San Francisco Real Estate Tax

The real estate market in San Francisco is a complex and dynamic entity, with various factors influencing property values and the overall economic landscape. One crucial aspect that often looms large in the minds of property owners and investors is the real estate tax landscape. In this comprehensive article, we will delve into the intricacies of San Francisco's real estate tax system, exploring its unique features, how it impacts property owners, and the strategies to navigate this complex terrain effectively.

Understanding San Francisco’s Real Estate Tax Landscape

San Francisco, known for its vibrant culture, technological prowess, and stunning vistas, also boasts a unique and intricate real estate tax structure. This tax system plays a pivotal role in shaping the city’s real estate market and the lives of its residents and investors. Here’s a detailed exploration of its key components.

Assessment Process and Property Values

At the heart of San Francisco’s real estate tax system lies the assessment process, which determines the taxable value of properties. The Assessor-Recorder’s Office is responsible for this crucial task, employing a combination of market trends, recent sales data, and physical inspections to assess property values accurately. This process ensures that property owners pay taxes commensurate with their property’s current market value.

One notable feature of San Francisco's assessment system is the Proposition 13, a constitutional amendment passed in 1978. This proposition limits the annual increase in assessed value to no more than 2% or the inflation rate, whichever is lower. This cap provides a measure of stability for property owners, protecting them from sudden and drastic increases in their tax liabilities.

| Assessment Year | Assessed Value Increase |

|---|---|

| 2022 | 1.8% |

| 2021 | 2.0% |

| 2020 | 1.9% |

Tax Rates and Revenue Allocation

San Francisco’s real estate tax rates are established by the City and County of San Francisco. These rates are applied to the assessed value of properties, with the revenue generated used to fund various public services and infrastructure projects. The city’s fiscal year, which runs from July 1 to June 30, serves as the basis for tax rate calculations and revenue allocation.

The tax rates vary based on the property type and its usage. For instance, residential properties have a different tax rate than commercial or industrial properties. Additionally, the city offers exemptions and abatements for certain property types, such as affordable housing units or properties used for specific community purposes.

| Property Type | Tax Rate |

|---|---|

| Residential | 1.1469% |

| Commercial | 1.5% |

| Industrial | 1.2% |

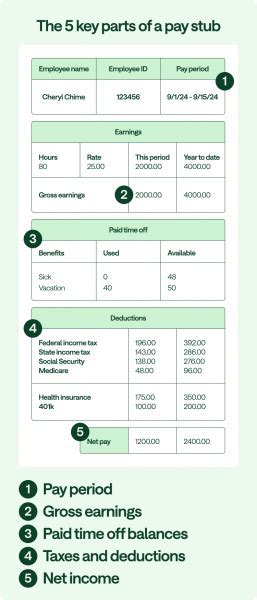

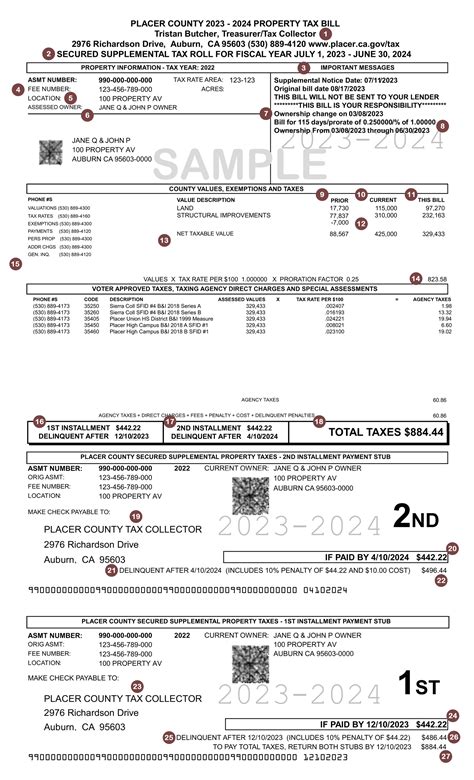

Property Tax Bills and Payment Schedules

Property owners in San Francisco receive their tax bills annually, typically in late summer or early fall. These bills outline the assessed value of the property, the applicable tax rate, and the total tax amount due. Property owners have the option to pay their taxes in two installments, with the first installment due by December 10th and the second by April 10th of the following year.

