Federal Tax Id Number Florida

The Federal Tax Identification Number (also known as an Employer Identification Number or EIN) is a unique nine-digit number assigned to businesses by the Internal Revenue Service (IRS) in the United States. This number is crucial for various business operations, including tax filing, employee management, and banking procedures. In the state of Florida, understanding the process and requirements for obtaining a Federal Tax ID is essential for businesses of all sizes.

Understanding the Federal Tax ID Number in Florida

A Federal Tax ID Number is required for businesses in Florida when they engage in certain activities, such as hiring employees, opening a business bank account, or applying for certain permits and licenses. It serves as a unique identifier for the business entity and is used by the IRS to track tax filings and payments.

In Florida, businesses are obligated to comply with both federal and state tax regulations. The Federal Tax ID Number is a critical component of this compliance, as it ensures that businesses accurately report and pay their federal taxes. It is particularly important for entities that have employees, as it facilitates the proper withholding and remittance of federal income tax, Social Security, and Medicare taxes.

Who Needs a Federal Tax ID Number in Florida?

The requirement for a Federal Tax ID Number in Florida depends on several factors, including the business structure, ownership, and the nature of operations. Here are some common scenarios where a Florida business would need an EIN:

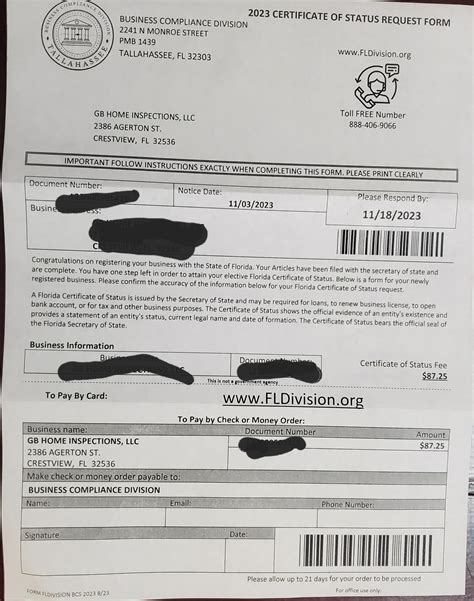

- Corporations and LLCs: These business entities are legally required to obtain an EIN, regardless of whether they have employees or not. The EIN serves as a unique identifier for the business and is necessary for various administrative and tax purposes.

- Partnerships and Sole Proprietorships: While these business structures may not always require an EIN, they are often beneficial for tax and legal purposes. For instance, if a sole proprietor intends to hire employees or open a business bank account, an EIN becomes necessary.

- Employee-Based Businesses: Any business in Florida that has employees must obtain an EIN. This is crucial for withholding and remitting payroll taxes, as well as for reporting employee income and tax deductions to the IRS.

- Trusts and Estates: These entities often require an EIN for tax purposes, especially if they have income-generating assets or engage in business activities.

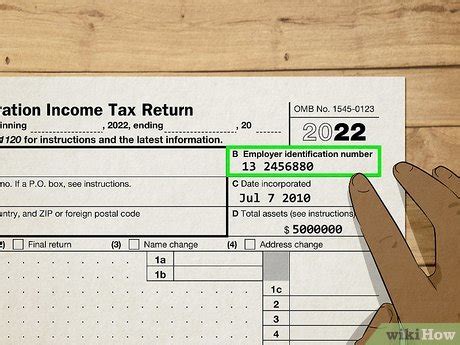

The Application Process for a Federal Tax ID in Florida

Obtaining a Federal Tax ID Number in Florida is a straightforward process, primarily managed through the IRS’s online application system. Here are the key steps involved:

- Determine Eligibility: As mentioned, certain business entities are legally required to obtain an EIN. It's essential to understand your business's needs and whether an EIN is necessary for your operations.

- Choose the Application Method: The IRS offers several ways to apply for an EIN, including online, by fax, by mail, or by phone. The online application is the quickest and most efficient method, typically providing an immediate response.

- Gather Required Information: Before applying, ensure you have the necessary details at hand. This includes the business's legal name, physical address, and the Responsible Party's information (such as name, date of birth, and Social Security Number or Individual Taxpayer Identification Number). The Responsible Party is typically the business owner or a designated individual with authority to manage the business's finances.

- Complete the Application: The online application form guides you through the process, prompting you to provide the required information. It's crucial to provide accurate and up-to-date details to avoid delays in processing.

- Submit and Receive Confirmation: Once the application is complete, submit it online. You will receive an immediate confirmation, including your assigned Federal Tax ID Number. It's essential to keep this number secure and readily accessible for future reference.

The Importance of a Federal Tax ID Number in Business Operations

A Federal Tax ID Number plays a pivotal role in the smooth operation of a business, particularly in Florida’s dynamic business landscape. Here are some key reasons why an EIN is essential:

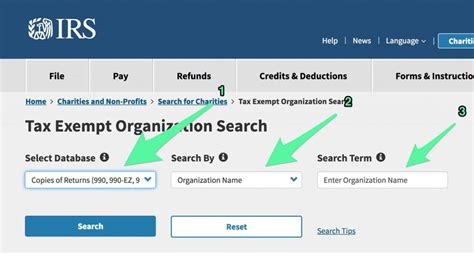

- Tax Compliance: The primary purpose of an EIN is to facilitate tax compliance. It allows businesses to accurately report and pay their federal taxes, ensuring they meet their legal obligations. This includes filing tax returns, paying employment taxes, and reporting income.

