California Sales Tax Fresno

California, the Golden State, is renowned for its diverse landscapes, thriving cities, and a business environment that attracts entrepreneurs and investors alike. One crucial aspect of doing business in California is understanding the state's sales tax regulations, which can vary depending on the location. In this comprehensive guide, we will delve into the intricacies of California sales tax as it pertains to the city of Fresno, exploring the rates, regulations, and unique considerations that businesses and consumers should be aware of.

Understanding California Sales Tax

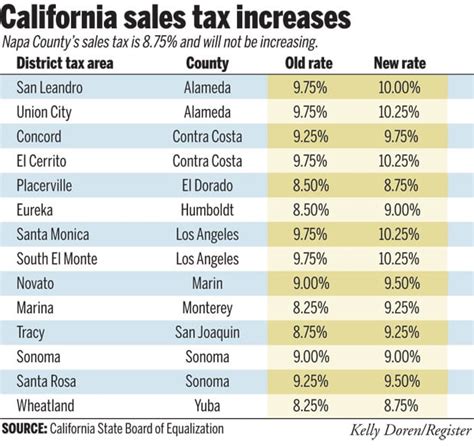

California imposes a sales and use tax on the retail sale, lease, or rental of tangible personal property, as well as certain services. The state sales tax rate is a vital component of this system, serving as the foundation upon which local jurisdictions build their own tax structures. Currently, the state sales tax rate stands at 7.25%, a figure that remains consistent across California. However, it is important to note that local jurisdictions have the authority to levy additional sales taxes, resulting in variations in the total sales tax rate from one area to another.

Fresno's Sales Tax Landscape

When it comes to sales tax, Fresno operates with a unique set of regulations that impact both businesses and consumers. Fresno County, where the city of Fresno is located, applies a 1.25% sales tax on top of the state rate, bringing the total sales tax to 8.50% for most transactions within the county. This additional tax is known as the Fresno County Transit Occupancy Tax and is used to support public transportation services in the region.

However, it is essential to recognize that certain areas within Fresno County have additional local taxes, further increasing the sales tax burden. For instance, the city of Fresno itself levies an extra 0.50% sales tax, resulting in a total sales tax rate of 9.00% for transactions occurring within city limits. Other cities and unincorporated areas within the county may have their own specific tax rates, so it is crucial for businesses to be aware of the precise location where sales are made to accurately calculate the applicable tax.

Sales Tax Exemptions in Fresno

While sales tax is a prevalent aspect of doing business in Fresno, it is not applicable to every transaction. Certain goods and services are exempt from sales tax, providing relief to both businesses and consumers. Here are some notable sales tax exemptions to be aware of in Fresno:

- Groceries: Food items purchased at grocery stores, including canned goods, produce, dairy products, and other essentials, are exempt from sales tax in California. This exemption extends to both Fresno and the rest of the state.

- Prescription Medications: Sales tax does not apply to prescription drugs and certain medical devices, offering a financial benefit to those requiring essential healthcare items.

- Manufacturing Equipment: Businesses engaged in manufacturing within Fresno may be eligible for sales tax exemptions on certain machinery and equipment purchases. This exemption aims to encourage investment in manufacturing infrastructure.

- Certain Services: Services such as legal, accounting, and consulting are generally exempt from sales tax, providing a cost advantage to businesses seeking professional assistance.

It is important to note that sales tax exemptions can be complex and may vary based on specific circumstances. Businesses should consult with tax professionals or refer to official California tax guides to ensure compliance with the latest regulations.

Collecting and Remitting Sales Tax in Fresno

For businesses operating in Fresno, collecting and remitting sales tax accurately is a critical aspect of compliance. Here are some key considerations to keep in mind:

Registration and Permits

To collect and remit sales tax in Fresno, businesses must obtain a Seller's Permit from the California Department of Tax and Fee Administration (CDTFA). This permit authorizes businesses to collect sales tax from customers and remit it to the state. The application process typically involves providing business information, such as the business name, address, and type of goods or services sold.

In addition to the state permit, businesses may also need to obtain local permits or licenses from Fresno County or the city of Fresno. These permits often have specific requirements and may involve additional fees.

Sales Tax Collection

Businesses operating in Fresno are responsible for collecting sales tax from customers at the point of sale. The tax is calculated based on the total purchase amount, including any applicable local taxes. It is important to accurately calculate the tax rate for each transaction to ensure compliance.

