Special Tax Notice Fidelity

The world of finance is complex, and one crucial aspect that often requires careful attention is tax management. When it comes to navigating the intricate landscape of taxes, especially in relation to financial institutions like Fidelity, it's essential to have a comprehensive understanding of the processes and implications. This article aims to shed light on a specific tax notice issued by Fidelity, providing a detailed analysis to help individuals and investors make informed decisions.

Understanding the Fidelity Special Tax Notice

Fidelity Investments, a leading financial services provider, occasionally issues special tax notices to its clients. These notices are designed to inform individuals about specific tax-related matters, ensuring compliance with relevant regulations and facilitating accurate tax reporting. The Fidelity Special Tax Notice is a vital communication tool, offering clarity on complex tax issues and guiding investors through the necessary steps to manage their tax obligations effectively.

The notice typically addresses a range of tax-related topics, including capital gains, dividend income, retirement account contributions, and other investment-specific tax considerations. It aims to provide a comprehensive overview, helping investors understand their tax liabilities and potential opportunities for tax optimization.

Key Features of the Special Tax Notice

The Fidelity Special Tax Notice is meticulously crafted to cater to the diverse needs of its clients. Here are some key features and aspects to consider:

- Personalized Information: Each notice is tailored to the recipient's unique financial situation, taking into account their specific investments, accounts, and transactions. This personalization ensures that the notice is relevant and actionable.

- Clear and Concise Language: Fidelity strives to use plain language, avoiding technical jargon whenever possible. This approach ensures that even individuals without extensive financial expertise can grasp the key messages and take appropriate actions.

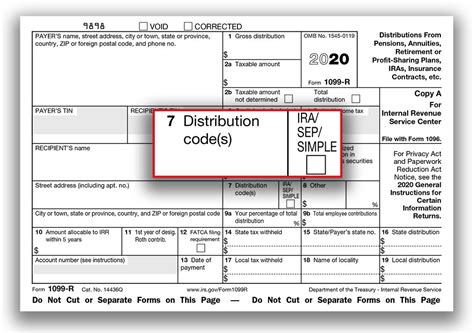

- Detailed Transaction Breakdown: The notice provides a comprehensive breakdown of all relevant transactions that may have tax implications. This includes sales of stocks, mutual funds, and other securities, as well as any distributions from retirement accounts.

- Tax Reporting Instructions: A critical component of the notice is the guidance it provides on how to accurately report the included transactions on tax forms. This section often includes step-by-step instructions and relevant IRS forms to ensure compliance.

- Potential Tax Savings: In some cases, the notice may highlight opportunities for tax optimization. This could involve suggestions for tax-efficient investment strategies or reminders about tax-advantaged accounts, such as Health Savings Accounts (HSAs) or 529 plans.

By receiving and carefully reviewing the Fidelity Special Tax Notice, individuals can gain a deeper understanding of their tax obligations and make informed decisions to optimize their financial and tax strategies.

The Impact on Individual Investors

For individual investors, the receipt of a Fidelity Special Tax Notice can have significant implications. It serves as a timely reminder of the importance of tax planning and compliance, prompting investors to take proactive steps to manage their tax liabilities effectively.

Facilitating Accurate Tax Reporting

One of the primary benefits of the special tax notice is its role in simplifying the tax reporting process. By providing a comprehensive summary of relevant transactions and their tax implications, investors can more easily complete their tax returns accurately. This not only reduces the risk of errors but also minimizes the chances of attracting unwanted attention from tax authorities.

For instance, consider an investor who actively trades stocks and mutual funds throughout the year. The special tax notice can consolidate all the relevant information, making it easier to track capital gains and losses, which are essential for calculating the investor's tax liability.

Tax Optimization Opportunities

Beyond facilitating accurate reporting, the notice often highlights opportunities for tax optimization. This can include suggestions for tax-efficient investment strategies, such as tax-loss harvesting, which involves selling losing investments to offset capital gains and potentially reduce tax liabilities.

Additionally, the notice may draw attention to tax-advantaged accounts that investors can utilize to minimize their tax burden. For example, contributing to a traditional IRA or a Roth IRA can offer significant tax benefits, especially for those planning for retirement. The notice may provide guidance on the eligibility criteria and potential advantages of such accounts.

Avoiding Costly Mistakes

The special tax notice also serves as a safeguard against costly mistakes. By providing a detailed breakdown of transactions, it helps investors identify potential errors or omissions that could lead to overpayment of taxes or even penalties. This proactive approach to tax management can save investors significant sums of money and reduce the stress associated with tax season.

