Us Canada Tax Treaty

The United States and Canada have a long history of economic and cultural ties, and one crucial aspect of their relationship is the tax agreement known as the US-Canada Tax Treaty. This treaty, officially titled the "Convention Between Canada and the United States of America With Respect to Taxes on Income and on Capital," has played a significant role in shaping cross-border tax policies and ensuring a harmonious fiscal relationship between the two nations. In this comprehensive article, we delve into the intricacies of the US-Canada Tax Treaty, exploring its history, key provisions, and its impact on taxpayers and businesses.

A Historical Perspective: The Evolution of the US-Canada Tax Treaty

The origins of the US-Canada Tax Treaty can be traced back to the post-World War II era, a period marked by increasing economic cooperation between the two North American neighbors. The treaty was first signed on September 26, 1980, and it aimed to address the complexities arising from the double taxation of income and capital between the United States and Canada.

Over the years, the treaty has undergone several amendments and updates to reflect the evolving economic landscape and changing tax policies of both countries. The most recent protocol amending the treaty was signed on February 5, 2014, and it brought significant changes to the treaty's provisions, particularly in the context of international tax planning and the prevention of tax evasion.

Key Provisions of the US-Canada Tax Treaty

The US-Canada Tax Treaty is a comprehensive agreement that covers a wide range of tax-related matters, including income tax, capital gains tax, inheritance tax, and social security contributions. Here are some of the treaty’s key provisions:

1. Elimination of Double Taxation

One of the primary objectives of the treaty is to eliminate double taxation, which occurs when income is taxed by both countries. The treaty establishes rules for determining the residence status of individuals and corporations, and it outlines the taxation rights of each country in various scenarios.

For instance, the treaty specifies that a Canadian resident individual who earns income from sources in the United States will be taxed in the United States but can claim a credit for the taxes paid in Canada. This ensures that the individual is not subject to double taxation on the same income.

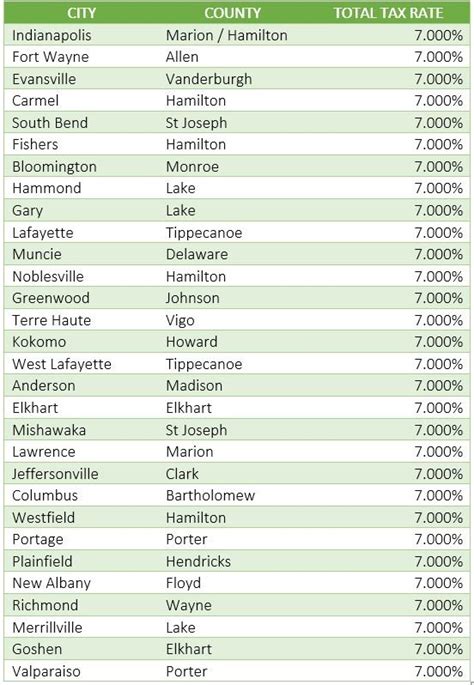

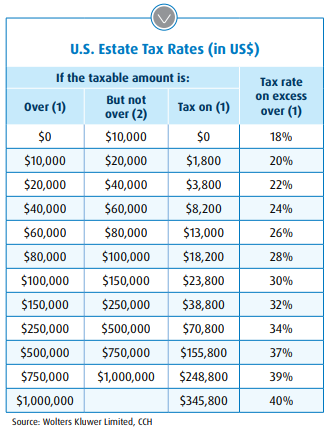

2. Tax Rates and Withholding

The treaty sets out specific tax rates that apply to various types of income, such as dividends, interest, royalties, and capital gains. These rates often differ from the standard domestic tax rates in both countries, providing tax benefits to taxpayers in certain circumstances.

Additionally, the treaty addresses the issue of withholding taxes, which are taxes deducted at the source by the payer. It specifies the maximum rates at which withholding taxes can be applied and provides mechanisms for taxpayers to claim a refund if the withheld amount exceeds the actual tax liability.

3. Exchange of Information

To combat tax evasion and ensure compliance with tax laws, the treaty includes provisions for the exchange of information between the tax authorities of the United States and Canada. This allows for the sharing of financial and tax-related data, aiding in the detection and prevention of tax fraud and non-compliance.

