Mercer Pa Tax Accountant

Welcome to an in-depth exploration of the vital role of a Mercer PA Tax Accountant and their impact on financial management and compliance within the state of Pennsylvania. This article aims to delve into the intricacies of this profession, shedding light on the skills, responsibilities, and importance of tax accountants in the Mercer County region. With a focus on practical insights and real-world applications, we aim to provide a comprehensive guide for individuals and businesses seeking to navigate the complex world of tax accounting.

The Role and Responsibilities of a Mercer PA Tax Accountant

A Mercer PA Tax Accountant is a financial expert specializing in tax preparation, planning, and compliance for individuals and businesses within the state of Pennsylvania, specifically in the Mercer County area. They are responsible for ensuring that their clients meet all state and federal tax obligations while optimizing their financial strategies to minimize tax liabilities.

The role of a tax accountant goes beyond mere number-crunching. It involves a deep understanding of the intricate tax laws and regulations, as well as the ability to apply this knowledge in a practical, strategic manner. Here's a closer look at the key responsibilities and skills associated with this profession:

Tax Preparation and Filing

The primary responsibility of a tax accountant is to prepare and file tax returns for their clients. This involves gathering and organizing financial data, such as income statements, expense reports, and receipts, to ensure accurate and timely tax filing. Tax accountants must stay up-to-date with the latest tax laws and regulations to ensure compliance and avoid penalties.

For instance, they may assist individuals in claiming deductions for medical expenses, mortgage interest, or charitable donations. For businesses, tax accountants help identify opportunities for tax credits, such as the Research and Development Tax Credit or the Work Opportunity Tax Credit, which can significantly reduce their tax liabilities.

Tax Planning and Strategy

Tax planning is a crucial aspect of a tax accountant’s role. They work with clients to develop long-term financial strategies that minimize tax burdens while maximizing overall financial health. This involves analyzing a client’s current financial situation, forecasting future tax obligations, and implementing strategies to optimize tax efficiency.

A tax accountant might recommend restructuring a business's ownership to take advantage of pass-through entity tax benefits, or they could advise individuals on retirement planning strategies that offer tax advantages, such as contributing to a Roth IRA or a Health Savings Account.

Compliance and Audits

Tax accountants are responsible for ensuring that their clients remain compliant with all relevant tax laws and regulations. This includes staying informed about any changes in tax codes and communicating these changes to clients. In the event of an audit, tax accountants work closely with their clients to gather and present the necessary documentation, representing their interests to the tax authorities.

For instance, they may assist clients in understanding the implications of the Affordable Care Act on their tax obligations, or they could guide businesses through the complex world of payroll taxes, ensuring accurate withholding and reporting.

Financial Consulting

Tax accountants often provide financial consulting services beyond tax preparation. They may advise clients on investment strategies, business expansions, or personal financial planning. By offering a holistic view of a client’s financial situation, tax accountants can provide valuable insights and recommendations to improve overall financial well-being.

This could involve suggesting cost-saving measures for a business, such as implementing tax-efficient supply chain management, or providing individuals with guidance on estate planning and inheritance tax strategies.

The Impact of a Mercer PA Tax Accountant

The work of a Mercer PA Tax Accountant has a significant impact on both individuals and businesses in the region. By ensuring compliance with tax laws and regulations, tax accountants help their clients avoid penalties and legal issues. Moreover, their strategic tax planning can lead to substantial savings, enabling businesses to reinvest in their operations and individuals to achieve their financial goals.

For instance, a tax accountant might help a small business in Mercer County secure a significant tax refund by identifying overlooked deductions for business travel and entertainment expenses. This refund could then be used to fund a much-needed expansion or hire additional staff, benefiting the business and the local economy.

Similarly, for individuals, a tax accountant could advise on strategies to reduce the tax burden on their investment income, allowing them to save for their children's education or plan for a comfortable retirement. The impact of these financial decisions can be far-reaching, influencing an individual's quality of life and long-term financial security.

The Benefits of Hiring a Local Tax Accountant

Choosing a local tax accountant, such as one based in Mercer County, offers several advantages. Local tax accountants have a deep understanding of the unique tax landscape within the state and the region. They are familiar with local tax laws, regulations, and even unwritten practices that can impact tax obligations.