Sales tax collection can be integrated into point-of-sale systems or accounting software to automate the process and reduce the risk of errors. Additionally, businesses should provide clear and concise information to customers regarding the sales tax amount and any applicable exemptions.

Sales Tax Remittance

Once sales tax has been collected, businesses must remit the funds to the appropriate tax authorities within a specified timeframe. In California, sales tax returns are typically due on a quarterly basis, with the specific due dates depending on the business's annual sales volume. However, it is crucial to note that Fresno County and the city of Fresno may have their own remittance requirements, so businesses should carefully review local regulations.

Sales tax returns should be filed electronically through the CDTFA's online portal, providing a convenient and secure method for businesses to fulfill their tax obligations. Late filing or non-compliance with sales tax remittance requirements can result in penalties and interest charges, so it is essential to stay organized and meet the deadlines.

Sales Tax Audits and Compliance

Compliance with sales tax regulations is a serious matter, and businesses operating in Fresno should be prepared for potential audits. The CDTFA has the authority to conduct audits to ensure that businesses are accurately collecting and remitting sales tax. Audits can be random or triggered by specific indicators, such as significant changes in business operations or discrepancies in tax filings.

During an audit, the CDTFA will review a business's sales records, tax returns, and other relevant documentation to verify compliance. It is crucial for businesses to maintain accurate and organized records to facilitate the audit process and demonstrate their commitment to sales tax compliance.

If an audit reveals discrepancies or underreporting of sales tax, businesses may face penalties and interest charges. In some cases, the CDTFA may also require businesses to pay back taxes, further emphasizing the importance of accurate sales tax collection and remittance.

Strategies for Sales Tax Compliance

To ensure compliance with Fresno's sales tax regulations, businesses can implement the following strategies:

- Stay Informed: Keep up-to-date with the latest sales tax regulations and any changes that may impact your business. Subscribe to tax newsletters, follow industry blogs, and attend workshops or webinars to stay informed.

- Implement Robust Systems: Invest in accounting software or point-of-sale systems that automate sales tax calculations and reporting. These tools can help reduce human error and ensure accurate tax collection and remittance.

- Train Your Staff: Ensure that employees who handle sales transactions are well-trained in sales tax regulations. Provide clear guidelines and resources to help them accurately calculate and collect sales tax.

- Regularly Review Records: Conduct internal audits or engage external professionals to review your sales tax records and ensure compliance. This proactive approach can help identify any potential issues before they become major concerns.

Conclusion: Navigating Fresno's Sales Tax Landscape

Doing business in Fresno comes with a unique set of sales tax considerations, from understanding the varying tax rates to navigating the exemptions and compliance requirements. By staying informed, implementing robust systems, and maintaining a commitment to compliance, businesses can successfully navigate Fresno's sales tax landscape.

As the business environment in Fresno continues to evolve, it is essential for businesses to adapt and stay ahead of the changing tax regulations. By staying proactive and seeking professional guidance when needed, businesses can ensure they are not only compliant but also positioned for success in this vibrant California city.

Frequently Asked Questions

What is the total sales tax rate in Fresno County, including city-specific taxes?

+

The total sales tax rate in Fresno County, including city-specific taxes, is 9.00% within the city of Fresno and 8.50% in other areas of the county.

Are there any sales tax exemptions for specific industries in Fresno?

+

Yes, Fresno, like the rest of California, offers sales tax exemptions for specific industries such as manufacturing. These exemptions aim to encourage investment and support local businesses.

How often do businesses need to file sales tax returns in Fresno County?

+

Businesses typically file sales tax returns on a quarterly basis in Fresno County. However, the specific due dates depend on the business’s annual sales volume, so it’s important to refer to the CDTFA’s guidelines for accurate filing.

Can businesses claim a sales tax refund if they overpay?

+

Yes, businesses can claim a refund for overpaid sales tax. The process involves filing a refund claim with the CDTFA, providing supporting documentation, and waiting for approval. It’s important to follow the guidelines to ensure a smooth refund process.

What happens if a business fails to collect or remit sales tax in Fresno County?

+

Failure to collect or remit sales tax in Fresno County can result in penalties, interest charges, and potential legal consequences. It’s crucial for businesses to stay compliant to avoid these issues.