Nyc Tax Calculator Sales

The city of New York is renowned for its vibrant culture, diverse population, and bustling economy. As a hub of business and commerce, it is essential for both residents and visitors to understand the tax landscape, particularly when it comes to sales taxes. This comprehensive guide aims to provide an in-depth analysis of the NYC sales tax calculator, shedding light on its intricacies, calculations, and implications.

Understanding the NYC Sales Tax Calculator

The NYC sales tax calculator is a vital tool for businesses and consumers alike, serving as a means to accurately determine the applicable sales tax on goods and services within the five boroughs of New York City. This calculator considers various factors, including the type of transaction, the location of the sale, and the specific goods or services being purchased.

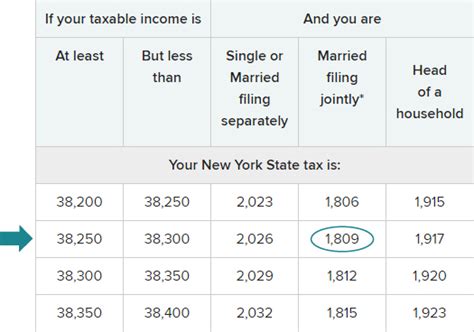

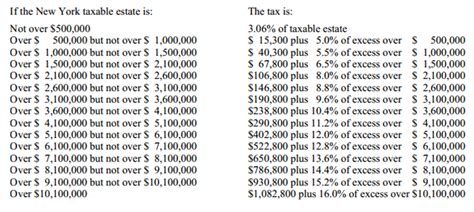

New York City's sales tax system is complex, consisting of multiple tax rates and exemptions. The standard sales tax rate in NYC is 4.5%, but this can vary based on the nature of the sale and the location within the city. For instance, certain boroughs, like Manhattan, may have additional local sales taxes applied, resulting in a higher overall tax rate.

Calculating Sales Tax in NYC

The calculation of sales tax in NYC involves a series of steps, each of which contributes to the final tax amount. Here’s a breakdown of the process:

- Determine the Base Amount: Start by identifying the total price of the goods or services before any taxes are applied. This is the base amount upon which the sales tax will be calculated.

- Identify Applicable Taxes: Different types of sales may be subject to varying taxes. For instance, the sale of certain goods may be exempt from state sales tax but subject to local taxes. It's crucial to understand the specific taxes applicable to your transaction.

- Calculate the Sales Tax: Multiply the base amount by the applicable tax rate(s). If multiple tax rates apply, calculate each separately and then add them together. For example, if the base amount is $100 and the tax rate is 8.875% (a common NYC rate), the sales tax would be $8.88.

- Add the Sales Tax to the Base Amount: Finally, add the calculated sales tax to the base amount to arrive at the total price, inclusive of taxes. In our example, the total price would be $108.88.

| Sales Tax Scenario | Base Amount | Tax Rate | Calculated Sales Tax | Total Price |

|---|---|---|---|---|

| Standard NYC Sale | $100 | 8.875% | $8.88 | $108.88 |

| Exempt Goods | $50 | 0% | $0 | $50 |

| Local Borough Tax | $200 | 5.875% | $11.75 | $211.75 |

Key Considerations and Exemptions

Understanding the nuances of the NYC sales tax system is crucial to ensure compliance and accuracy. Here are some key considerations and exemptions to keep in mind:

Types of Sales

Different types of sales may have different tax implications. For instance, sales of tangible personal property are generally subject to sales tax, while certain services may be exempt or have specific tax rates. It’s important to categorize your sale correctly to apply the appropriate tax.

Local Borough Taxes

As mentioned earlier, some boroughs in NYC have additional local sales taxes. These taxes can vary, so it’s essential to consult the specific tax rates for the borough in which the sale takes place. For instance, Manhattan has a 0.375% local tax on top of the standard NYC sales tax rate.

Exemptions and Special Cases

Certain goods and services are exempt from sales tax in NYC. These can include essential items like prescription drugs, certain types of food, and some agricultural products. Additionally, there may be special tax rates for specific industries or transactions. It’s crucial to stay informed about these exemptions and special cases to avoid overpaying or underpaying sales tax.

The Impact of NYC Sales Tax

The NYC sales tax has a significant impact on both businesses and consumers. For businesses, understanding and accurately calculating sales tax is crucial for compliance with tax laws and maintaining positive relationships with customers. For consumers, sales tax can influence purchasing decisions and budget planning.

Business Implications

Businesses operating in NYC must accurately calculate and collect sales tax to meet their tax obligations. This includes having a clear understanding of the sales tax rates, exemptions, and any changes to the tax system. Failure to comply with sales tax regulations can result in penalties and legal consequences.

Additionally, businesses should consider the impact of sales tax on their pricing strategies. While sales tax is typically passed on to the consumer, it can influence the perceived value of products and services. Accurate calculation and transparent communication of sales tax can help build trust with customers and ensure fair pricing.

Consumer Impact

For consumers, understanding NYC’s sales tax system is essential for making informed purchasing decisions. The sales tax can significantly impact the final cost of goods and services, especially for larger purchases. By using tools like the NYC sales tax calculator, consumers can estimate the total cost of their purchases and plan their budgets accordingly.

Furthermore, consumers should be aware of their rights and responsibilities regarding sales tax. They should receive accurate information about the sales tax applied to their purchases and have the opportunity to review and confirm the calculated tax before finalizing the transaction. In case of discrepancies, consumers can seek assistance from the NYC Department of Finance or other relevant authorities.

Future Outlook and Potential Changes

The NYC sales tax landscape is subject to change, and it’s important to stay updated on any potential modifications. Here are some key factors to consider:

Tax Rate Changes

Sales tax rates can fluctuate due to various factors, including economic conditions and legislative decisions. It’s essential to stay informed about any proposed or implemented changes to the tax rates, as these can significantly impact businesses and consumers.

Digital Sales Tax

With the rise of e-commerce, many cities, including NYC, are considering the implementation of digital sales taxes. These taxes would apply to online sales, ensuring that online retailers contribute to the city’s tax revenue. Businesses and consumers should be aware of any potential digital sales tax initiatives and their implications.

Simplification Efforts

There have been ongoing discussions about simplifying the NYC sales tax system to make it more straightforward and easier to understand for both businesses and consumers. While the current system is complex, efforts are being made to streamline the process and provide clearer guidelines.

Conclusion

Navigating the NYC sales tax system can be complex, but with the right tools and knowledge, it becomes more manageable. The NYC sales tax calculator is an invaluable resource for businesses and consumers alike, offering a means to accurately determine sales tax obligations. By understanding the nuances of the tax system, including rates, exemptions, and potential changes, individuals and businesses can ensure compliance and make informed decisions.

Staying informed and keeping up with any updates to the NYC sales tax landscape is crucial for staying ahead of the curve and maintaining a positive relationship with the city's tax authorities. Whether you're a business owner or a consumer, being tax-savvy is an essential part of doing business and making purchases in the Big Apple.

What is the standard sales tax rate in NYC?

+The standard sales tax rate in NYC is 4.5%, but this can vary depending on the location and type of sale.

Are there any sales tax exemptions in NYC?

+Yes, certain goods and services are exempt from sales tax in NYC. This includes prescription drugs, some types of food, and agricultural products.

How often do NYC sales tax rates change?

+Sales tax rates can change annually or even more frequently, depending on economic conditions and legislative decisions. It’s essential to stay updated with the latest tax rates.

Where can I find more information about NYC sales tax?

+You can find detailed information about NYC sales tax on the official website of the NYC Department of Finance. They provide comprehensive resources and guidelines to help businesses and consumers understand their tax obligations.