Delaware Property Tax

Property taxes are an essential aspect of owning a home or commercial property, and they can significantly impact your finances. In the state of Delaware, property tax is an important revenue source for local governments and plays a crucial role in funding public services and infrastructure. This comprehensive guide aims to provide an in-depth analysis of Delaware's property tax system, shedding light on its intricacies and offering valuable insights for property owners.

Understanding Delaware’s Property Tax Landscape

Delaware, known for its business-friendly environment and diverse real estate market, has a unique property tax system that varies across its three counties: New Castle, Kent, and Sussex. This variation allows for a more tailored approach to property taxation, considering the distinct characteristics of each county. Understanding these differences is key to navigating Delaware’s property tax landscape.

County-Specific Assessments and Rates

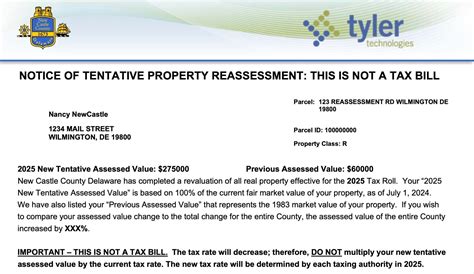

In Delaware, property assessments are conducted by the respective county governments. These assessments determine the value of the property, which forms the basis for calculating property taxes. The assessment process involves evaluating factors such as location, size, condition, and recent sales data of comparable properties.

Each county in Delaware has its own assessment schedule, which dictates how often properties are reassessed. For instance, New Castle County reassesses properties every four years, while Kent and Sussex counties reassess properties every three years. This ensures that property values are regularly updated to reflect market trends and changes.

| County | Assessment Schedule | Current Tax Rate (2024) |

|---|---|---|

| New Castle | Every 4 years | 1.2750 per 100 of assessed value</td> </tr> <tr> <td>Kent</td> <td>Every 3 years</td> <td>1.0750 per 100 of assessed value |

| Sussex | Every 3 years | 1.0500 per $100 of assessed value |

It’s important to note that tax rates can change annually based on budgetary needs and legislative decisions. Property owners can refer to their county’s official website for the most up-to-date tax rates and assessment information.

Exemptions and Credits: Easing the Tax Burden

Delaware offers a range of exemptions and credits to help property owners manage their tax liabilities. These provisions can significantly reduce the overall tax burden, making homeownership more affordable.

- Homestead Credit: This credit is available to homeowners who use their property as their primary residence. It provides a credit of $1,250 on their annual property tax bill. To qualify, homeowners must apply for the credit and meet certain income and residency requirements.

- Senior Citizen Tax Credit: Delaware residents aged 65 and above can apply for this credit, which provides a reduction in property taxes based on their income. The credit amount varies depending on the individual’s circumstances.

- Veterans Exemption: Honorably discharged veterans may be eligible for an exemption from property taxes. The exemption amount depends on the veteran’s disability rating and can be a significant relief for those who have served their country.

- Agricultural Land Exemption: Property owners with land dedicated to agricultural use can apply for this exemption, which can reduce the taxable value of their property. This encourages and supports Delaware’s agricultural industry.

It’s crucial for property owners to explore these exemptions and credits to ensure they are taking advantage of all the benefits available to them. Each county’s tax assessor’s office can provide specific details and guidance on applying for these provisions.

The Property Tax Calculation Process

Understanding how property taxes are calculated in Delaware is essential for property owners to budget effectively and anticipate their tax liabilities. The process involves several steps, from assessing the property’s value to applying tax rates and exemptions.

Step-by-Step Breakdown of Tax Calculation

- Property Assessment: The first step in the process is the assessment of the property’s value. As mentioned earlier, this is done by the county assessor’s office, taking into account various factors such as location, size, and recent sales data.

- Determining the Assessed Value: Once the assessment is complete, the assessor’s office determines the property’s assessed value. This value is a crucial component in calculating the property taxes.

