Tax Deducted At Source Meaning

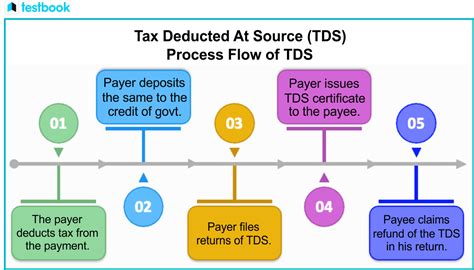

Tax Deducted at Source (TDS) is a vital component of the Indian taxation system, playing a crucial role in efficient tax collection and compliance. It's a method where the person making a specified payment deducts a certain percentage of tax from the payment and remits it to the government on behalf of the recipient. This article delves into the intricacies of TDS, exploring its definition, purpose, applicability, calculation methods, and its impact on taxpayers.

Understanding Tax Deducted at Source (TDS)

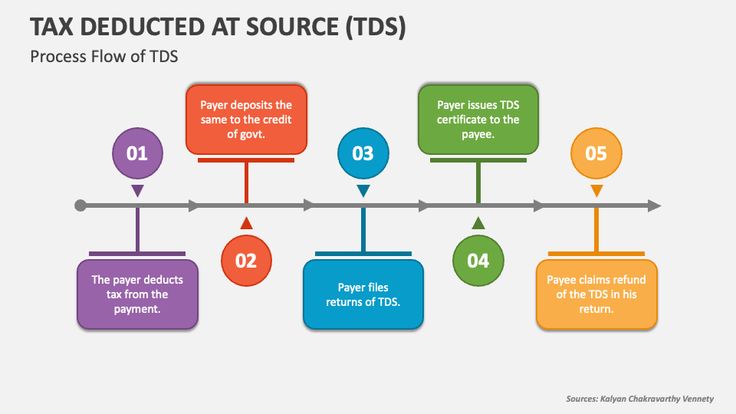

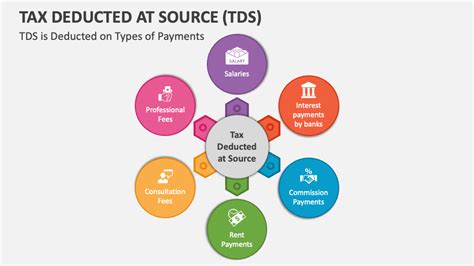

TDS is a mechanism designed to collect tax at the source of income generation. It ensures a steady flow of revenue for the government and minimizes tax evasion by collecting taxes at the earliest stage of a transaction. This system is applicable to various income sources, including salaries, interest, rent, professional fees, commission, and more.

When a specified payment is made, the deductor (the person making the payment) is responsible for deducting tax at the applicable rate and depositing it with the government. The deducted amount is then reflected in the deductor's TDS certificate (Form 16 for salaries and Form 16A for other payments), which serves as a record of the tax paid on the recipient's behalf.

Key Components of TDS

- Deductor: The person making the payment who is responsible for deducting TDS.

- Deductee: The recipient of the payment, on whose behalf the tax is deducted.

- TDS Rate: The rate at which TDS is deducted, as specified by the Income Tax Department. These rates vary based on the type of income and the status of the deductee (individual or company).

- TDS Threshold: The minimum amount above which TDS is applicable. Payments below this threshold are exempt from TDS deduction.

| Income Source | TDS Rate | TDS Threshold |

|---|---|---|

| Salaries | As per the applicable tax slab | Varies based on the individual's tax slab |

