Indiana Tax Forms

Indiana's tax system is an important aspect of its economic landscape, impacting individuals, businesses, and the state's overall financial health. Understanding the various tax forms and their implications is crucial for both residents and businesses operating within the state. This comprehensive guide will delve into the world of Indiana tax forms, providing an in-depth analysis and insights to navigate the complex tax landscape successfully.

The Indiana Tax System: An Overview

Indiana, like many other states, has a diverse tax structure, encompassing income tax, sales tax, property tax, and various other levies. The Indiana Department of Revenue plays a pivotal role in administering and enforcing these taxes, ensuring compliance and facilitating smooth tax processes for taxpayers.

For individuals, the state's income tax system is progressive, with tax rates varying based on income levels. The current income tax rates in Indiana range from 3.23% to 6.45%, providing a balanced approach to taxation. On the other hand, businesses face a corporate income tax rate of 6.5%, which is applied to taxable profits. This rate, while competitive compared to other states, significantly contributes to Indiana's revenue generation.

Key Indiana Tax Forms and Their Purposes

Navigating the Indiana tax system begins with understanding the various tax forms and their specific purposes. Here’s a breakdown of some of the most crucial tax forms in Indiana:

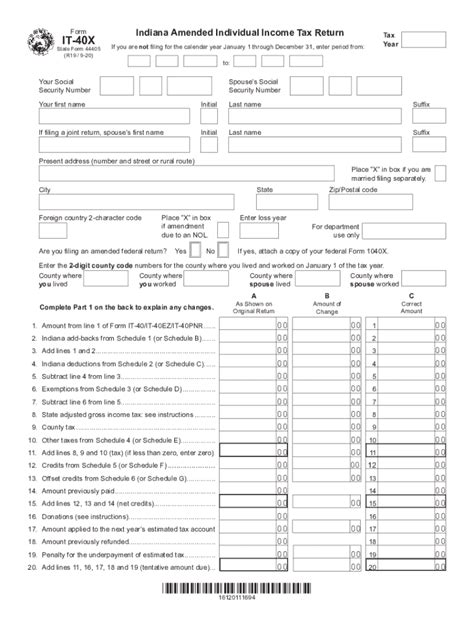

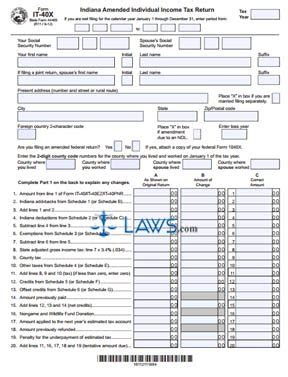

Form IT-40: Individual Income Tax Return

Form IT-40 is the primary tax form for Indiana residents and non-residents with Indiana-sourced income. It is used to report and calculate income tax liabilities, allowing taxpayers to claim deductions, credits, and exemptions. The form is detailed, covering various income sources, including wages, investments, and business income. Taxpayers must ensure accurate reporting to avoid penalties and interest.

| Key Information on Form IT-40 | Details |

|---|---|

| Income Sources | Wages, salaries, tips, interest, dividends, capital gains, rental income, etc. |

| Deductions | Standard deduction, itemized deductions (medical expenses, state and local taxes, mortgage interest, charitable contributions, etc.) |

| Credits | Child tax credit, education credits, retirement savings credits, etc. |

| Filing Status | Single, married filing jointly, married filing separately, head of household, qualifying widow(er) |

Taxpayers can choose to file Form IT-40 electronically or through traditional paper filing. The Indiana Department of Revenue provides a user-friendly online filing system, offering convenience and real-time processing status updates.

Form IT-40P: Individual Estimated Income Tax Payment Voucher

Form IT-40P is designed for taxpayers who anticipate owing taxes at the end of the year and wish to make estimated tax payments throughout the year. It is crucial for individuals with variable income or those who expect their tax liability to exceed certain thresholds. By making timely estimated payments, taxpayers can avoid penalties for underpayment of taxes.

