Cherokee County Ga Tax Commissioner

The Cherokee County Tax Commissioner's Office plays a crucial role in the administration and management of tax-related affairs within Cherokee County, Georgia. It is responsible for a range of essential functions that impact the lives of residents and businesses in the county. From property tax assessments to vehicle registrations, the Tax Commissioner's Office is a key player in the financial landscape of Cherokee County.

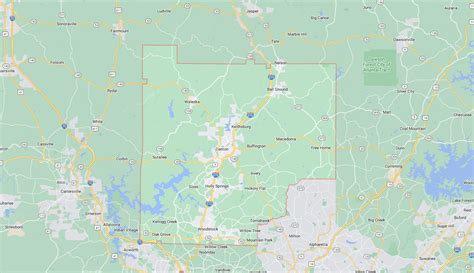

About Cherokee County, GA

Cherokee County, located in the northwestern part of the Atlanta metropolitan area, is known for its picturesque landscapes, thriving businesses, and vibrant communities. With a population of over 260,000 residents, it is one of the fastest-growing counties in Georgia. The county’s diverse economy, which includes a mix of manufacturing, technology, and service industries, contributes significantly to its economic prosperity.

Cherokee County's commitment to maintaining a high quality of life for its residents is evident in its well-maintained infrastructure, excellent schools, and ample recreational opportunities. The county's rich history, dating back to its founding in 1831, is reflected in its cultural heritage and preserved landmarks.

The Role of the Tax Commissioner

The Tax Commissioner in Cherokee County is an elected official responsible for overseeing a range of tax-related functions. This office is a vital link between the citizens and the government, ensuring that tax obligations are met efficiently and transparently. The Tax Commissioner’s duties encompass various critical tasks that impact the financial health of the county and its residents.

Property Tax Assessments

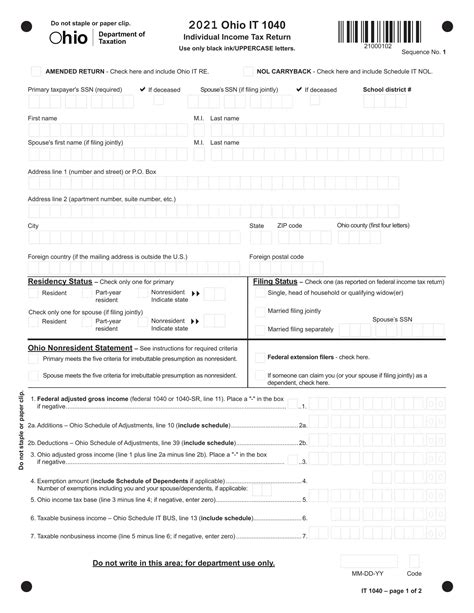

One of the primary responsibilities of the Tax Commissioner’s Office is the annual assessment of property taxes. This involves evaluating the value of real estate properties within the county, including residential, commercial, and industrial properties. The office uses a systematic approach to ensure fair and accurate assessments, taking into account factors such as location, size, and recent sales data.

| Assessment Period | Tax Rate |

|---|---|

| January - April | 6.5 mills (for residential properties) |

| May - December | 8.0 mills (for commercial properties) |

Property owners in Cherokee County can access their tax information and make payments through the Tax Commissioner's website, which offers a convenient online platform for managing their tax obligations.

Vehicle Registration and Tag Renewal

The Tax Commissioner’s Office is also responsible for vehicle registration and tag renewal services. Residents can visit the office or utilize online services to register their vehicles, transfer titles, and renew their license plates. The office ensures compliance with state regulations and provides guidance on vehicle-related taxes and fees.

Cherokee County offers a Tag by Mail program, allowing residents to receive their new tags and registration documents by mail, providing a convenient option for those with busy schedules.

Tax Payment Options

The Tax Commissioner’s Office provides flexible payment options for taxpayers. In addition to traditional methods like cash, check, or money order, the office accepts online payments through secure payment portals. This ensures that taxpayers can fulfill their obligations conveniently, whether they choose to visit the office in person or utilize digital services.

Tax Exemptions and Discounts

Cherokee County offers various tax exemptions and discounts to eligible residents. These include homestead exemptions for primary residences, disability exemptions, and senior citizen discounts. The Tax Commissioner’s Office provides information and guidance on these exemptions, helping residents understand their eligibility and the application process.

Services and Online Presence

The Cherokee County Tax Commissioner’s Office has embraced technology to enhance its services and improve accessibility. The official website, https://www.cherokeega.com/departments/tax-commissioner, serves as a comprehensive resource for taxpayers. It offers an array of online services, including property tax lookups, tax payment options, and downloadable forms.

The office's commitment to transparency is evident in its online presence, providing residents with access to important information such as tax rates, assessment schedules, and guidelines for various tax-related processes.

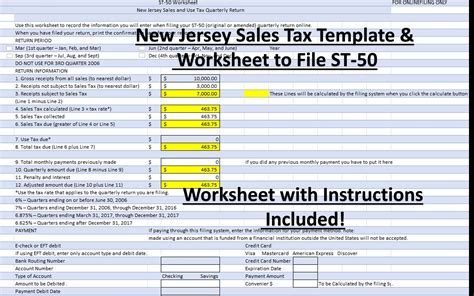

Online Services and Tools

- Property Tax Lookup: Residents can search for their property tax information, including assessed value, tax amounts, and payment history.

- Online Tax Payment: A secure portal allows taxpayers to make payments for property taxes, vehicle registration fees, and other taxes conveniently.

- Tax Due Dates and Deadlines: The website provides a calendar with important tax-related dates, ensuring residents stay informed about their obligations.

- Forms and Applications: Various forms related to tax exemptions, vehicle registration, and other services are available for download.

Contact Information and Office Hours

The Cherokee County Tax Commissioner’s Office is located at 1130 Bluffs Parkway, Suite 1101, Canton, GA 30114. The office is open from 8:00 AM to 5:00 PM, Monday through Friday, except for observed holidays. Residents can reach the office by phone at (770) 479-0400 or via email at taxcomm@cherokeega.com.

For after-hours assistance or during holidays, residents can access the Tax Commissioner's official website for information and guidance on tax-related matters.

Conclusion

The Cherokee County Tax Commissioner’s Office is a vital hub for tax-related services, ensuring the efficient management of tax obligations for residents and businesses. Its commitment to transparency, accessibility, and technological innovation enhances the overall tax experience for the county’s citizens. By providing a range of services, from property tax assessments to vehicle registration, the office plays a pivotal role in the financial well-being of Cherokee County.

What is the role of the Tax Commissioner in Cherokee County, GA?

+The Tax Commissioner is an elected official responsible for assessing property taxes, managing vehicle registration, and overseeing other tax-related functions in Cherokee County.

How can I pay my property taxes in Cherokee County?

+You can pay your property taxes online through the Tax Commissioner’s website or in person at the office. The office accepts various payment methods, including credit cards, debit cards, and e-checks.

Are there any tax exemptions or discounts available in Cherokee County?

+Yes, Cherokee County offers several tax exemptions and discounts, including homestead exemptions, disability exemptions, and senior citizen discounts. The Tax Commissioner’s Office provides detailed information on eligibility and the application process.

How can I register my vehicle in Cherokee County?

+You can register your vehicle at the Tax Commissioner’s Office by providing the necessary documentation, such as a title, proof of insurance, and a valid ID. The office will guide you through the process and collect the applicable fees.

What are the office hours for the Cherokee County Tax Commissioner’s Office?

+The office is open from 8:00 AM to 5:00 PM, Monday through Friday. It is closed on weekends and observed holidays.