Auto Sales Tax Georgia

In the state of Georgia, vehicle sales tax is an important consideration for anyone looking to purchase a new or used car. The sales tax rate can significantly impact the overall cost of the vehicle, and understanding how it works is crucial for making informed financial decisions. This comprehensive guide will delve into the specifics of auto sales tax in Georgia, providing an in-depth analysis of the rates, exemptions, and potential savings strategies.

Understanding the Georgia Auto Sales Tax Rates

The state of Georgia imposes a sales tax on the purchase of vehicles, which is calculated as a percentage of the vehicle’s purchase price. As of the latest information available, the general sales tax rate in Georgia is 4%, which is applied to most goods and services. However, there is an additional 3% county surcharge for vehicle purchases, bringing the total sales tax rate for cars to 7% in most counties across the state.

It's important to note that some counties in Georgia may have different tax rates due to local ordinances. For instance, Fulton County, which includes the city of Atlanta, has a 1% additional local tax, resulting in a total sales tax rate of 8% for vehicle purchases. It is essential to check the specific tax rate for your county before finalizing a vehicle purchase.

Calculating the Sales Tax

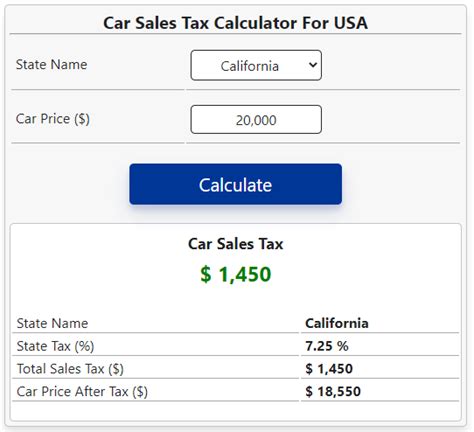

To calculate the sales tax on a vehicle purchase in Georgia, you can use the following formula:

Total Sales Tax = Purchase Price x (Sales Tax Rate / 100)

Let's consider an example. If you are purchasing a car for $25,000 in a county with a 7% sales tax rate, the sales tax amount would be:

Total Sales Tax = $25,000 x (7/100) = $1,750

So, in this case, the sales tax on the vehicle would be $1,750.

Taxable Items

The sales tax in Georgia applies to the purchase of new and used vehicles, including cars, trucks, motorcycles, and recreational vehicles. It is important to note that the sales tax is calculated based on the purchase price, which includes any additional fees, such as dealer preparation fees or delivery charges.

Additionally, any optional equipment or accessories added to the vehicle at the time of purchase are subject to sales tax. This can include items like upgraded sound systems, custom wheels, or specialized coatings.

Exemptions and Special Considerations

While the general sales tax rate applies to most vehicle purchases in Georgia, there are certain exemptions and special considerations to be aware of.

Leased Vehicles

When leasing a vehicle in Georgia, the sales tax is calculated differently. Instead of applying the sales tax to the entire purchase price, it is applied to the monthly lease payments. This means that the sales tax is spread out over the duration of the lease, typically for a period of 36 to 60 months.

The sales tax rate for leased vehicles is 4%, which is the general state sales tax rate. So, for a leased vehicle with a monthly payment of $400, the sales tax component would be $16 per month.

