Track Mo Tax Refund

Welcome to an in-depth exploration of the intriguing concept of tracking your tax refund, a process that can be as complex as it is essential. In the ever-evolving landscape of financial management, understanding the intricacies of tax refunds is paramount. This article aims to guide you through the process, providing a comprehensive and engaging perspective on how to effectively track your hard-earned money's journey back to your pocket.

Understanding the Tax Refund Journey

A tax refund is essentially a repayment of taxes that you, the taxpayer, have overpaid to the government. This overpayment can occur for a variety of reasons, including deductions, credits, and adjustments made during the tax year. The process of receiving a refund involves a meticulous journey through the tax system, and keeping track of its progress is crucial for both financial planning and peace of mind.

When you file your tax return, you initiate a complex sequence of events. The tax authorities receive your return, verify the information, and then proceed to calculate the amount you're owed. This calculation takes into account various factors, such as your income, deductions, and the tax rates applicable to your situation. Once the amount is determined, the refund journey begins.

In the digital age, tracking your tax refund has become more accessible and efficient. Most tax authorities provide online tools and resources to help taxpayers monitor the status of their refunds. These tools offer real-time updates, ensuring that you're always informed about the progress of your refund. Additionally, many tax preparation software and apps now integrate with these systems, providing a seamless and user-friendly tracking experience.

Key Factors Influencing Refund Time

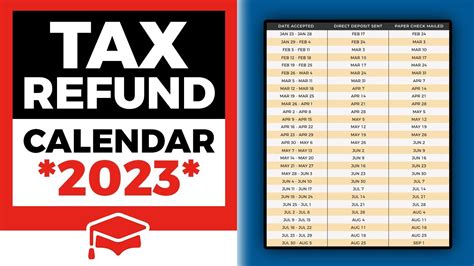

The time it takes for your tax refund to arrive can vary widely, influenced by a multitude of factors. These include the method of filing (paper or electronic), the complexity of your tax return, and even the time of year. For instance, refunds filed early in the tax season tend to be processed faster than those filed later, as the tax authorities may prioritize simpler returns first.

| Filing Method | Processing Time |

|---|---|

| Electronic Filing | Typically 3-4 weeks |

| Paper Filing | Can take up to 6-8 weeks |

Furthermore, if your tax return includes errors or requires additional information, the refund process may be delayed. It's essential to review your return thoroughly before filing to minimize the chances of errors. Additionally, staying updated with the latest tax regulations and guidelines can help you avoid common pitfalls that might slow down your refund.

Step-by-Step Guide to Tracking Your Refund

Now that we’ve established the basics, let’s delve into a detailed, step-by-step guide on how to effectively track your tax refund.

Step 1: Choose Your Tracking Method

There are several methods available for tracking your tax refund, each with its own advantages and suitability depending on your preferences and circumstances. Here’s a breakdown of the most common options:

- Online Tracking Tools: Most tax authorities offer online platforms where you can enter your personal information to check the status of your refund. These tools are usually secure and provide real-time updates. For instance, the IRS Tax Refund Tracker is a popular choice for US taxpayers.

- Mobile Apps: Many tax preparation companies and financial institutions offer mobile apps that integrate with tax authorities' systems. These apps provide a convenient way to track your refund on the go, often with push notifications to keep you informed.

- Telephone Hotlines: While less common in the digital age, some tax authorities still maintain telephone hotlines for refund inquiries. This method might be useful if you prefer a personal touch or if you encounter issues with online tracking.

- Mail: In some cases, you can opt to receive updates about your refund via postal mail. This method is slower and less convenient, but it can be useful as a backup or for those without internet access.

Step 2: Gather Essential Information

To track your tax refund effectively, you’ll need certain key pieces of information. These typically include your:

- Social Security Number (or equivalent)

- Tax filing status (single, married filing jointly, etc.)

- Exact amount of your expected refund

- Filing year

Having this information readily available will streamline the tracking process and ensure you're accessing the correct refund status.

Step 3: Utilize Available Resources

Once you’ve chosen your tracking method and gathered the necessary information, it’s time to put these resources to work. Here’s a closer look at some of the most effective tools:

- IRS Where's My Refund Tool: This online tool provided by the Internal Revenue Service (IRS) in the US allows taxpayers to check their refund status by entering their Social Security Number, filing status, and the exact amount of their refund. It's updated daily, except weekends and holidays.

- HMRC Online Services: For UK taxpayers, the HM Revenue and Customs (HMRC) offers an online service where you can track the progress of your refund. You'll need to sign in using your Government Gateway account details.

- TurboTax Refund Tracker: This popular tax preparation software offers a user-friendly refund tracking feature. Once you've filed your return using TurboTax, you can track the status of your refund directly within the software.

