Utah State Tax Return

The state of Utah, nestled in the western United States, offers a unique tax landscape with its own set of rules and regulations. Understanding Utah's tax system is crucial for individuals and businesses alike to ensure compliance and make the most of available deductions and credits. This article delves into the intricacies of Utah state tax returns, providing a comprehensive guide to help navigate the process efficiently and effectively.

Unraveling Utah’s Tax System

Utah’s tax structure is designed to support the state’s economy and provide essential services to its residents. The state collects revenue through various means, including income taxes, sales taxes, and property taxes. Let’s break down the key components of Utah’s tax system and how they impact individuals and businesses.

Income Tax in Utah

Utah imposes an income tax on its residents and businesses. The state operates on a progressive tax system, meaning tax rates increase as income levels rise. Currently, Utah has six income tax brackets ranging from 2.95% to 5.00%, with higher rates applied to higher income levels.

For the tax year 2023, the income tax brackets in Utah are as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 2.95% | 0 - 1,860 |

| 3.24% | 1,861 - 4,650 |

| 3.53% | 4,651 - 8,250 |

| 4.45% | 8,251 - 16,500 |

| 4.72% | 16,501 - 24,750 |

| 5.00% | $24,751 and above |

It's important to note that these rates are subject to change annually, so it's advisable to refer to the latest tax tables published by the Utah State Tax Commission for the most accurate information.

Utah offers several deductions and credits to help alleviate the tax burden on individuals and families. Some notable deductions include the standard deduction, which varies based on filing status, and itemized deductions for expenses such as medical costs, state and local taxes, and charitable contributions.

Additionally, Utah provides tax credits for various purposes, such as the Utah College Savings Plan Credit, which offers a credit for contributions made to eligible college savings plans, and the Utah Property Tax Refund Credit, which provides a credit to qualifying individuals based on their property taxes paid.

Sales and Use Tax

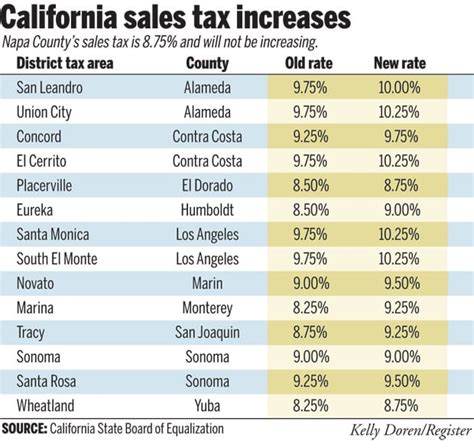

Utah also levies a sales and use tax on the sale of tangible personal property and certain services. The state sales tax rate is 4.70%, and local sales tax rates may vary depending on the jurisdiction. The combined sales tax rate can range from approximately 5% to over 10% depending on the location of the transaction.

Utah’s sales tax applies to a wide range of goods and services, including clothing, electronics, groceries (with certain exemptions), and restaurant meals. However, certain items, such as prescription drugs, most non-prepared foods, and residential utilities, are exempt from sales tax.

Businesses operating in Utah must register for a sales tax permit and collect the appropriate sales tax from customers. Failure to comply with sales tax regulations can result in penalties and interest charges.

Property Tax

Property taxes are another significant source of revenue for Utah. The state’s property tax system is primarily managed by local governments, including counties, cities, and special service districts.

Utah assesses property taxes based on the fair market value of real estate, including land and improvements. The tax rate varies depending on the location and type of property. Residential property owners often benefit from a lower tax rate compared to commercial or industrial properties.

Property owners in Utah receive a property tax notice annually, detailing the assessed value of their property and the corresponding tax amount. Taxpayers have the right to appeal their property’s assessed value if they believe it is inaccurate.

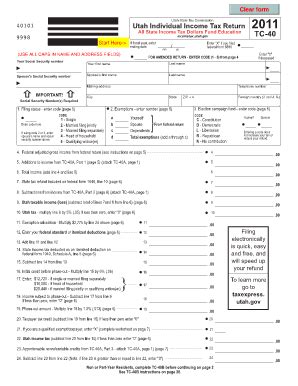

Filing Your Utah State Tax Return

Filing your Utah state tax return accurately and on time is crucial to avoid penalties and interest charges. Let’s guide you through the process step by step.

