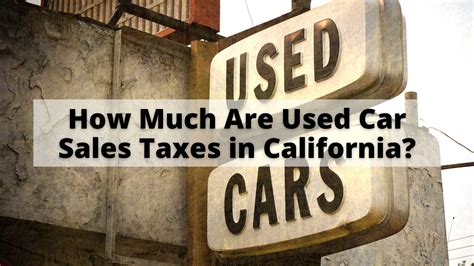

Taxes On Used Car Sales

When buying or selling a used car, understanding the tax implications is crucial to ensure a smooth and compliant transaction. The taxation of used car sales can vary depending on the jurisdiction and the specific circumstances of the sale. In this comprehensive guide, we will delve into the world of taxes on used car sales, providing you with expert insights and practical information to navigate this process effectively.

Understanding the Basics of Used Car Sales Taxation

The taxation of used car sales typically involves two main components: sales tax and potential capital gains tax. Sales tax is levied on the purchase price of the vehicle, while capital gains tax may apply when selling a vehicle for a profit. Let’s explore each aspect in detail.

Sales Tax on Used Car Sales

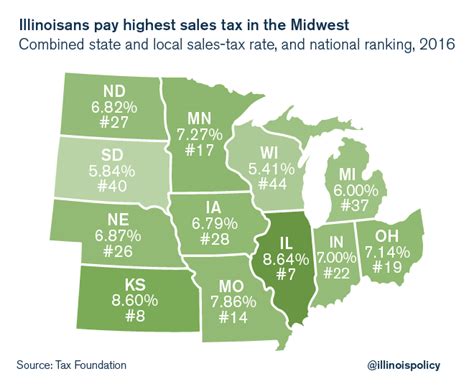

Sales tax is a consumption tax imposed on the sale of goods and services, including vehicles. The rate and applicability of sales tax can vary significantly across different regions. Some jurisdictions have a uniform sales tax rate, while others may have varying rates depending on the location of the sale or the type of vehicle being sold.

When selling a used car, it is essential to understand the sales tax regulations in your area. Here are some key considerations:

- Taxable Events: Sales tax is generally triggered when there is a transfer of ownership and possession of the vehicle. This can occur through a private sale between individuals or through a dealership. It is crucial to comply with the tax obligations associated with these transactions.

- Tax Rates: Research and familiarize yourself with the sales tax rates applicable in your region. These rates can be found on government websites or through tax authorities. Keep in mind that sales tax rates can change periodically, so staying updated is essential.

- Registration and Titling: The process of registering and titling a vehicle often involves paying sales tax. Ensure that you understand the requirements and procedures for registering the used car, as this step may be linked to tax compliance.

- Exemptions and Discounts: Some jurisdictions offer exemptions or reduced sales tax rates for specific circumstances, such as purchasing a used car from a nonprofit organization or for certain disability accommodations. Check if you qualify for any such exemptions.

Capital Gains Tax on Used Car Sales

Capital gains tax is a tax on the profit made from selling an asset, including a used car. When selling a vehicle for a gain, you may be subject to capital gains tax, depending on your jurisdiction’s tax laws.

Here are some key points to consider regarding capital gains tax on used car sales:

- Determining Capital Gain: To calculate the capital gain, you need to subtract the original purchase price (adjusted for inflation) from the sale price. This difference represents the profit made on the sale.

- Tax Rates and Thresholds: Capital gains tax rates can vary based on the jurisdiction and the seller’s tax status. Some jurisdictions may have different tax rates for short-term and long-term capital gains. Research the applicable rates and any thresholds that may impact your tax liability.

- Reporting Requirements: When filing your taxes, you may need to declare the sale of the used car and report the capital gain. Ensure that you understand the reporting obligations and provide accurate information to avoid penalties.

- Tax Planning: If you anticipate selling a used car for a profit, consider tax planning strategies. Consult with a tax professional to explore options such as timing the sale, utilizing capital losses from other investments, or taking advantage of tax incentives specific to your jurisdiction.