| Interest on Securities | 10% | Rs. 10,000 per annum |

| Interest on Bank Deposits | 10% | Rs. 40,000 per annum |

| Rent | 10% | Rs. 2,400 per month |

| Professional Fees | 10% or 5% (for individuals/HUFs) | Rs. 30,000 per annum |

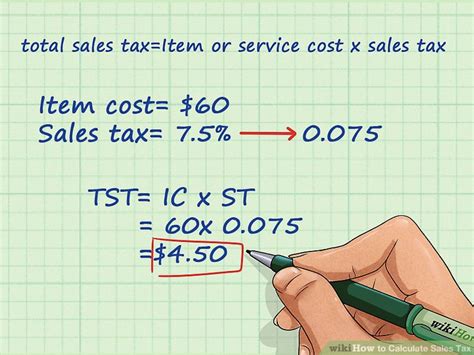

Calculation and Payment of TDS

The calculation of TDS involves determining the applicable tax rate and deducting the appropriate amount from the payment. For instance, if Mr. A receives a professional fee of Rs. 50,000 from a client, and the applicable TDS rate is 10%, the deductor (the client) will deduct Rs. 5,000 (10% of Rs. 50,000) and pay Mr. A the remaining Rs. 45,000. The deductor is then responsible for depositing the deducted amount with the government within the stipulated time frame.

TDS payments are made through the online tax payment portal provided by the Income Tax Department. The deductor is required to generate a Challan (ITNS 281) and make the payment accordingly. The payment details are then reflected in the TDS return filed by the deductor, which includes information about the deductee, the amount paid, and the tax deducted.

Impact of TDS on Taxpayers

TDS has a significant impact on taxpayers, as it affects their overall tax liability and cash flow. Here’s how TDS impacts different categories of taxpayers:

- Salaried Individuals: TDS on salaries is deducted by the employer and reflected in the employee's Form 16. This TDS is adjusted against the individual's total tax liability at the end of the financial year. If the TDS exceeds the total tax due, the individual is eligible for a refund.

- Freelancers and Professionals: For individuals earning income from multiple sources, TDS on professional fees can be a challenge. They must ensure that their total income, including TDS deducted, does not exceed the basic exemption limit to avoid paying additional taxes.

- Rentals: Landlords receiving rent income must be aware of the TDS implications. If the rent exceeds the threshold, TDS is applicable, and the landlord must deduct it from the rent and deposit it with the government. Failure to comply may result in penalties.

- Interest Income: Individuals earning interest income from bank deposits or securities must also consider TDS. While TDS is deducted by the bank or financial institution, it's essential to declare this income and adjust it against the total tax liability.

Compliance and Penalties

Compliance with TDS regulations is crucial to avoid penalties and legal consequences. Deductors must ensure accurate TDS deduction, timely payment, and correct filing of TDS returns. Failure to comply with TDS requirements can result in the following penalties:

- Late payment penalty: A penalty of 1% per month or part of a month on the amount of tax not deducted or paid.

- Failure to deduct TDS: A penalty of Rs. 10,000 or the amount of tax not deducted, whichever is higher.

- Delay in filing TDS returns: A penalty of Rs. 200 per day from the due date of filing until the date of filing.

Additionally, deductors must maintain proper records of TDS deductions and payments, as these records are crucial during tax audits and assessments.

Conclusion

Tax Deducted at Source is a fundamental aspect of the Indian tax system, ensuring efficient tax collection and compliance. It impacts taxpayers across various income sources, affecting their cash flow and tax liabilities. Understanding TDS rates, thresholds, and compliance requirements is essential for individuals and businesses to navigate the tax landscape effectively. By staying informed and compliant, taxpayers can avoid penalties and ensure a smooth tax filing process.

What is the purpose of TDS?

+TDS aims to collect tax at the source of income generation, ensuring a steady flow of revenue for the government and minimizing tax evasion.

How is TDS calculated?

+TDS is calculated by applying the applicable TDS rate to the payment amount. The rate varies based on the income source and the deductee’s status.

What are the consequences of non-compliance with TDS regulations?

+Non-compliance with TDS regulations can lead to penalties, including late payment charges, failure to deduct TDS penalties, and delay in filing TDS returns penalties. It’s crucial to stay compliant to avoid these consequences.

Can TDS be claimed as a tax credit?

+Yes, TDS deducted and deposited with the government can be claimed as a tax credit when filing income tax returns. This reduces the overall tax liability for the assessee.

Are there any exemptions from TDS deduction?

+Yes, TDS is not applicable for payments below the specified threshold. For instance, interest income below Rs. 10,000 per annum is exempt from TDS. However, it’s essential to verify the TDS threshold for each income source.