Arizona Sales Tax Rate

Welcome to the ultimate guide to understanding and navigating the Arizona sales tax landscape. In this comprehensive article, we will delve into the intricacies of Arizona's sales tax rate, its structure, and its implications for businesses and consumers alike. With a focus on clarity and precision, we aim to provide you with an expert-level understanding of this essential aspect of the state's economy.

Arizona Sales Tax: A Comprehensive Overview

Arizona, known for its vibrant cities, stunning natural landscapes, and thriving business environment, operates a well-defined sales tax system. The state’s sales tax rate is a crucial component of its economic framework, impacting a wide range of industries and shaping consumer behavior. In this section, we will explore the key aspects of Arizona’s sales tax, including its history, current rate, and the factors influencing its structure.

Historical Perspective and Current Rate

Arizona’s journey with sales tax began in the mid-20th century, with the state implementing its first sales tax legislation in 1933. Over the years, the sales tax rate has undergone several adjustments to meet the evolving needs of the state’s economy. As of 2023, Arizona’s state-wide sales tax rate stands at 5.6%, making it one of the more moderate rates among U.S. states.

However, it's important to note that Arizona's sales tax is not a flat rate across the board. The state's sales tax structure is more complex, with various additional taxes and exemptions applied at different levels.

Breaking Down the Arizona Sales Tax Structure

Arizona’s sales tax structure can be understood by examining its three main components: the state sales tax, local taxes, and special taxes. Each of these components plays a unique role in shaping the overall sales tax rate applied to various transactions within the state.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 5.6% |

| Local Taxes (City/County) | Varies by Jurisdiction (up to 2.0%) |

| Special Taxes (e.g., Restaurant Tax) | Additional 0.1% - 2.0% |

The state sales tax of 5.6% is a consistent rate across Arizona. However, local governments, including cities and counties, have the authority to impose additional local taxes on top of the state rate. These local taxes can vary significantly, with some jurisdictions levying up to an additional 2.0% on top of the state rate. This variability in local taxes is a key factor in the overall sales tax rate differences across Arizona.

Additionally, special taxes are applied to specific goods and services. For instance, Arizona imposes a restaurant tax of 0.1% on prepared food and beverage sales. Other special taxes may include telecommunications taxes, admissions taxes, and rental car taxes, which can add up to an additional 2.0% or more to the overall sales tax rate.

Understanding Sales Tax Exemptions

Arizona’s sales tax system also includes a range of exemptions and special provisions. These exemptions are designed to provide relief to certain industries, products, or services, and they play a significant role in shaping the state’s economic landscape.

One notable exemption is the food exemption, which applies to unprepared food items such as groceries. This exemption aims to reduce the tax burden on essential food items, making them more affordable for consumers. However, prepared foods and beverages, as mentioned earlier, are subject to the restaurant tax.

Other exemptions include those for prescription drugs, most medical devices, and some agricultural products. These exemptions are intended to support specific industries and ensure that essential goods and services remain accessible to the public.

The Impact of Arizona’s Sales Tax

Arizona’s sales tax rate and structure have a profound impact on both businesses and consumers. For businesses, the sales tax is a critical consideration in their pricing strategies and overall financial planning. It influences the cost of doing business and can impact a company’s competitive position in the market.

For consumers, the sales tax is a direct cost added to their purchases. The variability in sales tax rates across the state can affect consumer behavior, with some shoppers seeking out lower-tax jurisdictions for certain purchases. Additionally, the sales tax can influence the overall cost of living and the purchasing power of individuals and families.

Navigating the Arizona Sales Tax Landscape

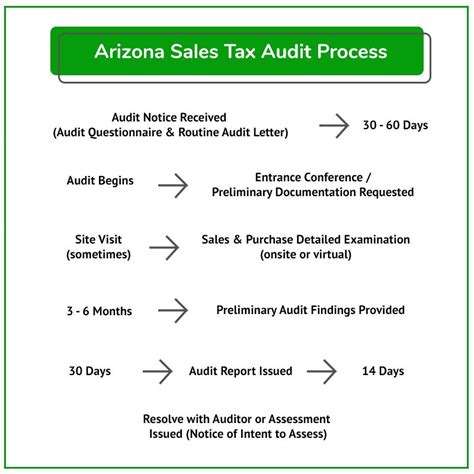

Given the complexity of Arizona’s sales tax system, businesses and individuals alike must stay informed and up-to-date on the latest regulations and rates. This is especially true for businesses operating across multiple jurisdictions within the state, as they must ensure compliance with varying local tax rates and special provisions.

For businesses, this may involve working with tax professionals or utilizing specialized software to accurately calculate and remit sales taxes. For consumers, staying informed about sales tax rates can help them make more informed purchasing decisions, especially when comparing prices across different locations.

Arizona's sales tax rate and structure are subject to change over time, influenced by economic factors, political decisions, and the state's evolving needs. It is essential for businesses and consumers to stay vigilant and adapt to these changes to ensure compliance and optimize their financial strategies.

Conclusion: Embracing the Complexity of Arizona’s Sales Tax

Arizona’s sales tax rate and structure are more than just numbers; they are a reflection of the state’s economic policies and priorities. While the state-wide rate of 5.6% is a starting point, the true complexity lies in the local and special taxes that shape the overall sales tax experience. Understanding these nuances is essential for businesses and consumers to navigate the state’s economic landscape successfully.

As we conclude this comprehensive guide, we hope to have provided you with a deeper understanding of Arizona's sales tax system. With this knowledge, you can make more informed decisions, whether you are a business owner seeking to optimize your tax strategies or a consumer looking to understand the impact of sales tax on your purchases. Stay informed, embrace the complexity, and navigate Arizona's sales tax landscape with confidence.

What is the current sales tax rate in Arizona?

+

As of 2023, the state-wide sales tax rate in Arizona is 5.6%.

Are there any local taxes in addition to the state sales tax?

+

Yes, local governments in Arizona have the authority to impose additional local taxes on top of the state rate, which can vary by jurisdiction.

What are some examples of special taxes in Arizona?

+

Special taxes in Arizona include the restaurant tax on prepared food and beverages, telecommunications taxes, admissions taxes, and rental car taxes.

Are there any sales tax exemptions in Arizona?

+

Yes, Arizona has exemptions for unprepared food items, prescription drugs, most medical devices, and some agricultural products.

How often does Arizona’s sales tax rate change?

+

Arizona’s sales tax rate can change periodically, typically influenced by economic factors and political decisions. It is important to stay updated on any changes to ensure compliance.