Mn Tax Return Status

For Minnesota residents eagerly awaiting their tax refunds, knowing the status of their tax return is crucial. In this comprehensive guide, we will delve into the intricacies of the Mn Tax Return Status, providing you with expert insights, real-time updates, and practical steps to track your refund. Whether you've recently filed your taxes or are planning to do so, this article will serve as your trusted companion throughout the process.

Understanding the Mn Tax Return Status Process

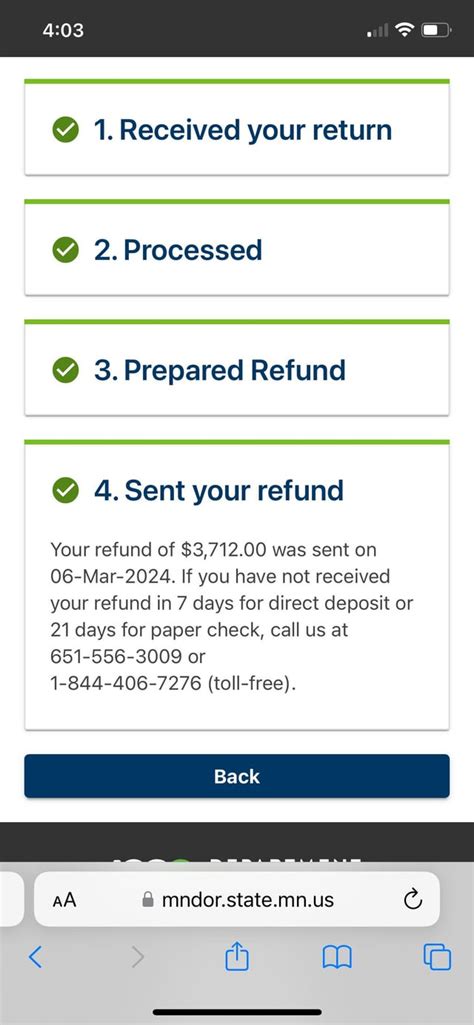

The Minnesota Department of Revenue is responsible for processing tax returns and issuing refunds to eligible residents. Understanding the Mn Tax Return Status process is essential to manage your expectations and stay informed. Here's a step-by-step breakdown of how it works:

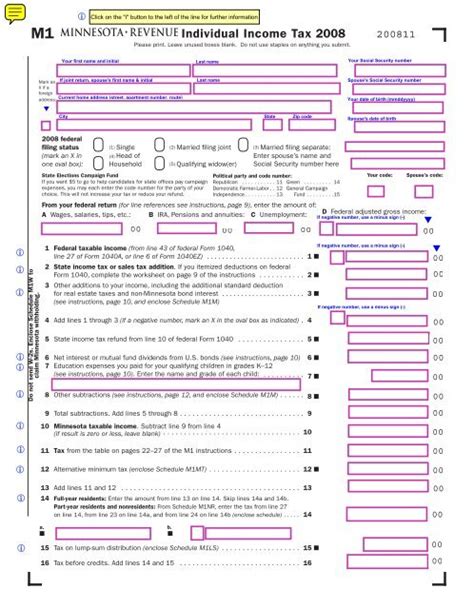

Filing Your Tax Return

The journey begins with the submission of your tax return. Whether you opt for traditional mail or electronic filing, the Department of Revenue receives your return and initiates the processing phase.

Processing Timeframes

Processing times can vary depending on various factors, including the complexity of your return, any errors or discrepancies, and the volume of returns received. The Minnesota Department of Revenue strives to process returns within a reasonable timeframe, but delays may occur during peak seasons.

To provide a more detailed outlook, here's a table outlining the estimated processing times for different tax scenarios:

| Tax Scenario | Estimated Processing Time |

|---|---|

| Simple Return with No Errors | 2-3 weeks |

| Complex Return with Business Income | 4-6 weeks |

| Returns with Missing or Incorrect Information | Varies, additional review may be required |

Error Resolution

In the event of errors or discrepancies, the Department of Revenue will contact you to resolve the issue. It's crucial to respond promptly to any requests for additional information to avoid further delays in processing your return.

Tracking Your Mn Tax Return Status

Now that we've covered the fundamentals, let's explore the various methods to track the status of your Mn tax return. Staying informed is key to managing your financial expectations and planning accordingly.