Navigating the Tax Landscape: Practical Tips for Used Car Sales

To ensure a seamless and tax-compliant used car sale, consider the following practical tips:

Documentation and Record-Keeping

Maintain thorough documentation of the used car sale, including the purchase agreement, registration documents, and any relevant receipts. Proper record-keeping will facilitate the calculation of sales tax and capital gains tax, if applicable.

Consultation with Tax Professionals

Given the complexity of tax laws, it is advisable to consult with tax professionals or accountants who specialize in automotive transactions. They can provide personalized guidance based on your specific circumstances and help you navigate any potential tax pitfalls.

Understanding Tax Implications for Buyers and Sellers

Both buyers and sellers should be aware of their tax obligations. Buyers should be prepared to pay sales tax on the purchase, while sellers should understand their potential tax liabilities, especially if the vehicle is sold for a profit. Clear communication between the parties can help ensure a transparent and compliant transaction.

Researching Local Tax Laws

Take the time to research and understand the tax laws specific to your jurisdiction. Government websites, tax authorities, and local automotive associations often provide valuable resources and guidelines. Stay informed about any changes in tax regulations to avoid unexpected surprises.

Considering Trade-Ins and Leases

If you are trading in your used car or returning a leased vehicle, understand the tax implications of these transactions. Trade-ins and leases may have different tax treatments, and it is crucial to consult with tax experts to navigate these scenarios effectively.

Case Study: A Real-World Example

Let’s consider a hypothetical case study to illustrate the taxation of a used car sale. Imagine Mr. Johnson, who purchased a used SUV three years ago for 25,000. Over time, he made some upgrades and improvements, increasing the vehicle's value. Now, he decides to sell the SUV for 30,000.

In this scenario, Mr. Johnson would need to calculate the capital gain by subtracting the adjusted purchase price from the sale price. He would also need to research the applicable capital gains tax rate and any potential exemptions or deductions. Additionally, he must ensure that he pays the appropriate sales tax on the transaction, considering the sales tax rate in his region.

| Purchase Price | Sale Price | Capital Gain |

|---|---|---|

| $25,000 | $30,000 | $5,000 |

Future Implications and Tax Reforms

The taxation landscape for used car sales is subject to change and evolution. Tax reforms and policy shifts can impact the tax obligations of buyers and sellers. Staying informed about any proposed or implemented changes is crucial for adapting to the evolving tax environment.

Additionally, technological advancements and the rise of online car marketplaces may influence the taxation of used car sales. As these platforms gain popularity, tax authorities may need to adapt their regulations to accommodate digital transactions and ensure tax compliance in the digital realm.

Conclusion: Navigating Taxes with Confidence

Taxes on used car sales can be complex, but with a thorough understanding of the applicable laws and practical tips, buyers and sellers can navigate the process confidently. By staying informed, seeking professional advice, and maintaining meticulous records, individuals can ensure compliance and minimize tax-related surprises.

As the automotive industry continues to evolve, staying updated on tax regulations and leveraging technology for efficient tax management will be key to a seamless and compliant used car sales experience.

Are there any exemptions or discounts for used car sales taxes?

+Yes, some jurisdictions offer exemptions or reduced sales tax rates for specific circumstances, such as purchasing a used car from a nonprofit organization or for certain disability accommodations. It is important to research and understand the available exemptions in your region.

How do I calculate capital gains tax on a used car sale?

+To calculate capital gains tax, subtract the original purchase price (adjusted for inflation) from the sale price. This difference represents the capital gain. Research the applicable tax rates and thresholds in your jurisdiction to determine your tax liability.

What records should I keep for tax purposes when selling a used car?

+Maintain records of the purchase agreement, registration documents, any improvements or upgrades made to the vehicle, and relevant receipts. These records will assist in calculating sales tax and capital gains tax, if applicable.