Gathering Necessary Documents

Before starting your tax return, ensure you have all the required documents and information. This includes:

- W-2 forms from all employers

- 1099 forms for any freelance or independent contracting work

- Interest and dividend statements

- Records of deductions and credits you plan to claim

- Previous year’s tax return (for reference)

Choosing Your Filing Method

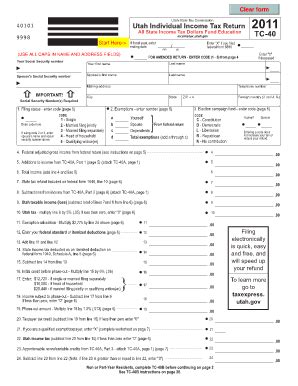

Utah offers several options for filing your state tax return. You can choose to file electronically using tax preparation software or directly through the Utah State Tax Commission’s online filing system. Alternatively, you can opt for paper filing by downloading the necessary forms and mailing them to the tax commission.

Electronic filing is generally faster and more convenient, with quicker processing times and the option to receive your refund via direct deposit. Paper filing, while less common, may be preferred by those who feel more comfortable with traditional methods.

Completing Your Tax Return

Whether you’re using tax preparation software or completing the forms manually, ensure you enter all your income, deductions, and credits accurately. Double-check your calculations and review your return for any errors before submitting.

If you have complex tax situations or are unsure about certain aspects of your return, consider seeking the assistance of a tax professional or utilizing the Utah State Tax Commission’s helpline for guidance.

Payment Options and Refunds

If you owe taxes, you can pay your Utah state tax liability through various methods, including credit card, debit card, electronic funds transfer, or by mailing a check or money order. Ensure you include the correct payment voucher with your return.

If you’re expecting a refund, you can choose to receive it via direct deposit into your bank account or by check. The processing time for refunds can vary, but electronic refunds are typically received faster than paper checks.

Navigating Common Tax Situations

Utah’s tax system, like any other, can present unique challenges and situations. Let’s explore some common scenarios and provide insights on how to navigate them effectively.

Filing as a Resident or Nonresident

Utah residents are subject to Utah income tax on their worldwide income. Nonresidents, on the other hand, are only taxed on income earned within the state. Determining your residency status is crucial to ensure you’re filing the correct tax return.

Utah considers individuals as residents if they maintain a permanent home in the state and spend more than 183 days in Utah during the tax year. Part-year residents may need to file a part-year resident return, reporting income earned both within and outside the state.

Dealing with Taxable Retirement Income

Utah treats retirement income differently depending on its source. Pension income and distributions from traditional IRAs and 401(k) plans are fully taxable in Utah. However, certain retirement accounts, such as Roth IRAs and Roth 401(k) plans, offer tax-free distributions under specific conditions.

It’s important to understand the tax implications of your retirement income and plan accordingly to minimize your tax liability.

Handling Business and Self-Employment Taxes

Utah imposes various taxes on businesses, including income tax, sales tax, and employer-related taxes such as unemployment insurance and worker’s compensation. The specific taxes and requirements depend on the business structure and industry.

Sole proprietors and self-employed individuals must report their business income on their personal tax return and pay self-employment tax. Partnerships and corporations have separate tax obligations and must file their own business tax returns.

Maximizing Your Tax Benefits

Understanding Utah’s tax system isn’t just about compliance; it’s also about maximizing the benefits and credits available to you. Let’s explore some strategies to optimize your tax situation.

Taking Advantage of Deductions

Utah offers a range of deductions to help reduce your taxable income. Some key deductions to consider include:

- Medical and dental expenses exceeding 7.5% of your adjusted gross income

- State and local taxes paid, including property taxes and sales taxes

- Charitable contributions to eligible organizations

- Interest paid on student loans and mortgage debt

By carefully tracking and claiming these deductions, you can lower your taxable income and potentially reduce your overall tax liability.

Exploring Tax Credits

In addition to deductions, Utah provides various tax credits to help offset your tax burden. Some notable credits include:

- Utah College Savings Plan Credit: A credit for contributions made to eligible college savings plans, helping families save for their children’s education.

- Child and Dependent Care Credit: A credit for expenses incurred for the care of qualifying individuals while the taxpayer works or attends school.

- Utah Property Tax Refund Credit: A credit available to qualifying individuals based on their property taxes paid, providing relief for homeowners.

These credits can significantly impact your tax liability, so ensure you understand the eligibility requirements and claim all applicable credits.

