Purchasing Tax Liens

In the realm of real estate and investment strategies, understanding the intricacies of purchasing tax liens is crucial for investors looking to expand their portfolios and generate potential returns. This comprehensive guide will delve into the world of tax liens, providing an in-depth analysis of this unique investment opportunity and offering expert insights to navigate this complex yet rewarding financial avenue.

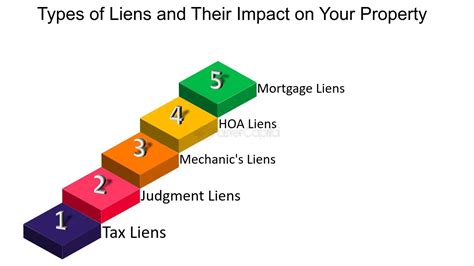

Understanding Tax Liens: A Legal Framework

Tax liens represent a powerful tool employed by governments to secure unpaid property taxes. When a property owner fails to meet their tax obligations, the government places a legal claim, known as a tax lien, on the property. This lien serves as a public notice, indicating that the property is subject to potential seizure and sale if the taxes remain unpaid.

The primary objective of tax liens is to incentivize property owners to settle their tax debts. However, for investors, tax liens present an opportunity to acquire properties at potentially advantageous prices. The process of purchasing tax liens involves a public auction, where investors bid on the right to collect the outstanding taxes, plus interest and penalties, within a specified timeframe.

Legal Implications and Risks

Engaging in tax lien investments requires a thorough understanding of the legal framework surrounding property taxes and lien redemption rights. Each jurisdiction has its own set of laws governing tax liens, outlining the terms and conditions for investors. Failure to comply with these regulations can lead to legal complications and financial losses.

Additionally, investors must be aware of the risks associated with tax lien investments. One significant risk is the potential for the property owner to redeem the lien, which involves paying off the taxes, interest, and penalties within a designated redemption period. If the owner redeems the lien, the investor's claim on the property is extinguished, and they may only receive the return on their investment, often limited to the amount paid for the lien plus interest.

| Jurisdiction | Redemption Period |

|---|---|

| California | 1 year |

| Florida | 2 years |

| Texas | 2 years |

In some cases, the redemption period can be as short as six months, leaving investors with a narrow window to recoup their investment. It's essential to research and understand the specific redemption rules and timelines in each jurisdiction before participating in tax lien auctions.

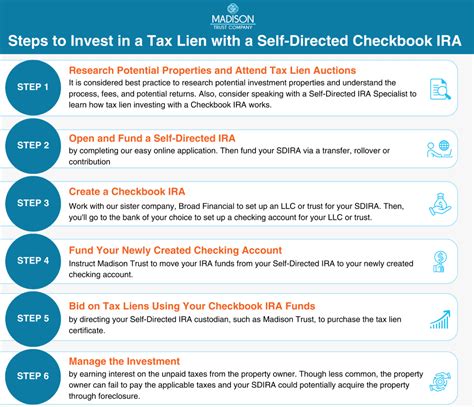

The Process of Purchasing Tax Liens: A Step-by-Step Guide

Navigating the process of purchasing tax liens requires a strategic approach. Here’s a detailed breakdown of the key steps involved:

Step 1: Research and Due Diligence

Before diving into tax lien investments, thorough research is imperative. Investors should familiarize themselves with the local tax lien laws, auction processes, and redemption rules. Understanding the specific requirements and timelines is crucial to making informed decisions.

Additionally, conducting due diligence on the properties in question is essential. This involves researching the property's title history, any existing liens or encumbrances, and the property's current market value. Online tools and databases can provide valuable insights into the property's condition, potential for development, and overall investment potential.

Step 2: Registration and Qualification

To participate in tax lien auctions, investors must register with the appropriate government agency or municipality. This process typically involves submitting an application, providing identification, and meeting specific financial criteria. Some jurisdictions may require investors to demonstrate financial stability and provide proof of funds.

Step 3: Auction Participation

Tax lien auctions can take various forms, including live auctions, online platforms, or sealed bids. Investors must carefully review the auction rules and regulations to ensure compliance. During the auction, investors bid on the right to collect the outstanding taxes, with the highest bidder winning the lien.

It's crucial to have a well-defined bidding strategy, considering factors such as the property's potential value, the amount of outstanding taxes, and the interest rate offered. Bidding too low may result in missing out on desirable liens, while bidding too high can lead to reduced returns or potential losses.

Step 4: Lien Redemption and Property Acquisition

Once the investor wins a tax lien, they must monitor the redemption period closely. If the property owner redeems the lien, the investor receives the return on their investment, as outlined by the terms of the lien. However, if the owner fails to redeem within the specified timeframe, the investor has the right to initiate the foreclosure process and potentially acquire the property.