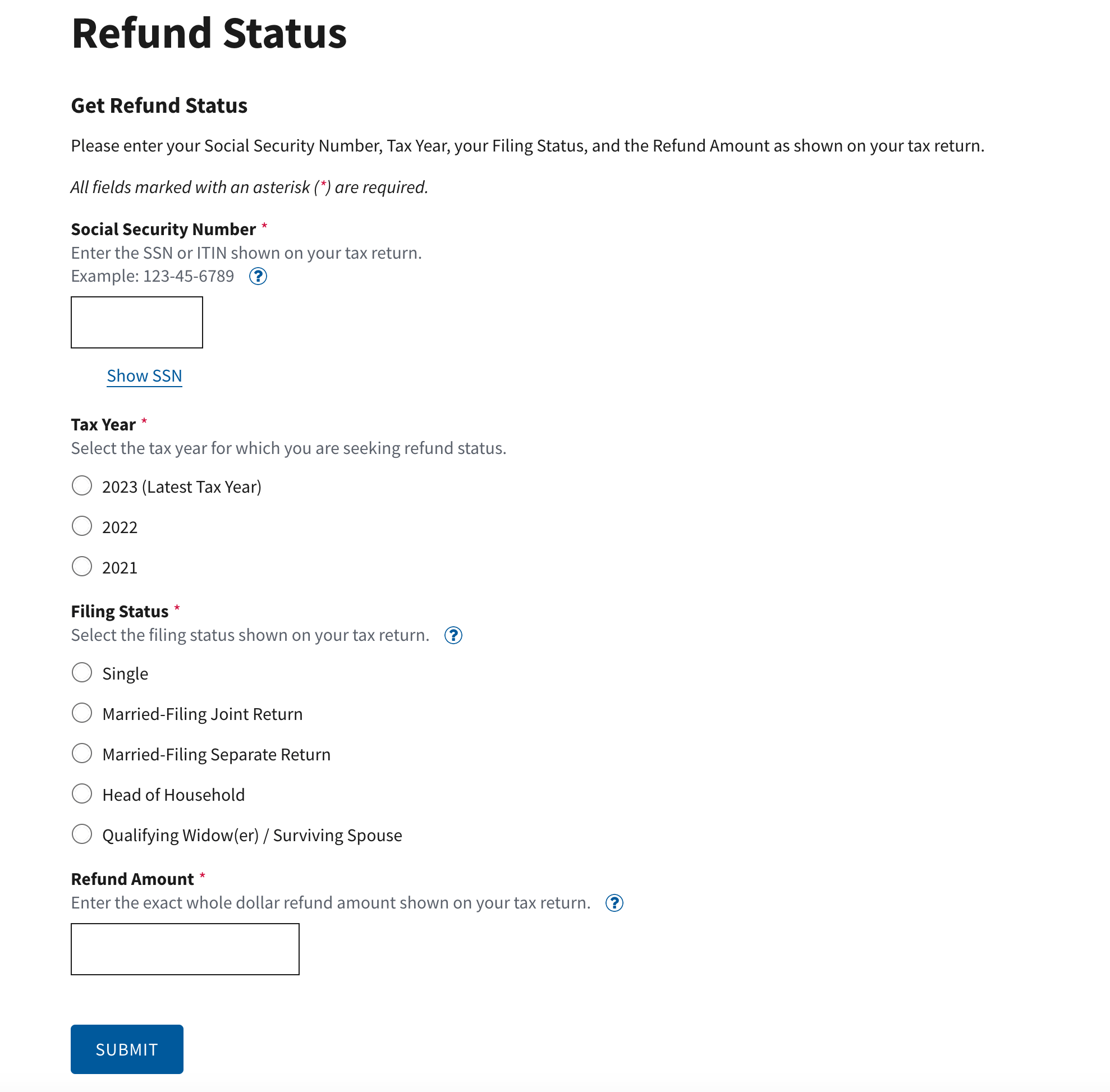

Online Status Check

The most convenient way to check your Mn Tax Return Status is through the Minnesota Department of Revenue's online portal. By accessing the MyMNTax account, you can log in using your credentials and gain real-time insights into the progress of your return. Here's a step-by-step guide:

- Visit the MyMNTax website.

- Enter your username and password. If you don't have an account, you can create one by following the registration process.

- Once logged in, navigate to the "Check Return Status" section.

- Select the relevant tax year and enter your personal identification details.

- The portal will display the current status of your return, including processing stages and any pending actions required from your end.