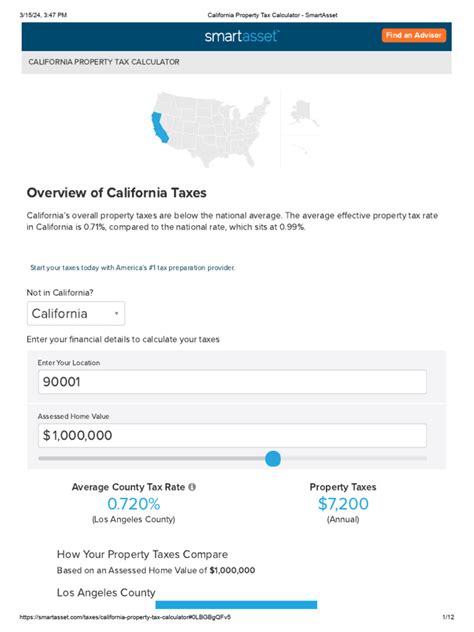

- Applying the Tax Rate: The assessed value is then multiplied by the applicable tax rate for the specific county. As mentioned, these rates can vary and are subject to change annually.

- Subtracting Exemptions and Credits: After calculating the initial tax amount, any applicable exemptions and credits are subtracted. This step ensures that property owners receive the benefits they are entitled to, reducing their overall tax liability.

- Final Tax Amount: The remaining amount after applying exemptions and credits is the property owner’s final tax liability for the year. This amount is due to the county government and is typically payable in installments.

It’s important to note that property owners have the right to appeal their property’s assessed value if they believe it is inaccurate. The appeal process involves submitting evidence and documentation to support their case, and it is a crucial step for those who feel their property has been overvalued.

Impact of Property Value Changes

Property values can fluctuate over time due to various factors, such as market conditions, improvements made to the property, or changes in the surrounding area. These changes directly impact the property taxes, as the assessed value forms the basis for tax calculations.

For instance, if a property’s value increases due to a thriving real estate market, the owner can expect a higher tax bill in the following year. On the other hand, if the property’s value decreases, the tax liability may also decrease, providing some relief to the property owner.

Regular reassessments by the county governments help ensure that property values are accurately reflected, providing a fair and equitable tax system for all property owners in Delaware.

Managing Property Taxes: Strategies and Tips

Navigating Delaware’s property tax system can be complex, but with the right strategies and understanding, property owners can effectively manage their tax liabilities. Here are some expert tips to help ease the tax burden and make the process more manageable.

Exploring Tax Relief Options

Delaware offers a range of tax relief programs designed to assist property owners, especially those who may be struggling with their tax obligations. These programs provide opportunities to reduce tax liabilities and make homeownership more affordable.

- Tax Abatement Programs: Certain areas in Delaware offer tax abatement programs, which provide a temporary reduction in property taxes for new developments or renovations. These programs encourage economic growth and can significantly reduce tax burdens for a set period.

- Deferred Payment Plans: For property owners facing financial hardships, deferred payment plans can be a lifesaver. These plans allow property owners to delay their tax payments without incurring penalties, providing much-needed flexibility during challenging times.

- Tax Incentives for Renovations: Delaware promotes economic development and supports local businesses by offering tax incentives for property renovations. These incentives can reduce the taxable value of the property, making it more cost-effective to improve and maintain real estate.

It’s essential for property owners to stay informed about these tax relief options and explore them when needed. County websites and local government offices can provide detailed information on eligibility criteria and application processes.

Maximizing Exemptions and Credits

As discussed earlier, Delaware offers a variety of exemptions and credits that can significantly reduce property tax liabilities. Property owners should ensure they are taking full advantage of these provisions to minimize their tax burden.

For instance, homeowners should not miss out on the Homestead Credit, which provides a direct reduction on their annual tax bill. Similarly, seniors and veterans should explore the Senior Citizen Tax Credit and Veterans Exemption to reduce their tax obligations. Additionally, property owners with agricultural land can benefit from the Agricultural Land Exemption, which reduces the taxable value of their property.

Staying informed about these exemptions and credits and ensuring timely applications can make a significant difference in a property owner’s financial situation.