The foreclosure process can be complex and time-consuming, often requiring legal assistance. Investors should carefully assess the potential costs and risks associated with foreclosure, as well as the potential rewards of acquiring the property outright.

Maximizing Returns: Strategies for Tax Lien Investors

To make tax lien investments more lucrative, investors can employ various strategies to maximize returns. Here are some expert insights:

Focus on High-Demand Areas

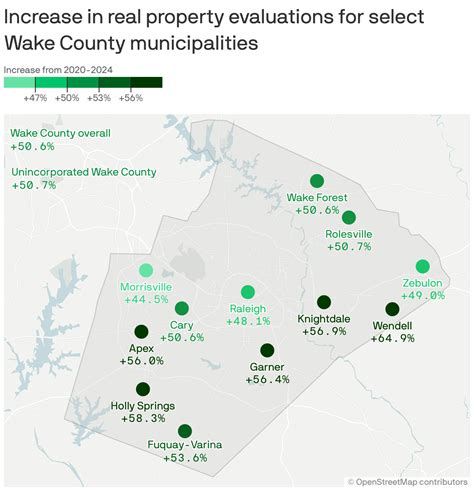

Properties located in desirable neighborhoods or areas with high real estate demand often carry more value. By targeting these areas, investors can potentially acquire properties with greater potential for appreciation and rental income.

Diversify Your Portfolio

Spreading your investments across multiple tax liens can help mitigate risks. Diversification allows investors to balance their portfolio, reducing the impact of potential losses from redeemed liens or unsuccessful foreclosures.

Utilize Technology and Data

Leveraging technology and data analytics can provide valuable insights into the tax lien market. Online platforms and software tools can help investors identify the most promising liens, track auction trends, and make data-driven decisions.

Collaborate with Experts

Working with experienced real estate professionals, attorneys, and tax advisors can be invaluable. These experts can provide guidance on legal matters, property valuation, and the overall investment process, ensuring compliance and maximizing returns.

The Future of Tax Lien Investments: Trends and Outlook

The landscape of tax lien investments is continually evolving, influenced by economic conditions, tax policies, and technological advancements. Here’s a glimpse into the future of this investment niche:

Online Auctions and Digital Platforms

The shift towards online tax lien auctions and digital platforms is gaining momentum. These platforms offer investors increased accessibility, allowing them to participate in auctions remotely and access a wider range of investment opportunities. The convenience and efficiency of online auctions are expected to drive further growth in this sector.

Market Volatility and Economic Cycles

Economic downturns and market volatility can impact the tax lien market. During recessionary periods, the number of tax liens may increase as property owners face financial challenges. Investors should be prepared for potential shifts in the market and adjust their strategies accordingly.

Legal and Regulatory Changes

Tax lien laws and regulations are subject to change, and investors must stay updated on any amendments or reforms. Changes in redemption periods, interest rates, or auction processes can significantly impact investment strategies and outcomes.

Alternative Investment Strategies

As the tax lien market evolves, investors may explore alternative strategies, such as investing in tax deed sales or partnering with other investors to pool resources and reduce risks. These approaches can offer unique opportunities and help investors adapt to changing market dynamics.

Conclusion: Navigating the Tax Lien Landscape

Purchasing tax liens presents a unique and potentially rewarding investment opportunity for those willing to navigate the complex legal and financial landscape. By understanding the legal framework, conducting thorough research, and employing strategic approaches, investors can capitalize on the potential benefits of tax lien investments while managing the associated risks.

As the tax lien market continues to evolve, staying informed and adapting to changing conditions will be key to long-term success. With the right knowledge, expertise, and a well-defined strategy, investors can unlock the full potential of this niche investment avenue.

What is the average redemption rate for tax liens?

+The redemption rate for tax liens can vary significantly depending on the jurisdiction and economic conditions. On average, redemption rates range from 10% to 30%, with some areas experiencing higher or lower rates. It’s crucial to research the specific redemption rates in your target market.

Can tax lien investors receive a title to the property if the owner doesn’t redeem the lien?

+Yes, if the property owner fails to redeem the tax lien within the specified redemption period, the investor has the right to initiate the foreclosure process. Once the foreclosure is complete, the investor can receive the title to the property. However, the foreclosure process can be lengthy and may require legal assistance.

Are there any tax implications for tax lien investors?

+Yes, tax lien investments have tax implications. The interest and penalties collected from the property owner are considered taxable income for the investor. It’s essential to consult with a tax advisor to understand the specific tax obligations and ensure compliance.