What Is The Agi On Taxes

The concept of AGI on taxes is a crucial aspect of the U.S. tax system, playing a significant role in determining an individual's tax liability. AGI, which stands for Adjusted Gross Income, is a fundamental metric used in tax calculations and can greatly impact the amount of tax owed or the potential refund received. Understanding AGI and its implications is essential for taxpayers to navigate the tax landscape effectively.

Understanding Adjusted Gross Income (AGI)

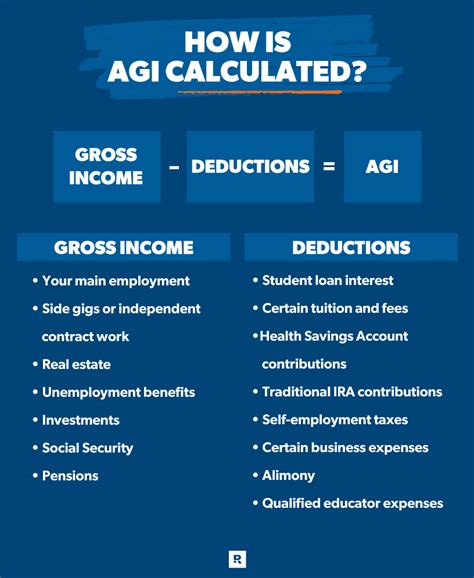

Adjusted Gross Income serves as a critical starting point for tax calculations. It represents the income earned by an individual or household after certain deductions and adjustments have been applied. AGI takes into account various sources of income, including wages, salaries, tips, interest, dividends, and business income. However, it also considers specific deductions and expenses that reduce the overall income, providing a more accurate representation of an individual's financial situation.

For instance, let's consider a hypothetical taxpayer, Ms. Johnson. Ms. Johnson has an annual salary of $80,000 and also earns $3,000 in rental income from a property she owns. Additionally, she contributes $5,000 to her traditional IRA and has $2,000 in student loan interest payments. When calculating her AGI, these factors would be considered:

| Income Sources | Amount |

|---|---|

| Salary | $80,000 |

| Rental Income | $3,000 |

| Total Income | $83,000 |

Now, let's look at the deductions and adjustments that would impact Ms. Johnson's AGI:

| Deductions/Adjustments | Amount |

|---|---|

| Traditional IRA Contribution | $5,000 |

| Student Loan Interest | $2,000 |

| Total Deductions | $7,000 |

By subtracting the total deductions from her total income, we calculate Ms. Johnson's AGI as follows:

AGI = Total Income - Total Deductions

AGI = $83,000 - $7,000 = $76,000

The Role of AGI in Tax Calculations

AGI is a pivotal factor in determining an individual's tax bracket and, subsequently, their tax liability. The U.S. tax system operates on a progressive tax rate structure, meaning that higher income levels are taxed at higher rates. By calculating AGI, taxpayers can identify the appropriate tax bracket they fall into and estimate their tax obligation accordingly.

For example, if Ms. Johnson's AGI of $76,000 places her in the 22% tax bracket, she would calculate her tax liability as follows:

Taxable Income = AGI - Standard Deduction

Assuming Ms. Johnson claims the standard deduction of $12,950 (for single filers in 2023), her taxable income would be:

Taxable Income = $76,000 - $12,950 = $63,050

Now, we can calculate her tax liability using the tax bracket rates:

| Tax Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| 10% | 10% | $0 - $10,275 |

| 12% | 12% | $10,276 - $41,775 |

| 22% | 22% | $41,776 - $89,075 |

| ... | ... | ... |

Applying the 22% tax rate to her taxable income, Ms. Johnson's tax liability would be:

Tax Liability = Taxable Income * Tax Rate

Tax Liability = $63,050 * 0.22 = $13,871

The Impact of AGI on Tax Credits and Deductions

AGI also plays a crucial role in determining eligibility for various tax credits and deductions. Many tax benefits, such as the Child Tax Credit, Education Credits, and the Earned Income Tax Credit, are income-based. By calculating AGI, taxpayers can assess their eligibility for these credits and potentially reduce their tax liability or increase their refund.

For instance, the Child Tax Credit is a non-refundable credit available to taxpayers with qualifying children. The credit amount is based on the taxpayer's AGI and can be up to $2,000 per qualifying child. If Ms. Johnson has a qualifying child and her AGI is within the eligible range, she could claim this credit, further reducing her tax liability.

Maximizing AGI for Tax Advantages

Understanding AGI and its impact on tax calculations allows taxpayers to make informed financial decisions. By strategically contributing to tax-advantaged accounts, such as IRAs or 401(k) plans, individuals can reduce their taxable income and, consequently, their AGI. This not only lowers their tax liability but also increases their potential for tax savings and refund amounts.

Additionally, taxpayers can explore other deductions and adjustments, such as medical expenses, charitable contributions, or business-related expenses, to further optimize their AGI. By consulting with tax professionals and staying updated on tax laws and regulations, individuals can navigate the complexities of tax calculations and make the most of their financial strategies.

Frequently Asked Questions

How is AGI calculated for tax purposes?

+

AGI is calculated by adding up all sources of income, such as wages, salaries, interest, dividends, and business income. Then, specific deductions and adjustments, like IRA contributions and student loan interest, are subtracted from the total income to arrive at the AGI.

Why is AGI important in tax calculations?

+

AGI serves as the foundation for determining tax brackets and tax liability. It helps identify the appropriate tax rate and calculates the taxable income, ensuring accurate tax assessments.

Can AGI impact eligibility for tax credits and deductions?

+

Absolutely! Many tax credits and deductions, like the Child Tax Credit and Education Credits, are income-based. AGI is a key factor in determining eligibility for these benefits, potentially reducing tax liability or increasing refunds.

How can I strategically reduce my AGI for tax advantages?

+

Taxpayers can consider contributing to tax-advantaged accounts, such as IRAs or 401(k) plans, which reduce taxable income and AGI. Additionally, exploring other deductions and adjustments, like medical expenses or charitable contributions, can further optimize AGI and tax savings.