San Francisco County Property Tax

San Francisco County, nestled in the heart of California, is renowned for its vibrant culture, iconic landmarks, and diverse neighborhoods. As one of the most sought-after real estate markets in the United States, understanding the intricacies of property taxes is crucial for both homeowners and prospective buyers. In this comprehensive guide, we delve into the world of San Francisco County property taxes, exploring the factors that influence them, the assessment process, payment options, and strategies to navigate this essential aspect of homeownership.

Unraveling the Complexities of San Francisco County Property Taxes

Property taxes in San Francisco County play a significant role in funding essential services and infrastructure, from education and public safety to transportation and community development. The assessment and collection of these taxes are governed by the San Francisco County Assessor’s Office, which ensures a fair and equitable process for all property owners.

One of the key factors influencing property taxes in San Francisco County is the assessed value of a property. This value is determined through a comprehensive assessment process, taking into account various factors such as the property's location, size, improvements, and market conditions. The assessed value serves as the basis for calculating the annual property tax bill, which is typically due in two installments.

The Assessment Process: A Detailed Breakdown

The San Francisco County Assessor’s Office employs a meticulous assessment process to ensure accuracy and fairness. Here’s an insider’s guide to how it works:

- Data Collection: Assessors gather detailed information about each property, including physical characteristics, recent sales data, and any improvements made. This data is collected through various means, including property visits, public records, and homeowner input.

- Property Inspection: In some cases, assessors may conduct physical inspections to verify the accuracy of the data. This step is particularly important for newly constructed properties or properties with significant renovations.

- Market Analysis: Assessors analyze recent sales and market trends to determine the fair market value of properties. This step ensures that the assessed value aligns with the current real estate market conditions.

- Assessment Calculation: Using a formula that takes into account the assessed value, the tax rate, and any applicable exemptions or discounts, the assessor calculates the property tax liability for each property.

- Notice of Proposed Assessment: Property owners receive a Notice of Proposed Assessment, which outlines the proposed assessed value and the calculated tax liability. This notice provides an opportunity for homeowners to review and challenge the assessment if they believe it is inaccurate.

- Appeal Process: If a property owner disagrees with the proposed assessment, they can initiate an appeal. The appeal process involves submitting evidence and supporting documentation to justify a lower assessed value. The assessor's office reviews the appeal and makes a final determination.

It's important to note that the assessment process is an ongoing endeavor, with assessors continuously updating property records and reassessing values to reflect changes in the real estate market.

| Assessment Timeline | Key Dates |

|---|---|

| Notice of Proposed Assessment Mailing | Late February to Early March |

| Appeal Deadline | Early April |

| Final Assessment Notices | Mid-May |

Understanding Property Tax Rates and Exemptions

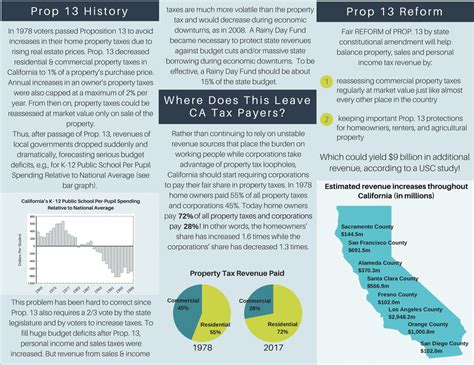

The property tax rate in San Francisco County is determined by the local government and is applied to the assessed value of the property. This rate can vary depending on the specific location within the county and the type of property. For instance, commercial properties may have a different tax rate compared to residential properties.

Additionally, San Francisco County offers various exemptions and discounts to eligible property owners. These exemptions can significantly reduce the property tax liability and are designed to support specific groups, such as seniors, veterans, and low-income homeowners.

- Homestead Exemption: This exemption provides a partial tax relief for owner-occupied residential properties. To qualify, homeowners must meet certain income and residency requirements.

- Senior Citizen Exemption: Seniors who are at least 65 years old and meet specific income and residency criteria may be eligible for a reduction in their property taxes.

- Veteran's Exemption: Qualified veterans and their spouses may receive a property tax exemption based on their military service.

- Low-Income Exemption: Homeowners with limited income and assets may qualify for a reduction in their property taxes.

It's important for property owners to explore these exemptions and understand their eligibility to maximize their tax savings.

Navigating Property Tax Payments: Options and Strategies

Property tax payments in San Francisco County are typically due in two installments, with the first installment due by December 10th and the second installment due by April 10th of the following year. Late payments incur penalties and interest, so timely payment is crucial.

To make property tax payments more manageable, San Francisco County offers various payment options, including online payment portals, phone payments, and in-person payments at designated locations. Property owners can also set up automatic payments to ensure timely remittances.

For those facing financial challenges or unexpected circumstances, San Francisco County provides hardship programs and payment plans to assist homeowners in meeting their property tax obligations.

Future Implications and Trends in San Francisco County Property Taxes

The real estate market in San Francisco County is known for its volatility, with property values fluctuating based on various economic and social factors. As a result, property tax assessments can also experience fluctuations, impacting the overall tax burden for homeowners.

In recent years, San Francisco County has implemented measures to stabilize property tax assessments, such as the Proposition 13 cap on annual increases. This proposition limits the annual increase in assessed value to 2% or the inflation rate, whichever is lower. While this provides stability for homeowners, it also means that property tax assessments may not fully reflect market value increases.

Looking ahead, the real estate market in San Francisco County is expected to continue its dynamic nature, with ongoing development projects, population growth, and changing economic conditions influencing property values and, subsequently, property taxes. It's crucial for homeowners and prospective buyers to stay informed about these trends and their potential impact on property tax assessments.

Additionally, San Francisco County is actively exploring innovative solutions to fund essential services while ensuring fairness and equity in property tax assessments. This includes initiatives such as reassessment programs and targeted tax relief measures for specific communities.

Conclusion: Navigating the Complex World of Property Taxes

Understanding and navigating the intricacies of San Francisco County property taxes is essential for homeowners and prospective buyers alike. From the assessment process to payment options and future trends, being informed empowers individuals to make informed decisions about their property tax obligations.

By staying updated on the latest developments, exploring available exemptions, and utilizing the resources provided by the San Francisco County Assessor's Office, property owners can ensure a fair and equitable assessment of their properties. As the real estate market continues to evolve, staying proactive and engaged in the property tax landscape is key to successful homeownership in San Francisco County.

How often are property assessments conducted in San Francisco County?

+Property assessments in San Francisco County are conducted annually. The Assessor’s Office reviews and updates property records to ensure accuracy and fairness.

Can property owners challenge their assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The appeal process involves submitting evidence and supporting documentation to justify a lower assessment.

What are the payment options for property taxes in San Francisco County?

+San Francisco County offers various payment options, including online payments, phone payments, and in-person payments. Property owners can also set up automatic payments to ensure timely remittances.

Are there any exemptions or discounts available for property taxes in San Francisco County?

+Yes, San Francisco County offers several exemptions and discounts, including the Homestead Exemption, Senior Citizen Exemption, Veteran’s Exemption, and Low-Income Exemption. These exemptions provide tax relief to eligible property owners.

How can I stay informed about changes in property tax assessments and rates in San Francisco County?

+Stay updated by regularly visiting the San Francisco County Assessor’s Office website, subscribing to their newsletters, and attending community meetings or workshops. These resources provide valuable insights into property tax assessments and any upcoming changes.