Missouri Auto Sales Tax Estimator

When it comes to purchasing a vehicle, understanding the associated taxes is crucial. Missouri residents, in particular, need to be well-informed about the auto sales tax to make informed financial decisions. This comprehensive guide aims to demystify the Missouri auto sales tax estimator, providing a detailed analysis of how it works and its impact on vehicle purchases. By breaking down the tax calculation process and offering practical insights, this article will empower readers to navigate the tax landscape with confidence.

Understanding the Missouri Auto Sales Tax

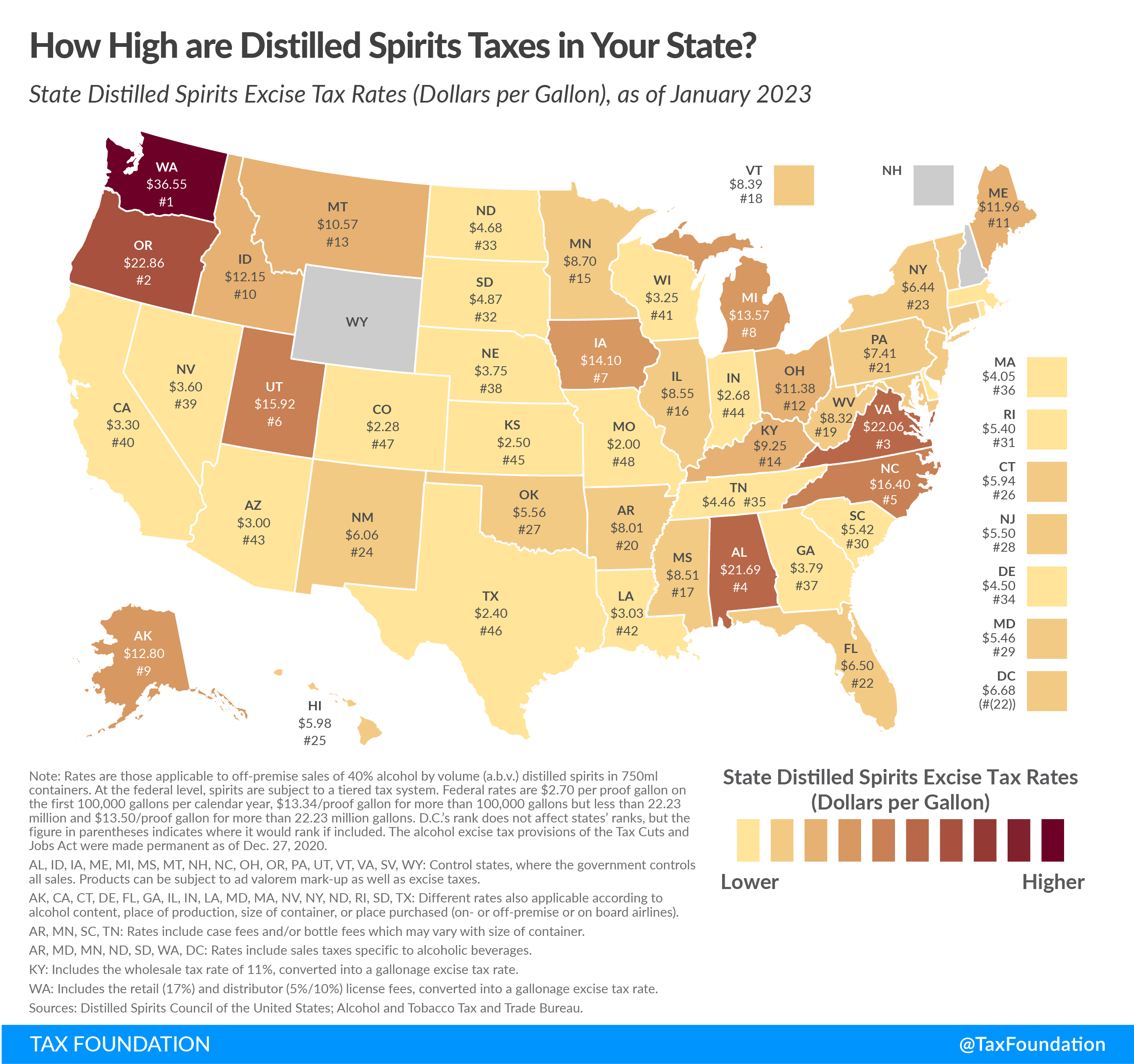

The auto sales tax in Missouri is a percentage-based tax applied to the purchase price of a vehicle. This tax is an essential revenue source for the state, contributing to various public services and infrastructure development. Understanding how this tax is calculated and applied is vital for buyers to budget effectively and make strategic purchasing decisions.