- Bank Mobile Apps: Some banks and financial institutions offer integration with tax authorities, allowing you to track your refund directly from your banking app. This method provides a seamless experience, as your refund can be deposited directly into your account.

Step 4: Monitor and Manage Expectations

Tracking your tax refund is not just about knowing where it is; it’s also about managing your expectations. Remember that refund processing times can vary, and unexpected delays may occur. Stay informed about the typical processing times for your specific circumstances, and be prepared for potential delays due to errors or additional reviews.

If you encounter any issues or have concerns about the status of your refund, don't hesitate to reach out to the tax authorities or a tax professional for assistance. They can provide guidance and help resolve any problems that might be causing delays.

Maximizing Your Tax Refund

Tracking your tax refund is an important part of the process, but it’s equally crucial to ensure you’re getting the maximum refund you’re entitled to. Here are some strategies to help maximize your refund:

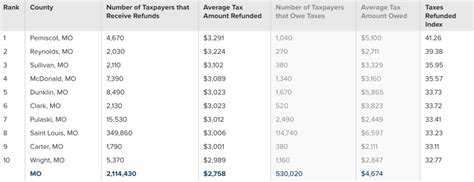

Claim All Eligible Deductions and Credits

Deductions and credits can significantly reduce your tax liability, thereby increasing your refund. Make sure you’re aware of all the deductions and credits you’re eligible for, and claim them accurately on your tax return. Common deductions include those for charitable donations, medical expenses, and certain business expenses. Credits, such as the Child Tax Credit or the Earned Income Tax Credit, can also provide substantial benefits.

Review Your Withholdings

If you’re consistently receiving large refunds, it might be an indication that you’re having too much tax withheld from your paycheck. Consider adjusting your tax withholdings so that you have more take-home pay throughout the year. However, be cautious not to reduce your withholdings too much, as this could result in owing taxes at the end of the year.

Consider Tax-Advantaged Accounts

Contributing to tax-advantaged accounts, such as IRAs or 401(k)s, can reduce your taxable income and potentially increase your refund. These accounts offer tax benefits, such as tax-free growth or tax deductions on contributions. Consult with a financial advisor to determine which accounts might be suitable for your situation.

Future Implications and Trends

As technology continues to advance, the process of tracking tax refunds is likely to become even more efficient and user-friendly. Here’s a glimpse into the future of tax refund tracking:

Artificial Intelligence and Machine Learning

AI and machine learning technologies are already being utilized to enhance the tax refund process. These technologies can analyze vast amounts of data, identify patterns, and provide more accurate predictions about refund timelines. They can also help detect errors and anomalies, ensuring a smoother and faster refund journey.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies, has the potential to revolutionize the way tax refunds are tracked and processed. By providing a secure, transparent, and tamper-proof record of transactions, blockchain can enhance trust and efficiency in the refund process. It can also facilitate cross-border refunds, making international tax refunds more accessible and reliable.

Enhanced Integration with Financial Institutions

As tax authorities and financial institutions continue to collaborate, we can expect to see deeper integration between tax refund systems and banking platforms. This integration will allow for more seamless deposit of refunds directly into taxpayers’ accounts, reducing the time and effort required to access your refund.

Improved User Experience

With the increasing popularity of mobile devices, tax authorities and tax preparation companies are focusing on developing user-friendly apps and platforms. These tools will offer intuitive interfaces, personalized refund tracking, and push notifications to keep taxpayers informed. The goal is to make the tracking process as simple and stress-free as possible.

Conclusion

Tracking your tax refund is an essential part of managing your finances, and with the right tools and knowledge, it can be a straightforward and even enjoyable process. By understanding the refund journey, utilizing available resources, and staying informed about future trends, you can ensure a smooth and efficient experience. Remember, your tax refund is your money, and keeping track of it is a vital part of your financial journey.

How long does it typically take to receive a tax refund?

+The time it takes to receive a tax refund can vary. On average, it takes about 3-4 weeks for electronic filings and 6-8 weeks for paper filings. However, factors like the complexity of your return, errors, or additional reviews can influence the processing time.

Can I track my refund status without an online account?

+Yes, you can track your refund status without an online account. Many tax authorities offer telephone hotlines or postal mail services for refund inquiries. However, online tracking tools are usually the fastest and most convenient method.

What should I do if my refund status shows an error?

+If you encounter an error while tracking your refund, it’s important to address it promptly. Contact the tax authority or a tax professional for guidance. They can help resolve the issue and get your refund processing back on track.

How can I maximize my tax refund?

+To maximize your tax refund, make sure to claim all eligible deductions and credits on your tax return. Additionally, review your tax withholdings to ensure you’re not overpaying throughout the year. Finally, consider contributing to tax-advantaged accounts, which can reduce your taxable income and increase your refund.