- Business Banking: Most financial institutions in Florida require a Federal Tax ID Number when opening a business bank account. This is a critical step in separating personal and business finances, which is essential for tax and liability purposes.

- Employee Management: For businesses with employees, an EIN is mandatory for payroll management. It enables the business to withhold and remit payroll taxes, as well as to report employee income and deductions accurately to the IRS.

- Licensing and Permits: Certain business licenses and permits in Florida may require an EIN as part of the application process. This ensures that the business is properly registered and compliant with state and federal regulations.

- Business Contracts and Agreements: When entering into business agreements or contracts, particularly with other businesses or government entities, an EIN can provide added credibility and assurance of the business's legitimacy.

Real-World Example: Case Study of a Florida Business

Consider the case of EcoFresh Farms, a small family-owned agricultural business located in Central Florida. Initially, EcoFresh Farms operated as a sole proprietorship, selling their produce directly to local farmers’ markets and restaurants. However, as their business grew, they realized the need to expand their operations and hire additional staff.

As they prepared to take on employees, the owners of EcoFresh Farms understood the importance of obtaining a Federal Tax ID Number. They recognized that an EIN was not only a legal requirement for employee-based businesses but also a crucial step in establishing their business's credibility and ensuring proper tax compliance.

The owners applied for their EIN through the IRS's online application system, providing their business's legal name, physical address, and their own personal information as the Responsible Party. Within minutes, they received their Federal Tax ID Number, which they promptly recorded and stored securely.

With their EIN in hand, EcoFresh Farms was able to open a dedicated business bank account, separating their personal and business finances. They also used their EIN to register for the necessary state and federal tax obligations, ensuring they could accurately report and pay their taxes as their business grew. The EIN facilitated the smooth integration of new employees into their payroll system, allowing for proper withholding and remittance of taxes.

In this case, obtaining a Federal Tax ID Number was a critical step in EcoFresh Farms' growth and success. It enabled them to navigate the complexities of business ownership, manage their finances responsibly, and comply with tax regulations. By understanding the importance of an EIN and taking the necessary steps to obtain one, they set a strong foundation for their business's future.

The Future of Federal Tax ID Numbers in Florida’s Business Landscape

As Florida’s business environment continues to evolve, the role of the Federal Tax ID Number is likely to remain integral to the state’s economic landscape. With the increasing complexity of tax regulations and the growing emphasis on digital technologies, businesses in Florida will need to stay updated with the latest requirements and processes for obtaining and utilizing an EIN.

One notable trend is the increasing use of digital tools and platforms for tax management and compliance. Many businesses in Florida are leveraging cloud-based software and online accounting systems to streamline their tax processes, and an EIN is often a critical component of these digital solutions. By integrating their EIN into these systems, businesses can automate various tax-related tasks, from payroll management to tax filing, making tax compliance more efficient and less time-consuming.

Furthermore, as Florida continues to attract a diverse range of businesses, including startups and remote companies, the need for clear and accessible information on Federal Tax ID requirements will become even more critical. Providing businesses with comprehensive resources and support on obtaining an EIN will be essential to fostering a supportive business environment in the state.

In conclusion, the Federal Tax ID Number is a fundamental aspect of business operations in Florida. Whether it's for tax compliance, employee management, or establishing business legitimacy, an EIN plays a crucial role in the success and sustainability of businesses in the Sunshine State. By understanding the process and importance of obtaining an EIN, businesses can ensure they are well-prepared to navigate the complexities of the Florida business landscape.

Can a business in Florida have more than one Federal Tax ID Number?

+In certain situations, a business in Florida may need more than one Federal Tax ID Number. This is often the case for businesses with multiple entities or for specific tax purposes. For example, if a business has separate divisions or subsidiaries that are treated as distinct entities for tax purposes, each may require its own EIN. Additionally, certain tax obligations, such as excise taxes or pension plan administration, may require a dedicated EIN. It’s important to consult with a tax professional to determine if your business needs multiple EINs and to ensure proper tax compliance.

How long does it take to obtain a Federal Tax ID Number in Florida?

+The time it takes to obtain a Federal Tax ID Number in Florida depends on the application method. If you apply online, you will typically receive your EIN immediately upon submission of your application. However, if you choose to apply by fax, mail, or phone, it may take several days or even weeks for your application to be processed and for you to receive your EIN. Therefore, the fastest and most efficient method is to apply online through the IRS website.

Can a business owner in Florida apply for a Federal Tax ID Number on behalf of their business?

+Absolutely! In fact, the business owner or a designated individual with authority to manage the business’s finances, known as the Responsible Party, is typically the one who applies for the Federal Tax ID Number. When applying online, the Responsible Party’s information, including their name, date of birth, and Social Security Number or Individual Taxpayer Identification Number, is required. This ensures that the IRS can verify the identity of the individual applying on behalf of the business.