Optimizing Retirement Plan Contributions

Contributing to retirement plans can offer significant tax benefits. Utah allows taxpayers to deduct contributions made to traditional IRAs and employer-sponsored retirement plans, such as 401(k)s and 403(b)s. These deductions reduce your taxable income for the year.

Additionally, consider the tax advantages of Roth accounts. While contributions to Roth IRAs and Roth 401(k)s are made with after-tax dollars, qualified distributions are tax-free, offering a potentially significant benefit during retirement.

Planning for the Future: Tax Strategies

Navigating Utah’s tax system effectively requires a proactive approach and thoughtful planning. Let’s delve into some long-term tax strategies to help you optimize your financial situation.

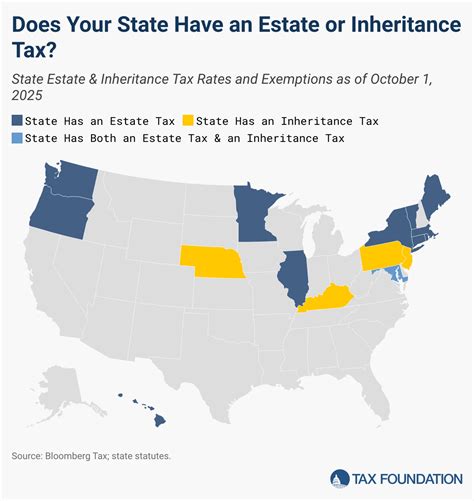

Estate Planning and Inheritance Taxes

Utah does not impose an inheritance tax, which means heirs generally do not pay taxes on inherited property. However, estate planning is still crucial to ensure your assets are distributed according to your wishes and to minimize potential federal estate taxes.

Consulting an estate planning attorney can help you navigate the complexities of estate taxes and ensure your assets are protected for future generations.

Investment and Asset Management

Strategic investment planning can help you grow your wealth while minimizing tax liabilities. Consider the tax implications of different investment vehicles, such as stocks, bonds, and real estate, and how they fit into your overall financial goals.

Work with a financial advisor to develop a diversified investment portfolio that aligns with your risk tolerance and tax considerations. This can help you optimize your returns and potentially reduce your tax burden.

Business Tax Planning

For businesses operating in Utah, effective tax planning is essential to manage cash flow and maximize profitability. Consider the following strategies:

- Implementing tax-efficient accounting methods, such as the cash or accrual method, to optimize your tax position.

- Reviewing and optimizing your business structure to take advantage of tax benefits and minimize liabilities.

- Staying informed about tax incentives and credits offered by the state and local governments, such as tax breaks for research and development or job creation.

Engaging a tax professional or a business accountant can provide valuable insights and guidance tailored to your specific business needs.

Conclusion

Understanding Utah’s tax system is a crucial step toward financial empowerment and compliance. By staying informed about the state’s tax laws, deductions, and credits, you can make the most of your financial situation and plan for a secure future.

Remember, the information provided in this article is a general guide, and individual circumstances may vary. It’s always advisable to consult with tax professionals or seek expert advice for personalized guidance tailored to your unique situation.

When is the deadline for filing my Utah state tax return?

+The deadline for filing your Utah state tax return is typically aligned with the federal tax deadline, which is April 15th of the year following the tax year. However, it’s essential to check for any extensions or changes to this deadline, as it may vary from year to year.

Can I file my Utah state tax return electronically?

+Yes, Utah offers electronic filing options for both individuals and businesses. You can use tax preparation software or file directly through the Utah State Tax Commission’s online filing system. Electronic filing is generally faster and more convenient.

What happens if I miss the filing deadline for my Utah state tax return?

+If you miss the filing deadline, you may be subject to penalties and interest charges. It’s important to file your return as soon as possible to minimize these additional costs. In certain circumstances, you may be able to request an extension, but this should be done well in advance of the original deadline.

How can I check the status of my Utah state tax refund?

+You can check the status of your Utah state tax refund online through the Utah State Tax Commission’s website. Simply enter your Social Security number, filing status, and the amount of your expected refund to track its progress. Refunds are typically issued within 60 days of filing, but this timeline may vary.

Are there any resources available for tax assistance in Utah?

+Yes, the Utah State Tax Commission provides a helpline for taxpayers with questions or concerns. Additionally, many tax professionals and accounting firms offer assistance with tax preparation and filing. It’s always beneficial to seek expert guidance when navigating complex tax situations.