By regularly checking your MyMNTax account, you can stay updated on the progress of your refund and take necessary actions if any issues arise.

Telephone Inquiry

If you prefer a more personalized approach, the Minnesota Department of Revenue offers a dedicated telephone line for tax return status inquiries. By calling the designated number, you can speak directly with a representative who can provide you with the latest updates on your return.

Here's the contact information for your reference:

Minnesota Department of Revenue

Telephone: 1-651-296-5603 or 1-800-657-3534 (toll-free)

Hours of Operation: Monday to Friday, 8:00 AM to 4:30 PM CST

Mail Correspondence

For those who prefer traditional methods, the Department of Revenue also accepts mail inquiries regarding Mn Tax Return Status. Simply send a written request to the following address, including your full name, social security number, and the tax year in question.

Minnesota Department of Revenue

Attention: Tax Return Status

PO Box 64448

St. Paul, MN 55164-0448

Tips for a Smooth Mn Tax Return Process

To ensure a seamless experience throughout the Mn tax return process, consider the following tips and best practices:

Accurate Information

Double-check all the information on your tax return before submitting it. Inaccurate or incomplete details can lead to processing delays and potential errors.

Keep Records

Maintain organized records of your tax-related documents. This will not only assist in the event of an audit but also facilitate a smoother refund process.

Electronic Filing

Consider filing your tax return electronically. This method is not only more efficient but also reduces the chances of errors and ensures faster processing.

Timely Filing

Aim to file your tax return as early as possible, especially during peak seasons. This can help reduce processing times and potential delays.

Respond Promptly

If the Department of Revenue reaches out to you regarding your return, respond promptly. Timely communication can expedite the resolution of any issues and speed up the refund process.

Future Implications and Updates

Staying informed about tax-related updates and changes is crucial for Minnesota residents. The Department of Revenue regularly introduces new initiatives and improvements to enhance the tax return process. Here are some key future implications to keep in mind:

Digital Transformation

The Department of Revenue is actively working towards a more digitalized tax system. Expect further enhancements to the MyMNTax portal, making it even more user-friendly and efficient for tracking Mn Tax Return Status and managing your tax affairs.

Tax Law Updates

Keep an eye on any changes to Minnesota tax laws. These updates can impact your tax obligations and refund amounts. Stay informed through official sources and consider seeking professional advice if needed.

Improved Processing Times

Efforts are continuously made to streamline the tax return processing system. While processing times may vary, expect ongoing improvements to reduce delays and provide a faster and more efficient experience for taxpayers.

Online Payment Options

To enhance convenience, the Department of Revenue is exploring additional online payment options for tax payments and refunds. This will provide taxpayers with more flexibility and security when managing their financial transactions.

Community Outreach

The Minnesota Department of Revenue actively engages with the community through various outreach programs and initiatives. Stay connected to these channels to receive valuable tax-related information and stay updated on the latest developments.

Frequently Asked Questions

How long does it typically take to receive a Mn tax refund after filing?

+

The time it takes to receive a refund can vary depending on the complexity of your return and the volume of returns being processed. On average, simple returns with no errors can be processed within 2-3 weeks, while more complex returns may take up to 6 weeks or more. It’s important to note that these are estimates, and actual processing times may differ.

What should I do if my Mn tax return is selected for an audit?

+

If your return is selected for an audit, you will receive a notice from the Minnesota Department of Revenue. It’s important to respond promptly and cooperate with the audit process. Gather all the necessary documentation and work closely with the assigned auditor to resolve any discrepancies. Seeking professional advice from a tax expert can also be beneficial during an audit.

Can I check my Mn tax return status without an online account?

+

Yes, you can check your Mn tax return status without an online account. You can use the telephone inquiry service or send a written request to the Department of Revenue’s mailing address. However, having an online account through MyMNTax provides a more convenient and real-time way to track your return status.

What if I haven’t received my Mn tax refund within the estimated processing time?

+

If you haven’t received your refund within the estimated processing time, it’s recommended to contact the Minnesota Department of Revenue. They can provide further assistance and investigate any potential delays. Keep track of your return status and any correspondence with the Department to ensure a smooth resolution.

Are there any penalties for late Mn tax return filing or payment?

+

Yes, late filing or payment of Mn taxes may result in penalties and interest charges. It’s important to meet the filing and payment deadlines to avoid additional costs. If you anticipate difficulties in meeting these deadlines, consider applying for an extension or contacting the Department of Revenue for guidance on potential relief options.