Late payments incur penalties, with interest accumulating at a rate of 1.5% per month. It's essential for property owners to stay abreast of these deadlines to avoid unnecessary financial burdens.

Appeals and Assessment Review

San Francisco recognizes the importance of a fair and transparent assessment process. Property owners who believe their assessed value is incorrect or unfair have the right to appeal. The Assessment Appeals Board, an independent body, handles these appeals, providing a forum for property owners to present their case and seek a review of their assessment.

Appeals can be based on various grounds, including inaccurate valuation, changes in property characteristics, or unequal assessments. The board's decisions are final and binding, offering property owners a crucial avenue for ensuring fairness in the tax assessment process.

Impact on Property Owners and Strategies for Management

The real estate tax landscape in San Francisco has a profound impact on property owners, influencing their financial planning, investment strategies, and overall property management decisions. Understanding these impacts and devising effective strategies is crucial for navigating this complex terrain successfully.

Financial Planning and Budgeting

Real estate taxes are a significant expense for property owners, and effective financial planning is essential to manage these costs. Property owners must consider tax liabilities when budgeting for their properties, ensuring they have sufficient funds to cover these expenses without compromising other critical areas of their financial plans.

Strategies such as setting aside dedicated funds for tax payments, exploring financing options to cover tax liabilities, and leveraging tax benefits or deductions can help property owners manage their financial obligations effectively.

Investment Strategies and Property Management

The real estate tax landscape influences investment decisions and property management strategies. For instance, property owners may consider the tax implications when deciding between buying a property outright or leveraging financing options. The tax treatment of rental income, deductions for property improvements, and the impact of tax rates on overall returns are all critical factors in investment decision-making.

From a property management perspective, understanding the tax implications of various maintenance and improvement decisions is crucial. For instance, investing in energy-efficient upgrades may qualify for tax credits, while certain renovations may increase the property's assessed value, leading to higher tax liabilities.

Maximizing Tax Benefits and Deductions

San Francisco’s real estate tax system offers a range of benefits and deductions that property owners can leverage to reduce their tax liabilities. For instance, homeowners may qualify for the Homeowner’s Exemption, which reduces the assessed value of their primary residence by up to $7,000. This exemption provides a substantial reduction in tax obligations for eligible homeowners.

Other deductions and credits, such as those for solar energy systems, earthquake retrofits, or certain types of renovations, can further reduce tax burdens. Property owners should stay informed about these opportunities and consult with tax professionals to maximize their tax benefits.

Navigating Changes and Uncertainty

The real estate tax landscape in San Francisco, like any dynamic market, is subject to change. Whether it’s shifts in tax rates, new assessment methodologies, or changes in tax regulations, property owners must stay informed and adaptable. Monitoring local news, engaging with industry professionals, and staying connected with the Assessor-Recorder’s Office are essential strategies for navigating these changes effectively.

Conclusion: Navigating San Francisco’s Real Estate Tax Terrain

San Francisco’s real estate tax system is a complex and evolving landscape, influencing the city’s vibrant real estate market and the lives of its property owners. From the assessment process to tax rates, payment schedules, and appeals, each component plays a crucial role in shaping the financial obligations and opportunities for property owners.

By understanding this landscape, property owners can make informed decisions, optimize their tax obligations, and navigate the market effectively. Whether through strategic financial planning, leveraging tax benefits, or staying abreast of market changes, a proactive approach is key to success in San Francisco's real estate tax terrain.

How often are property assessments conducted in San Francisco?

+

Property assessments in San Francisco are conducted annually, with the assessed value of properties reviewed and adjusted based on market trends and recent sales data.

What happens if I miss the tax payment deadline?

+

Missing the tax payment deadline can result in penalties and interest charges. Property owners are encouraged to pay their taxes on time to avoid unnecessary financial burdens.

Can I appeal my property’s assessed value if I believe it’s incorrect?

+

Yes, property owners have the right to appeal their assessed value if they believe it’s inaccurate or unfair. The Assessment Appeals Board handles these appeals, providing a fair and independent review process.

Are there any tax benefits or deductions available for San Francisco property owners?

+

Absolutely! San Francisco offers various tax benefits and deductions, such as the Homeowner’s Exemption, solar energy credits, and deductions for certain renovations. Property owners should consult with tax professionals to maximize these opportunities.