The Tax Rate Structure

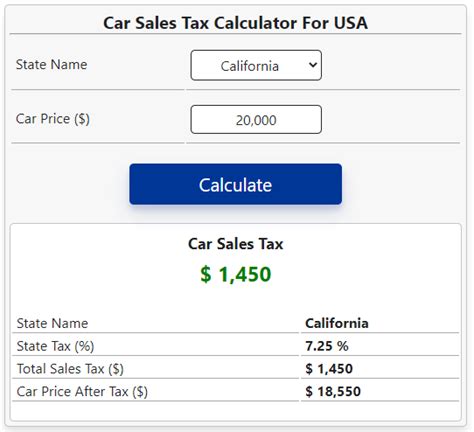

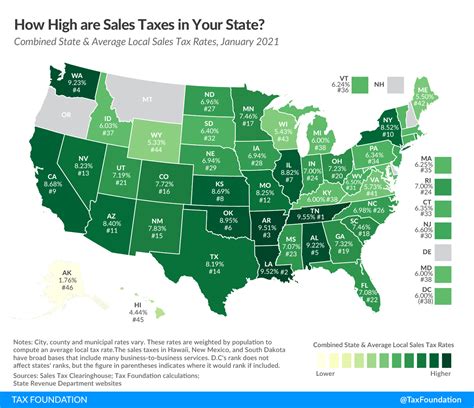

Missouri’s auto sales tax rate is a straightforward percentage of the vehicle’s purchase price. Currently, the tax rate stands at 4.225% for most vehicle purchases. This rate is a combination of the state sales tax and various local taxes, which can vary slightly depending on the specific county where the vehicle is purchased. However, it is important to note that this rate is consistent across the state, ensuring a uniform tax structure for all buyers.

For example, if you are purchasing a vehicle priced at $25,000, the auto sales tax would amount to $1,056.25, calculated as follows: $25,000 x 0.04225 = $1,056.25. This simple calculation ensures transparency and helps buyers anticipate their financial obligations accurately.

Exemptions and Special Cases

While the auto sales tax applies to most vehicle purchases, there are certain exemptions and special cases that buyers should be aware of. For instance, certain types of vehicles, such as those used for agricultural purposes or those purchased by tax-exempt organizations, may be eligible for reduced or waived sales tax.

Additionally, Missouri offers a sales tax credit for the trade-in value of a vehicle. This credit reduces the tax liability for buyers who trade in their old vehicles when purchasing a new one. The credit amount is calculated based on the trade-in value and can significantly lower the overall sales tax owed. This incentive encourages vehicle turnover and supports the state's efforts to maintain a modern vehicle fleet.

| Vehicle Type | Sales Tax Rate |

|---|---|

| Standard Vehicles | 4.225% |

| Agricultural Vehicles | Reduced or Waived |

| Vehicles for Tax-Exempt Organizations | Reduced or Waived |

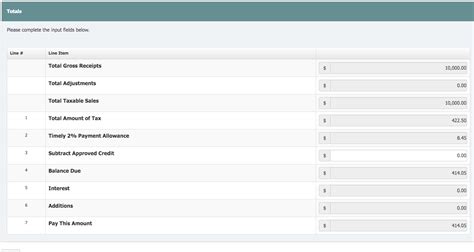

Calculating the Missouri Auto Sales Tax

Calculating the auto sales tax in Missouri involves a simple mathematical process. As mentioned earlier, the tax is a percentage of the vehicle’s purchase price. However, there are a few additional considerations to keep in mind to ensure an accurate calculation.

