Virginia State Income Tax

Welcome to our comprehensive guide on Virginia's income tax system. As one of the most populous states in the US, Virginia's tax policies play a significant role in shaping its economic landscape. Understanding the intricacies of the state income tax can help individuals and businesses make informed financial decisions. In this article, we will delve into the specifics of Virginia's income tax structure, providing you with all the information you need to navigate this essential aspect of financial management.

The tax rate for Virginia residents earning 50,000 annually would fall into the third tax bracket, which has a tax rate of 5.0%. This rate applies to taxable income between 5,001 and 17,000. It’s important to calculate your exact taxable income after deductions to determine the precise tax amount.">What is the current tax rate for Virginia residents earning 50,000 annually? +

The Virginia State Income Tax: A Comprehensive Overview

Virginia, known as the "Old Dominion State," operates on a progressive income tax system, which means that as your income increases, so does the tax rate applied to your earnings. This system ensures fairness and contributes to the state's revenue generation. Let's explore the key aspects of Virginia's income tax structure in detail.

Tax Rates and Brackets

Virginia has five income tax brackets, each with its own tax rate. These brackets are adjusted annually to account for inflation and changes in the cost of living. The current tax rates for the 2023 tax year are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0 - $3,000 | 2.0% |

| $3,001 - $5,000 | 3.0% |

| $5,001 - $17,000 | 5.0% |

| $17,001 - $250,000 | 5.75% |

| $250,001 and above | 5.75% |

These tax brackets are applied to taxable income, which is your total income minus any applicable deductions and exemptions. Virginia allows for various deductions and credits, which we will discuss further in the next section.

Deductions and Credits

Virginia offers a range of deductions and credits to help taxpayers reduce their taxable income and overall tax liability. Some of the notable deductions and credits include:

- Standard Deduction: All Virginia taxpayers are entitled to a standard deduction, which is adjusted annually. For the 2023 tax year, the standard deduction is $3,000 for single filers and $6,000 for joint filers.

- Personal Exemptions: Virginia allows personal exemptions for taxpayers and their dependents. Each exemption reduces your taxable income. However, it's important to note that personal exemptions were phased out starting in 2021 due to federal tax law changes.

- Itemized Deductions: If your allowable deductions exceed the standard deduction, you may opt for itemized deductions. These can include medical expenses, charitable contributions, state and local taxes paid, and mortgage interest. Itemized deductions can significantly reduce your taxable income.

- Credit for Low-Income Taxpayers: Virginia offers a refundable tax credit for low-income individuals and families. This credit is designed to provide relief for those with limited financial means.

- Elderly or Disabled Tax Credit: Qualifying elderly or disabled individuals can claim a tax credit to reduce their overall tax liability. This credit aims to support those with specific medical conditions or advanced age.

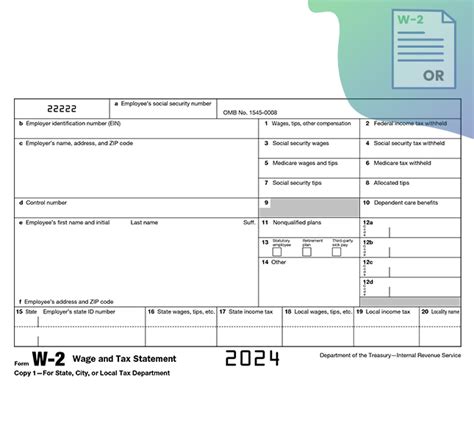

Filing Options and Deadlines

Virginia offers several filing options for taxpayers, including online filing through the Virginia Department of Taxation's website and traditional paper filing. The state also allows for electronic filing of tax returns, which can be a convenient option for those comfortable with digital systems.

The deadline for filing Virginia state income tax returns typically aligns with the federal tax deadline. For the 2023 tax year, the deadline is April 18, 2024. However, it's important to note that this deadline may be extended in certain circumstances, such as natural disasters or other emergencies.

Electronic Filing and Payment Options

Virginia encourages electronic filing and offers various options for taxpayers to submit their returns online. The state's online filing system is user-friendly and provides a secure platform for taxpayers to transmit their data. Additionally, electronic payment options are available, including direct debit and credit/debit card payments.

For those who prefer traditional methods, Virginia also accepts paper tax returns and offers the option to pay by check or money order. However, it's important to note that electronic filing and payment options are generally faster and more efficient, reducing the risk of errors and delays.

Tax Refunds and Amended Returns

If you overpay your Virginia state income tax, you are entitled to a refund. The Virginia Department of Taxation processes refunds within a specified timeframe, typically within 45 days of receiving your return. However, delays may occur due to various factors, including high volumes of returns or errors in your filing.

In the event that you need to make corrections to your tax return, you can file an amended return. Virginia allows taxpayers to amend their returns within a certain period, which is typically three years from the original filing deadline. Amended returns should be filed using the same methods as the original return, either online or by mail.

Resources and Support for Taxpayers

The Virginia Department of Taxation provides extensive resources and support to help taxpayers navigate the state's income tax system. Their website offers a wealth of information, including tax forms, publications, and guidance on various tax-related topics. Additionally, the department provides a helpline for taxpayers to seek assistance with their specific tax queries.

For complex tax situations or those seeking professional advice, taxpayers can engage the services of tax professionals, such as certified public accountants (CPAs) or enrolled agents. These professionals can provide personalized guidance and ensure compliance with Virginia's tax laws.

Conclusion

In conclusion, Virginia's state income tax system is designed to be fair and progressive, ensuring that taxpayers contribute to the state's revenue in a manner commensurate with their earnings. By offering a range of deductions, credits, and support resources, the state provides taxpayers with the tools to manage their tax obligations effectively. Whether you're an individual taxpayer or a business owner, understanding Virginia's income tax structure is crucial for sound financial planning and compliance.

Frequently Asked Questions

What is the current tax rate for Virginia residents earning 50,000 annually?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The tax rate for Virginia residents earning 50,000 annually would fall into the third tax bracket, which has a tax rate of 5.0%. This rate applies to taxable income between 5,001 and 17,000. It’s important to calculate your exact taxable income after deductions to determine the precise tax amount.

Are there any special tax provisions for Virginia businesses?

+

Yes, Virginia offers various tax incentives and provisions for businesses. These can include tax credits for research and development, job creation, and investment in certain industries. It’s advisable for businesses to consult with tax professionals to explore these opportunities.

Can I file my Virginia state income tax return electronically?

+

Absolutely! Virginia encourages electronic filing and provides a secure online platform for taxpayers to submit their returns. This method is efficient, reduces errors, and typically offers faster processing times compared to traditional paper filing.

What happens if I miss the tax filing deadline?

+

Missing the tax filing deadline can result in penalties and interest charges. It’s important to file your return as soon as possible to minimize these additional costs. If you’re unable to file by the deadline, consider filing for an extension to avoid further complications.

Are there any tax breaks for homeowners in Virginia?

+

Yes, Virginia offers several tax breaks for homeowners. These can include a homeowner’s tax credit, which provides a reduction in property taxes for eligible homeowners. Additionally, certain deductions for mortgage interest and property taxes are available to help reduce taxable income.