Appealing Property Assessments

In some cases, property owners may feel that their property’s assessed value is inaccurate or too high. In such situations, it’s important to know that property owners have the right to appeal their assessment. This process involves gathering evidence, such as recent sales data of comparable properties, to support the argument for a lower assessed value.

Appealing an assessment can be a complex process, and it’s advisable to seek professional guidance from tax consultants or legal experts who specialize in property tax matters. A successful appeal can lead to a reduced tax liability, providing much-needed relief to the property owner.

Future Implications and Trends

Delaware’s property tax system is constantly evolving, influenced by economic trends, legislative decisions, and changes in the real estate market. Understanding these trends and their potential impact can help property owners prepare for the future and make informed decisions.

Economic Impact and Policy Changes

The economic health of Delaware plays a significant role in shaping property tax policies. During economic downturns, property values may decrease, leading to reduced tax revenues for local governments. In response, governments may need to adjust tax rates or explore new revenue streams to maintain public services.

Conversely, during periods of economic growth, property values may increase, leading to higher tax revenues. This can provide an opportunity for governments to invest in infrastructure and public services, further boosting the state’s economy.

Property owners should stay informed about economic trends and legislative changes, as these factors can directly impact their tax liabilities and the overall real estate market.

The Impact of Remote Work and Urban Migration

The shift towards remote work and the increased popularity of urban migration have significantly impacted real estate markets across the country, including Delaware. These trends can influence property values and, consequently, property taxes.

For instance, as more people move to suburban or rural areas, property values in these regions may increase, leading to higher tax liabilities for homeowners. On the other hand, urban areas may experience a decrease in property values, providing some relief to city dwellers.

Property owners should stay attuned to these migration trends and their potential impact on property values and taxes. Understanding these shifts can help homeowners make strategic decisions about their properties and tax obligations.

Technological Advancements and Property Assessment

Technology is increasingly playing a role in property assessment processes, offering more accurate and efficient ways to determine property values. Advanced tools and data analytics can provide more precise valuations, reducing the likelihood of errors and ensuring a fair tax system.

For instance, drones and satellite imagery can provide detailed visuals of properties, helping assessors evaluate conditions and make more accurate assessments. Additionally, data analytics can consider a broader range of factors, such as demographic trends and environmental impacts, to provide a more holistic view of property values.

These technological advancements can lead to more equitable property tax systems, ensuring that property owners pay their fair share based on accurate valuations. However, it’s important for property owners to understand these technologies and their implications, as they may impact their tax obligations.

FAQs

What is the average property tax rate in Delaware?

+

The average property tax rate in Delaware varies by county. As of 2024, New Castle County has a rate of 1.2750 per $100 of assessed value, Kent County has a rate of 1.0750, and Sussex County has a rate of 1.0500. These rates are subject to change annually.

How often are properties reassessed in Delaware?

+

The frequency of property reassessments varies by county. New Castle County reassesses properties every four years, while Kent and Sussex counties reassess every three years. These assessments ensure that property values are regularly updated to reflect market trends.

Are there any exemptions or credits available for property owners in Delaware?

+

Yes, Delaware offers a range of exemptions and credits to help property owners manage their tax liabilities. These include the Homestead Credit, Senior Citizen Tax Credit, Veterans Exemption, and Agricultural Land Exemption. Each provision has specific eligibility criteria and application processes.

Can I appeal my property’s assessed value in Delaware?

+

Yes, property owners in Delaware have the right to appeal their property’s assessed value if they believe it is inaccurate. The appeal process involves submitting evidence and supporting documentation to the county assessor’s office. It’s advisable to seek professional guidance for a successful appeal.

How do economic trends and legislative changes impact property taxes in Delaware?

+

Economic trends and legislative changes can significantly impact property taxes in Delaware. During economic downturns, property values may decrease, leading to reduced tax revenues for local governments. Conversely, economic growth can lead to higher property values and increased tax revenues. Legislative changes, such as tax rate adjustments or new relief programs, can also directly impact property owners.