Trade-Ins and Vehicle Transfers

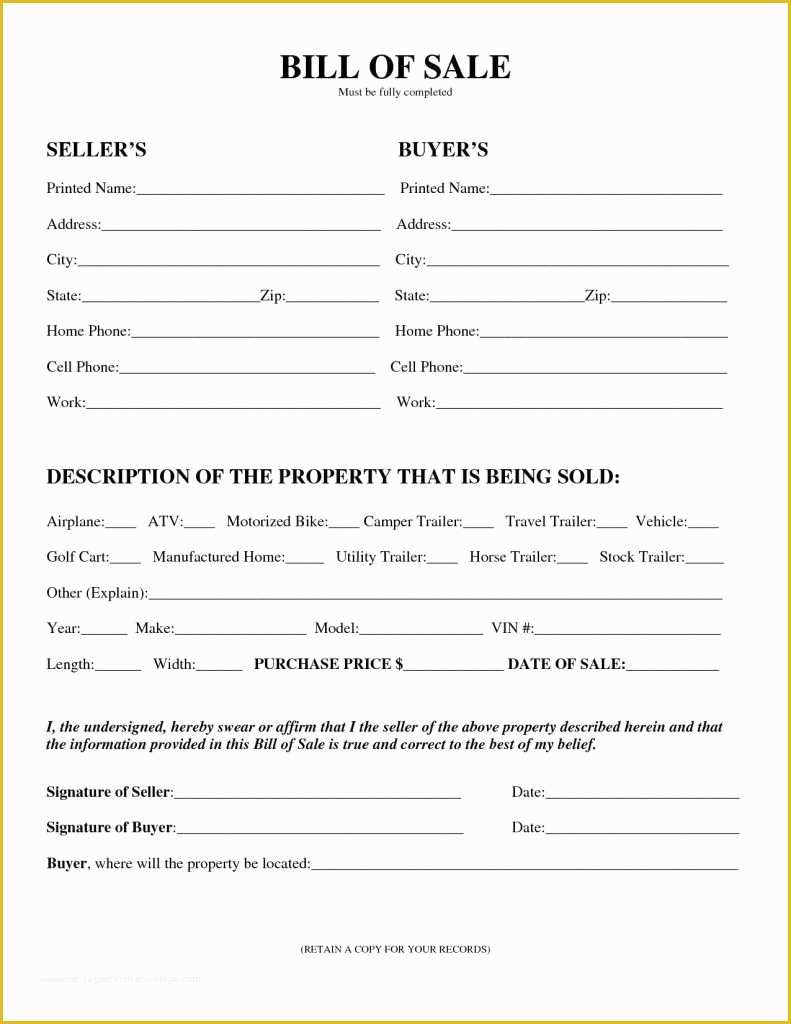

If you are trading in your old vehicle as part of the purchase of a new one, the sales tax calculation can be affected. In Georgia, the trade-in value is deducted from the purchase price of the new vehicle before the sales tax is applied. This can result in a lower overall sales tax amount.

For example, if you are trading in a vehicle valued at $5,000 and purchasing a new car for $30,000, the sales tax would be calculated on the difference, which is $25,000 in this case.

Military and Veteran Exemptions

Georgia offers sales tax exemptions for certain military personnel and veterans. Active-duty military members, reservists, and members of the National Guard who are Georgia residents are exempt from paying sales tax on vehicle purchases. This exemption also applies to their spouses and dependents.

Additionally, honorably discharged veterans who are Georgia residents may be eligible for a sales tax exemption. It is important to check the specific requirements and documentation needed to claim this exemption.

Strategies for Saving on Auto Sales Tax

While the sales tax rate in Georgia is set by the state and local governments, there are still strategies that car buyers can employ to potentially save on sales tax.

Timing Your Purchase

One strategy is to time your vehicle purchase to take advantage of tax-free holidays or promotional events. Georgia occasionally offers sales tax holidays, during which certain items, including vehicles, are exempt from sales tax for a limited time. These holidays typically occur during specific weekends or periods and can result in significant savings.

It's important to stay updated on any upcoming tax-free holidays or promotional events through local news sources or by checking the Georgia Department of Revenue's website.

Utilizing Tax-Free Zones

Another strategy is to consider purchasing your vehicle in a tax-free zone. Some states, such as Delaware, do not impose a sales tax on vehicle purchases. By purchasing your vehicle in a tax-free state and then registering it in Georgia, you can potentially save on sales tax. However, it’s important to note that this strategy may not be feasible for everyone due to logistical and registration requirements.

Negotiating and Bundling

Negotiating the purchase price of your vehicle can also impact the overall sales tax amount. By negotiating a lower purchase price, you can reduce the base amount on which the sales tax is calculated. This strategy can be particularly effective when purchasing a used vehicle, as the price is often more flexible.

Additionally, bundling your vehicle purchase with other services or products can sometimes result in savings. Some dealerships may offer packages that include additional services or accessories, which can lower the overall sales tax burden.

Performance Analysis and Future Implications

The sales tax revenue generated from vehicle purchases in Georgia plays a significant role in funding various state and local initiatives. It contributes to infrastructure development, education, and other public services. As such, the sales tax rate and its collection are closely monitored by government agencies.

In recent years, there has been a growing trend of online vehicle sales, which has prompted discussions about the potential impact on sales tax collection. While online purchases can provide convenience and access to a wider range of vehicles, they also present challenges in ensuring proper tax compliance. Georgia, like many other states, is exploring ways to address these issues and ensure fair tax collection from online vehicle sales.

Furthermore, the future of auto sales tax in Georgia may be influenced by advancements in vehicle technology and the rise of electric vehicles (EVs). As more consumers opt for EVs, there may be considerations for adjusting tax policies to reflect the changing landscape of the automotive industry. Some states have already implemented or proposed specific tax structures for electric vehicles, and Georgia may follow suit to encourage the adoption of environmentally friendly transportation options.

| Category | Data |

|---|---|

| General Sales Tax Rate | 4% |

| Vehicle Sales Tax Rate | 7% (3% county surcharge) |

| Fulton County Sales Tax Rate | 8% (1% additional local tax) |

| Leased Vehicle Sales Tax Rate | 4% |

Are there any counties in Georgia with different sales tax rates for vehicles?

+Yes, some counties in Georgia have different tax rates due to local ordinances. For example, Fulton County has a 1% additional local tax, resulting in an 8% sales tax rate for vehicle purchases.

How is the sales tax calculated for leased vehicles in Georgia?

+For leased vehicles, the sales tax is calculated based on the monthly lease payments. The sales tax rate is 4%, which is applied to each monthly payment.

Are there any sales tax exemptions for military personnel or veterans in Georgia?

+Yes, active-duty military members, reservists, and National Guard members who are Georgia residents are exempt from paying sales tax on vehicle purchases. This exemption also extends to their spouses and dependents. Additionally, honorably discharged veterans may be eligible for a sales tax exemption.