4. Social Security Coordination

The US-Canada Tax Treaty also addresses social security matters, particularly regarding the coordination of social security contributions and benefits for individuals who work in both countries. It aims to prevent double coverage and ensure that individuals are not disadvantaged due to their cross-border employment.

5. Dispute Resolution

In cases of disputes arising from the interpretation or application of the treaty, the agreement provides mechanisms for resolving such conflicts. This includes mutual agreement procedures and the establishment of a competent authority to facilitate the resolution of tax-related issues.

Impact on Taxpayers and Businesses

The US-Canada Tax Treaty has a significant impact on both individuals and businesses operating across the border. For taxpayers, the treaty provides clarity and certainty regarding their tax obligations, ensuring that they are not subject to double taxation or excessive tax burdens.

Businesses, especially those engaged in cross-border trade and investment, benefit from the treaty's provisions. It facilitates the flow of capital and goods between the two countries by reducing tax barriers and providing a stable tax environment. The treaty's tax rate reductions and withholding tax provisions can make cross-border transactions more cost-effective, enhancing the competitiveness of businesses operating in the US-Canada market.

Moreover, the treaty's exchange of information provisions plays a crucial role in maintaining tax integrity and fostering a climate of trust between the two nations. By facilitating the detection and prosecution of tax evasion and non-compliance, the treaty helps ensure a level playing field for taxpayers and businesses, promoting fairness and compliance with tax laws.

Case Study: The Impact of the US-Canada Tax Treaty on Cross-Border Investments

To illustrate the practical implications of the US-Canada Tax Treaty, let’s consider the case of a Canadian corporation, XYZ Inc., that decides to expand its operations into the United States. Without the treaty, XYZ Inc. would face significant tax challenges, including double taxation on its US-sourced income and complex tax compliance requirements.

However, with the treaty in place, XYZ Inc. can benefit from the reduced tax rates on dividends and other forms of income. The treaty also provides clarity on the taxation of intellectual property rights, ensuring that the company's patents and trademarks are not subject to excessive taxation in either country. Furthermore, the exchange of information provisions allows for efficient tax reporting and compliance, reducing the administrative burden on the company.

Future Implications and Ongoing Developments

The US-Canada Tax Treaty remains a dynamic agreement, subject to continuous evaluation and potential amendments to address emerging tax issues and global tax trends. One of the key areas of focus for future developments is the prevention of tax evasion and aggressive tax planning, particularly in the context of cross-border transactions and the use of hybrid entities.

Additionally, as the digital economy continues to grow, the treaty may need to be adapted to address the tax challenges posed by the rise of e-commerce and the increasing digitalization of businesses. This could involve revisions to the treaty's provisions on the taxation of digital services and the allocation of taxing rights in the digital realm.

Furthermore, the treaty's social security coordination provisions may be reviewed to ensure they keep pace with evolving labor market dynamics and the changing nature of employment relationships, including the rise of gig economy workers and remote work arrangements.

In conclusion, the US-Canada Tax Treaty is a vital agreement that has facilitated the economic cooperation between the two countries for decades. By eliminating double taxation, providing tax certainty, and fostering a climate of tax transparency, the treaty has played a pivotal role in shaping the fiscal relationship between the United States and Canada. As the treaty continues to evolve, it will remain a cornerstone of the cross-border tax landscape, ensuring a harmonious and mutually beneficial fiscal environment for taxpayers and businesses alike.

How often is the US-Canada Tax Treaty updated or amended?

+The treaty has undergone several amendments since its initial signing in 1980. The most recent protocol amending the treaty was signed in 2014, reflecting the need for ongoing updates to address changing tax landscapes and emerging issues.

What are the main benefits of the US-Canada Tax Treaty for businesses?

+The treaty provides businesses with reduced tax rates on cross-border transactions, clarity on tax obligations, and a stable tax environment. It also facilitates the exchange of information, aiding in tax compliance and reducing administrative burdens.

How does the treaty address double taxation for individuals with income in both countries?

+The treaty establishes rules for determining residence status and outlines the taxation rights of each country. It allows individuals to claim tax credits for taxes paid in the other country, ensuring they are not subject to double taxation on the same income.

What is the role of the competent authority in resolving tax disputes under the treaty?

+The competent authority is responsible for facilitating the resolution of tax-related issues and disputes arising from the interpretation or application of the treaty. It acts as a liaison between the tax authorities of the two countries, aiming to find mutually agreeable solutions.