|---|---|

| Millage Rate | 35 mills |

| Property Tax Liability | $7,000 |

It's important to note that property tax rates can change annually, reflecting shifts in local government budgets and funding requirements. Property owners should stay informed about any changes in millage rates to accurately estimate their tax liabilities.

Assessment Process: Ensuring Fairness and Accuracy

The Mobile County Tax Assessor's Office follows a comprehensive assessment process to ensure that property values are determined fairly and accurately. This process involves several key steps:

- Data Collection: Tax assessors gather extensive data on properties within the county, including physical characteristics, improvements, and recent sales information. This data is crucial for establishing a reliable basis for assessment.

- Property Inspection: In some cases, tax assessors may conduct physical inspections of properties to verify their condition and any improvements made. These inspections help in assessing the property's current value accurately.

- Sales Analysis: The assessor's office analyzes recent sales data of similar properties in the area. This sales comparison approach helps in determining the fair market value of properties, as it reflects the actual prices buyers are willing to pay in the open market.

- Value Determination: Based on the collected data and sales analysis, the tax assessor's office determines the assessed value of each property. This value serves as the basis for calculating the property tax liability.

- Notification and Appeal: Property owners are notified of their assessed values and tax liabilities. If a property owner believes that the assessed value is incorrect or unfair, they have the right to appeal the assessment through a formal process outlined by the Mobile County Tax Assessor's Office.

Implications for Property Owners

Understanding the Mobile County property tax system has significant implications for property owners. It allows them to budget effectively, anticipate their tax liabilities, and make informed decisions regarding property ownership and investments.

For instance, property owners who are planning to sell their homes can estimate their potential capital gains tax liabilities by considering the assessed value and applicable tax rates. Similarly, investors looking to acquire properties in Mobile County can assess the financial viability of their investments by factoring in the property tax expenses.

Moreover, property owners can explore various tax incentives and exemptions offered by Mobile County. These incentives, such as the homestead exemption or the agricultural use valuation, can reduce the assessed value of certain properties, leading to lower tax liabilities. Staying informed about these opportunities can help property owners optimize their tax obligations.

Conclusion: A Transparent and Fair Property Tax System

The Mobile County property tax system is designed to be transparent, fair, and equitable. By following a rigorous assessment process and setting millage rates annually, the county ensures that property owners contribute their fair share towards local government operations and community development. Understanding this system empowers property owners to make informed decisions, plan their finances effectively, and contribute to the vibrant communities within Mobile County.

How often are property tax assessments conducted in Mobile County?

+Property tax assessments in Mobile County are conducted on an annual basis. The tax assessor’s office evaluates properties and determines their assessed values each year.

Can property owners contest their assessed values in Mobile County?

+Absolutely! Property owners who believe their assessed value is inaccurate or unfair have the right to appeal. The Mobile County Tax Assessor’s Office provides a formal appeal process, allowing owners to present their case and supporting evidence.

Are there any tax incentives or exemptions available in Mobile County?

+Yes, Mobile County offers various tax incentives and exemptions. These include the homestead exemption for primary residences and the agricultural use valuation for properties used for agricultural purposes. Property owners should consult the tax assessor’s office or a tax professional to explore these opportunities.