New York City Ny Sales Tax Rate

Understanding the sales tax landscape in New York City is crucial for both residents and businesses. The tax system in NYC, like in many other metropolitan areas, is a complex interplay of local, state, and sometimes even federal regulations. This guide aims to demystify the sales tax rates in NYC, offering a comprehensive insight into the current rates, their application, and their impact on the city's economy.

The Sales Tax Structure in New York City

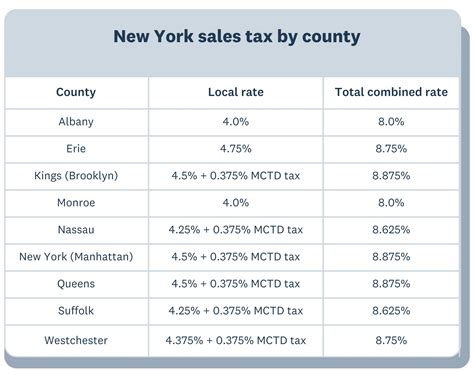

Sales tax in New York City is a cumulative tax, meaning that it is applied on top of any other applicable taxes. The sales tax rate is comprised of a state tax rate, a city tax rate, and sometimes additional county or local taxes. This structure ensures that the city and state can fund essential services and infrastructure while also providing a revenue stream for local projects.

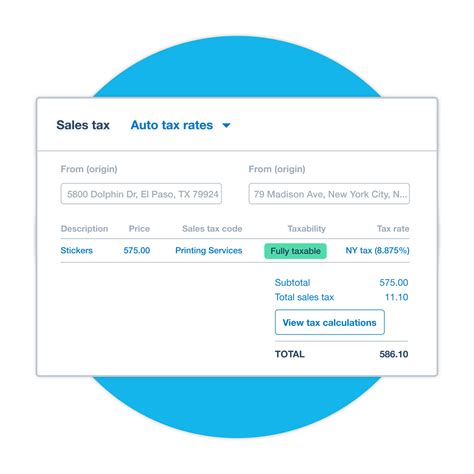

The current sales tax rate in New York City is 8.875%, which includes:

- A state sales tax of 4%

- A city sales tax of 4.5%

- An additional 0.375% tax for the Metropolitan Commuter Transportation District (MCTD)

It's important to note that certain items are exempt from sales tax in NYC, such as essential groceries, prescription drugs, and some clothing items under a specific price threshold. Additionally, there are special provisions for businesses, like the Quarterly Sales and Use Tax Return which allows businesses to remit their sales tax obligations on a quarterly basis.

Impact on NYC’s Economy

The sales tax plays a significant role in NYC’s economy, providing a steady revenue stream for the city’s operations and development projects. The tax revenue funds vital services like public transportation, schools, and emergency services. It also contributes to the city’s overall economic health by incentivizing businesses to locate in NYC, thus creating jobs and driving economic growth.

However, the sales tax rate also impacts consumer behavior. High sales tax rates can deter consumers from making purchases, especially for non-essential items. This could lead to a decrease in retail sales and, subsequently, a decline in tax revenue. On the other hand, certain industries, such as tourism and hospitality, can benefit from a robust sales tax system as it provides a reliable source of income for the city's infrastructure and services.

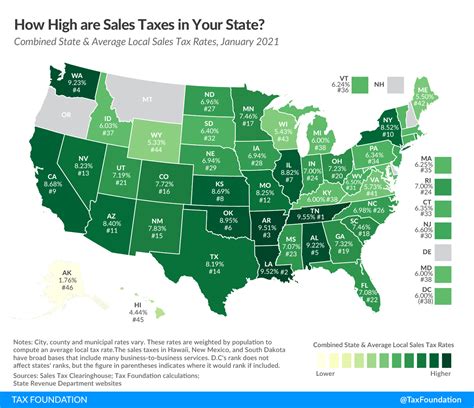

Comparison with Other Major Cities

New York City’s sales tax rate is on the higher end when compared to other major cities in the United States. For instance, Los Angeles has a sales tax rate of 9.5%, while Chicago’s rate is 10.25%. On the other hand, cities like Houston and Miami have lower sales tax rates at 8.25% and 7.975% respectively.

| City | Sales Tax Rate |

|---|---|

| New York City | 8.875% |

| Los Angeles | 9.5% |

| Chicago | 10.25% |

| Houston | 8.25% |

| Miami | 7.975% |

This comparison shows that NYC's sales tax rate is competitive with other major cities, albeit on the higher end. This can be attributed to the city's diverse economy and its reliance on sales tax revenue to fund its extensive infrastructure and services.

Future Outlook

The sales tax rate in New York City is subject to change, often in response to economic conditions and the city’s budgetary needs. In recent years, there have been discussions about potential tax reforms, including the possibility of lowering the sales tax rate to stimulate consumer spending and attract more businesses. However, any significant changes would require careful consideration to ensure the city’s fiscal stability and continued investment in essential services.

Additionally, with the rise of e-commerce, there is a growing debate about how to effectively tax online sales. This is particularly relevant for NYC, as it could impact the city's tax revenue stream. The future of sales tax in NYC will likely involve adapting to these digital trends and ensuring that the tax system remains fair, efficient, and sustainable.

Frequently Asked Questions

Are there any items exempt from sales tax in NYC?

+Yes, certain items are exempt from sales tax in NYC. This includes essential groceries, prescription drugs, and some clothing items under a specific price threshold. It’s important to check the official guidelines for a comprehensive list of exempt items.

How often do sales tax rates change in NYC?

+Sales tax rates can change annually or even more frequently, depending on various economic factors and budgetary needs. It’s important to stay updated with the latest tax rates to ensure compliance and accurate financial planning.

What is the impact of the sales tax on tourism in NYC?

+The sales tax in NYC can impact tourism, as visitors may be deterred by high tax rates on non-essential items. However, the tax revenue generated from tourism helps fund the city’s infrastructure and services, benefiting both residents and tourists alike.