Sales Tax In Cerritos Ca

Sales tax is an essential component of the revenue system in the United States, with each state, county, and city having its own set of rules and regulations. Cerritos, a vibrant city located in Los Angeles County, California, is no exception. Understanding the sales tax system in Cerritos is crucial for both consumers and businesses operating within the city limits. In this comprehensive guide, we will delve into the intricacies of sales tax in Cerritos, exploring its rates, exemptions, and the impact it has on the local economy.

Unraveling the Sales Tax Landscape in Cerritos, CA

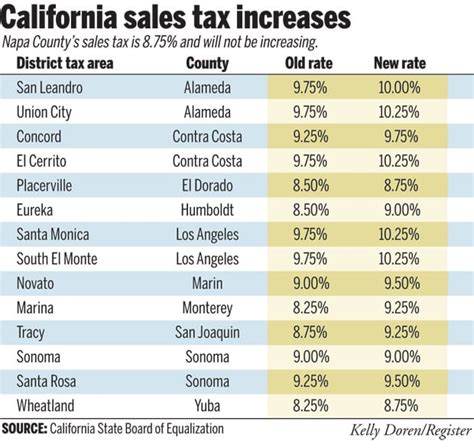

Sales tax in Cerritos, like the rest of California, is a multi-tiered system, consisting of state, county, and city tax rates. This complex structure can sometimes be confusing, especially for those new to the area or for businesses expanding into Cerritos. Let’s break down the sales tax rates and how they are applied.

State Sales Tax

California is renowned for its diverse landscapes, from the sunny beaches to the snowy mountains, and its sales tax rates are just as varied. The state sales tax in California is set at 7.25%, which is applicable to most tangible personal property and some services. This base rate is established by the California State Board of Equalization, which governs tax administration in the state.

County Sales Tax

Los Angeles County, where Cerritos is situated, adds an additional 0.25% to the state sales tax rate. This county-wide tax is used to fund various local services and initiatives. Thus, the total sales tax rate applicable in Cerritos and the surrounding areas of Los Angeles County is 7.50% for most purchases.

City Sales Tax

Cerritos, as a city, also imposes its own sales tax, which is currently set at 1.00%. This city-specific tax is a vital source of revenue for the local government, supporting infrastructure development, public safety, and other essential services. As a result, the combined sales tax rate for Cerritos is 8.50%, making it one of the higher rates in the state.

| Sales Tax Category | Rate |

|---|---|

| State Sales Tax | 7.25% |

| County Sales Tax | 0.25% |

| City Sales Tax (Cerritos) | 1.00% |

| Total Sales Tax Rate | 8.50% |

Sales Tax Exemptions in Cerritos

While sales tax is a broad-based tax, there are certain categories of goods and services that are exempt from sales tax in Cerritos. These exemptions can be beneficial for both consumers and businesses, reducing the overall tax burden. Here are some of the key exemptions to be aware of:

- Grocery Items: Most food items for home consumption are exempt from sales tax in California. This exemption is a significant benefit for households, helping to reduce the cost of living in Cerritos.

- Prescription Medications: Sales tax does not apply to prescription drugs and certain medical devices. This exemption is particularly crucial for individuals with medical needs.

- Certain Services: Some services, such as legal and professional services, are generally not subject to sales tax. This exemption can be advantageous for businesses providing these services.

- Manufacturing Equipment: Sales tax is often not applicable to the purchase of manufacturing equipment and machinery, which can be a significant incentive for industrial businesses looking to set up operations in Cerritos.

The Impact of Sales Tax on Cerritos’ Economy

Sales tax is a critical component of Cerritos’ revenue stream, contributing significantly to the city’s overall economic health. The funds generated from sales tax are used to maintain and improve the city’s infrastructure, from roads and parks to public facilities. Additionally, sales tax revenue supports vital services like public safety, education, and social programs.

Infrastructure Development

Cerritos, known for its well-maintained streets and attractive public spaces, benefits significantly from sales tax revenue. The city consistently reinvests a portion of its sales tax income into infrastructure projects, ensuring that Cerritos remains a desirable place to live, work, and do business. From road improvements to the development of recreational areas, sales tax plays a pivotal role in enhancing the quality of life for residents and the overall appeal of the city.

Economic Growth and Business Attraction

Despite the relatively high sales tax rate, Cerritos continues to attract new businesses and investments. The city’s vibrant economy, combined with its strategic location and access to a skilled workforce, makes it an appealing choice for companies across various industries. Sales tax revenue not only supports existing businesses but also contributes to economic growth by funding initiatives that create a business-friendly environment, such as tax incentives and infrastructure development.

Community Support and Social Programs

Beyond infrastructure and economic development, sales tax revenue in Cerritos is also directed towards community support and social programs. This includes funding for education, healthcare, and social services, ensuring that the city’s most vulnerable residents receive the support they need. By investing in these areas, Cerritos fosters a sense of community and social responsibility, contributing to a higher quality of life for all its residents.

Future Implications and Tax Trends

Looking ahead, the sales tax landscape in Cerritos and California as a whole is likely to continue evolving. As the state and local governments navigate changing economic conditions and policy priorities, sales tax rates and regulations may be subject to adjustments. Here are some potential future implications and trends to consider:

- Economic Growth and Tax Revenue: As Cerritos' economy continues to thrive, sales tax revenue is expected to increase, providing additional resources for the city's development and community initiatives.

- Policy Changes: With changing political landscapes, there may be proposals to modify sales tax rates or introduce new exemptions to support specific industries or social causes. Staying informed about these potential changes is essential for both businesses and residents.

- Online Sales Tax: With the growth of e-commerce, the collection and enforcement of sales tax on online purchases is an evolving area of focus for tax authorities. Businesses operating online should be aware of their sales tax obligations and potential changes in this area.

- Community Engagement: Cerritos has a strong tradition of community involvement and citizen engagement. As the city's leadership considers sales tax policies, resident input and feedback will continue to play a vital role in shaping the future of sales tax in the city.

Conclusion

Understanding the sales tax system in Cerritos, CA, is crucial for both consumers and businesses operating within the city. With a combined sales tax rate of 8.50%, Cerritos contributes significantly to the state’s overall tax revenue. Despite the relatively high tax rate, the city’s vibrant economy, well-maintained infrastructure, and strong community spirit make it an attractive place to live and do business. As Cerritos continues to thrive, its sales tax revenue will play a pivotal role in supporting the city’s growth and development, ensuring a high quality of life for its residents.

How often are sales tax rates updated in Cerritos, CA?

+Sales tax rates are typically updated annually, usually effective from January 1st. These updates are based on legislative changes or adjustments made by the California State Board of Equalization and local governing bodies.

Are there any special sales tax holidays in Cerritos or California?

+California does not have specific sales tax holidays, unlike some other states. However, there may be occasional promotional periods or incentives offered by local businesses or the city to encourage shopping and support the local economy.

How can businesses stay updated on sales tax regulations in Cerritos and California?

+Businesses can stay informed by regularly checking the California State Board of Equalization’s website for updates and by subscribing to their newsletters. Additionally, local business associations often provide resources and guidance on sales tax regulations.