Step-by-Step Guide

- Determine the purchase price of the vehicle. This is the amount you agree to pay the seller, including any additional fees or charges.

- Convert the purchase price into a decimal format. For example, if the purchase price is 30,000, convert it to 30,000.00.</li> <li>Multiply the purchase price (in decimal format) by the sales tax rate. In Missouri, this rate is 0.04225 (4.225% expressed as a decimal). So, for a 30,000 vehicle, the calculation would be: 30,000.00 x 0.04225 = 1,267.50.

- The result of the multiplication is the auto sales tax owed. In this example, the tax amount is $1,267.50.

Online Calculators and Resources

For added convenience, several online tools and calculators are available to assist buyers in estimating their auto sales tax. These resources often provide real-time calculations based on the vehicle’s make, model, and location. While these calculators are valuable, it’s essential to verify the accuracy of the tax rate and any specific exemptions that may apply to your purchase.

Tips for Managing Auto Sales Tax

Understanding the auto sales tax is just the first step; managing this tax effectively can significantly impact your overall vehicle purchase experience and budget. Here are some practical tips to help you navigate the tax landscape with confidence.

Research and Compare

Before making a purchase, take the time to research and compare the auto sales tax rates in different counties or states. While Missouri’s tax rate is relatively consistent, there may be slight variations in certain areas. By comparing rates, you can make an informed decision about where to purchase your vehicle and potentially save on taxes.

Consider Trade-Ins and Incentives

Maximizing the value of your trade-in can significantly reduce your overall sales tax liability. Take advantage of the trade-in credit offered by Missouri to lower your tax burden. Additionally, be on the lookout for other incentives or rebates that can further reduce the taxable amount. These incentives can make a substantial difference in your final tax calculation.

Negotiate and Plan

When negotiating the purchase price of a vehicle, keep in mind the impact of the auto sales tax. A lower purchase price can result in a significant reduction in the tax owed. Strategically plan your negotiations to include the tax implications, as this can be a powerful tool in securing a better deal.

Utilize Financing Options

Financing a vehicle purchase can provide flexibility and help manage the upfront costs, including the sales tax. Explore various financing options, such as loans or leases, to find the most suitable arrangement for your budget. Remember, the financing terms can impact your overall tax liability, so choose wisely.

Future Implications and Trends

The auto sales tax landscape is constantly evolving, and keeping abreast of potential changes is essential for informed decision-making. Here’s a glimpse into the future of Missouri’s auto sales tax and its potential impact on vehicle purchases.

Potential Rate Changes

While the current auto sales tax rate in Missouri is relatively stable, it’s important to stay informed about any proposed changes. Tax rates can fluctuate due to various economic factors and political decisions. Monitoring these changes can help buyers anticipate potential increases or decreases in the tax burden, allowing for better financial planning.

Environmental Considerations

As environmental concerns gain prominence, there is a growing trend toward incentivizing the purchase of electric vehicles (EVs) and hybrid cars. Missouri, like many other states, may introduce tax credits or rebates specifically for EV buyers. These incentives can significantly reduce the overall cost of purchasing an eco-friendly vehicle, making them more accessible to a wider audience.

Digital Tax Collection

With the increasing digital transformation of various industries, the auto sales tax collection process may also move towards a more digitalized system. This could streamline the tax payment process, making it more efficient and reducing administrative burdens. Stay updated on any digital initiatives that may impact the way you pay your auto sales tax.

Frequently Asked Questions

How often does Missouri revise its auto sales tax rate?

+

Missouri’s auto sales tax rate is relatively stable and is not revised frequently. However, it is advisable to check for any updates annually, as there may be occasional adjustments to align with economic conditions or budgetary needs.

Are there any online tools to estimate the auto sales tax accurately?

+

Yes, several online tax calculators are available that can provide accurate estimates based on the vehicle’s details and location. These tools are regularly updated to reflect any changes in tax rates or exemptions.

Can I negotiate the auto sales tax with the dealer?

+

The auto sales tax is a mandatory tax, and dealers cannot negotiate or waive it. However, you can negotiate the vehicle’s purchase price, which will indirectly impact the tax amount.