For example, a local tax accountant might be aware of specific tax incentives or grants offered by the state or county government, which can significantly benefit local businesses. They can also provide personalized service, building long-term relationships with their clients and offering tailored financial advice.

| Advantages of Hiring a Local Tax Accountant |

|---|

| In-depth knowledge of local tax laws and regulations |

| Familiarity with regional tax incentives and grants |

| Personalized service and long-term relationships |

| Tailored financial advice for individuals and businesses |

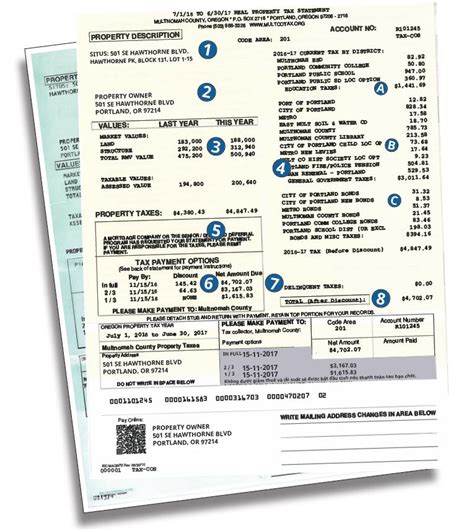

The Importance of Tax Compliance

Tax compliance is a critical aspect of financial management. Non-compliance can lead to severe penalties, including fines, interest, and even criminal charges. A Mercer PA Tax Accountant plays a vital role in ensuring that their clients meet all their tax obligations, thereby avoiding these potential pitfalls.

Furthermore, tax accountants help their clients understand the broader implications of tax laws. For instance, they can explain how changes in tax codes, such as the Tax Cuts and Jobs Act, affect their clients' financial strategies, helping them adapt and plan accordingly.

The Future of Tax Accounting

The field of tax accounting is continuously evolving, driven by changes in tax laws and advancements in technology. Tax accountants must stay ahead of these changes to provide the best service to their clients. This includes staying informed about new tax laws, such as the Taxpayer First Act, and utilizing technology to streamline processes and enhance accuracy.

For instance, many tax accountants are now adopting cloud-based accounting software and online tax preparation tools to improve efficiency and security. They are also leveraging data analytics to identify trends and patterns in tax data, enabling more accurate and strategic tax planning.

Conclusion

In conclusion, a Mercer PA Tax Accountant is a trusted financial advisor, guiding individuals and businesses through the complex world of tax accounting. Their expertise ensures compliance, minimizes tax liabilities, and optimizes financial strategies. By choosing a local tax accountant, individuals and businesses can benefit from personalized service and an in-depth understanding of the unique regional tax landscape.

As the field of tax accounting continues to evolve, the role of a tax accountant remains essential. With their knowledge and strategic insights, tax accountants are pivotal in helping their clients navigate the ever-changing tax landscape and achieve their financial goals.

What qualifications do I need to become a Mercer PA Tax Accountant?

+To become a Mercer PA Tax Accountant, you typically need a bachelor’s degree in accounting, finance, or a related field. Many tax accountants also pursue certifications such as the Certified Public Accountant (CPA) designation or the Enrolled Agent (EA) license. These certifications demonstrate a high level of expertise and are often required for certain tax services.

How can I find a reliable Mercer PA Tax Accountant for my business?

+When searching for a Mercer PA Tax Accountant for your business, it’s essential to consider their experience, qualifications, and client testimonials. Look for accountants who specialize in your industry and have a proven track record of success. Online reviews and referrals from trusted sources can also be valuable in finding the right tax accountant for your business needs.

What are some common tax deductions or credits available to businesses in Mercer County, PA?

+Businesses in Mercer County, PA, may be eligible for various tax deductions and credits. Some common examples include the Research and Development Tax Credit, the Work Opportunity Tax Credit, and the New Markets Tax Credit. It’s essential to consult with a tax accountant to understand which credits your business may qualify for and how to maximize these benefits.