Form IT-20S: Indiana Partnership Return

Form IT-20S is a critical tax form for partnerships operating in Indiana. It requires partnerships to report their income, gains, losses, deductions, and credits, providing a comprehensive overview of their financial activities. The form also facilitates the distribution of partnership income and losses to individual partners, ensuring accurate tax reporting.

Form COR-IT: Indiana Corporate Income Tax Return

Form COR-IT is the primary tax form for corporations doing business in Indiana. It is used to report corporate income, calculate tax liabilities, and claim deductions and credits specific to corporate structures. The form adheres to Indiana’s corporate income tax laws, ensuring fair taxation of corporate entities.

Form SC-100: Sales and Use Tax Return

Form SC-100 is an essential tax form for businesses involved in selling goods or providing services subject to Indiana’s sales and use tax. It requires businesses to report and remit sales tax collected from customers, ensuring compliance with state tax laws. The form also allows businesses to claim any eligible sales tax deductions or exemptions.

Navigating the Indiana Tax Landscape: Expert Insights

Understanding Indiana’s tax system and the intricacies of its tax forms is essential for both individuals and businesses. Here are some expert insights to navigate this complex landscape effectively:

- Stay Informed: Keep up-to-date with Indiana's tax laws and regulations. The Indiana Department of Revenue's website provides valuable resources and updates on tax changes, ensuring you remain compliant.

- Seek Professional Guidance: For complex tax situations or businesses with unique structures, consulting a tax professional can provide tailored advice and ensure accurate tax reporting.

- Utilize Online Resources: The Indiana Department of Revenue offers online tools and resources, including tax calculators and guides, to assist taxpayers in estimating their tax liabilities and understanding their obligations.

- Plan for Estimated Tax Payments: If you expect to owe taxes, consider making estimated tax payments to avoid penalties and ensure a smooth tax filing process.

- Keep Detailed Records: Maintain organized financial records to simplify the tax preparation process and support your tax filings. This practice ensures accuracy and facilitates audits, if necessary.

The Future of Indiana’s Tax System

As Indiana’s economy evolves, so does its tax system. The state is continuously exploring ways to streamline tax processes, enhance compliance, and attract businesses. Recent initiatives include the introduction of online filing systems and the implementation of tax incentives for specific industries. These measures aim to simplify tax obligations, encourage economic growth, and position Indiana as a competitive business destination.

Stay tuned for future developments in Indiana's tax landscape, as the state strives to create a balanced and efficient tax environment for its residents and businesses.

Conclusion

Indiana’s tax system is a dynamic and intricate part of its economic framework. By understanding the key tax forms, their purposes, and the expert insights provided, individuals and businesses can navigate this landscape with confidence. Remember, staying informed, seeking professional guidance when needed, and maintaining accurate records are crucial steps toward successful tax management in Indiana.

Frequently Asked Questions

What is the deadline for filing Indiana tax returns?

+

The deadline for filing Indiana tax returns is typically April 15th each year. However, this deadline may be extended in certain circumstances, such as during natural disasters or other emergencies.

How can I obtain Indiana tax forms?

+

Indiana tax forms can be easily accessed through the Indiana Department of Revenue’s official website. You can download and print the forms directly from their online portal, ensuring you have the most up-to-date versions.

Are there any tax incentives or credits available for businesses in Indiana?

+

Yes, Indiana offers a range of tax incentives and credits to attract and support businesses. These include tax credits for research and development, job creation, and investment in certain industries. It’s advisable to consult with a tax professional or refer to the Indiana Economic Development Corporation’s website for detailed information on available incentives.

Can I file my Indiana taxes electronically?

+

Absolutely! Indiana encourages electronic filing, and the Indiana Department of Revenue provides a user-friendly online filing system. This system offers real-time processing status updates and ensures a more efficient and secure tax filing process.

What happens if I miss the tax filing deadline in Indiana?

+

Missing the tax filing deadline may result in penalties and interest charges. It is advisable to file your tax return as soon as possible to minimize these additional costs. If you anticipate not being able to file by the deadline, consider requesting an extension to avoid penalties.