For example, an investor who receives a distribution from a retirement account but fails to report it accurately on their tax return may face penalties and interest charges. The special tax notice, by drawing attention to this distribution and providing clear instructions on how to report it, helps prevent such oversights.

Best Practices for Responding to the Special Tax Notice

To maximize the benefits of the Fidelity Special Tax Notice, it is essential for investors to follow certain best practices. Here are some key recommendations:

- Read Thoroughly: Take the time to read the notice carefully, paying attention to all the details. Understanding the information provided is crucial for making informed decisions.

- Seek Professional Advice: If the notice raises complex tax issues or if you have specific concerns, consider consulting a tax professional or financial advisor. They can provide personalized guidance based on your unique financial situation.

- Review Your Records: Compare the information in the notice with your own records to ensure accuracy. This step is particularly important if you have multiple investment accounts or have made significant transactions during the year.

- Utilize Tax-Efficient Strategies: If the notice highlights opportunities for tax optimization, consider implementing those strategies. This could involve adjusting your investment portfolio or contributing to tax-advantaged accounts to minimize your tax liability.

- Stay Organized: Keep all relevant tax documents, including the special tax notice, in a secure and easily accessible location. This will make it easier to refer back to the information when preparing your tax return or seeking professional advice.

Future Implications and Industry Trends

The landscape of tax management is continually evolving, and financial institutions like Fidelity play a crucial role in adapting to these changes. As technology advances and regulatory environments shift, the way tax notices are delivered and the strategies they suggest may also evolve.

Digital Transformation in Tax Management

The financial industry is experiencing a rapid digital transformation, and tax management is no exception. Fidelity and other financial institutions are leveraging technology to enhance the efficiency and accessibility of tax-related services. This includes the development of user-friendly online portals where investors can access their tax documents, receive personalized tax advice, and even prepare and file their tax returns.

Additionally, the integration of artificial intelligence and machine learning algorithms can further streamline the tax management process. These technologies can analyze an investor's financial data, identify tax-efficient opportunities, and provide real-time recommendations to optimize tax strategies.

Regulatory Changes and Compliance

The tax landscape is subject to constant changes and updates, and financial institutions must adapt to ensure compliance. Fidelity and other firms are actively monitoring regulatory developments and implementing necessary adjustments to their tax notices and processes. This ensures that investors receive accurate and up-to-date information, helping them navigate the complexities of tax laws.

For instance, changes in tax rates, deductions, or reporting requirements can significantly impact an investor's tax liability. By staying abreast of these changes, financial institutions can provide timely guidance and support to their clients, ensuring they remain compliant and make informed decisions.

Collaborative Approaches to Tax Management

As the financial industry evolves, there is a growing emphasis on collaboration between financial institutions, tax professionals, and investors. Fidelity and similar firms are increasingly partnering with tax experts to provide comprehensive tax management solutions. This collaborative approach allows investors to receive specialized tax advice alongside their financial planning services, creating a more integrated and efficient tax management strategy.

Moreover, the integration of tax planning into overall financial planning can lead to more holistic financial management. By considering tax implications alongside investment goals, investors can make more strategic decisions that align with their long-term financial objectives.

Conclusion

The Fidelity Special Tax Notice is a valuable tool for investors, providing clarity and guidance on complex tax matters. By understanding the implications of the notice and taking proactive steps, individuals can optimize their tax strategies, minimize liabilities, and ensure compliance with relevant regulations. As the financial industry continues to evolve, investors can expect further innovations in tax management, driven by technology and collaborative approaches.

How often does Fidelity send out special tax notices?

+Fidelity typically sends out special tax notices annually, usually in the early months of the year. These notices cover the previous tax year and provide a comprehensive overview of relevant transactions and their tax implications.

What should I do if I receive a special tax notice but have questions or concerns?

+If you have questions or concerns about the special tax notice, it is recommended to seek professional advice. You can consult a tax advisor or financial planner who can provide personalized guidance based on your specific financial situation. They can help clarify any complexities and ensure you take appropriate actions.

Are there any potential tax benefits associated with the notice that I should be aware of?

+Yes, the special tax notice may highlight potential tax benefits or optimization opportunities. These could include suggestions for tax-efficient investment strategies, such as tax-loss harvesting, or reminders about tax-advantaged accounts like HSAs or 529 plans. It’s important to review the notice carefully and consider implementing these strategies to minimize your tax liability.

Can I access my special tax notice online through Fidelity’s website or app?

+Yes, Fidelity provides online access to your tax documents, including the special tax notice. You can log in to your Fidelity account through their website or mobile app to view and download your tax-related documents. This digital access ensures convenience and ease of reference.