Sales Tax Login Florida

Welcome to the comprehensive guide on the Sales Tax Login in Florida. As a business owner or accountant, understanding the process and requirements for sales tax registration and login is crucial for compliance and smooth financial operations. In this article, we will delve into the specifics of sales tax login in Florida, covering everything from registration to the practical steps involved.

Understanding Sales Tax Registration in Florida

Florida, known for its vibrant economy and tourism industry, imposes a sales and use tax on the sale of tangible personal property, certain services, and rentals within the state. As a business operating in Florida, it is essential to navigate the sales tax system effectively to avoid penalties and ensure compliance.

The Florida Department of Revenue (FDOR) is responsible for administering and enforcing sales tax regulations. They provide a user-friendly online platform for businesses to register, manage, and file their sales tax obligations. This guide will walk you through the entire process, from initial registration to accessing your account and managing your sales tax responsibilities.

Sales Tax Registration Process

To begin, let’s outline the steps involved in registering for sales tax in Florida:

- Determine Registration Eligibility: Before registering, ensure your business meets the criteria for sales tax collection and remittance. Generally, businesses with a physical presence or significant economic nexus in Florida are required to register.

- Choose Registration Method: Florida offers multiple ways to register for sales tax. You can choose between online registration, paper application, or in-person registration at a local FDOR office.

- Gather Required Information: Prepare the necessary details, including your business entity information, federal tax ID (EIN), contact information, and details of the products or services subject to sales tax.

- Complete the Registration Form: Whether online or via paper, fill out the registration form accurately and completely. Provide all the required information and ensure its accuracy to avoid delays in processing.

- Submit the Registration: Once the form is complete, submit it to the FDOR. Online submissions are instant, while paper applications may take a few days to process.

Receiving Your Sales Tax Registration Certificate

After submitting your registration, the FDOR will review your application. If approved, you will receive a Sales Tax Registration Certificate. This certificate is a crucial document, as it authorizes your business to collect and remit sales tax in Florida. Keep it in a safe place, as you may need to provide it to various entities, such as suppliers or partners.

| Sales Tax Registration Certificate | Details to Note |

|---|---|

| Certificate Number | A unique identifier for your business's sales tax registration. |

| Effective Date | The date from which your sales tax registration becomes active. |

| Expiration Date | The certificate may have an expiration date, after which you need to renew your registration. |

Sales Tax Login and Account Management

Once you have successfully registered for sales tax in Florida, it’s time to access your account and manage your sales tax obligations. The FDOR provides a secure online portal for businesses to manage their sales tax affairs efficiently.

Logging into Your Sales Tax Account

To access your sales tax account, follow these steps:

- Visit the FDOR Website: Go to the official website of the Florida Department of Revenue (https://www.myfloridacfo.com/division/tax).

- Find the Login Portal: Look for the “Login” or “My Account” section on the website. It is usually located in the top right corner or a dedicated section on the homepage.

- Enter Your Credentials: Input your username and password. If you are logging in for the first time, you may need to use the temporary credentials provided during registration. Ensure you change your password for enhanced security.

- Secure Login: The FDOR portal uses secure protocols to protect your information. Look for the “https” in the URL and the padlock icon in your browser’s address bar to ensure a safe connection.

Navigating Your Sales Tax Account Dashboard

Upon successful login, you will be directed to your personalized sales tax account dashboard. This dashboard serves as a central hub for managing your sales tax obligations. Here’s an overview of what you can expect:

- Account Overview: A snapshot of your sales tax account, including your registration details, upcoming deadlines, and any outstanding obligations.

- Filing and Payment: Access your sales tax return forms and make payments online. You can also set up automatic payments or utilize payment plans if needed.

- Reports and Documents: View and download important sales tax-related documents, such as your registration certificate, tax returns, and payment receipts.

- Notifications and Alerts: Stay informed about important updates, reminders, and changes to sales tax regulations or your account status.

- Account Management: Update your business information, change your login credentials, and manage user access for your account.

Sales Tax Return Filing and Payment

One of the critical aspects of sales tax management is filing your returns accurately and timely. Here’s a step-by-step guide to filing and paying your sales tax obligations in Florida:

- Access the Filing Portal: From your sales tax account dashboard, navigate to the filing section.

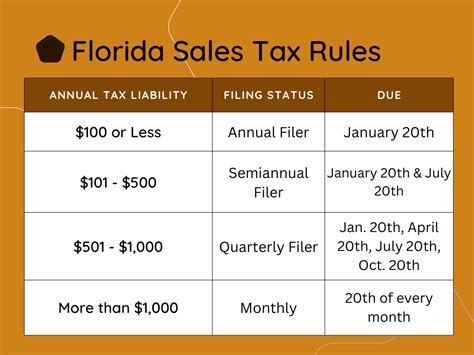

- Select the Tax Period: Choose the tax period for which you are filing. Florida typically requires sales tax returns to be filed quarterly or monthly, depending on your business’s sales volume.

- Complete the Sales Tax Return Form: Fill out the required fields, including your sales revenue, taxable items sold, and any applicable exemptions.

- Review and Submit: Carefully review the information provided and ensure its accuracy. Once satisfied, submit the return.

- Make the Payment: If you have a balance due, proceed to make the payment online. The FDOR offers various payment methods, including credit cards, electronic checks, and wire transfers.

- Save and Download: After filing and paying, save and download a copy of your filed return for your records.

Managing Sales Tax Obligations

Sales tax management is an ongoing process. Here are some key aspects to consider to ensure smooth compliance with Florida’s sales tax regulations:

Sales Tax Collection and Remittance

As a registered business, you are responsible for collecting sales tax from your customers at the point of sale. Ensure that your point-of-sale systems are configured to accurately calculate and display the applicable sales tax rate. Additionally, keep detailed records of all sales transactions to facilitate accurate reporting and auditing.

Sales Tax Exemptions and Special Circumstances

Florida offers various sales tax exemptions and special circumstances that may apply to certain businesses or transactions. Stay informed about these exemptions and ensure you understand the eligibility criteria. Some common exemptions include sales to government entities, certain nonprofit organizations, and specific goods or services.

Sales Tax Audits and Compliance

The FDOR may conduct sales tax audits to ensure businesses are complying with the regulations. During an audit, you may be required to provide detailed sales records, tax returns, and supporting documentation. Stay organized and maintain accurate records to facilitate a smooth audit process. Additionally, familiarize yourself with the audit procedures and your rights as a taxpayer.

Future Implications and Considerations

Staying informed about changes in sales tax regulations is crucial for businesses operating in Florida. Here are some future implications and considerations to keep in mind:

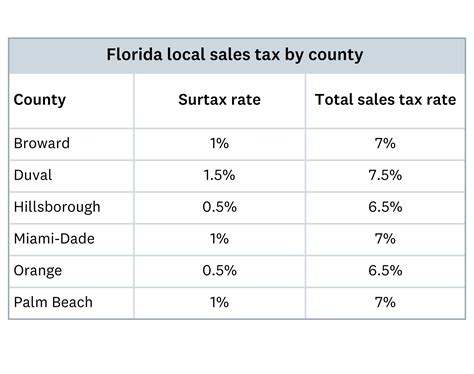

Sales Tax Rate Changes

Sales tax rates in Florida may change periodically due to legislative decisions or local initiatives. Stay updated on any rate changes to ensure you are collecting and remitting the correct amount of sales tax. The FDOR provides resources and notifications to keep businesses informed about rate changes.

Expansion and Multi-State Operations

If your business expands beyond Florida or operates in multiple states, you may need to navigate different sales tax regulations and registration requirements. Research and understand the sales tax laws in each state where you conduct business to ensure compliance and avoid penalties.

Sales Tax Software and Automation

Consider investing in sales tax software or automation tools to streamline your sales tax management process. These tools can help you calculate sales tax accurately, manage multiple tax rates and jurisdictions, and generate compliant sales tax returns. By automating your sales tax operations, you can reduce errors and save valuable time.

FAQ

What are the penalties for non-compliance with sales tax regulations in Florida?

+Non-compliance with sales tax regulations in Florida can result in penalties and interest charges. The FDOR may impose penalties for late filing, late payment, or failure to collect and remit sales tax. Penalties can range from 5% to 25% of the tax due, depending on the severity of the violation. It is crucial to stay compliant to avoid these penalties and maintain a positive relationship with the FDOR.

How often do I need to file sales tax returns in Florida?

+The frequency of filing sales tax returns in Florida depends on your business’s sales volume. Generally, businesses with annual sales exceeding a certain threshold are required to file returns quarterly. However, businesses with higher sales volumes may be required to file returns monthly. It is essential to consult the FDOR guidelines or seek professional advice to determine the appropriate filing frequency for your business.

Can I file my sales tax returns electronically in Florida?

+Yes, Florida strongly encourages businesses to file their sales tax returns electronically. The FDOR provides a secure online portal for electronic filing, which offers several benefits, including faster processing, reduced errors, and convenient payment options. Electronic filing also allows for easy access to previous returns and simplifies the record-keeping process.

What happens if I need to update my business information after registration?

+If your business information changes after registration, such as a change in ownership, address, or contact details, it is crucial to update your sales tax account with the FDOR. Log into your account, navigate to the account management section, and provide the updated information. Timely updates ensure accurate communication and prevent potential compliance issues.

How can I stay informed about sales tax rate changes in Florida?

+To stay informed about sales tax rate changes in Florida, subscribe to the FDOR’s newsletters and alerts. They provide regular updates on any changes to sales tax rates, exemptions, and regulations. Additionally, regularly visit the FDOR website, where they publish official announcements and provide resources to help businesses understand and comply with the latest sales tax requirements.